Enlarge image

Form OR-706 Instructions

Oregon Estate Transfer Tax 2022

This publication is a guide, not a complete statement, of Oregon Revised Statutes (ORS) and Oregon Administrative Rules (OAR).

For possible updates and more information, refer to the laws and rules on our website, www.oregon.gov/dor.

Contents

Purpose of Form OR-706 ......................................................2 Amount paid by the due date of the return ......................5

Penalty due .............................................................................5

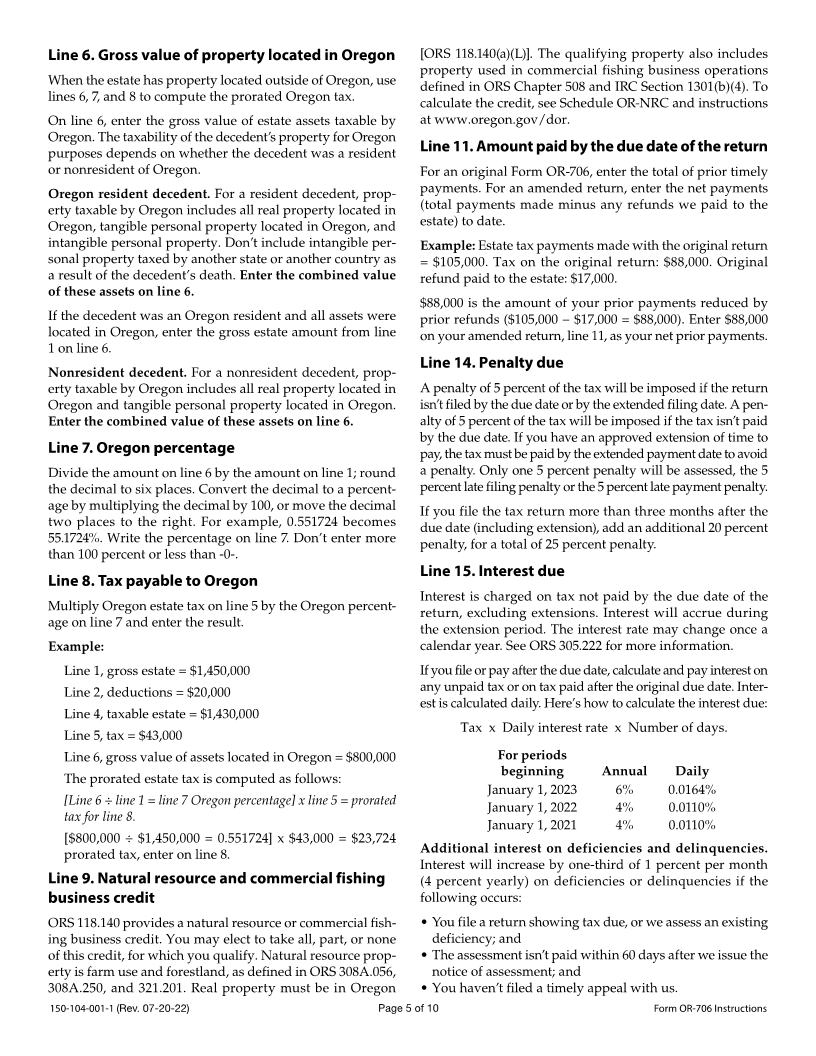

What’s new ...............................................................................2 Interest due .............................................................................5

Total due .................................................................................6

Looking ahead ........................................................................2 Executor signature .................................................................6

Authorization .........................................................................6

Important .................................................................................2

Part 3: Elections by the executor .......................................6

Overview ...................................................................................2

Alternate valuation ................................................................6

Filing requirements ...............................................................2 Special use valuation of Section 2032A ..............................6

Who must file the return ......................................................2 Reversionary or remainder interests ..................................6

When to file return—due date ............................................3

Part 4: General information ................................................6

Mailing addresses and payment instructions ...............3 Surviving spouse ...................................................................6

Returns ....................................................................................3 Beneficiary information........................................................6

Payment only..........................................................................3 Section 2044 property ...........................................................7

Private delivery services .......................................................3 Insurance not included in the gross estate ........................7

Amended returns ..................................................................3 Partnership interests and stock in closely

Forms and schedules ............................................................3 held corporations ...................................................................7

Trusts .......................................................................................7

Part 1: Decedent and executor information ..................4

Decedent name and SSN ......................................................4 Part 5: Recapitulation ...........................................................7

Decedent domicile .................................................................4 Conservation easement exclusion .......................................7

Extensions ...............................................................................4 Deductions ..............................................................................7

Separate election checkbox ..................................................4 Marital deduction—Schedule M .........................................7

Executor name and address ................................................4

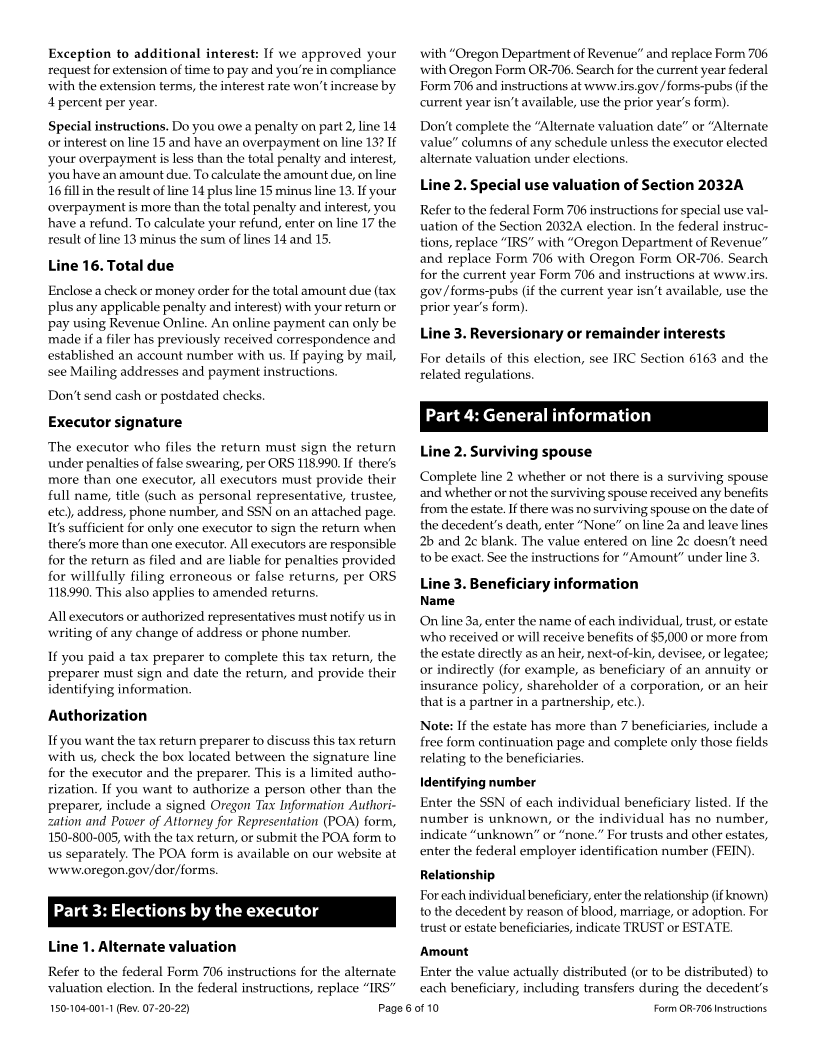

Part 6: Tax table ......................................................................8

Part 2: Tax computation ...................................................... 4 Assembly and processing.....................................................8

Rounding off to whole dollars ............................................ 4 Filing checklist for Form OR-706 .........................................8

Total gross estate ...................................................................4 What happens after you file the tax return? .....................8

Oregon estate tax. ..................................................................4

Installment payments ...........................................................9

Gross value of property located in Oregon .......................5

Oregon percentage ................................................................5 Survivor information ............................................................9

Tax payable to Oregon ..........................................................5

Definitions ..............................................................................9

Natural resource and commercial

fishing business credit ..........................................................5 Do you have questions or need help? ............................ 10

150-104-001-1 (Rev. 07-20-22) Page 1 of 10 Form OR-706 Instructions