Enlarge image

1 1

1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form With grid With grid & data2 84 85

3 4 82 83

3 3

4 4

5 Office use only 5

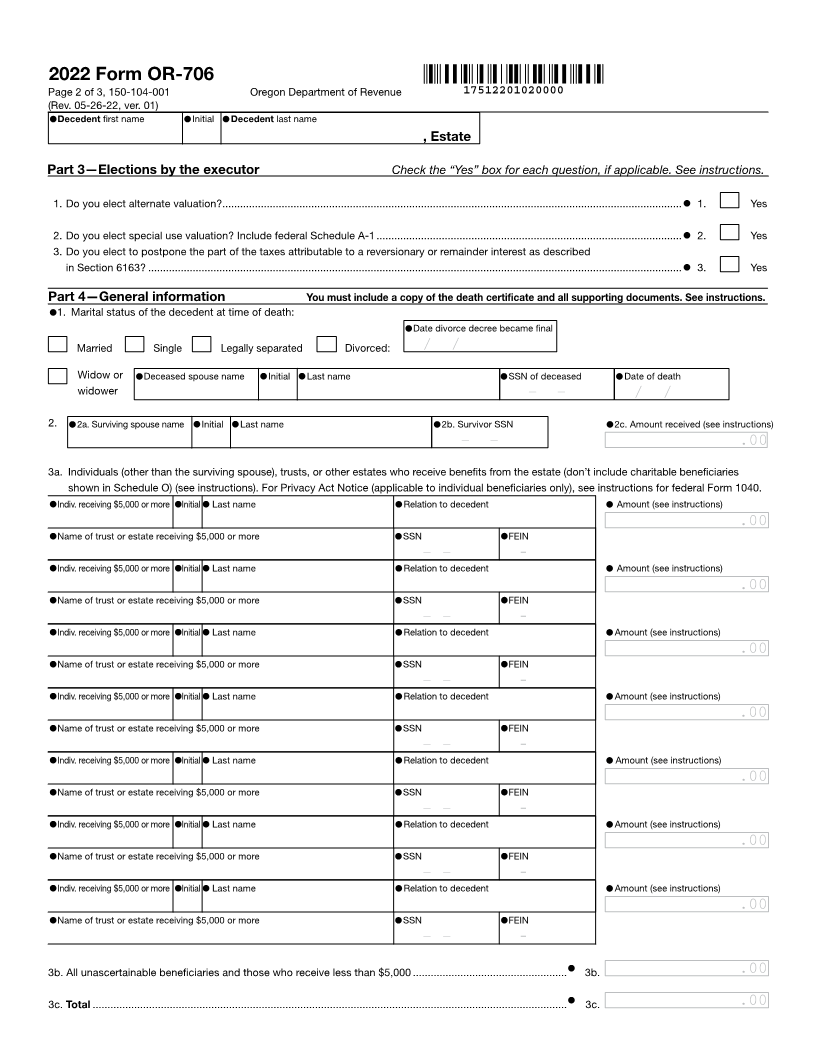

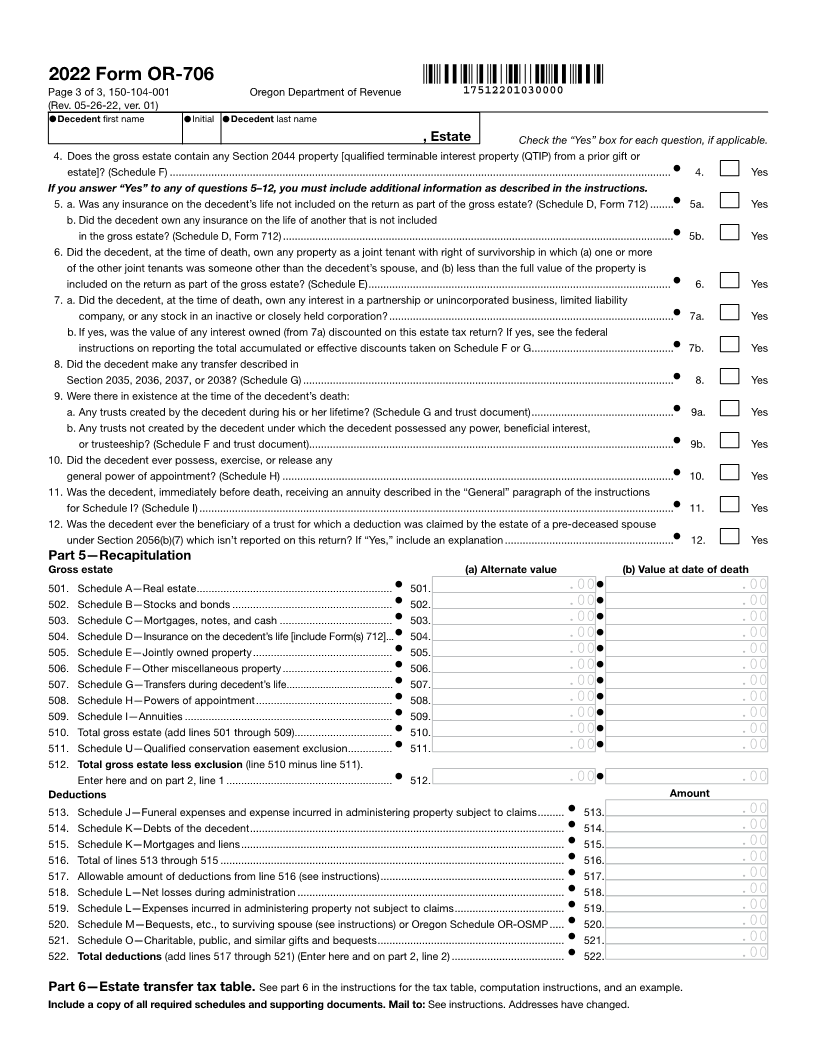

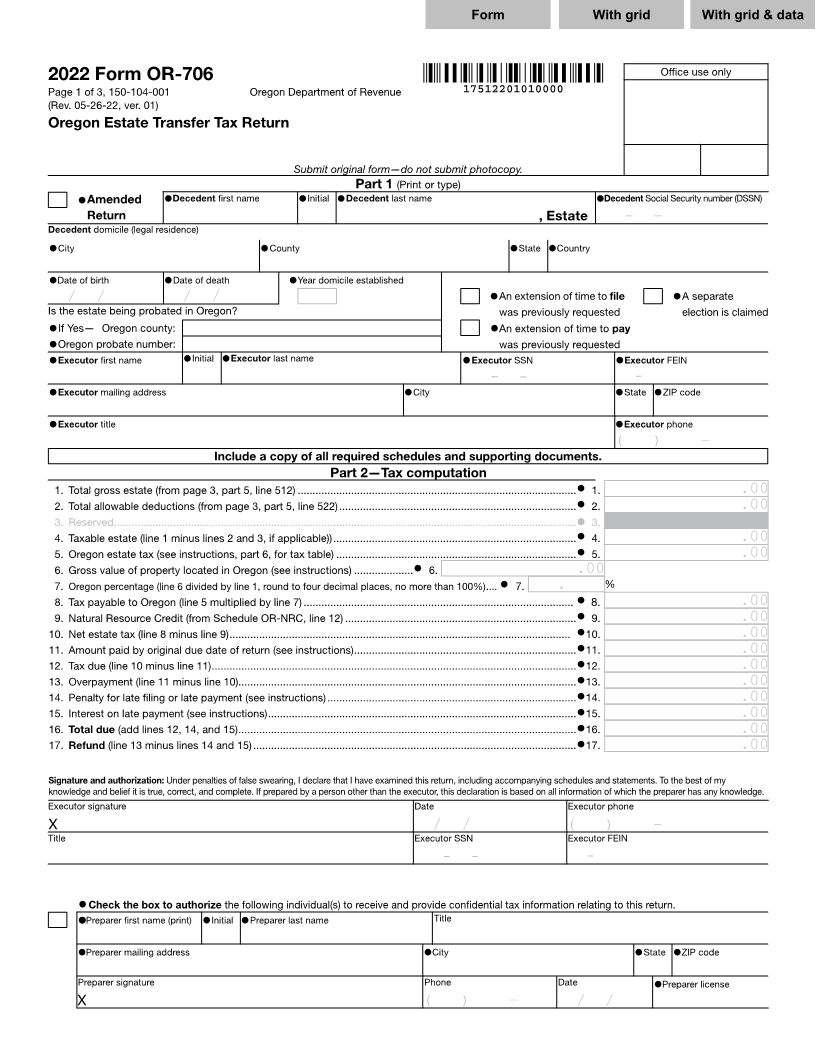

2022 Form OR-706

6 Page 1 of 3, 150-104-001 Oregon Department of Revenue 17512201010000 6

7 (Rev. 05-26-22, ver. 01) 7

8 Oregon Estate Transfer Tax Return 8

9 9

10 10

11 Submit original form—do not submit photocopy. 11

12 Part 1 (Print or type) 12

Initial

13 X •Amended •Decedent first name • •Decedent last name •Decedent Social Security number (DSSN) 13

14 Return XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXX , Estate 999-99-9999– – 14

15 Decedent domicile (legal residence) 15

16 •City • County •State •Country 16

17 17

XXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXXXXXX XX XXXXXXXXXXXXXXXXXXXXX

18 •Date of birth •Date of death •Year domicile established 18

19 99/99/9999/ / 99/99/9999/ / 9999 X •An extension of time tofile X •A separate 19

20 Is the estate being probated in Oregon? was previously requested election is claimed 20

21 •If Yes— Oregon county: XXXXXXXXXXXXXXXXXXXXXXXXX X •An extension of time to pay 21

22 •Oregon probate number: XXXXXXXXXXX was previously requested 22

Initial

23 •Executor first name • •Executor last name •Executor SSN •Executor FEIN 23

24 – 24

XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXX 999-99-9999- - 99-9999999

25 •Executor mailing address •City • State •ZIP code 25

26 26

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXX XX XXXXX-XXXX

27 •Executor title • Executor phone 27

28 28

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX ((999))999-9999–

29 Include a copy of all required schedules and supporting documents. 29

30 Part 2—Tax computation 30

31 1. Total gross estate (from page 3, part 5, line 512) ..............................................................................................•• 1. 99,999,999,999.00.00 31

32 2. Total allowable deductions (from page 3, part 5, line 522) ................................................................................•• 2. 99,999,999,999.00.00 32

33 3. Reserved ............................................................................................................................................................• • 3. 33

34 4. Taxable estate (line 1 minus lines 2 and 3, if applicable)) ..................................................................................•• 4. 99,999,999,999.00.00 34

35 5. Oregon estate tax (see instructions, part 6, for tax table) .................................................................................•• 5. 99,999,999,999.00.00 35

36 6. Gross value of property located in Oregon (see instructions) ....................•• 6. 99,999,999,999.00.00 36

37 7. Oregon percentage (line 6 divided by line 1, round to four decimal places, no more than 100%) .... •• 7. 999.9999.0000% 37

38 8. Tax payable to Oregon (line 5 multiplied by line 7) ........................................................................................... •• 8. 99,999,999,999.00.00 38

39 9. Natural Resource Credit (from Schedule OR-NRC, line 12) ..............................................................................•• 9. 99,999,999,999.00.00 39

40 10. Net estate tax (line 8 minus line 9) ...................................................................................................................•• 10. 99,999,999,999.00.00 40

41 11. Amount paid by original due date of return (see instructions) ...........................................................................••11. 99,999,999,999.00.00 41

42 12. Tax due (line 10 minus line 11) ...........................................................................................................................••12. 99,999,999,999.00.00 42

43 13. Overpayment (line 11 minus line 10) ..................................................................................................................••13. 99,999,999,999.00.00 43

44 14. Penalty for late filing or late payment (see instructions) ....................................................................................••14. 99,999,999,999.00.00 44

45 15. Interest on late payment (see instructions) ........................................................................................................••15. 99,999,999,999.00.00 45

46 16. Total due(add lines 12, 14, and 15) ..................................................................................................................••16. 99,999,999,999.00.00 46

47 17. Refund (line 13 minus lines 14 and 15) .............................................................................................................••17. 99,999,999,999.00.00 47

48 48

49 Signature and authorization: Under penalties of false swearing, I declare that I have examined this return, including accompanying schedules and statements. To the best of my 49

50 knowledge and belief it is true, correct, and complete. If prepared by a person other than the executor, this declaration is based on all information of which the preparer has any knowledge. 50

51 Executor signature Date Executor phone 51

52 X 99/99/9999/ / ((999))999-9999– 52

53 Title Executor SSN Executor FEIN 53

54 – – – 54

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 999-99-9999 99-9999999

55 55

56 56

57 • Check the box to authorize the following individual(s) to receive and provide confidential tax information relating to this return. 57

• •

58 X Preparer first name (print) •Initial •Preparer last name Title 58

59 59

XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

60 •Preparer mailing address •City •State •ZIP code 60

61 61

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXX XX XXXXX-XXXX

62 Preparer signature Phone Date •Preparer license 62

63 X (999)( )999-9999– 99/99/9999/ / XXXXXXXXXX 63

64 64

1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85

3 4 82 83

66 66