Enlarge image

Form OR-706 Instructions

Oregon Estate Transfer Tax 2023

This publication is a guide, not a complete statement, of Oregon Revised Statutes (ORS) and Oregon Administrative Rules (OAR).

For possible updates and more information, refer to the laws and rules on our website, www.oregon.gov/dor.

Contents

Purpose of Form OR-706 ......................................................2 Penalty due .............................................................................6

Interest due .............................................................................6

What’s new ...............................................................................2 Total due .................................................................................7

Executor signature .................................................................7

Important .................................................................................2

Authorization .........................................................................7

Overview ...................................................................................2 Part 3: Elections by the executor .......................................7

Filing requirements ...............................................................2 Alternate valuation ................................................................7

Who must file the return ......................................................2 Special use valuation of Section 2032A ..............................7

When to file return—due date ............................................2 Reversionary or remainder interests ..................................7

Return mailing addresses and payment instructions ...3 Part 4: General information ................................................7

Returns ....................................................................................3 Surviving spouse ...................................................................7

Payment only..........................................................................3 Beneficiary information........................................................7

Private delivery services .......................................................3 Section 2044 property ...........................................................8

Amended returns ..................................................................3

Insurance not included in the gross estate ........................8

Forms and schedules ............................................................3

Partnership interests and stock in closely

Part 1: Decedent and executor information ..................4 held corporations ...................................................................8

Decedent name and SSN ......................................................4 Trusts .......................................................................................8

Decedent domicile .................................................................4 Part 5: Recapitulation ...........................................................8

Extensions ...............................................................................4

Conservation easement exclusion .......................................8

Separate election checkbox ..................................................4

Deductions ..............................................................................8

Executor name and address ................................................4

Marital deduction—Schedule M .........................................9

Part 2: Tax computation ...................................................... 4

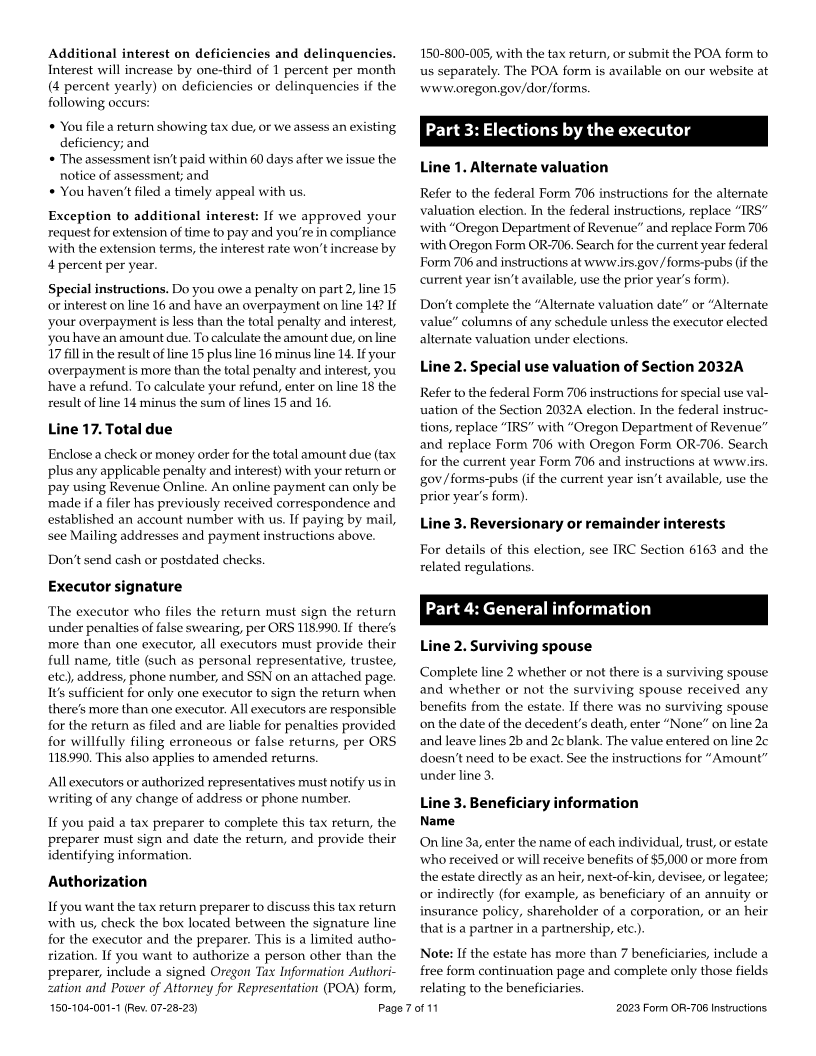

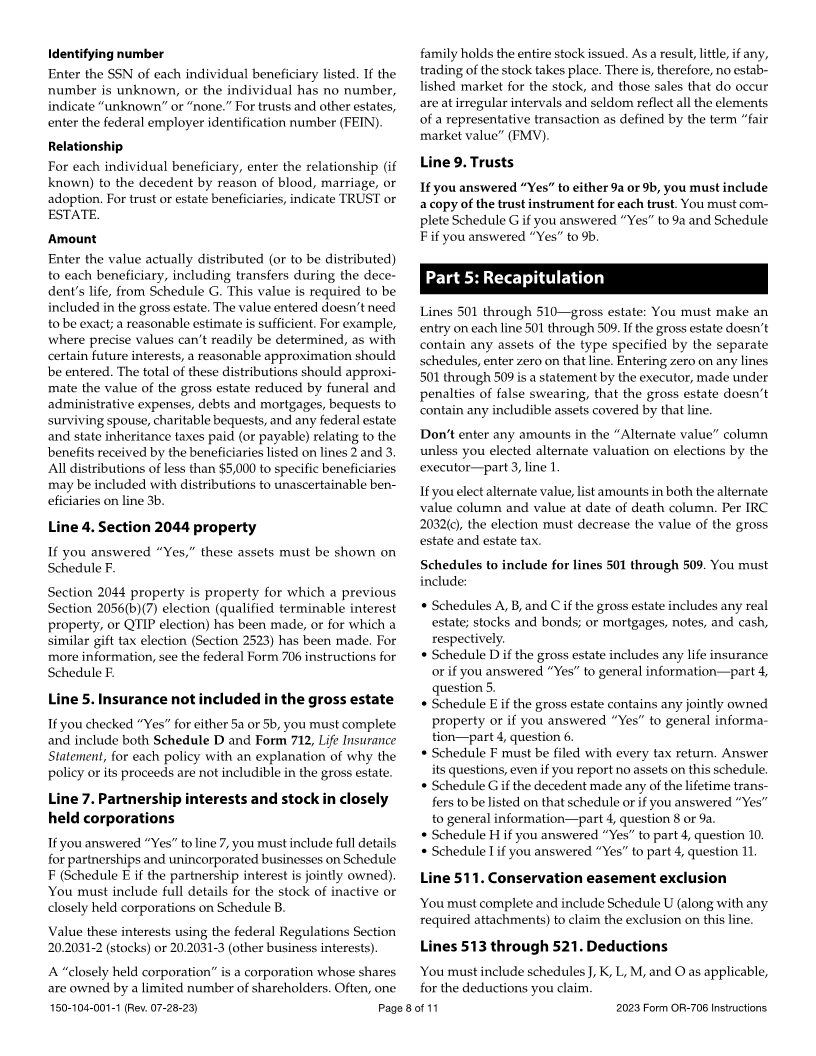

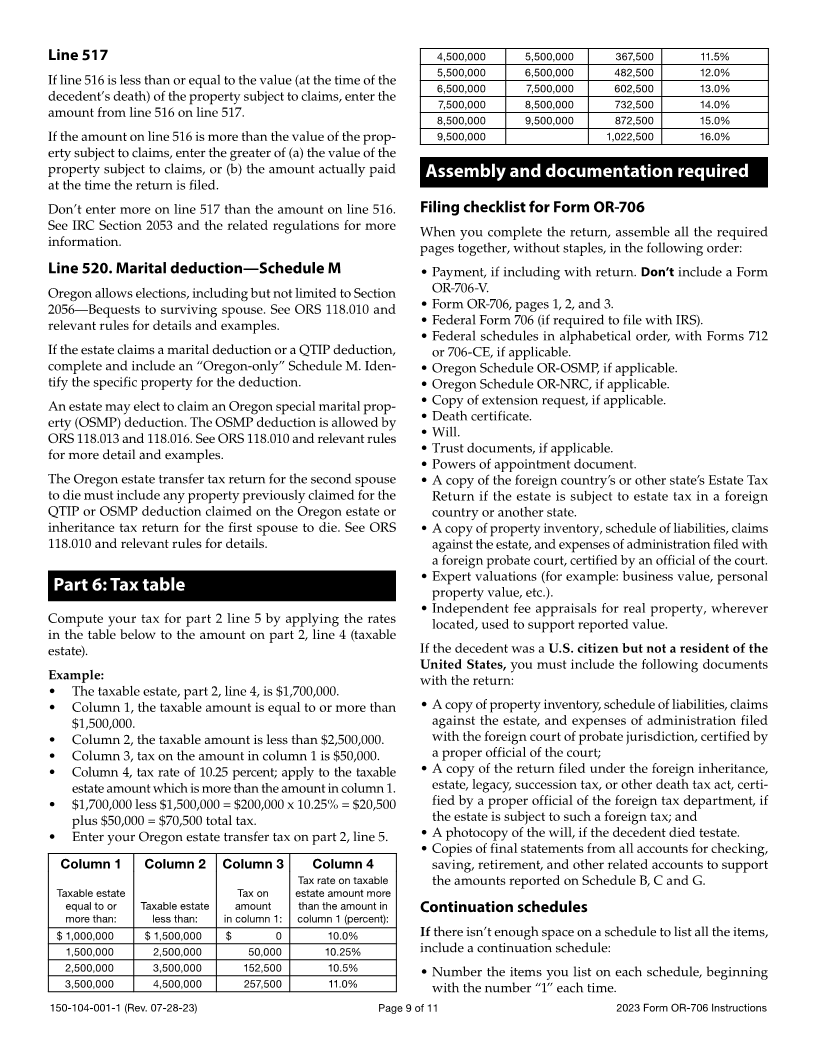

Part 6: Tax table ......................................................................9

Rounding off to whole dollars ............................................ 4

Total gross estate ...................................................................4 Assembly and processing.....................................................9

Natural resource property exemption ................................4 Filing checklist for Form OR-706 .........................................9

Oregon estate tax. ..................................................................5 What happens after you file the tax return? ................... 10

Gross value of property located in Oregon .......................5 Installment payments ......................................................... 10

Oregon percentage ................................................................6

Tax payable to Oregon ..........................................................6 Survivor information .......................................................... 10

Natural resource and commercial

Definitions ............................................................................ 10

fishing business credit ..........................................................6

Amount paid by the due date of the return ......................6 Do you have questions or need help? ............................ 11

150-104-001-1 (Rev. 07-28-23) Page 1 of 11 2023 Form OR-706 Instructions