Enlarge image

1 1

1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form All layers With grid &2 data 84 85

3 4 82 83

3 3

4 4

5 Oregon Department of Revenue 5

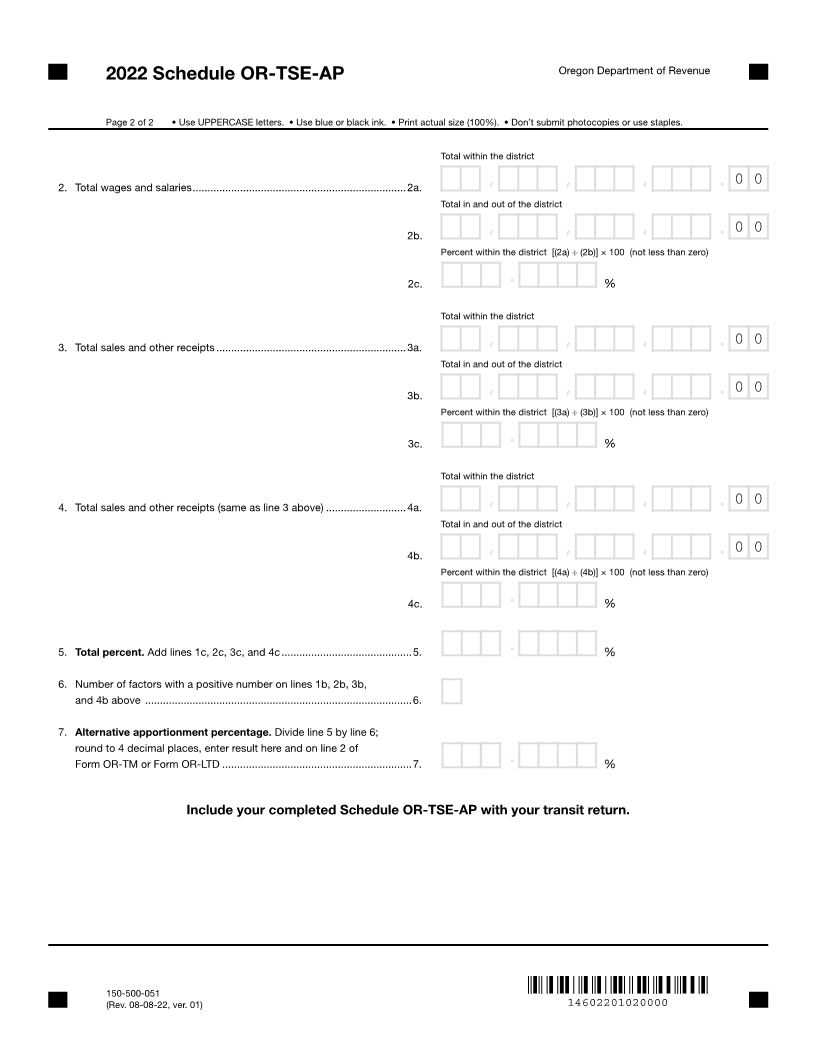

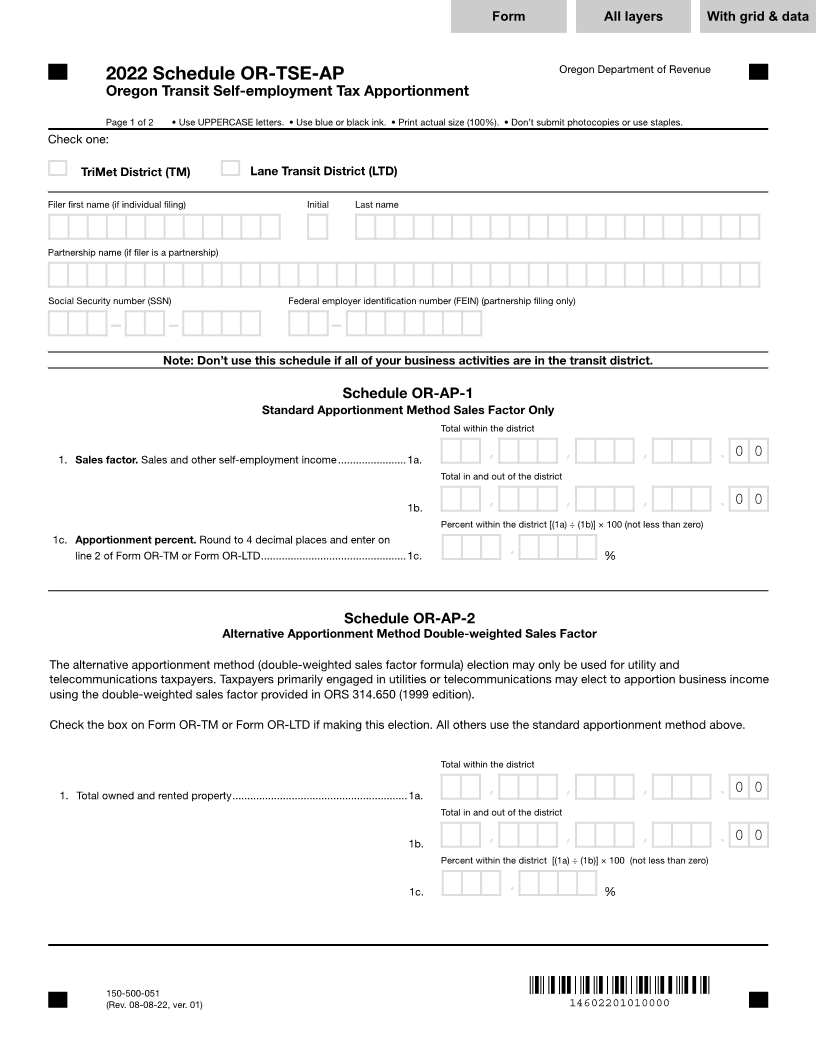

2022 Schedule OR-TSE-AP

6 Oregon Transit Self-employment Tax Apportionment 6

7 7

8 Page 1 of 2 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples. 8

9 Check one: 9

10 10

11 X TriMet District (TM) X Lane Transit District (LTD) 11

12 12

13 Filer first name (if individual filing) Initial Last name 13

14 14

15 15

XXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

16 Partnership name (if filer is a partnership) 16

17 17

18 18

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

19 Social Security number (SSN) Federal employer identification number (FEIN) (partnership filing only) 19

20 20

21 21

999-99-9999 99-9999999

22 22

23 Note: Don’t use this schedule if all of your business activities are in the transit district. 23

24 24

25 Schedule OR-AP-1 25

26 Standard Apportionment Method Sales Factor Only 26

27 Total within the district 27

28 28

29 1. Sales factor. Sales and other self-employment income .......................1a. , , 99,999,999,999.00, 0 0 29

30 Total in and out of the district 30

31 31

32 1b. , , 99,999,999,999.00, 0 0 32

33 Percent within the district [(1a) ÷ (1b)] × 100 (not less than zero) 33

34 1c. Apportionment percent. Round to 4 decimal places and enter on 34

35 line 2 of Form OR-TM or Form OR-LTD .................................................1c. 999.9999 % 35

36 36

37 37

38 38

39 Schedule OR-AP-2 39

40 Alternative Apportionment Method Double-weighted Sales Factor 40

41 41

42 The alternative apportionment method (double-weighted sales factor formula) election may only be used for utility and 42

43 telecommunications taxpayers. Taxpayers primarily engaged in utilities or telecommunications may elect to apportion business income 43

44 using the double-weighted sales factor provided in ORS 314.650 (1999 edition). 44

45 45

46 Check the box on Form OR-TM or Form OR-LTD if making this election. All others use the standard apportionment method above. 46

47 47

48 Total within the district 48

49 49

50 1. Total owned and rented property ...........................................................1a. , , 99,999,999,999.00, 0 0 50

51 Total in and out of the district 51

52 52

53 1b. , , 99,999,999,999.00, 0 0 53

54 Percent within the district [(1a) ÷ (1b)] × 100 (not less than zero) 54

55 55

56 1c. 999.9999 % 56

57 57

58 58

59 59

60 60

61 61

62 62

150-500-051

63 (Rev. 08-08-22, ver. 01) 14602201010000 63

64 64

1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85

3 4 82 83

66 66