Enlarge image

1 1

1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form With grid With grid & data2 84 85

3 4 82 83

3 3

4 4

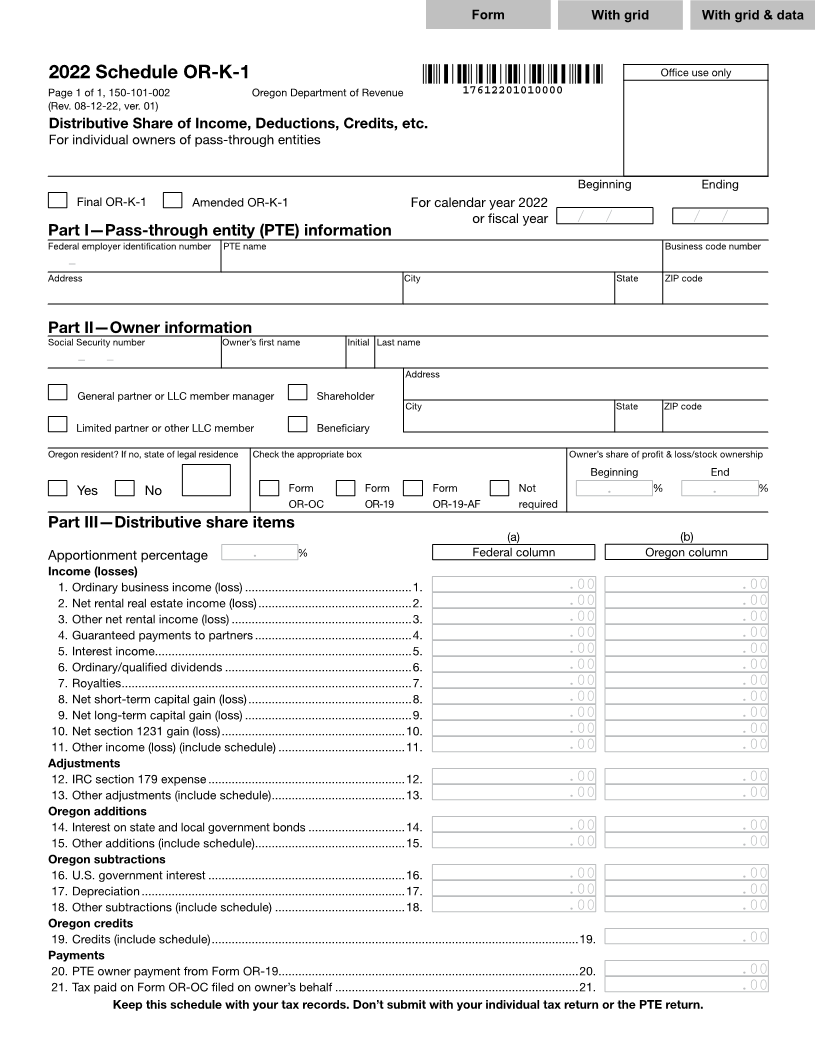

5 2022 Schedule OR-K-1 Office use only 5

6 Page 1 of 1, 150-101-002 Oregon Department of Revenue 17612201010000 6

7 (Rev. 08-12-22, ver. 01) 7

8 Distributive Share of Income, Deductions, Credits, etc. 8

9 For individual owners of pass-through entities 9

10 10

11 11

12 Beginning Ending 12

13 X Final OR-K-1 X Amended OR-K-1 For calendar year 2022 13

14 or fiscal year 99/99/9999/ / 99/99/9999/ / 14

15 Part I—Pass-through entity (PTE) information 15

16 Federal employer identification number PTE name Business code number 16

17 17

18 99-9999999Address- XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXCity State 9999999999ZIP code 18

19 19

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXX XX XXXXX-XXXX

20 20

21 Part II—Owner information 21

22 Social Security number Owner’s first name Initial Last name 22

23 23

24 999-99-9999- - XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXAddress 24

25 X General partner or LLC member manager X Shareholder XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 25

26 City State ZIP code 26

27 X Limited partner or other LLC member X Beneficiary XXXXXXXXXXXXXXXXXXXXX XX XXXXX-XXXX 27

28 28

29 Oregon resident? If no, state of legal residence Check the appropriate box Owner’s share of profit & loss/stock ownership 29

30 Beginning End 30

31 Yes No Form Form Form Not % % 31

X X XX X X X X 999.9999. 999.9999.

32 OR-OC OR-19 OR-19-AF required 32

33 Part III—Distributive share items 33

34 (a) (b) 34

35 Apportionment percentage 999.9999. % Federal column Oregon column 35

36 Income (losses) 36

37 1. Ordinary business income (loss) ..................................................1. 99,999,999,999.00.00 99,999,999,999.00.00 37

38 2. Net rental real estate income (loss) ..............................................2. 99,999,999,999.00.00 99,999,999,999.00.00 38

39 3. Other net rental income (loss) ......................................................3. 99,999,999,999.00.00 99,999,999,999.00.00 39

40 4. Guaranteed payments to partners ...............................................4. 99,999,999,999.00.00 99,999,999,999.00.00 40

41 5. Interest income .............................................................................5. 99,999,999,999.00.00 99,999,999,999.00.00 41

42 6. Ordinary/qualified dividends ........................................................6. 99,999,999,999.00.00 99,999,999,999.00.00 42

43 7. Royalties .......................................................................................7. 99,999,999,999.00.00 99,999,999,999.00.00 43

44 8. Net short-term capital gain (loss) .................................................8. 99,999,999,999.00.00 99,999,999,999.00.00 44

45 9. Net long-term capital gain (loss) ..................................................9. 99,999,999,999.00.00 99,999,999,999.00.00 45

46 10. Net section 1231 gain (loss) .......................................................10. 99,999,999,999.00.00 99,999,999,999.00.00 46

47 11. Other income (loss) (include schedule) ......................................11. 99,999,999,999.00.00 99,999,999,999.00.00 47

48 Adjustments 48

49 12. IRC section 179 expense ...........................................................12. 99,999,999,999.00.00 99,999,999,999.00.00 49

50 13. Other adjustments (include schedule) ........................................13. 99,999,999,999.00.00 99,999,999,999.00.00 50

51 Oregon additions 51

52 14. Interest on state and local government bonds .............................14. 99,999,999,999.00.00 99,999,999,999.00.00 52

53 15. Other additions (include schedule) .............................................15. 99,999,999,999.00.00 99,999,999,999.00.00 53

54 Oregon subtractions 54

55 16. U.S. government interest ...........................................................16. 99,999,999,999.00.00 99,999,999,999.00.00 55

56 17. Depreciation ...............................................................................17. 99,999,999,999.00.00 99,999,999,999.00.00 56

57 18. Other subtractions (include schedule) .......................................18. 99,999,999,999.00.00 99,999,999,999.00.00 57

58 Oregon credits 58

59 19. Credits (include schedule) ..............................................................................................................19. 99,999,999,999.00.00 59

60 Payments 60

61 20. PTE owner payment from Form OR-19..........................................................................................20. 99,999,999,999.00.00 61

62 21. Tax paid on Form OR-OC filed on owner’s behalf .........................................................................21. 99,999,999,999.00.00 62

63 Keep this schedule with your tax records. Don’t submit with your individual tax return or the PTE return. 63

64 64

1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85

3 4 82 83

66 66