Enlarge image

Form OR-19 Instructions

Annual Report of Pass-through Entity Owner Tax Payments 2024

“Nonelecting owner” is a nonresident owner who chooses

Introduction not to join in the filing of a composite return, is required to

file an Oregon tax return, and has Oregon-source distribu-

Purpose of form tive income.

Form OR-19 is used to report tax payments withheld by “Owner” is a partner of a partnership or limited liability

pass-through entities (PTEs) with distributive income from partnership (LLP), shareholder of an S corporation, member

Oregon sources. The tax withheld is a prepayment of Oregon of a limited liability company (LLC), or beneficiary of a trust.

income and excise tax for the PTE’s owners.

“Pass-through entity (PTE)” is a partnership, S corpora-

For composite filing information, see Publication OR-OC. For tion, LLP, LLC, or certain trusts. Note: Single-member LLCs

affidavit filing information, see Form OR-19-AF Instructions. owned by an individual or a corporation and grantor trusts

Qualifying publicly traded partnerships, estates, and most are disregarded for tax purposes and aren’t PTEs. For this

trusts aren’t required to withhold tax for their nonresident purpose only: Estates aren’t PTEs.

owners.

A PTE that elects to pay the PTE elective tax will generally Owner payment requirements

not be required to withhold for the owners. Withholding

may be required for other types of taxes not included on the A PTE is required to pay tax to the department on behalf of

PTE elective tax return, such as built-in gains or excess net the nonelecting owner unless:

passive income tax. • The PTE elects to file and pay the Pass-through Entity

Elective (PTE-E) tax;

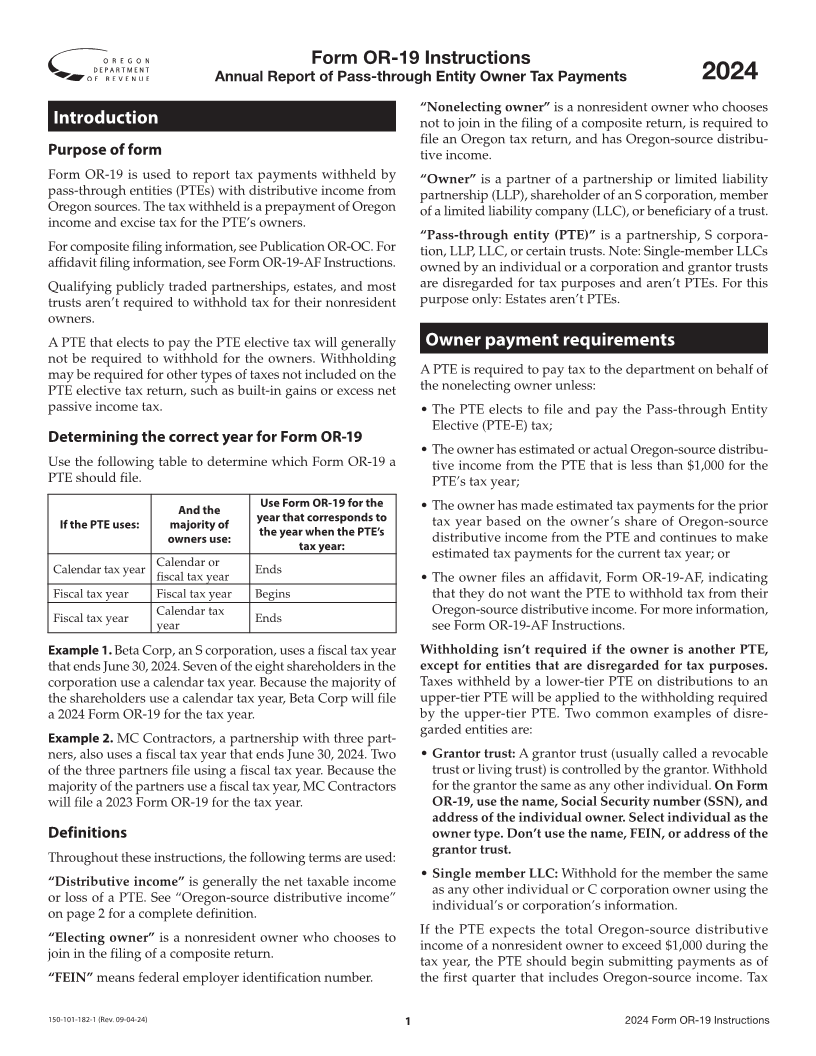

Determining the correct year for Form OR-19

• The owner has estimated or actual Oregon-source distribu-

Use the following table to determine which Form OR-19 a tive income from the PTE that is less than $1,000 for the

PTE should file. PTE’s tax year;

Use Form OR-19 for the

And the • The owner has made estimated tax payments for the prior

year that corresponds to

If the PTE uses: majority of tax year based on the owner’s share of Oregon-source

the year when the PTE’s

owners use: distributive income from the PTE and continues to make

tax year:

estimated tax payments for the current tax year; or

Calendar or

Calendar tax year Ends

fiscal tax year • The owner files an affidavit, Form OR-19-AF, indicating

Fiscal tax year Fiscal tax year Begins that they do not want the PTE to withhold tax from their

Calendar tax Oregon-source distributive income. For more information,

Fiscal tax year Ends

year see Form OR-19-AF Instructions.

Example 1. Beta Corp, an S corporation, uses a fiscal tax year Withholding isn’t required if the owner is another PTE,

that ends June 30, 2024. Seven of the eight shareholders in the except for entities that are disregarded for tax purposes.

corporation use a calendar tax year. Because the majority of Taxes withheld by a lower-tier PTE on distributions to an

the shareholders use a calendar tax year, Beta Corp will file upper-tier PTE will be applied to the withholding required

a 2024 Form OR-19 for the tax year. by the upper-tier PTE. Two common examples of disre-

garded entities are:

Example 2. MC Contractors, a partnership with three part-

ners, also uses a fiscal tax year that ends June 30, 2024. Two • Grantor trust: A grantor trust (usually called a revocable

of the three partners file using a fiscal tax year. Because the trust or living trust) is controlled by the grantor. Withhold

majority of the partners use a fiscal tax year, MC Contractors for the grantor the same as any other individual. On Form

will file a 2023 Form OR-19 for the tax year. OR-19, use the name, Social Security number (SSN), and

address of the individual owner. Select individual as the

Definitions owner type. Don’t use the name, FEIN, or address of the

grantor trust.

Throughout these instructions, the following terms are used:

• Single member LLC: Withhold for the member the same

“Distributive income” is generally the net taxable income

as any other individual or C corporation owner using the

or loss of a PTE. See “Oregon-source distributive income”

individual’s or corporation’s information.

on page 2 for a complete definition.

If the PTE expects the total Oregon-source distributive

“Electing owner” is a nonresident owner who chooses to

income of a nonresident owner to exceed $1,000 during the

join in the filing of a composite return.

tax year, the PTE should begin submitting payments as of

“FEIN” means federal employer identification number. the first quarter that includes Oregon-source income. Tax

150-101-182-1 (Rev. 09-04-24) 1 2024 Form OR-19 Instructions