Enlarge image

1 1

1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form With grid With grid & data2 84 85

3 4 82 83

3 3

4 4

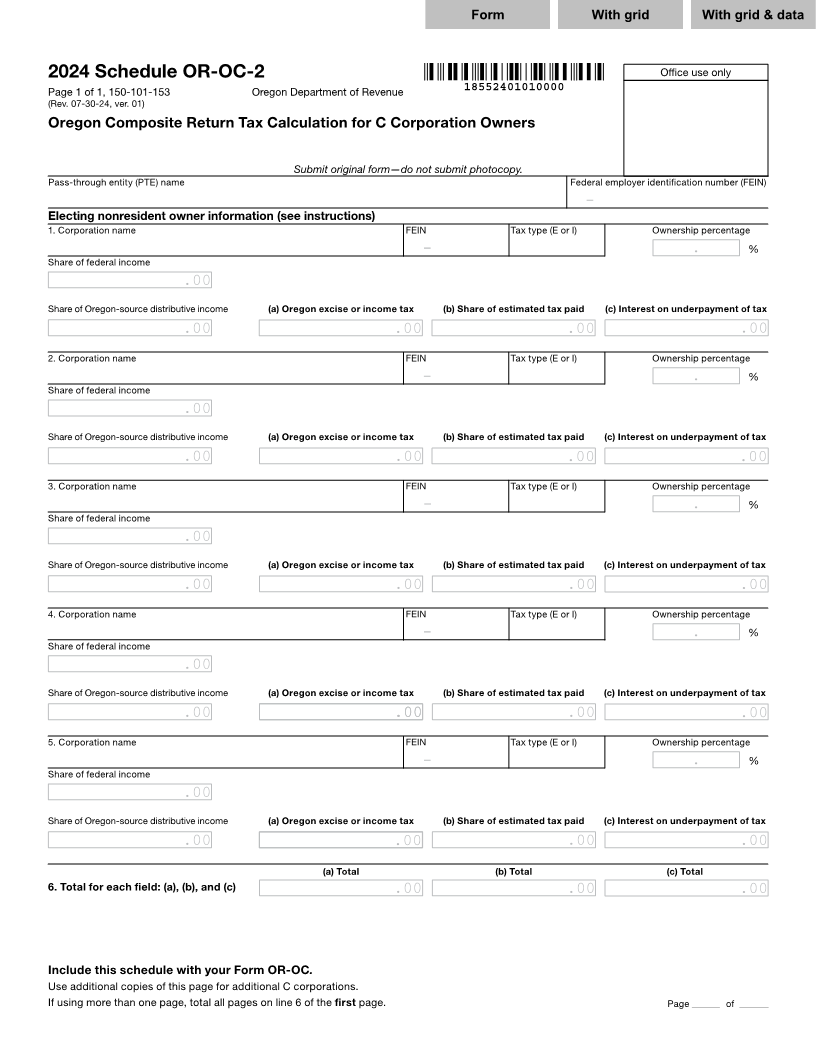

5 2024 Schedule OR-OC-2 Office use only 5

6 Page 1 of 1, 150-101-153 Oregon Department of Revenue 18552401010000 6

7 (Rev. 07-30-24, ver. 01) 7

8 Oregon Composite Return Tax Calculation for C Corporation Owners 8

9 9

10 10

11 Submit original form—do not submit photocopy. 11

12 Pass-through entity (PTE) name Federal employer identification number (FEIN) 12

13 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99-9999999– 13

14 Electing nonresident owner information (see instructions) 14

15 1. Corporation name FEIN Tax type (E or I) Ownership percentage 15

16 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99-9999999– X 999.9999. % 16

17 Share of federal income 17

18 18

99,999,999,999.00.00

19 19

20 Share of Oregon-source distributive income (a) Oregon excise or income tax (b) Share of estimated tax paid (c) Interest on underpayment of tax 20

21 21

99,999,999,999.00.00 99,999,999,999.00.0099,999,999,999.00.00 99,999,999,999.00.00

22 22

23 2. Corporation name FEIN Tax type (E or I) Ownership percentage 23

24 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99-9999999– X 999.9999. % 24

25 Share of federal income 25

26 26

99,999,999,999.00.00

27 27

28 Share of Oregon-source distributive income (a) Oregon excise or income tax (b) Share of estimated tax paid (c) Interest on underpayment of tax 28

29 29

99,999,999,999.00.00 99,999,999,999.00.0099,999,999,999.00.0099,999,999,999.00.00

30 30

31 3. Corporation name FEIN Tax type (E or I) Ownership percentage 31

32 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99-9999999– X 999.9999. % 32

33 Share of federal income 33

34 34

99,999,999,999.00.00

35 35

36 Share of Oregon-source distributive income (a) Oregon excise or income tax (b) Share of estimated tax paid (c) Interest on underpayment of tax 36

37 37

99,999,999,999.00.00 99,999,999,999.00.00 99,999,999,999.00.00 99,999,999,999.00.00

38 38

39 4. Corporation name FEIN Tax type (E or I) Ownership percentage 39

40 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99-9999999– X 999.9999. % 40

41 Share of federal income 41

42 42

99,999,999,999.00.00

43 43

44 Share of Oregon-source distributive income (a) Oregon excise or income tax (b) Share of estimated tax paid (c) Interest on underpayment of tax 44

45 45

99,999,999,999.00.00 99,999,999,999.00.00.00 99,999,999,999.00.00 99,999,999,999.00.00

46 46

47 5. Corporation name FEIN Tax type (E or I) Ownership percentage 47

48 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99-9999999– X 999.9999. % 48

49 Share of federal income 49

50 50

99,999,999,999.00.00

51 51

52 Share of Oregon-source distributive income (a) Oregon excise or income tax (b) Share of estimated tax paid (c) Interest on underpayment of tax 52

53 53

99,999,999,999.00.00 99,999,999,999.00.00 99,999,999,999.00.00 99,999,999,999.00.00

54 54

55 (a) Total (b) Total (c) Total 55

56 6. Total for each field: (a), (b), and (c) 56

99,999,999,999.00.00 99,999,999,999.00.00 99,999,999,999.00.00

57 57

58 58

59 59

60 60

61 Include this schedule with your Form OR-OC . 61

62 Use additional copies of this page for additional C corporations. 62

63 If using more than one page, total all pages on line 6 of the first page. Page ______ 999of 999_______63

64 64

1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85

3 4 82 83

66 66