Enlarge image

1 1

1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form With grid With grid & data2 84 85

3 4 82 83

3 3

4 4

5 Office use only 5

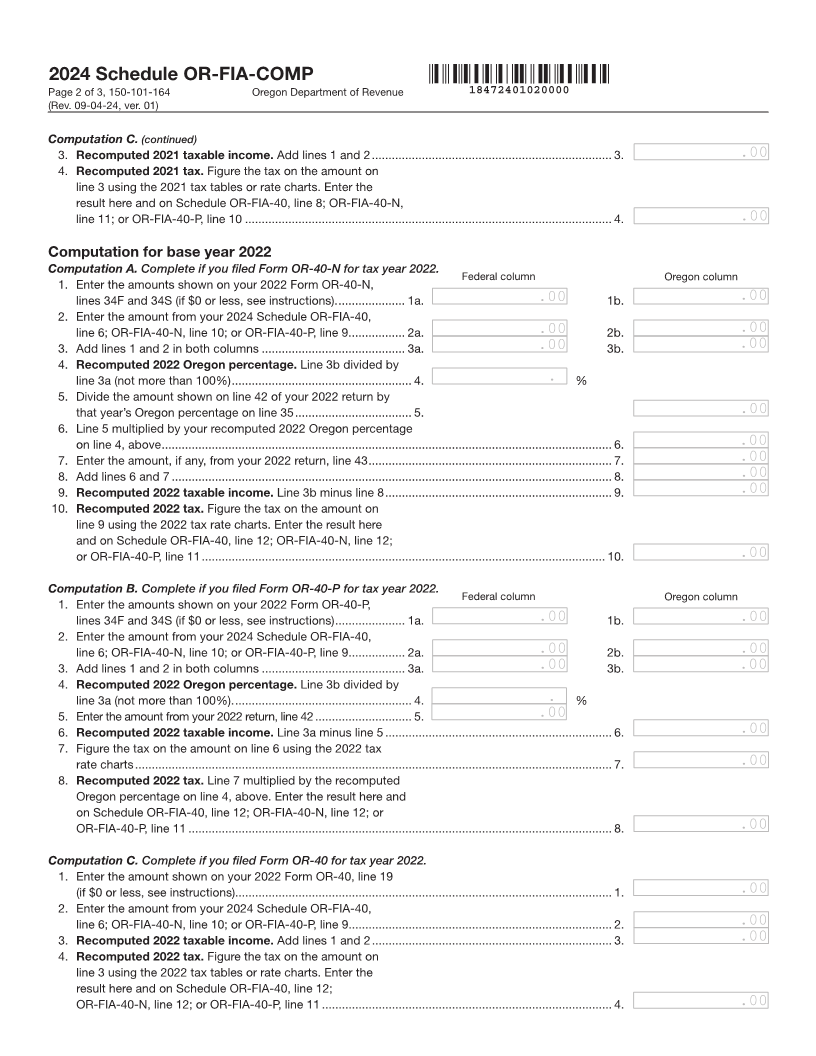

2024 Schedule OR-FIA-COMP

6 Page 1 of 3, 150-101-164 Oregon Department of Revenue 18472401010000 6

7 (Rev. 09-04-24, ver. 01) 7

8 Oregon Farm Income Averaging Computation of Tax 8

9 9

10 10

11 11

12 First name Initial Last name Social Security number (SSN) 12

13 XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXX 999-99-9999– – 13

14 Spouse first name Initial Spouse last name Spouse SSN 14

15 XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXX 999-99-9999– – 15

16 If you used farm income averaging for any base year, see the instructions for the amount(s) to enter on line 1 for each base 16

17 year computation. Otherwise, enter the line 1 amount(s) for Computation A, B, or C for each base year as directed. 17

18 18

19 Computation for base year 2021 19

20 Computation A. Complete if you filed Form OR-40-N for tax year 2021. 20

Federal column Oregon column

21 1. Enter the amounts shown on your 2021 Form OR-40-N, 21

22 lines 34F and 34S (if $0 or less, see instructions) ......................1a. 999,999,999.00.00 1b. 999,999,999.00.00 22

23 2. Enter the amount from your 2024 Schedule OR-FIA-40, 23

24 line 6; OR-FIA-40-N, line 10; or OR-FIA-40-P, line 9 ................. 2a. 999,999,999.00.00 2b. 999,999,999.00.00 24

25 3. Add lines 1 and 2 in both columns ........................................... 3a. 999,999,999.00.00 3b. 999,999,999.00.00 25

26 4. Recomputed 2021 Oregon percentage. Line 3b divided by 26

27 line 3a (not more than 100%) ...................................................... 4. 999.9. % 27

28 5. Divide the amount shown on line 42 of your 2021 return by 28

29 that year’s Oregon percentage on line 35 ............................................................................................... 5. 999,999,999.00.00 29

30 6. Line 5 multiplied by your recomputed 2021 Oregon percentage 30

31 on line 4, above. ...................................................................................................................................... 6. 999,999,999.00.00 31

32 7. Enter the amount, if any, from your 2021 return, line 43. ........................................................................ 7. 999,999,999.00.00 32

33 8. Add lines 6 and 7 .................................................................................................................................... 8. 999,999,999.00.00 33

34 9. Recomputed 2021 taxable income. Line 3b minus line 8 .................................................................... 9. 999,999,999.00.00 34

35 10. Recomputed 2021 tax. Figure the tax on the amount on 35

36 line 9 using the 2021 tax rate charts. Enter the result here 36

37 and on Schedule OR-FIA-40, line 8; OR-FIA-40-N, line 11; 37

38 or OR-FIA-40-P, line 10 ......................................................................................................................... 10. 999,999,999.00.00 38

39 39

40 Computation B. Complete if you filed Form OR-40-P for tax year 2021. Federal column Oregon column 40

41 1. Enter the amounts shown on your 2021 Form OR-40-P, 41

42 lines 34F and 34S (if $0 or less, see instructions) ........................1a. 999,999,999.00.00 1b. 999,999,999.00.00 42

43 2. Enter the amount from your 2024 Schedule OR-FIA-40, 43

44 line 6; OR-FIA-40-N, line 10; or OR-FIA-40-P, line 9. ................ 2a. 999,999,999.00.00 2b. 999,999,999.00.00 44

45 3. Add lines 1 and 2 in both columns ........................................... 3a. 999,999,999.00.00 3b. 999,999,999.00.00 45

46 4. Recomputed 2021 Oregon percentage. Line 3b divided 46

47 by line 3a (not more than 100%) ................................................. 4. 999.9. % 47

48 5. Enter the amount from your 2021 return, line 42 ..............................5. 999,999,999.00.00 48

49 6. Recomputed 2021 taxable income. Line 3a minus line 5 .................................................................... 6. 999,999,999.00.00 49

50 7. Figure the tax on the amount on line 6 using the 2021 tax 50

51 rate charts ............................................................................................................................................... 7. 999,999,999.00.00 51

52 8. Recomputed 2021 tax. Line 7 multiplied by the recomputed 52

53 Oregon percentage on line 4, above. Enter the result here 53

54 and on Schedule OR-FIA-40, line 8; OR-FIA-40-N, line 11; 54

55 or OR-FIA-40-P, line 10 ........................................................................................................................... 8. 999,999,999.00.00 55

56 56

57 Computation C. Complete if you filed Form OR-40 for tax year 2021. 57

58 1. Enter the amount shown on your 2021 Form OR-40, 58

59 line 19 (if $0 or less, see instructions) ..................................................................................................... 1. 999,999,999.00.00 59

60 2. Enter the amount from your 2024 Schedule OR-FIA-40, 60

61 line 6; OR-FIA-40-N, line 10; or OR-FIA-40-P, line 9 ............................................................................... 2. 999,999,999.00.00 61

62 62

63 63

64 64

1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85

3 4 82 83

66 66