Enlarge image

Schedule OR-PTE-FY Instructions 2024

Qualified business income reduced tax rate for

Oregon full-year residents

• Has ordinary business income that doesn’t exceed

General information $5 million;

• Employs one or more employees in Oregon who meet the

If you have qualifying income from a sole proprietorship,

employee requirements described below; and

partnership, or an S corporation, you may elect to use a • If ordinary business income is more than $250,000, com-

reduced tax rate for that income. The reduced tax rate can plies with the employee-to-owner ratio requirement or

be claimed for qualifying income up to $5 million. Use meets the income distribution requirement described

Schedule OR-PTE-FY to claim this reduced tax rate if you’re below.

a full-year resident.

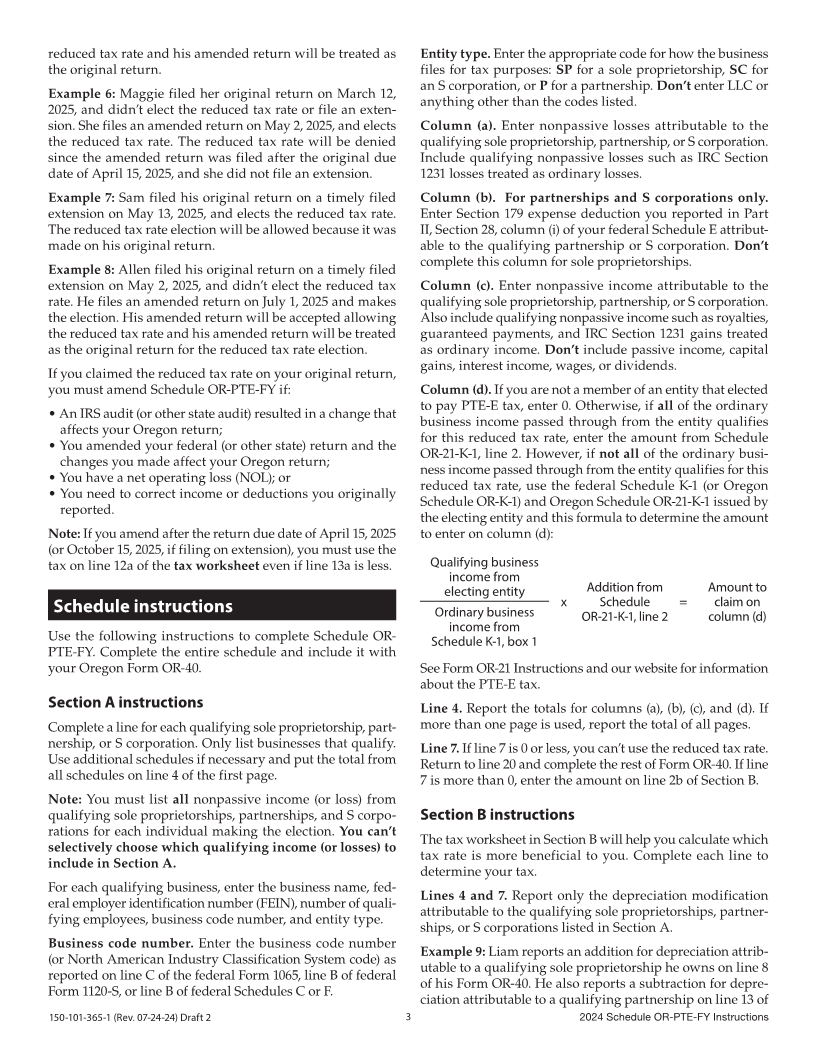

Employee-to-owner ratio requirement. Unless the income

Important: The qualifying business income reduced tax distribution requirement is met, partnerships and S corpora-

rate is an irrevocable election that must be made each year tions with more than $250,000 in ordinary business income

on an original return. You can’t amend to revoke or make must have, at a minimum, the number of qualifying employ-

the election after your original return is filed unless you ees in Oregon per owner as shown in this table. The com-

file an amended return on or before the original due date of bined total of hours worked by the qualifying employees,

April 15, 2025, or if filing on extension, October 15, 2025. See up to 1,200 hours per employee, must be at least the number

the “Amending” section for more information. The annual shown in this table.

election is made by completing Schedule OR-PTE-FY and

Partnership and S corporation employee requirements:

checking box 20c on the Oregon Form OR-40.

Qualifying income may only be modified for depreciation Ordinary But not Employees Aggregate

before applying the reduced tax rate. No other additions, business more than required hours worked

subtractions, or deductions are allowed in the calculation income is at by employees

of the tax on qualifying income. least

$0 $250,000 One 1,200

Schedule OR-PTE-FY is for Oregon full-year residents only.

One per 1,200 per

If you are an Oregon part-year resident, use Schedule OR- $250,001 $500,000

PTE-PY. If you are an Oregon nonresident, use Schedule owner owner

OR-PTE-NR. Two per 2,400 per

$500,001 $1,000,000

owner owner

Four per 4,800 per

Qualifications $1,000,001 $2,500,000

owner owner

Ten per 12,000 per

Generally $2,500,001 $5,000,000

owner owner

To be eligible for the reduced tax rate, you must materially Income distribution requirement. A partnership or S

participate in the business, have at least the minimum num- corporation with more than $250,000 in ordinary business

ber of qualifying Oregon employees, and meet any specific income may still qualify for the reduced tax rate even if

requirements for a sole proprietorship or for a partnership the employee-to-owner ratio shown in this table isn’t met,

or S corporation. so long as income distributions don’t exceed 25 percent of

ordinary business income. Calculate the percentage using

Sole proprietorship

the total distributions and total ordinary business income

To be eligible for the reduced tax rate, a sole proprietor must: for the current tax year and up to two of the most recent tax

years. Treat an annual amount of less than zero as zero for

• Have qualifying business income from the sole

that year.

proprietorship;

• Materially participate in the business; and Qualifying business income. For your income to qualify

• Employ one or more employees in Oregon who meet the for the reduced tax rate, it must be nonpassive income from

employee requirements explained below for at least 1,200 a sole proprietorship, partnership, or S corporation. Income

aggregate hours during the tax year. from trusts or estates doesn’t qualify for the reduced tax rate.

“Nonpassive income” is income other than that from passive

Partnership or S corporation

activities as defined in Section 469 of the Internal Revenue

To be eligible for the reduced tax rate, a partner or S corpo- Code (IRC). This includes, but isn’t limited to, nonpassive

ration shareholder must have qualifying income from and income reported on federal Schedules C (line 31), E [line 28,

materially participate in a partnership or S corporation that: column (k)], and F (line 34); IRC Section 1231 gains treated as

150-101-365-1 (Rev. 07-24-24) Draft 2 1 2024 Schedule OR-PTE-FY Instructions