Enlarge image

1 1

1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form With grid With grid & data2 84 85

3 4 82 83

3 3

4 4

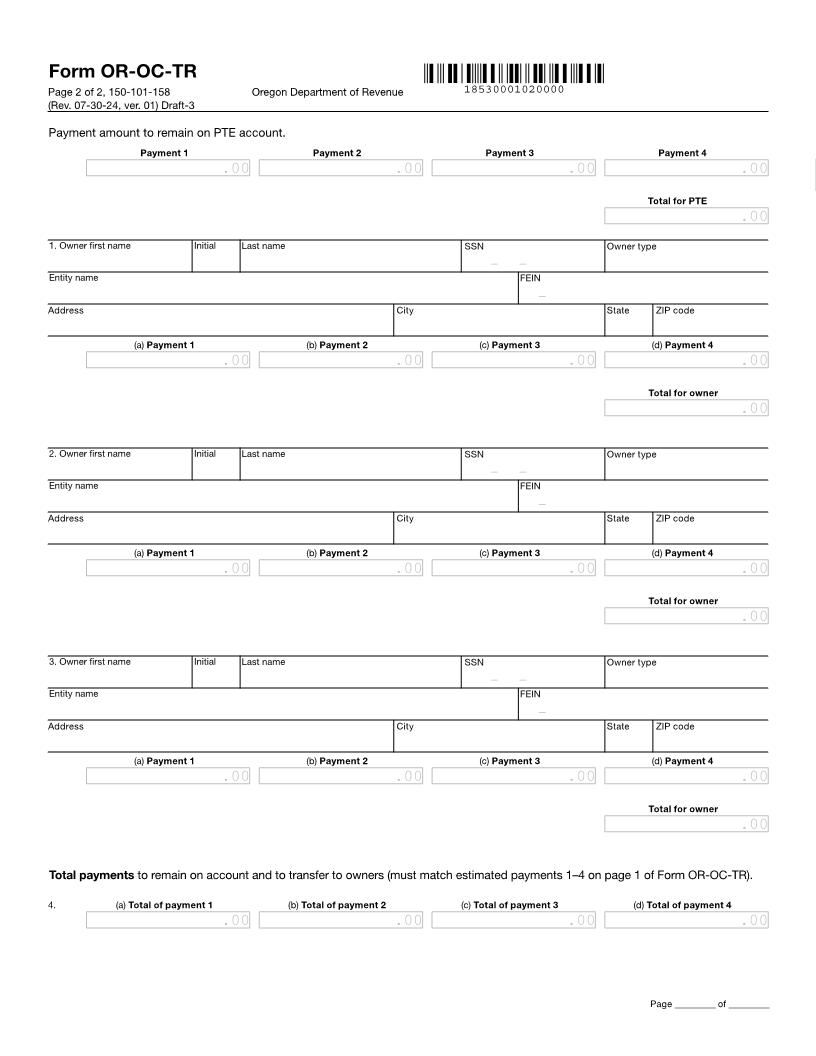

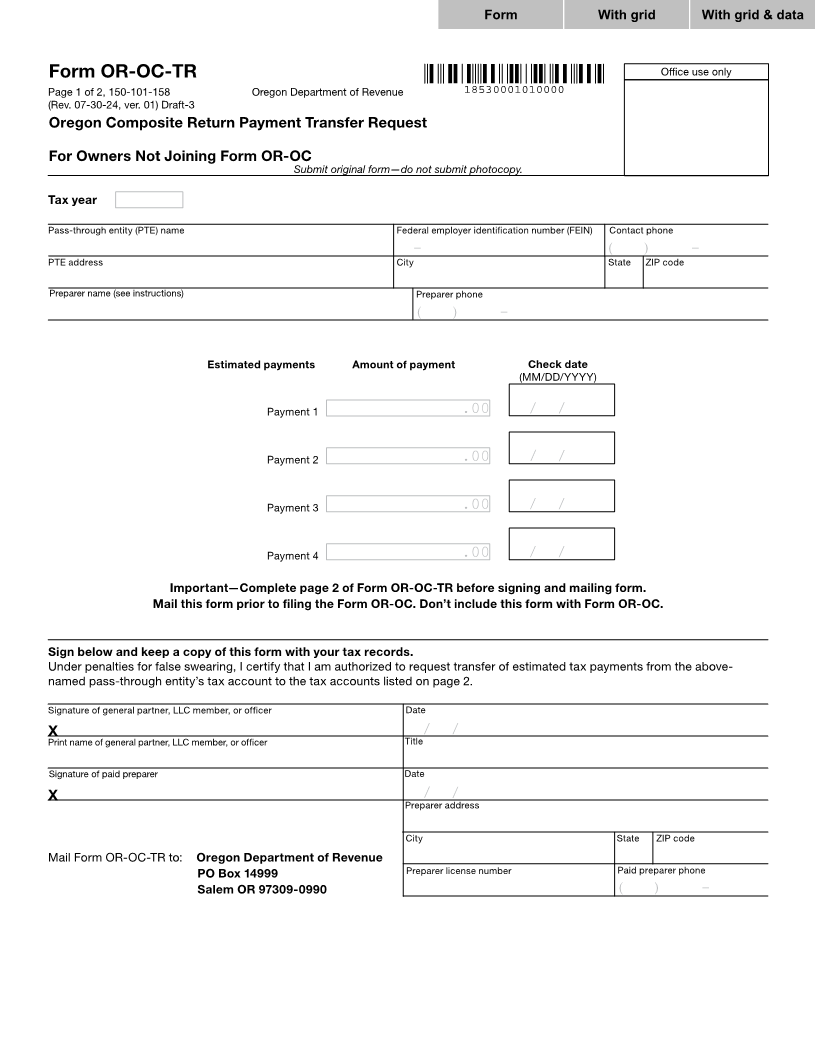

5 Form OR‑OC‑TR Office use only 5

6 Page 1 of 2, 150-101-158 Oregon Department of Revenue 18530001010000 6

7 (Rev. 07-30-24, ver. 01) Draft-3 7

8 Oregon Composite Return Payment Transfer Request 8

9 9

10 10

For Owners Not Joining Form OR‑OC

11 Submit original form—do not submit photocopy. 11

12 12

13 Tax year 13

9999

14 14

15 Pass-through entity (PTE) name Federal employer identification number (FEIN) Contact phone 15

16 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99-9999999– (999)( ) 999-9999– 16

17 PTE address City State ZIP code 17

18 18

19 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXPreparer name (see instructions) XXXXXXXXXXXXXXXXXXXXXPreparer phone XX XXXXX-XXXX 19

20 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX (999)( ) 999-9999– 20

21 21

22 22

23 Estimated payments Amount of payment Check date 23

24 (MM/DD/YYYY) 24

25 25

26 Payment 1 99,999,999,999.00.00 99/99/9999/ / 26

27 27

28 28

29 Payment 2 99,999,999,999.00.00 99/99/9999/ / 29

30 30

31 31

32 Payment 3 99,999,999,999.00.00 99/99/9999/ / 32

33 33

34 34

35 Payment 4 99,999,999,999.00.00 99/99/9999/ / 35

36 36

37 Important—Complete page 2 of Form OR‑OC‑TR before signing and mailing form. 37

38 Mail this form prior to filing the Form OR‑OC. Don’t include this form with Form OR‑OC. 38

39 39

40 40

41 Sign below and keep a copy of this form with your tax records. 41

42 Under penalties for false swearing, I certify that I am authorized to request transfer of estimated tax payments from the above- 42

43 named pass-through entity’s tax account to the tax accounts listed on page 2. 43

44 44

45 Signature of general partner, LLC member, or officer Date 45

46 X 99/99/9999/ / 46

47 Print name of general partner, LLC member, or officer Title 47

48 48

49 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXSignature of paid preparer XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXDate 49

50 X 99/99/9999/ / 50

51 Preparer address 51

52 52

53 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXCity State ZIP code 53

54 Mail Form OR-OC-TR to: Oregon Department of Revenue XXXXXXXXXXXXXXXXXXXXX XX XXXXX-XXXX 54

55 PO Box 14999 Preparer license number Paid preparer phone 55

56 Salem OR 97309‑0990 (999)( ) 999-9999– 56

XXXXXXXXXX

57 57

58 58

59 59

60 60

61 61

62 62

63 63

64 64

1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85

3 4 82 83

66 66