Enlarge image

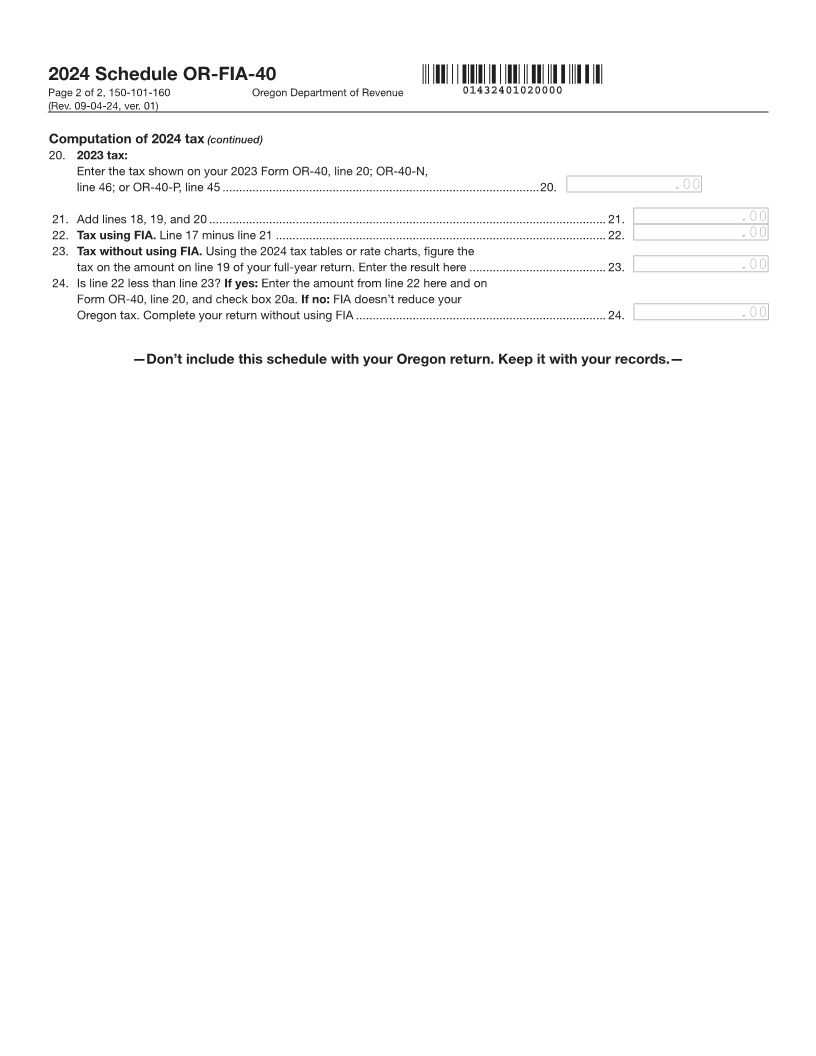

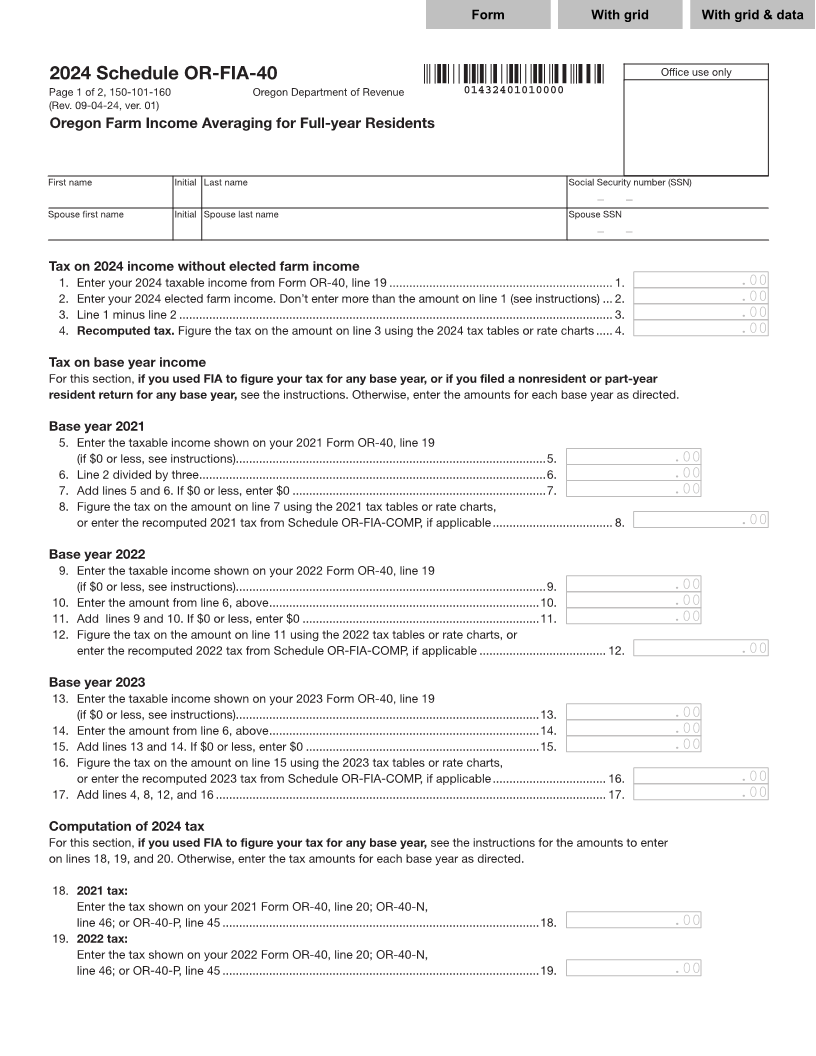

1 1 1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form With grid With grid & data2 84 85 3 4 82 83 3 3 4 4 5 2024 Schedule OR-FIA-40 Office use only 5 6 Page 1 of 2, 150-101-160 Oregon Department of Revenue 01432401010000 6 7 (Rev. 09-04-24, ver. 01) 7 8 Oregon Farm Income Averaging for Full-year Residents 8 9 9 10 10 11 11 12 First name Initial Last name Social Security number (SSN) 12 13 XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXX 999-99-9999– – 13 14 Spouse first name Initial Spouse last name Spouse SSN 14 15 XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXX 999-99-9999– – 15 16 16 17 Tax on 2024 income without elected farm income 17 18 1. Enter your 2024 taxable income from Form OR-40, line 19 ................................................................... 1. 999,999,999.00.00 18 19 2. Enter your 2024 elected farm income. Don’t enter more than the amount on line 1 (see instructions) ... 2. 999,999,999.00.00 19 20 3. Line 1 minus line 2 .................................................................................................................................. 3. 999,999,999.00.00 20 21 4. Recomputed tax. Figure the tax on the amount on line 3 using the 2024 tax tables or rate charts ..... 4. 999,999,999.00.00 21 22 22 23 Tax on base year income 23 24 For this section, if you used FIA to figure your tax for any base year, or if you filed a nonresident or part-year 24 25 resident return for any base year, see the instructions. Otherwise, enter the amounts for each base year as directed. 25 26 26 27 Base year 2021 27 28 5. Enter the taxable income shown on your 2021 Form OR-40, line 19 28 29 (if $0 or less, see instructions).............................................................................................5. 999,999,999.00.00 29 30 6. Line 2 divided by three ........................................................................................................6. 999,999,999.00.00 30 31 7. Add lines 5 and 6. If $0 or less, enter $0 ............................................................................7. 999,999,999.00.00 31 32 8. Figure the tax on the amount on line 7 using the 2021 tax tables or rate charts, 32 33 or enter the recomputed 2021 tax from Schedule OR-FIA-COMP, if applicable .................................... 8. 999,999,999.00.00 33 34 34 35 Base year 2022 35 36 9. Enter the taxable income shown on your 2022 Form OR-40, line 19 36 37 (if $0 or less, see instructions).............................................................................................9. 999,999,999.00.00 37 38 10. Enter the amount from line 6, above .................................................................................10. 999,999,999.00.00 38 39 11. Add lines 9 and 10. If $0 or less, enter $0 .......................................................................11. 999,999,999.00.00 39 40 12. Figure the tax on the amount on line 11 using the 2022 tax tables or rate charts, or 40 41 enter the recomputed 2022 tax from Schedule OR-FIA-COMP, if applicable ...................................... 12. 999,999,999.00.00 41 42 42 43 Base year 2023 43 44 13. Enter the taxable income shown on your 2023 Form OR-40, line 19 44 45 (if $0 or less, see instructions)...........................................................................................13. 999,999,999.00.00 45 46 14. Enter the amount from line 6, above .................................................................................14. 999,999,999.00.00 46 47 15. Add lines 13 and 14. If $0 or less, enter $0 ......................................................................15. 999,999,999.00.00 47 48 16. Figure the tax on the amount on line 15 using the 2023 tax tables or rate charts, 48 49 or enter the recomputed 2023 tax from Schedule OR-FIA-COMP, if applicable .................................. 16. 999,999,999.00.00 49 50 17. Add lines 4, 8, 12, and 16 ..................................................................................................................... 17. 999,999,999.00.00 50 51 51 52 Computation of 2024 tax 52 53 For this section, if you used FIA to figure your tax for any base year, see the instructions for the amounts to enter 53 54 on lines 18, 19, and 20. Otherwise, enter the tax amounts for each base year as directed. 54 55 55 56 18. 2021 tax: 56 57 Enter the tax shown on your 2021 Form OR-40, line 20; OR-40-N, 57 58 line 46; or OR-40-P, line 45 ...............................................................................................18. 999,999,999.00.00 58 59 19. 2022 tax: 59 60 Enter the tax shown on your 2022 Form OR-40, line 20; OR-40-N, 60 61 line 46; or OR-40-P, line 45 ...............................................................................................19. 999,999,999.00.00 61 62 62 63 63 64 64 1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85 3 4 82 83 66 66