Enlarge image

1 1

1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form All layers With grid &2 data 84 85

3 4 82 83

3 3

4 4

5 Oregon Department of Revenue 5

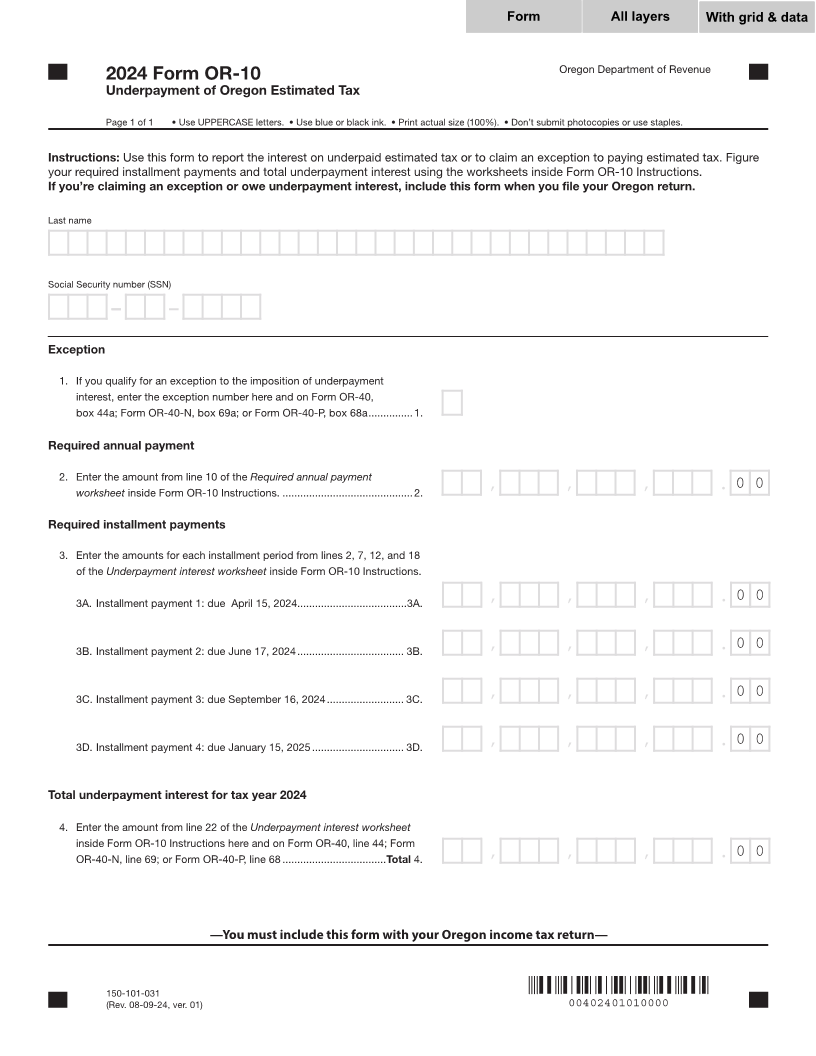

2024 Form OR-10

6 Underpayment of Oregon Estimated Tax 6

7 7

8 Page 1 of 1 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples. 8

9 9

10 10

Instructions: Use this form to report the interest on underpaid estimated tax or to claim an exception to paying estimated tax. Figure

11 your required installment payments and total underpayment interest using the worksheets inside Form OR-10 Instructions. 11

12 If you’re claiming an exception or owe underpayment interest, include this form when you file your Oregon return. 12

13 13

14 Last name 14

15 15

16 16

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

17 17

18 Social Security number (SSN) 18

19 19

20 20

999-99-9999

21 21

22 22

Exception

23 23

24 1. If you qualify for an exception to the imposition of underpayment 24

25 interest, enter the exception number here and on Form OR-40, 25

26 box 44a; Form OR-40-N, box 69a; or Form OR-40-P, box 68a ...............1. 9 26

27 27

28 28

Required annual payment

29 29

30 2. Enter the amount from line 10 of the Required annual payment 30

31 worksheet inside Form OR-10 Instructions. ............................................2. , , 99,999,999,999.00, 0 0 31

32 32

33 Required installment payments 33

34 34

35 3. Enter the amounts for each installment period from lines 2, 7, 12, and 18 35

36 of the Underpayment interest worksheet inside Form OR-10 Instructions. 36

37 37

38 3A. Installment payment 1: due April 15, 2024.....................................3A. , , 99,999,999,999.00, 0 0 38

39 39

40 40

41 3B. Installment payment 2: due June 17, 2024 .................................... 3B. , , 99,999,999,999.00, 0 0 41

42 42

43 43

44 3C. Installment payment 3: due September 16, 2024 .......................... 3C. , , 99,999,999,999.00, 0 0 44

45 45

46 46

47 3D. Installment payment 4: due January 15, 2025 ............................... 3D. , , 99,999,999,999.00, 0 0 47

48 48

49 49

50 Total underpayment interest for tax year 2024 50

51 51

52 4. Enter the amount from line 22 of the Underpayment interest worksheet 52

53 inside Form OR-10 Instructions here and on Form OR-40, line 44; Form 53

54 OR-40-N, line 69; or Form OR-40-P, line 68 ...................................Total 4. , , 99,999,999,999.00, 0 0 54

55 55

56 56

57 57

58 58

59 —You must include this form with your Oregon income tax return— 59

60 60

61 61

62 62

150-101-031

63 (Rev. 08-09-24, ver. 01) 00402401010000 63

64 64

1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85

3 4 82 83

66 66