Enlarge image

Form OR-10 Instructions 2024

Underpayment of Oregon Estimated Tax

Oregon law generally requires you to pay tax as you earn or receive income during the year. Oregon employers and other payers

are required to withhold tax when they pay you. You may be required to make estimated payments if the tax on your return after

all credits and withholding will be $1,000 or more.

Your annual estimated tax payment may be paid in up to four installments. Unless an exception applies, underpayment interest is

charged for each installment period when you underpaid or made late payments. Use these instructions to determine if you owe

underpayment interest.

For more information about estimated taxes, see Publication OR-ESTIMATE.

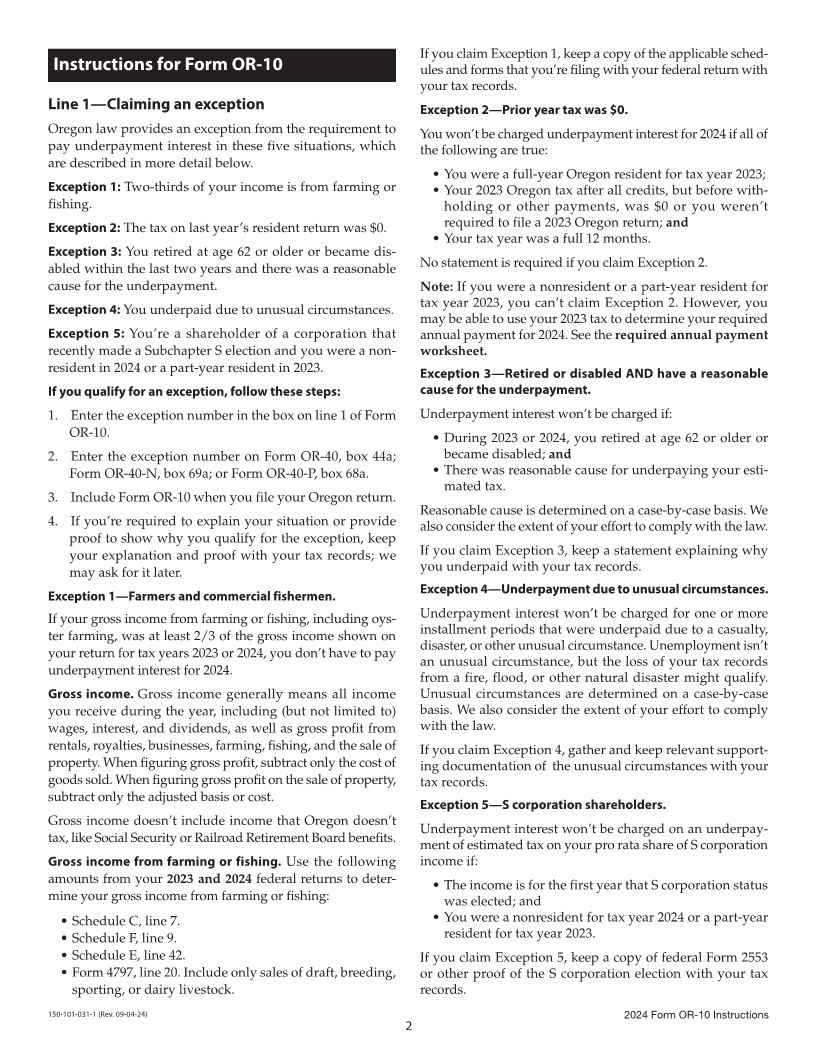

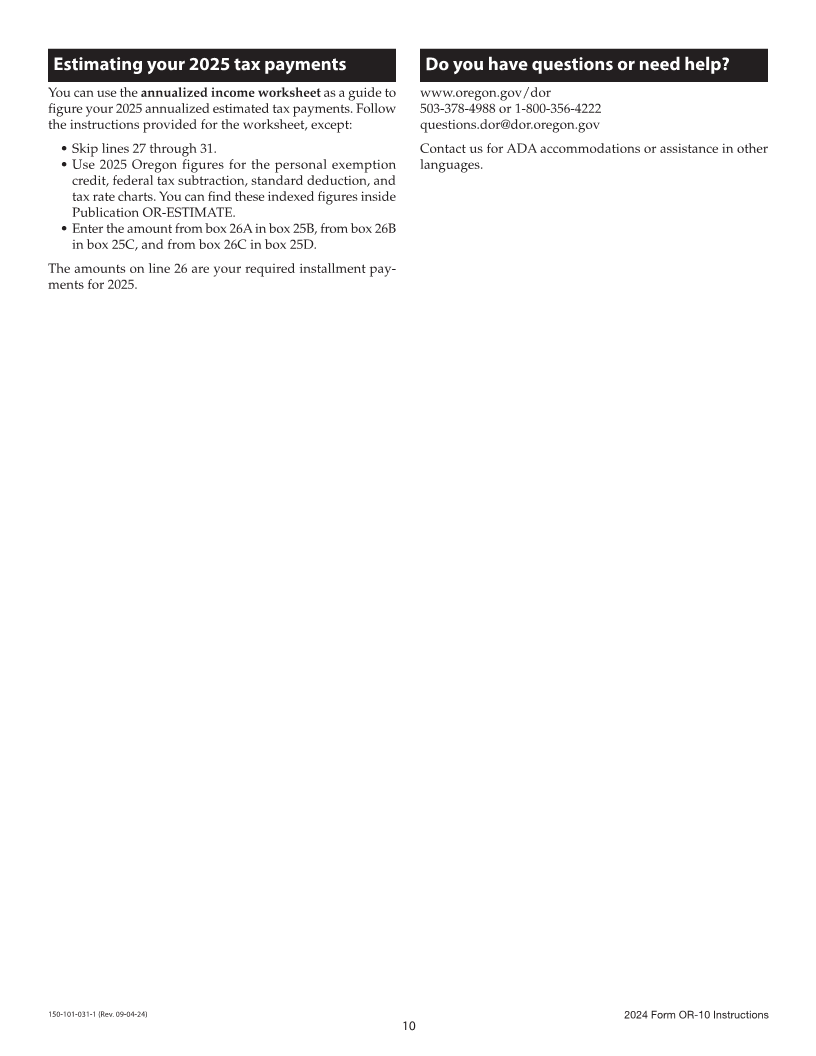

Do I owe interest on underpayment of 2024 estimated tax payments?

Start here

Does the difference between the tax after all credits and Don’t file Form OR-10. You won’t be charged under-

your withholding on your 2024 Oregon return equal If no payment interest for 2024.

$1,000 or more?

If yes

No interest will be charged on an underpayment of

Do you qualify for one of the five exceptions listed on If yes estimated tax for 2024. Follow the instructions start-

page 2? ing on page 2 and on Form OR-10, line 1 to claim the

exception.

If no

Use the worksheets in these instructions to figure your required payments and any underpayment interest you owe. File

Form OR-10 with your Oregon return.

Estimated payments at a glance

Required annual payment: The total amount of all tax payments, including estimated tax and withholding, that you must

make in order to avoid being charged underpayment interest. Your required annual payment is the lesser of:

• Ninety percent (90%) of the tax after all credits shown on your 2024 Oregon return; or

• One hundred percent (100%) of the tax after all credits shown on your 2023 Oregon return (also known as “safe harbor”).

Annual estimated tax payment: Your required annual payment minus your withholding. This may be paid in up to four

installments. You may also pay the entire annual amount by the due date for the first installment payment.

Required installment payment: The amount of estimated tax to be paid each installment period.

• Regular installment: The annual estimated tax payment amount divided by four.

• Annualized installment: An estimated tax payment based on income actually earned or received during an installment

period. Annualizing income may benefit taxpayers who don’t receive their income evenly throughout the year or are

part-year residents. Instructions for annualizing your income begin on page 6.

Required installment payment due dates for tax year 2024:

Calendar-year filers Fiscal-year filers

April 15, 2024 15th day of the 4th month of the tax year

June 17, 2024 15th day of the 6th month

September 16, 2024 15th day of the 9th month

January 15, 2025 15 days after the last day of the tax year

150-101-031-1 (Rev. 09-04-24) 2024 Form OR-10 Instructions

1