Enlarge image

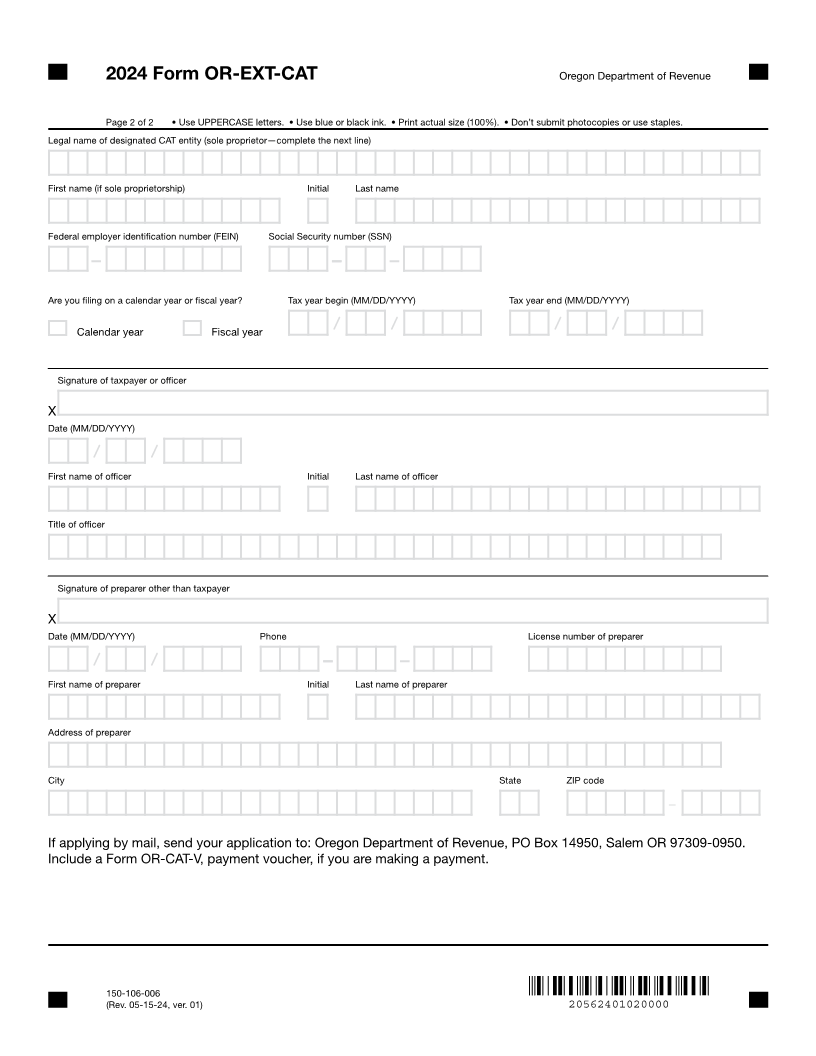

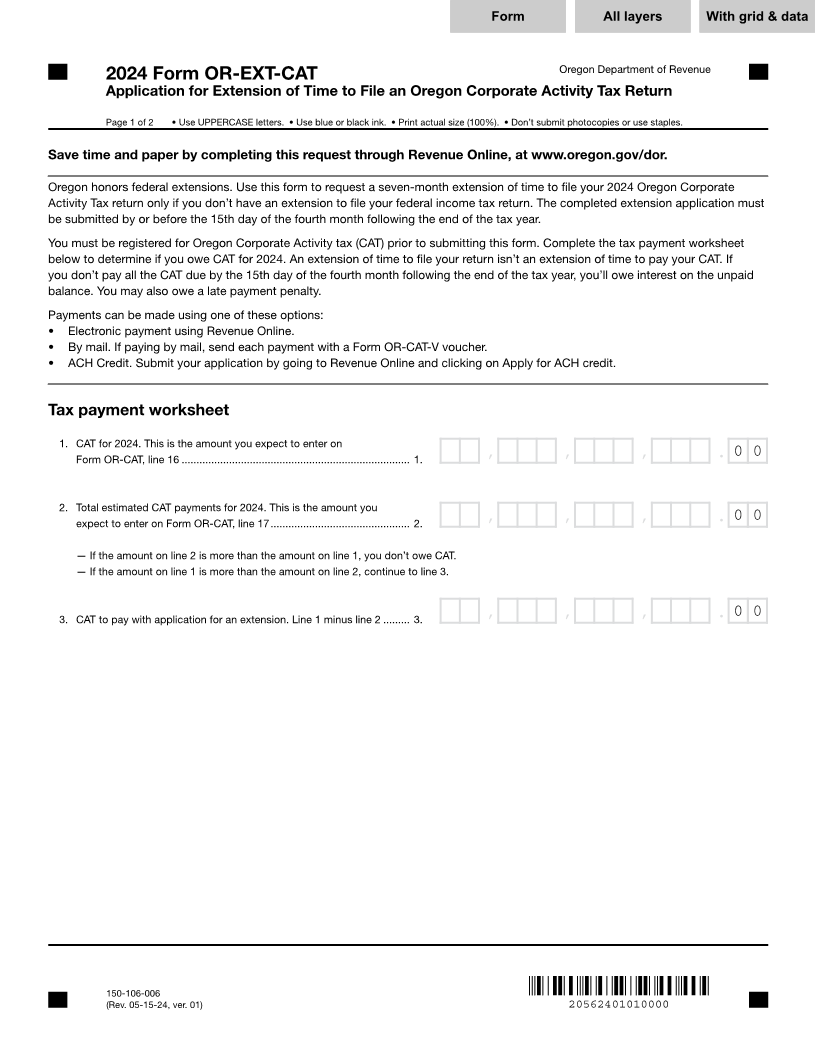

1 1 1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form All layers With grid &2 data 84 85 3 4 82 83 3 3 4 4 5 Oregon Department of Revenue 5 2024 Form OR-EXT-CAT 6 Application for Extension of Time to File an Oregon Corporate Activity Tax Return 6 7 7 8 Page 1 of 2 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples. 8 9 9 10 Save time and paper by completing this request through Revenue Online, at www.oregon.gov/dor. 10 11 11 12 Oregon honors federal extensions. Use this form to request a seven-month extension of time to file your 2024 Oregon Corporate 12 13 Activity Tax return only if you don’t have an extension to file your federal income tax return. The completed extension application must 13 14 be submitted by or before the 15th day of the fourth month following the end of the tax year. 14 15 15 16 You must be registered for Oregon Corporate Activity tax (CAT) prior to submitting this form. Complete the tax payment worksheet 16 17 below to determine if you owe CAT for 2024. An extension of time to file your return isn’t an extension of time to pay your CAT. If 17 18 you don’t pay all the CAT due by the 15th day of the fourth month following the end of the tax year, you’ll owe interest on the unpaid 18 19 balance. You may also owe a late payment penalty. 19 20 Payments can be made using one of these options: 20 21 • Electronic payment using Revenue Online. 21 22 • By mail. If paying by mail, send each payment with a Form OR-CAT-V voucher. 22 23 • ACH Credit. Submit your application by going to Revenue Online and clicking on Apply for ACH credit. 23 24 24 25 25 26 Tax payment worksheet 26 27 27 28 1. CAT for 2024. This is the amount you expect to enter on 28 29 Form OR-CAT, line 16 ............................................................................. 1., , 99,999,999,999.00, 0 0 29 30 30 31 31 32 2. Total estimated CAT payments for 2024. This is the amount you 32 33 expect to enter on Form OR-CAT, line 17 ............................................... 2., , 99,999,999,999.00, 0 0 33 34 34 35 — If the amount on line 2 is more than the amount on line 1, you don’t owe CAT. 35 36 — If the amount on line 1 is more than the amount on line 2, continue to line 3. 36 37 37 38 38 39 3. CAT to pay with application for an extension. Line 1 minus line 2 ......... 3. , , 99,999,999,999.00, 0 0 39 40 40 41 41 42 42 43 43 44 44 45 45 46 46 47 47 48 48 49 49 50 50 51 51 52 52 53 53 54 54 55 55 56 56 57 57 58 58 59 59 60 60 61 61 62 62 150-106-006 63 (Rev. 05-15-24, ver. 01) 20562401010000 63 64 64 1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85 3 4 82 83 66 66