Enlarge image

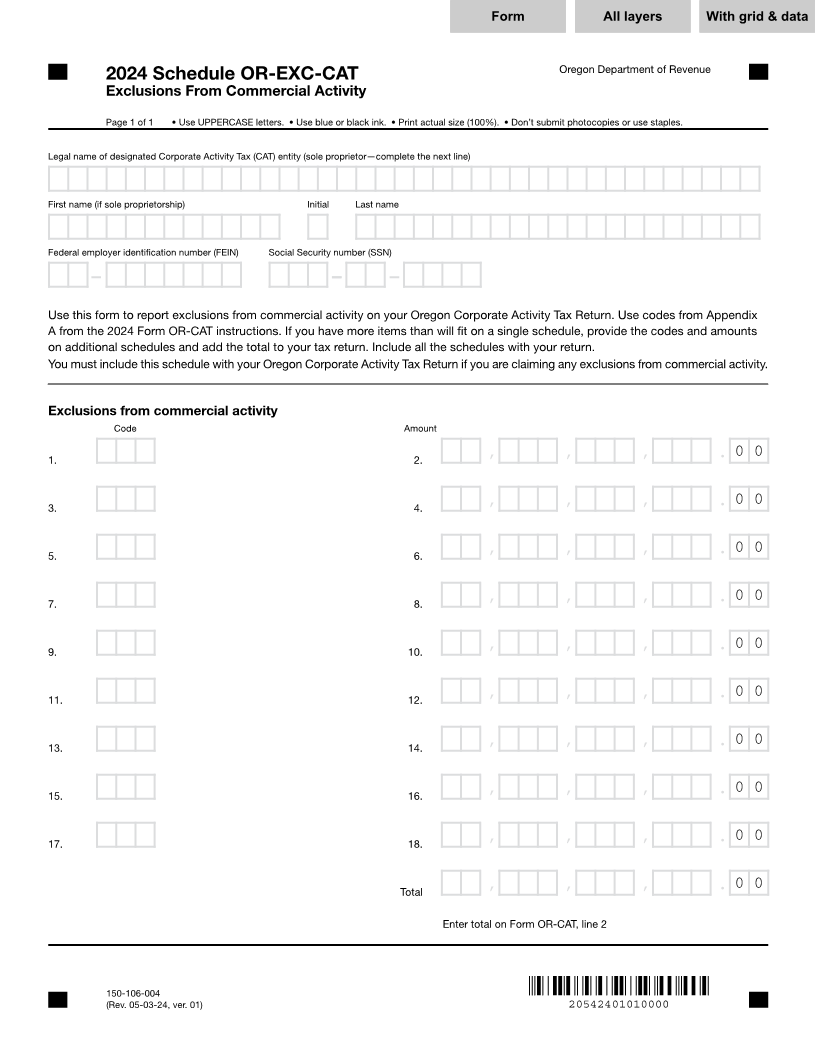

1 1 1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form All layers With grid &2 data 84 85 3 4 82 83 3 3 4 4 5 Oregon Department of Revenue 5 2024 Schedule OR-EXC-CAT 6 Exclusions From Commercial Activity 6 7 7 8 Page 1 of 1 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples. 8 9 9 10 Legal name of designated Corporate Activity Tax (CAT) entity (sole proprietor—complete the next line) 10 11 11 12 12 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 13 First name (if sole proprietorship) Initial Last name 13 14 14 15 15 XXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 16 Federal employer identification number (FEIN) Social Security number (SSN) 16 17 17 18 18 99-9999999 999-99-9999 19 19 20 Use this form to report exclusions from commercial activity on your Oregon Corporate Activity Tax Return. Use codes from Appendix 20 21 A from the 2024 Form OR-CAT instructions. If you have more items than will fit on a single schedule, provide the codes and amounts 21 22 on additional schedules and add the total to your tax return. Include all the schedules with your return. 22 23 You must include this schedule with your Oregon Corporate Activity Tax Return if you are claiming any exclusions from commercial activity. 23 24 24 25 25 26 Exclusions from commercial activity 26 27 Code Amount 27 28 28 29 1. 999 2. , , 99,999,999,999.00, 0 0 29 30 30 31 31 32 3. 999 4. , , 99,999,999,999.00, 0 0 32 33 33 34 34 35 5. 999 6. , , 99,999,999,999.00, 0 0 35 36 36 37 37 38 7. 999 8. , , 99,999,999,999.00, 0 0 38 39 39 40 40 41 9. 999 10. , , 99,999,999,999.00, 0 0 41 42 42 43 43 44 11. 999 12. , , 99,999,999,999.00, 0 0 44 45 45 46 46 47 13. 999 14. , , 99,999,999,999.00, 0 0 47 48 48 49 49 50 15. 999 16. , , 99,999,999,999.00, 0 0 50 51 51 52 52 53 17. 999 18. , , 99,999,999,999.00, 0 0 53 54 54 55 55 56 Total , , 99,999,999,999.00, 0 0 56 57 57 58 Enter total on Form OR-CAT, line 2 58 59 59 60 60 61 61 62 62 150-106-004 63 (Rev. 05-03-24, ver. 01) 20542401010000 63 64 64 1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85 3 4 82 83 66 66