Enlarge image

Oregon Corporate Activity Tax

Form OR-CAT Instructions 2024

Table of contents

What’s new .................................................................................2 Auto dealers ...............................................................................3

Important reminders ................................................................2 Wholesale or retail sale of groceries.......................................3

Filing information .....................................................................2 Filing checklist and reminders ...............................................4

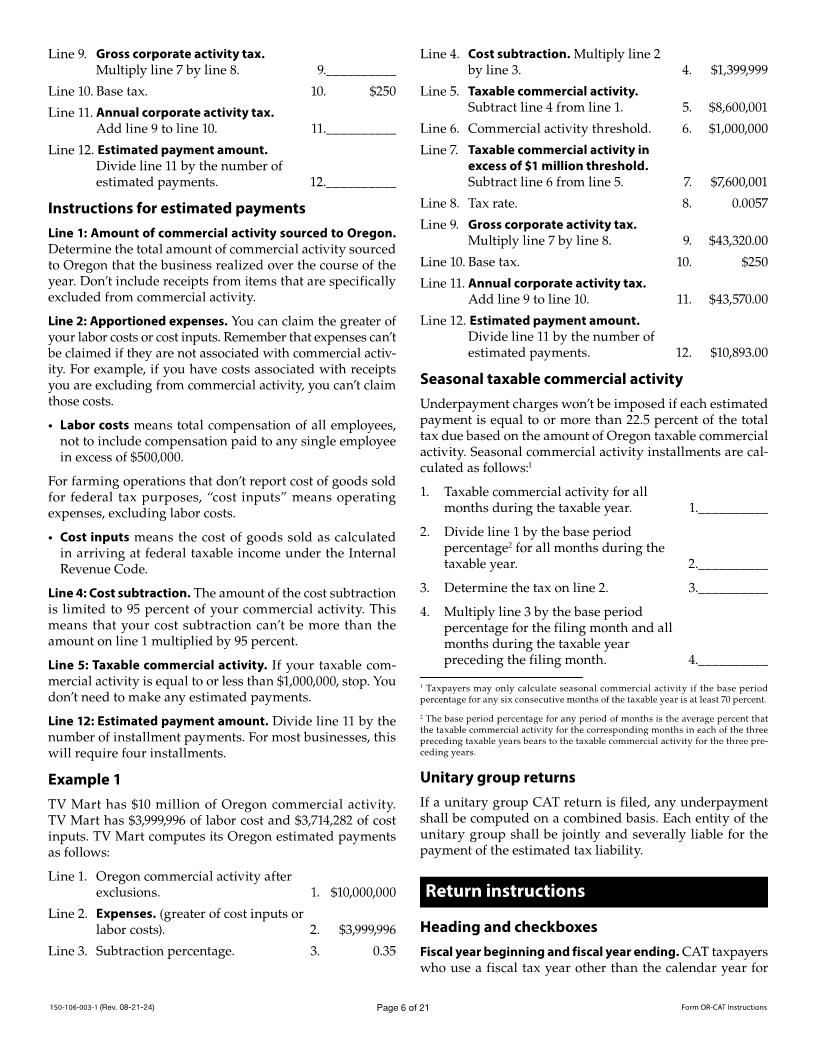

Who must register? ...................................................................2 Estimated tax payments ...........................................................5

Who must file? ...........................................................................2 Return instructions ...................................................................6

What form do I use? ..................................................................2 Schedule OR-AF-CAT instructions ...................................... 10

Filing requirements ..................................................................2 Schedule OR-EXC-CAT instructions .................................... 11

Unitary groups ..........................................................................2 Form OR-QUP-CAT instructions .......................................... 11

E-file ............................................................................................2 Do you have questions or need help? ...................................12

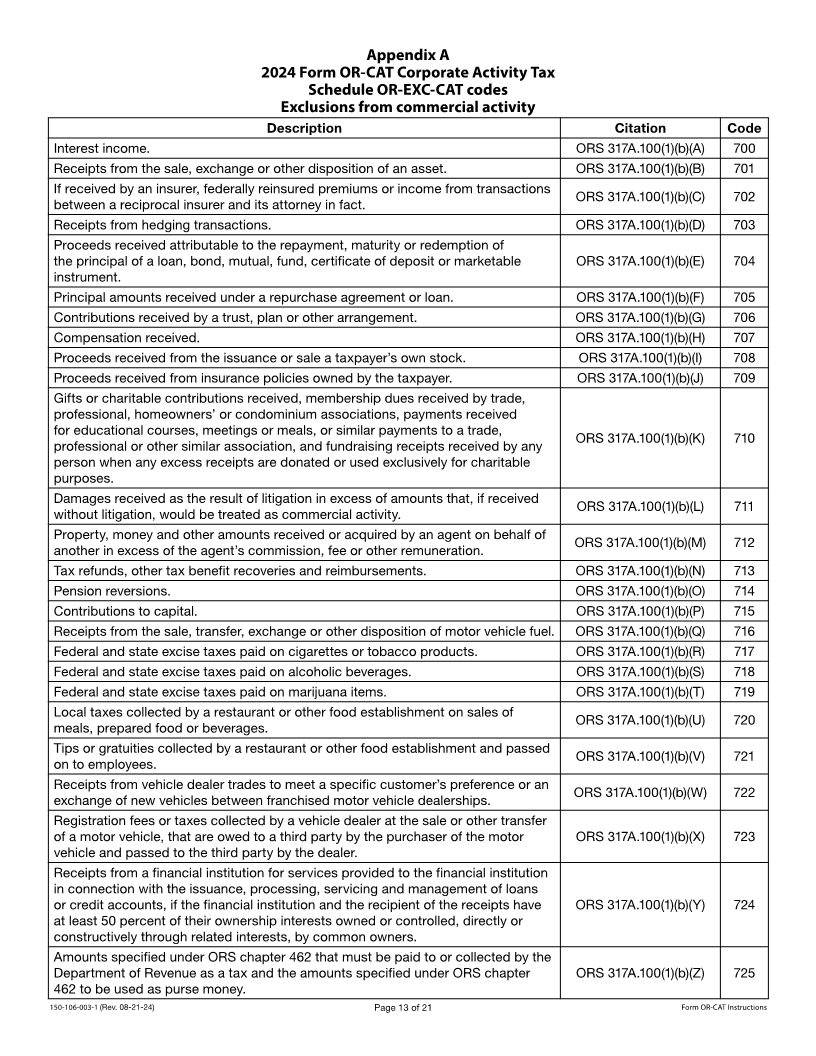

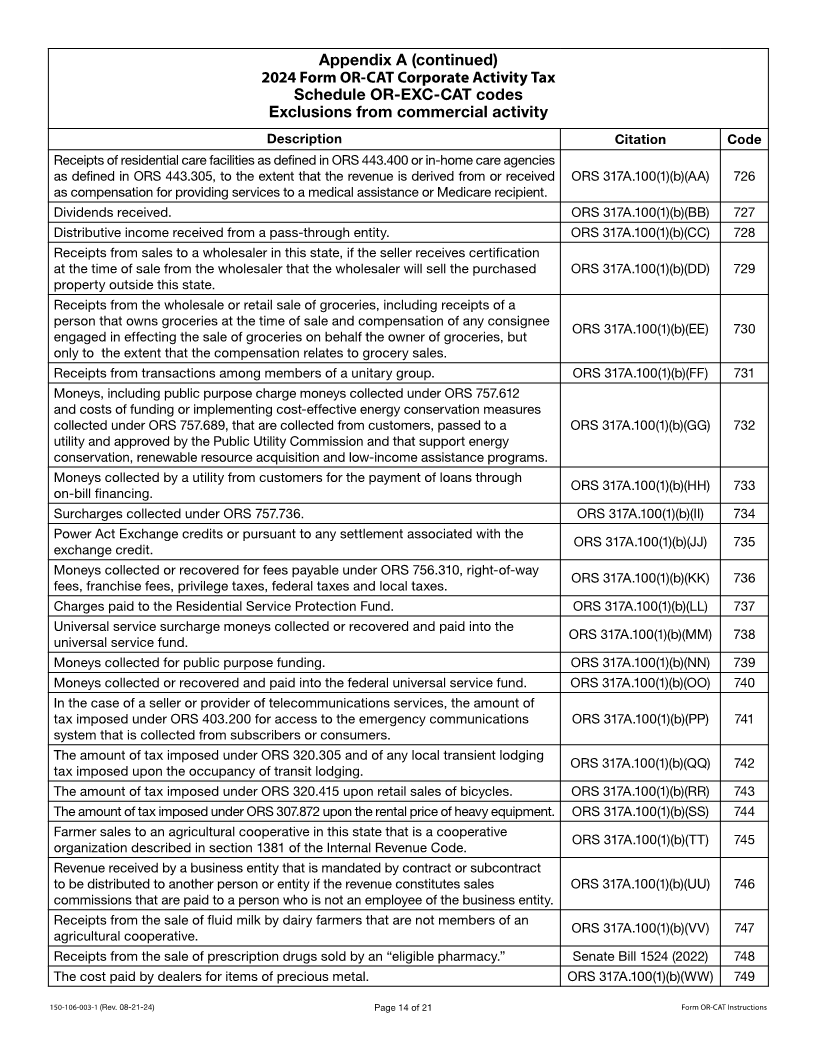

Federal or other state audit changes .......................................3 Appendix A, 2024 Schedule OR-EXC-CAT code list ..........13

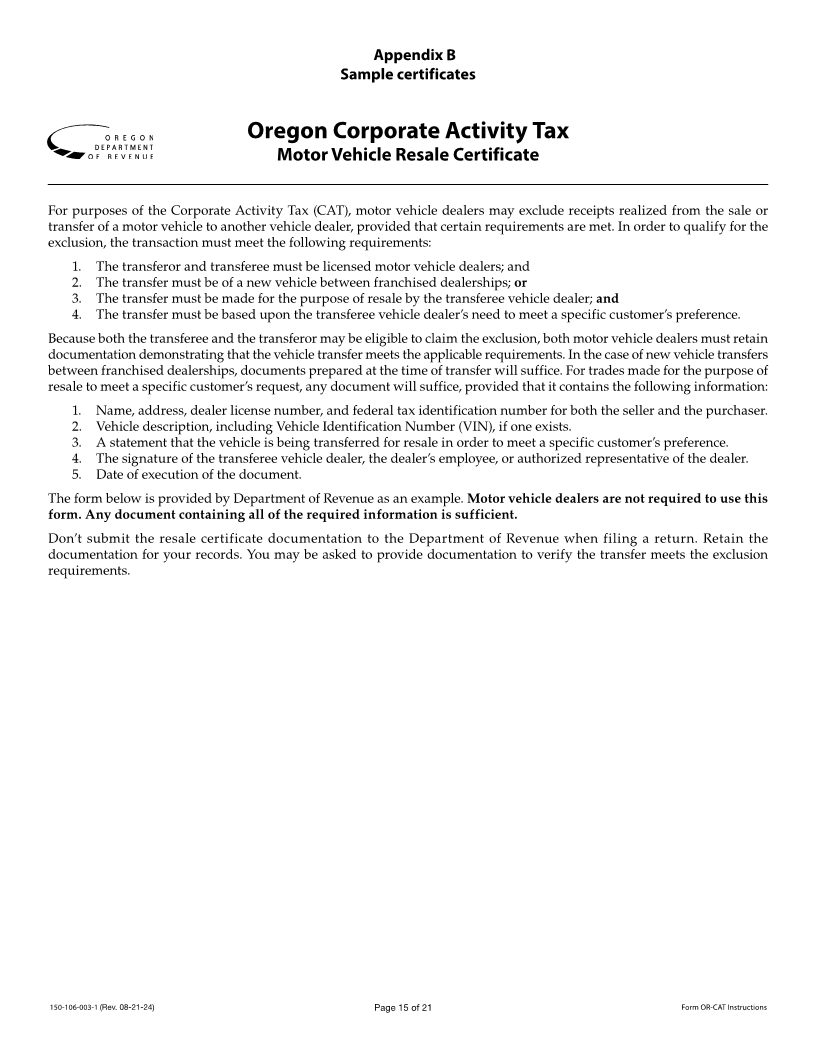

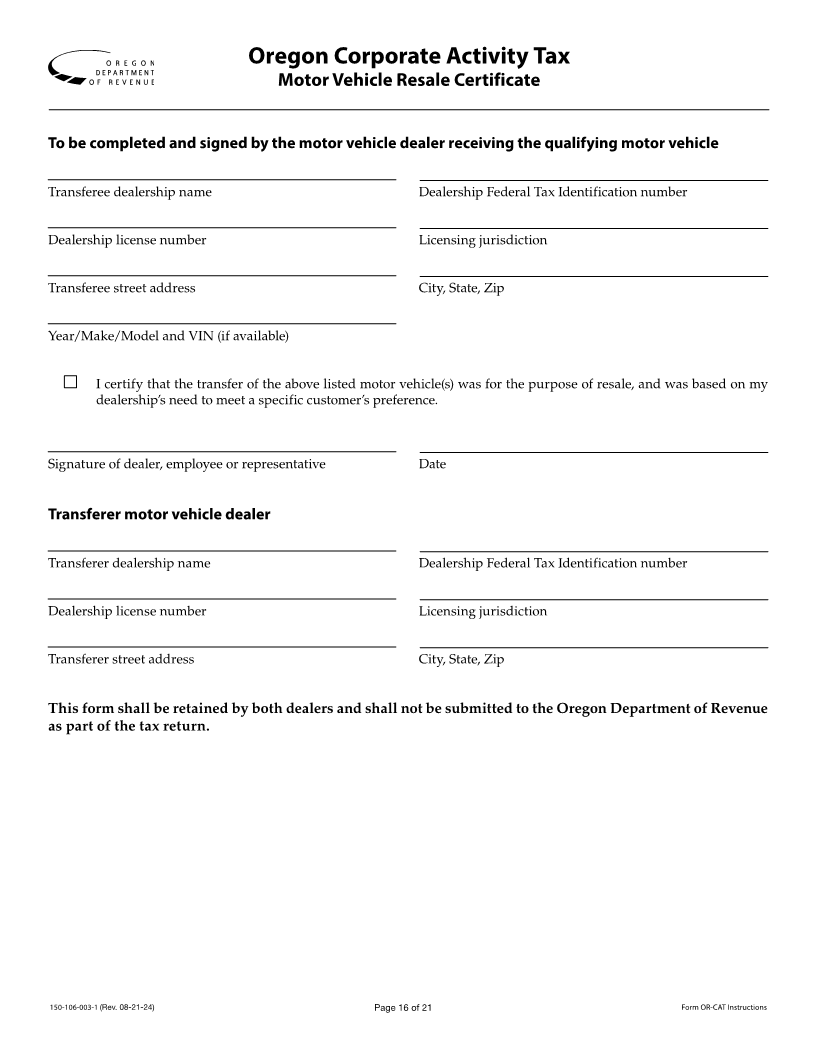

Amended returns ......................................................................3 Appendix B, Sample certificates ...........................................15

Protective claims .......................................................................3

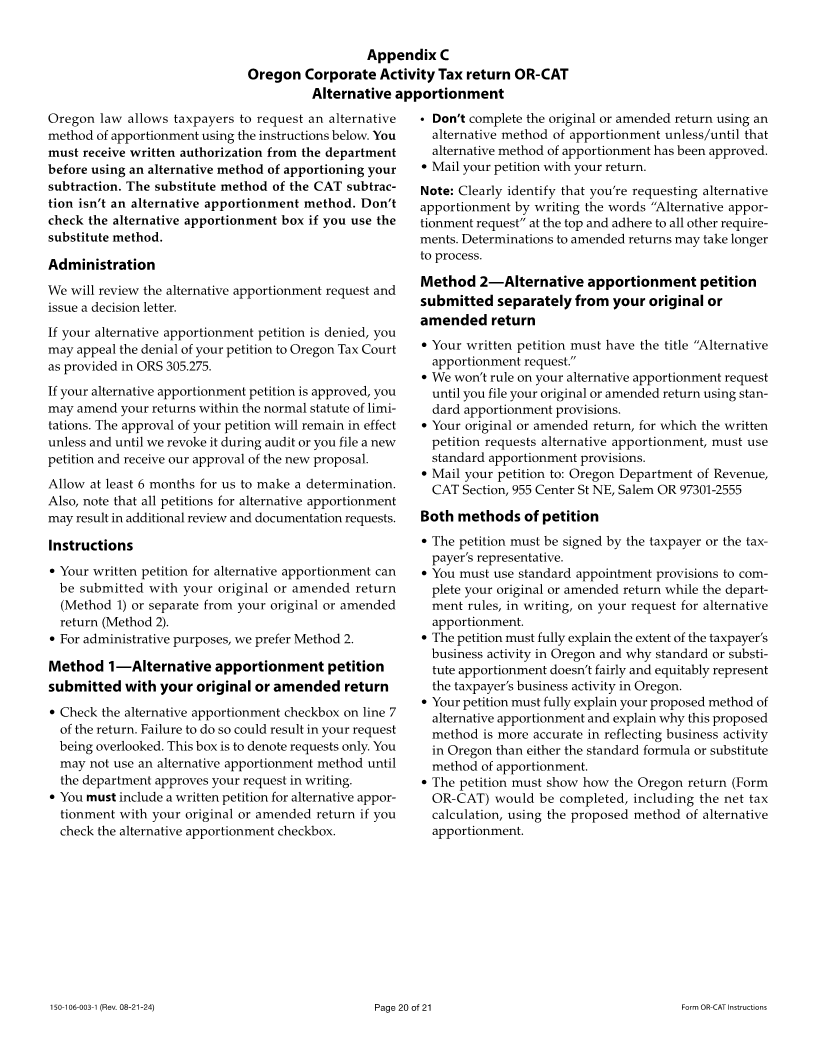

Appendix C, Alternative apportionment ............................20

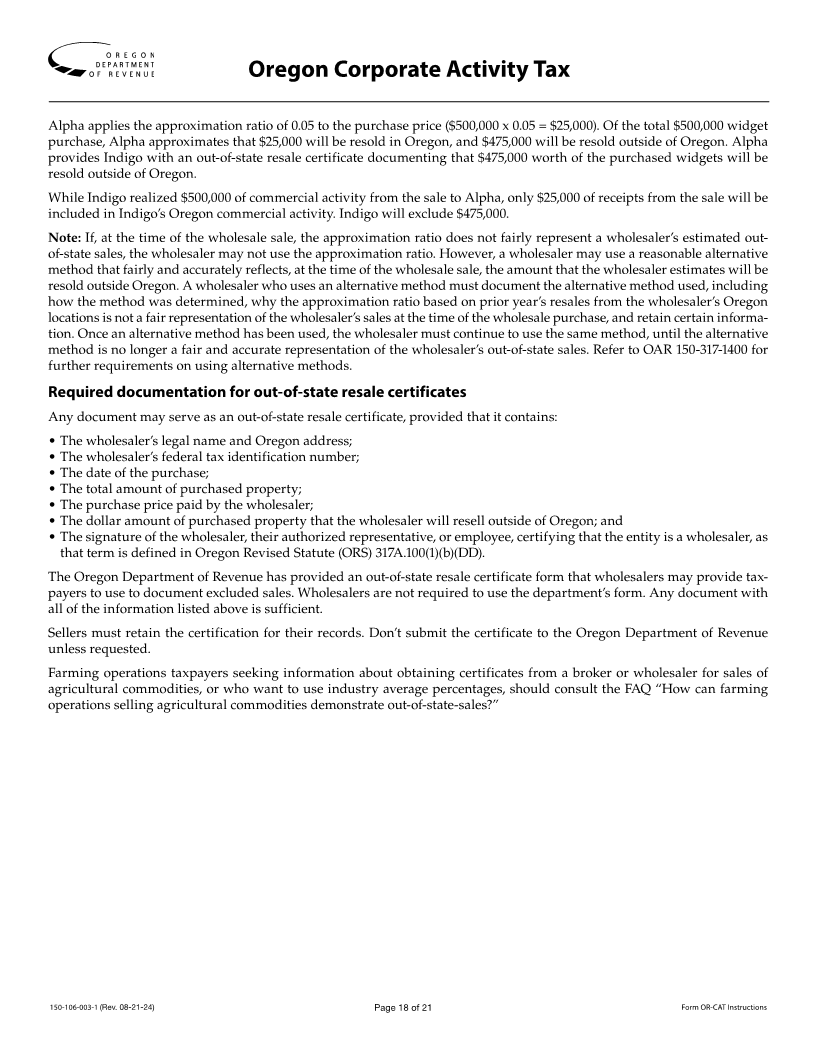

Additional information on certain exclusions ......................3

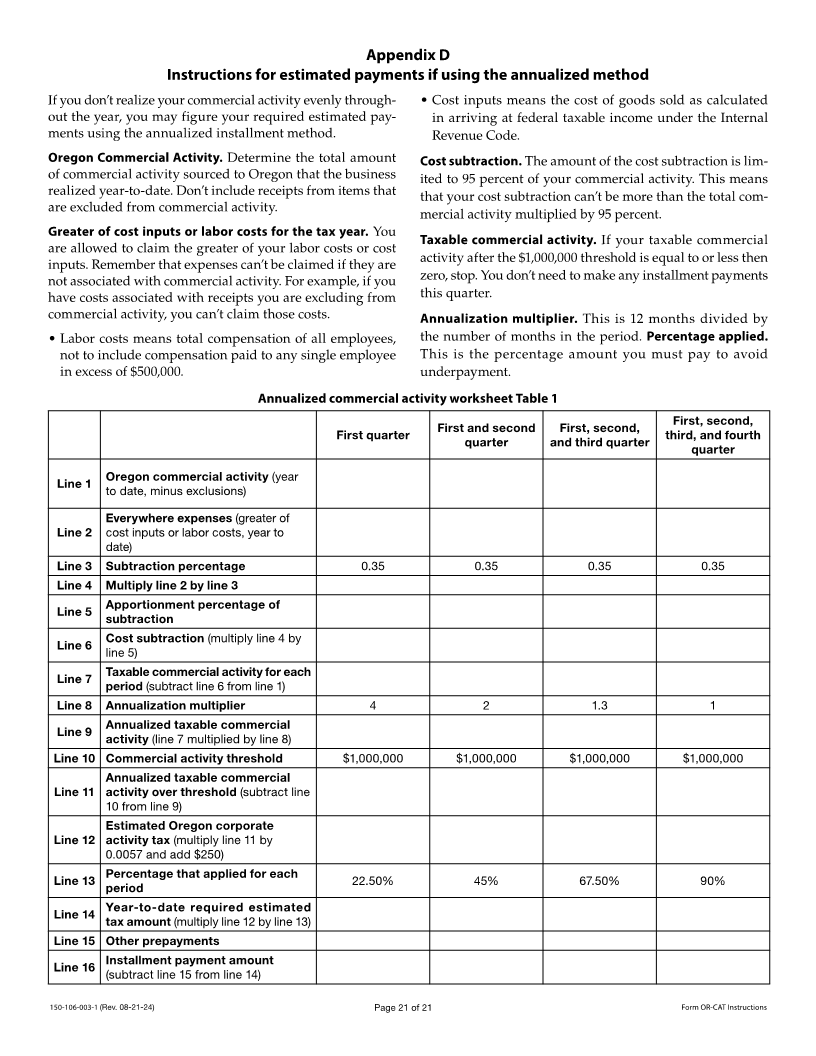

Appendix D, Instructions for estimated payments

Agents. ........................................................................................3 if using the annualized method ...........................................21

Information contained herein is a guide. For complete details of law, refer to Oregon Revised Statutes (ORS) and Oregon

Administrative Rules (OAR).

Go electronic

Fast • Accurate • Secure

File your Corporate Activity Tax return through the electronic filing program. With approved third-party software, you can

e-file your return with all schedules. You can also conveniently include an electronic payment with your e-filed original

return. See “E-file.”

150-106-003-1 (Rev. 08-21-24) Page 1 of 21 Form OR-CAT Instructions