Enlarge image

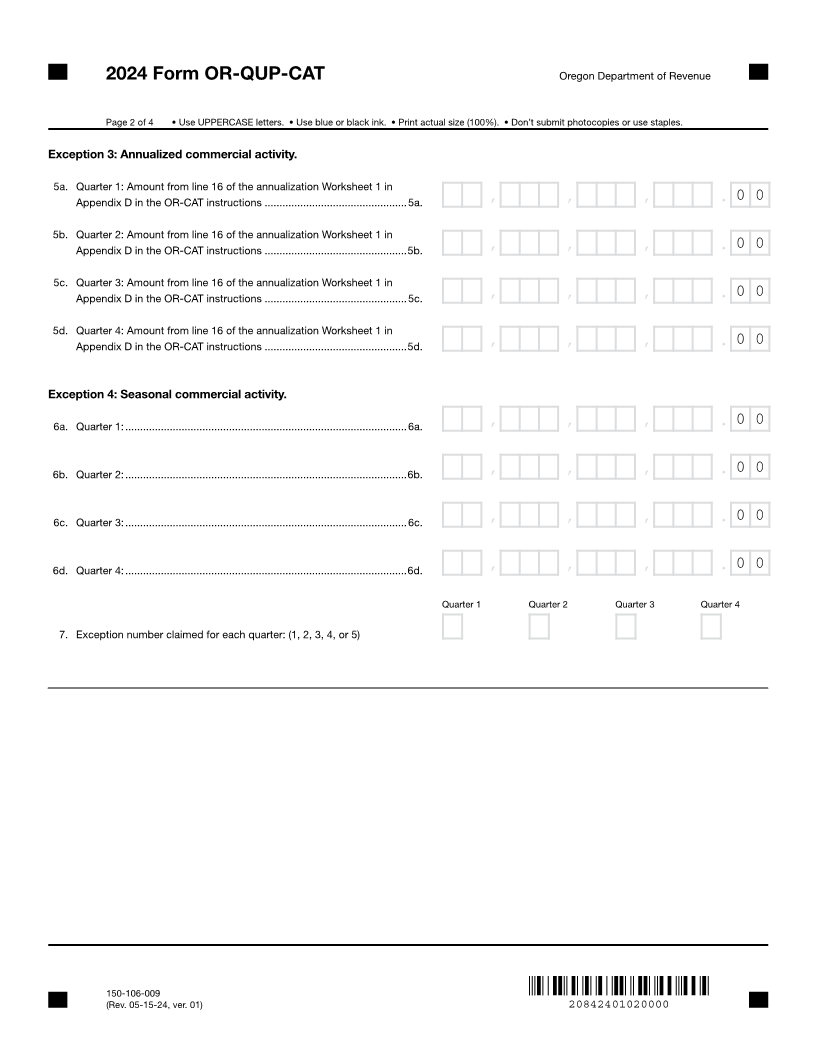

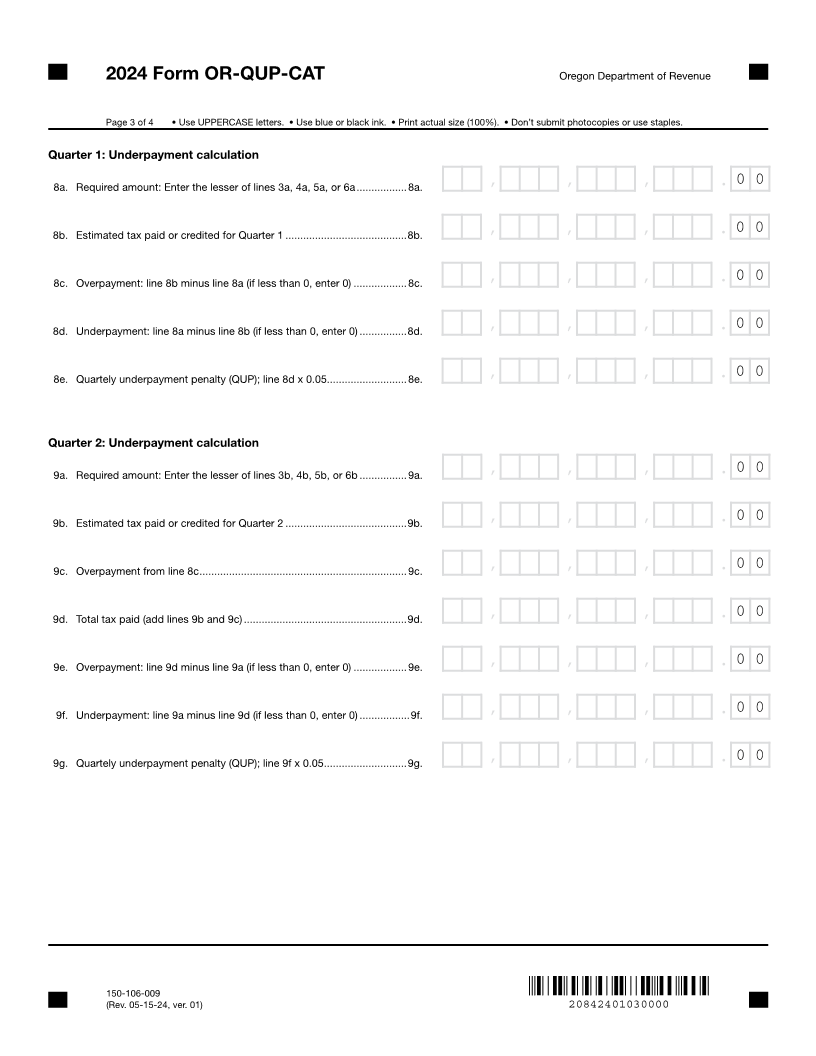

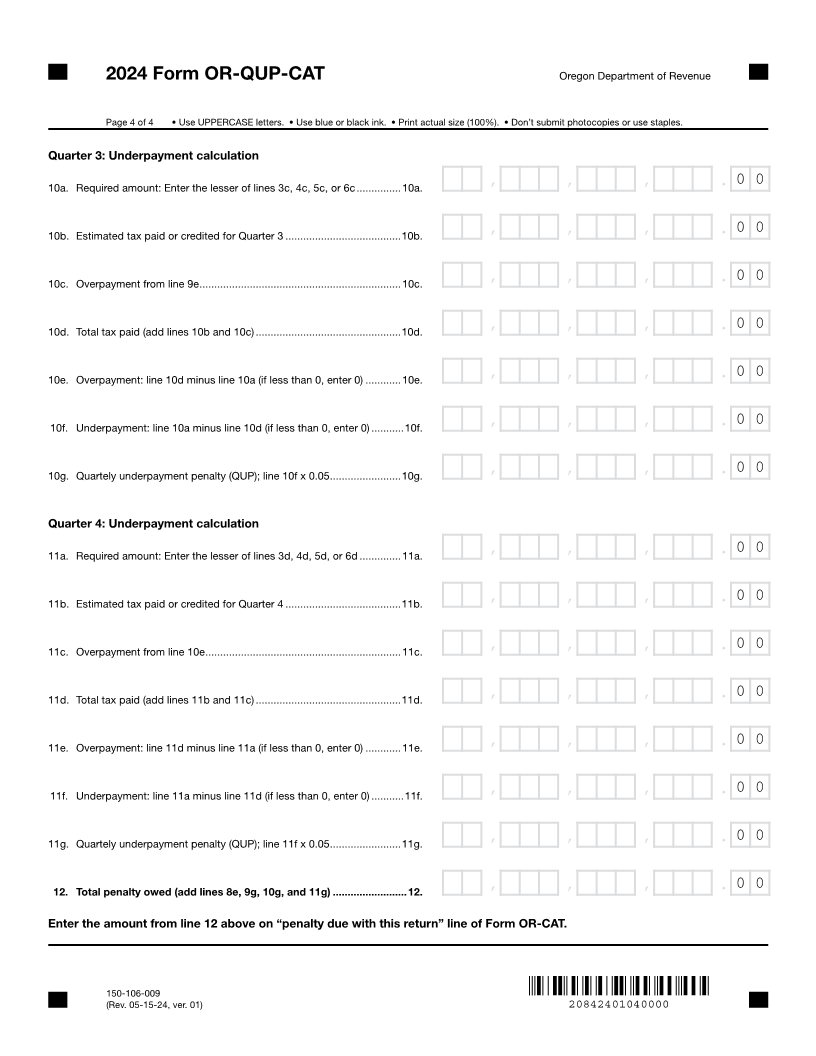

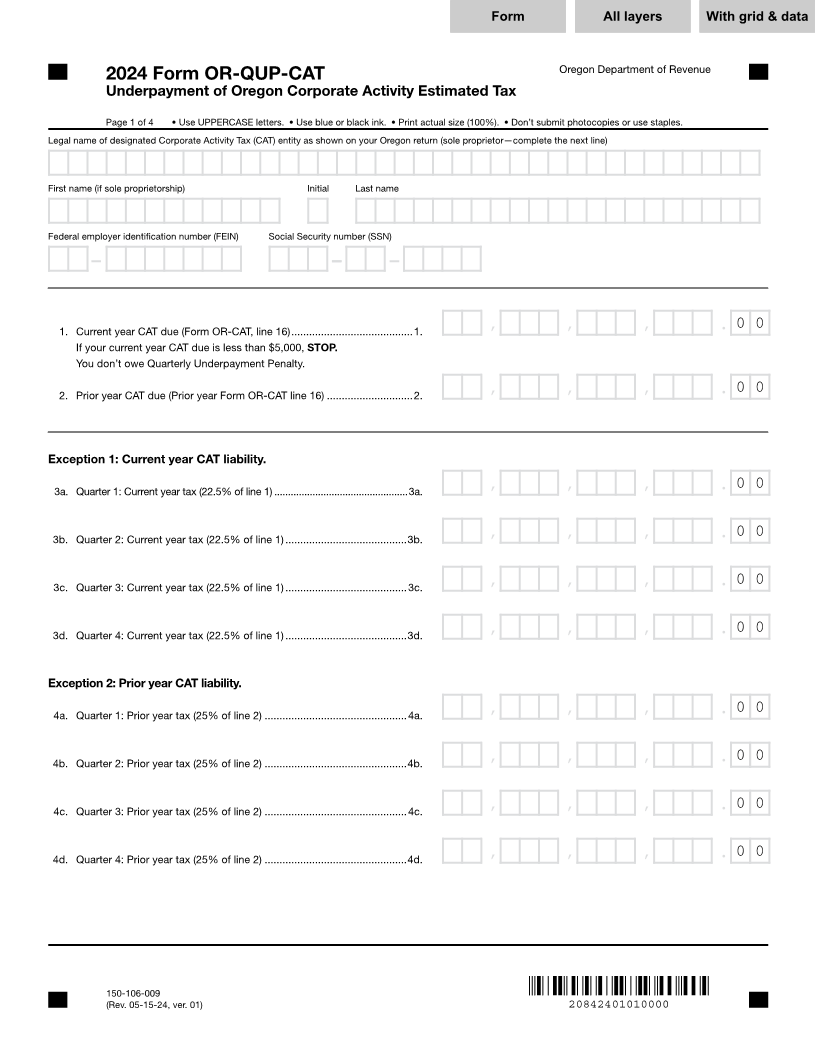

1 1 1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form All layers With grid &2 data 84 85 3 4 82 83 3 3 4 4 5 Oregon Department of Revenue 5 2024 Form OR-QUP-CAT 6 Underpayment of Oregon Corporate Activity Estimated Tax 6 7 7 8 Page 1 of 4 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples. 8 9 Legal name of designated Corporate Activity Tax (CAT) entity as shown on your Oregon return (sole proprietor—complete the next line) 9 10 10 11 11 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 12 First name (if sole proprietorship) Initial Last name 12 13 13 14 14 XXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 15 Federal employer identification number (FEIN) Social Security number (SSN) 15 16 16 17 17 99-9999999 999-99-9999 18 18 19 19 20 20 21 1. Current year CAT due (Form OR-CAT, line 16) .........................................1. , , 99,999,999,999.00, 0 0 21 22 If your current year CAT due is less than $5,000, STOP. 22 23 You don’t owe Quarterly Underpayment Penalty. 23 24 24 25 2. Prior year CAT due (Prior year Form OR-CAT line 16) .............................2. , , 99,999,999,999.00, 0 0 25 26 26 27 27 28 28 29 Exception 1: Current year CAT liability. 29 30 30 31 3a. Quarter 1: Current year tax (22.5% of line 1) .................................................3a. , , 99,999,999,999.00, 0 0 31 32 32 33 33 34 3b. Quarter 2: Current year tax (22.5% of line 1) .........................................3b. , , 99,999,999,999.00, 0 0 34 35 35 36 36 37 3c. Quarter 3: Current year tax (22.5% of line 1) .........................................3c. , , 99,999,999,999.00, 0 0 37 38 38 39 39 40 3d. Quarter 4: Current year tax (22.5% of line 1) .........................................3d. , , 99,999,999,999.00, 0 0 40 41 41 42 42 43 Exception 2: Prior year CAT liability. 43 44 44 45 4a. Quarter 1: Prior year tax (25% of line 2) ................................................4a. , , 99,999,999,999.00, 0 0 45 46 46 47 47 48 4b. Quarter 2: Prior year tax (25% of line 2) ................................................4b. , , 99,999,999,999.00, 0 0 48 49 49 50 50 51 4c. Quarter 3: Prior year tax (25% of line 2) ................................................4c. , , 99,999,999,999.00, 0 0 51 52 52 53 53 54 4d. Quarter 4: Prior year tax (25% of line 2) ................................................4d. , , 99,999,999,999.00, 0 0 54 55 55 56 56 57 57 58 58 59 59 60 60 61 61 62 62 150-106-009 63 (Rev. 05-15-24, ver. 01) 20842401010000 63 64 64 1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85 3 4 82 83 66 66