Enlarge image

1 1

1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form All layers With grid &2 data 84 85

3 4 82 83

3 3

4 4

5 Oregon Department of Revenue 5

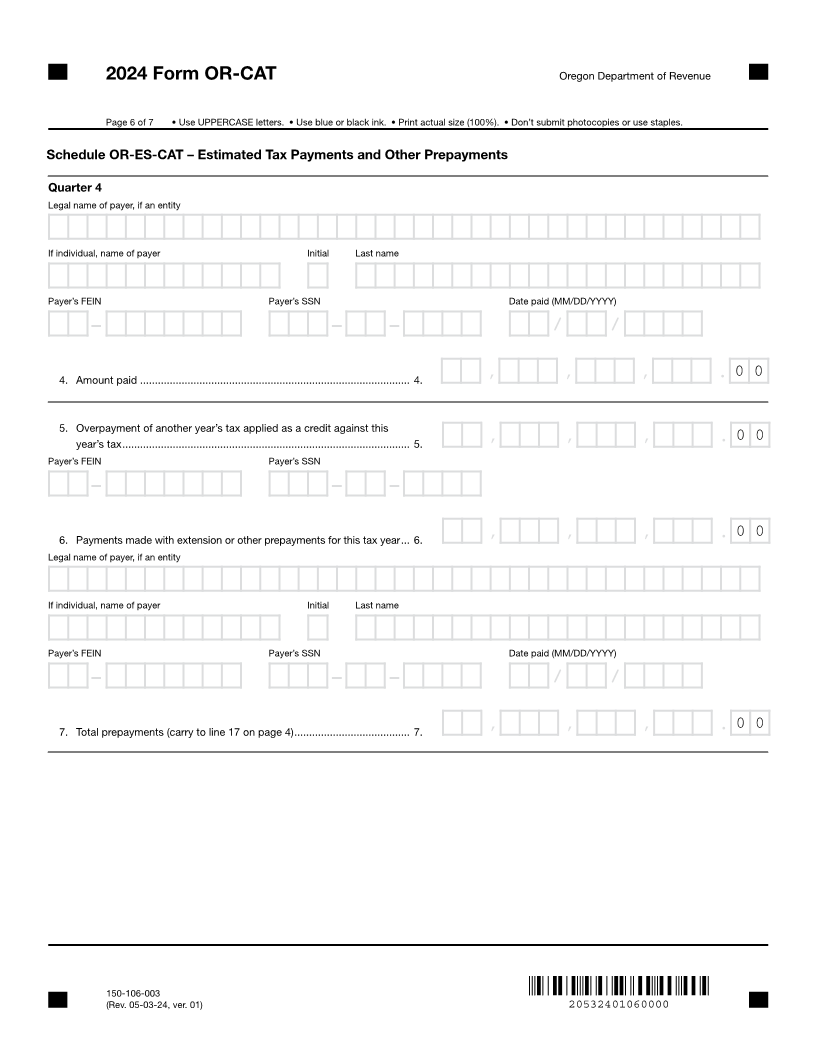

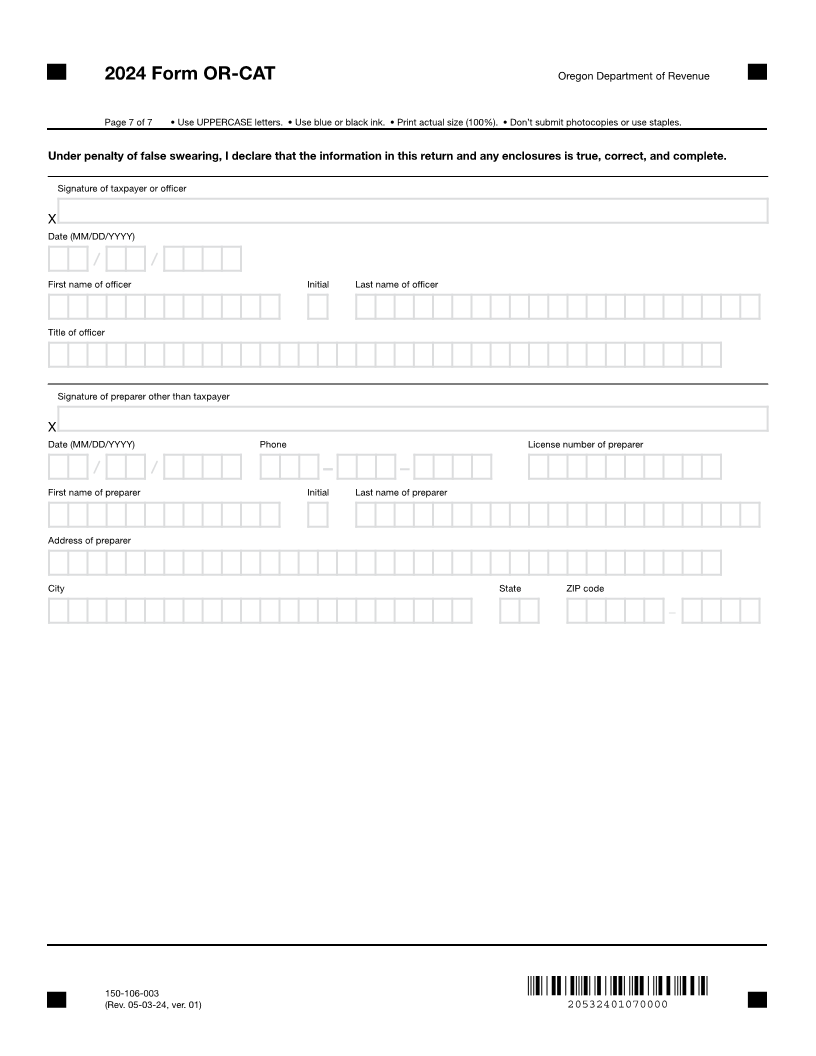

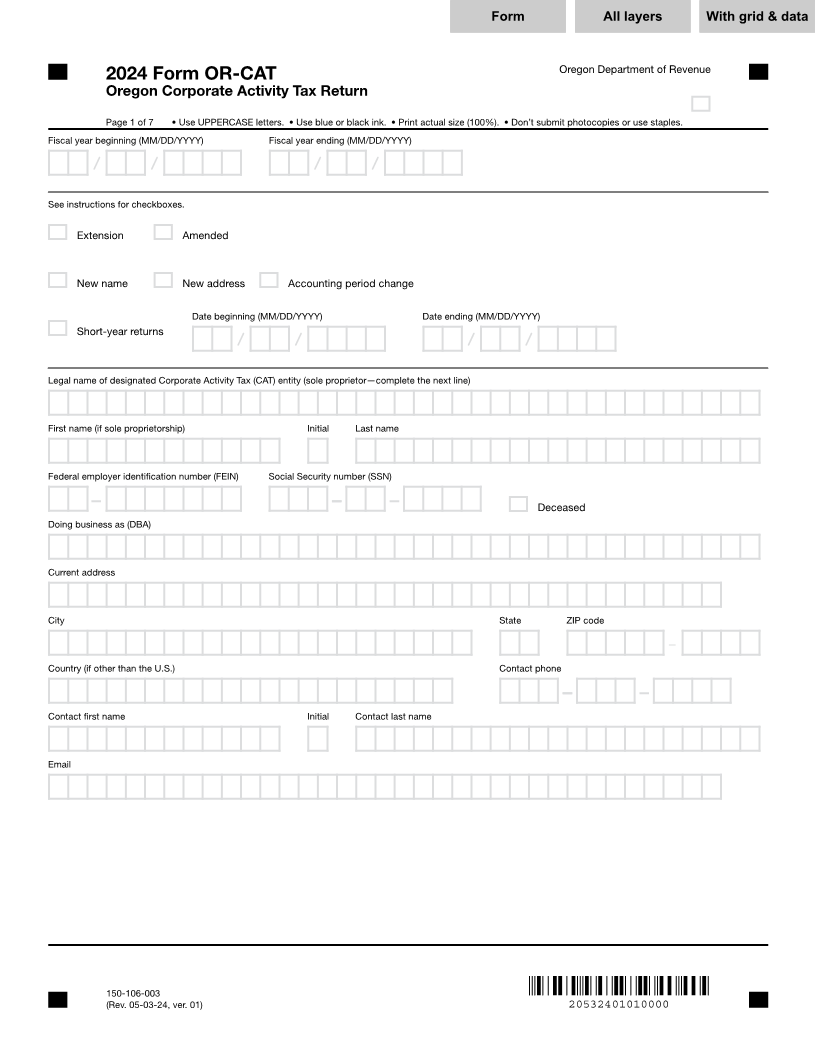

2024 Form OR-CAT

6 Oregon Corporate Activity Tax Return 6

7 7

8 Page 1 of 7 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples. 8

9 Fiscal year beginning (MM/DD/YYYY) Fiscal year ending (MM/DD/YYYY) 9

10 10

11 99/99/9999/ / 99/99/9999/ / 11

12 12

13 See instructions for checkboxes. 13

14 14

15 X Extension X Amended 15

16 16

17 17

18 X New name X New address X Accounting period change 18

19 19

20 Date beginning (MM/DD/YYYY) Date ending (MM/DD/YYYY) 20

21 X Short-year returns 21

22 99/99/9999/ / 99/99/9999/ / 22

23 23

24 Legal name of designated Corporate Activity Tax (CAT) entity (sole proprietor—complete the next line) 24

25 25

26 26

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

27 First name (if sole proprietorship) Initial Last name 27

28 28

29 29

XXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

30 Federal employer identification number (FEIN) Social Security number (SSN) 30

31 31

32 99-9999999 999-99-9999 X Deceased 32

33 Doing business as (DBA) 33

34 34

35 35

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

36 Current address 36

37 37

38 38

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

39 City State ZIP code 39

40 40

41 XXXXXXXXXXXXXXXXXXXXXX XX XXXXX-XXXX - 41

42 Country (if other than the U.S.) Contact phone 42

43 43

44 44

XXXXXXXXXXXXXXXXXXXXX 999-999-9999

45 Contact first name Initial Contact last name 45

46 46

47 47

XXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

48 Email 48

49 49

50 50

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

51 51

52 52

53 53

54 54

55 55

56 56

57 57

58 58

59 59

60 60

61 61

62 62

150-106-003

63 (Rev. 05-03-24, ver. 01) 20532401010000 63

64 64

1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85

3 4 82 83

66 66