Enlarge image

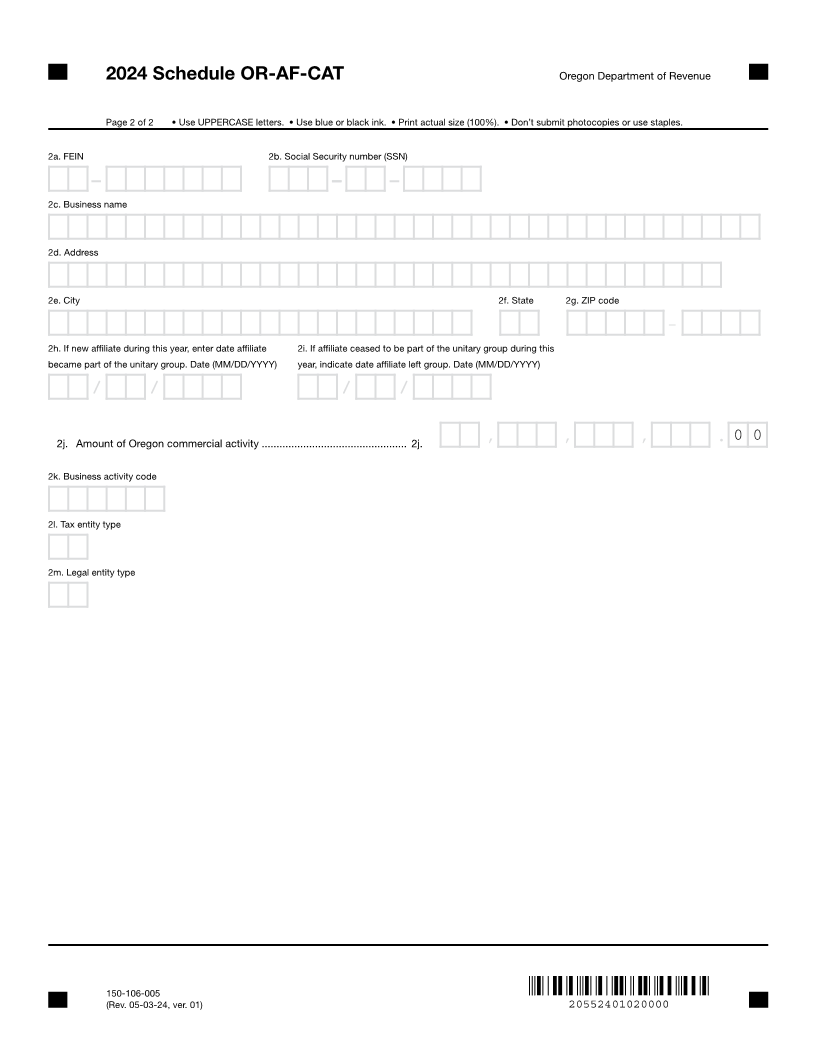

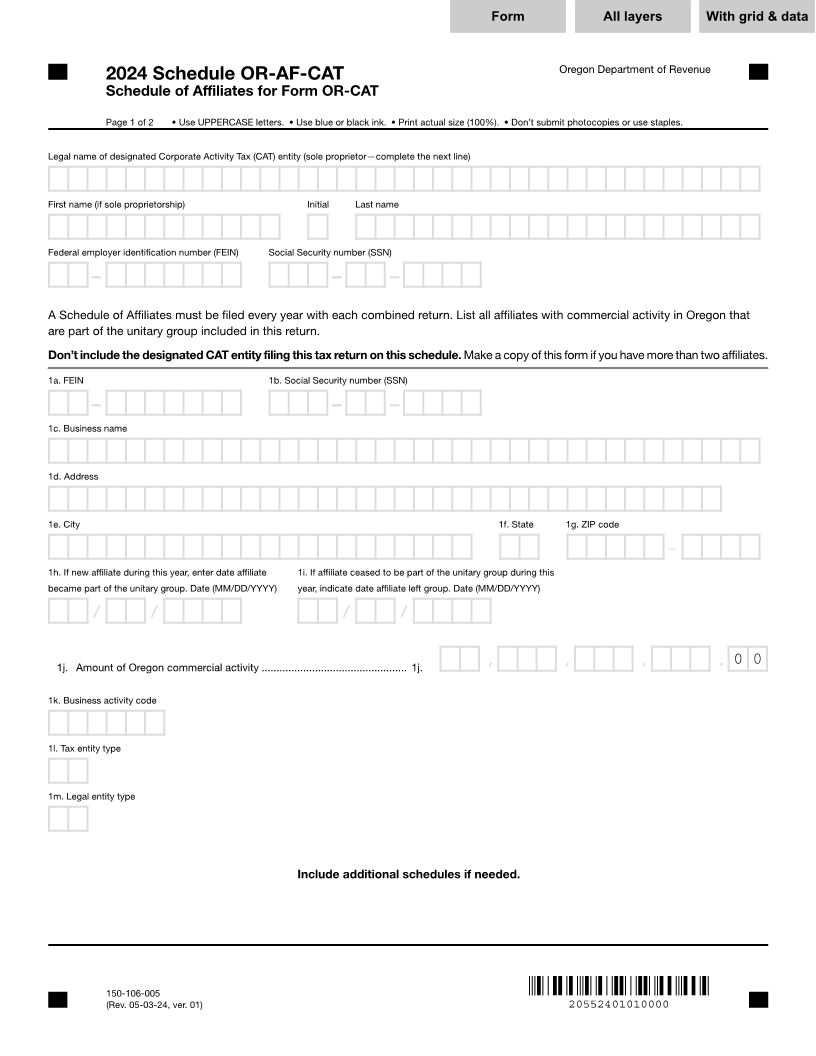

1 1 1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form All layers With grid &2 data 84 85 3 4 82 83 3 3 4 4 5 Oregon Department of Revenue 5 2024 Schedule OR-AF-CAT 6 Schedule of Affiliates for Form OR-CAT 6 7 7 8 Page 1 of 2 • Use UPPERCASE letters. • Use blue or black ink. • Print actual size (100%). • Don’t submit photocopies or use staples. 8 9 9 10 Legal name of designated Corporate Activity Tax (CAT) entity (sole proprietor—complete the next line) 10 11 11 12 12 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 13 First name (if sole proprietorship) Initial Last name 13 14 14 15 15 XXXXXXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 16 Federal employer identification number (FEIN) Social Security number (SSN) 16 17 17 18 18 99-9999999 999-99-9999 19 19 20 A Schedule of Affiliates must be filed every year with each combined return. List all affiliates with commercial activity in Oregon that 20 21 are part of the unitary group included in this return. 21 22 22 23 Don’t include the designated CAT entity filing this tax return on this schedule. Make a copy of this form if you have more than two affiliates. 23 24 1a. FEIN 1b. Social Security number (SSN) 24 25 25 26 26 99-9999999 999-99-9999 27 1c. Business name 27 28 28 29 29 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 30 1d. Address 30 31 31 32 32 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 33 1e. City 1f. State 1g. ZIP code 33 34 34 35 XXXXXXXXXXXXXXXXXXXXXX XX XXXXX-XXXX - 35 36 1h. If new affiliate during this year, enter date affiliate 1i. If affiliate ceased to be part of the unitary group during this 36 37 became part of the unitary group. Date (MM/DD/YYYY) year, indicate date affiliate left group. Date (MM/DD/YYYY) 37 38 38 39 99/99/9999/ / 99/99/9999/ / 39 40 40 41 41 42 1j. Amount of Oregon commercial activity ................................................. 1j. , , 99,999,999,999.00, 0 0 42 43 43 44 1k. Business activity code 44 45 45 46 46 999999 47 1l. Tax entity type 47 48 48 49 49 XX 50 1m. Legal entity type 50 51 51 52 52 XX 53 53 54 54 55 Include additional schedules if needed. 55 56 56 57 57 58 58 59 59 60 60 61 61 62 62 150-106-005 63 (Rev. 05-03-24, ver. 01) 20552401010000 63 64 64 1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85 3 4 82 83 66 66