Enlarge image

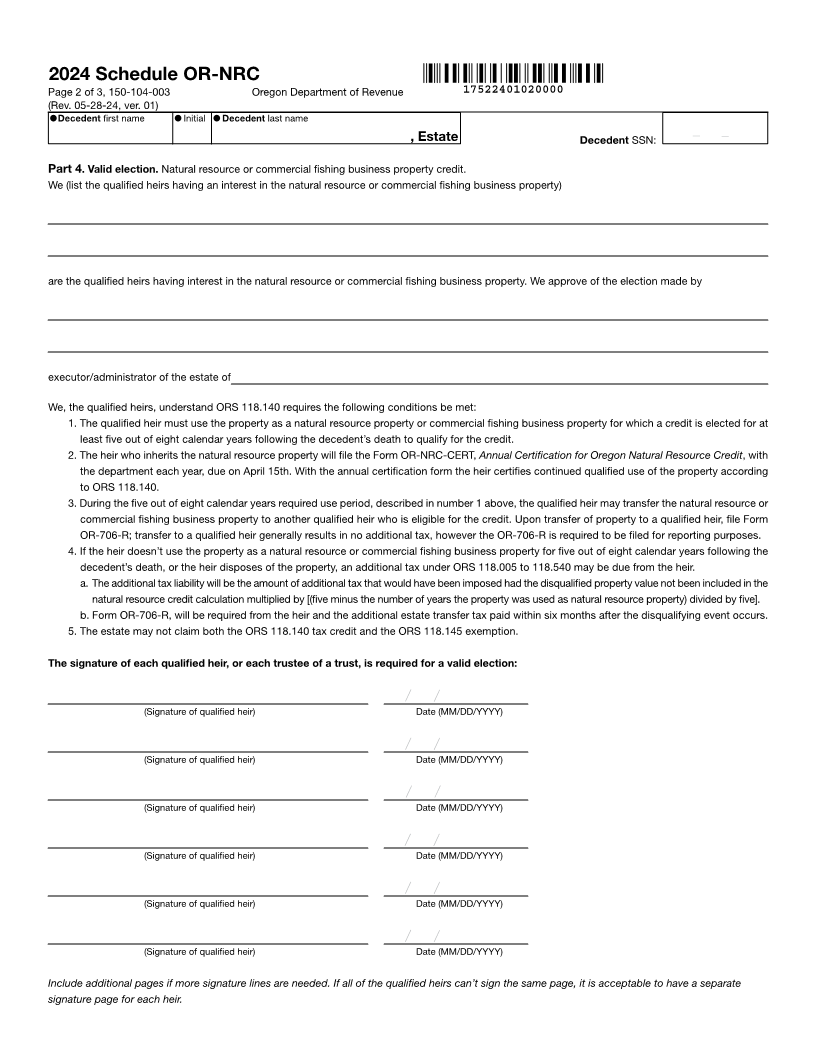

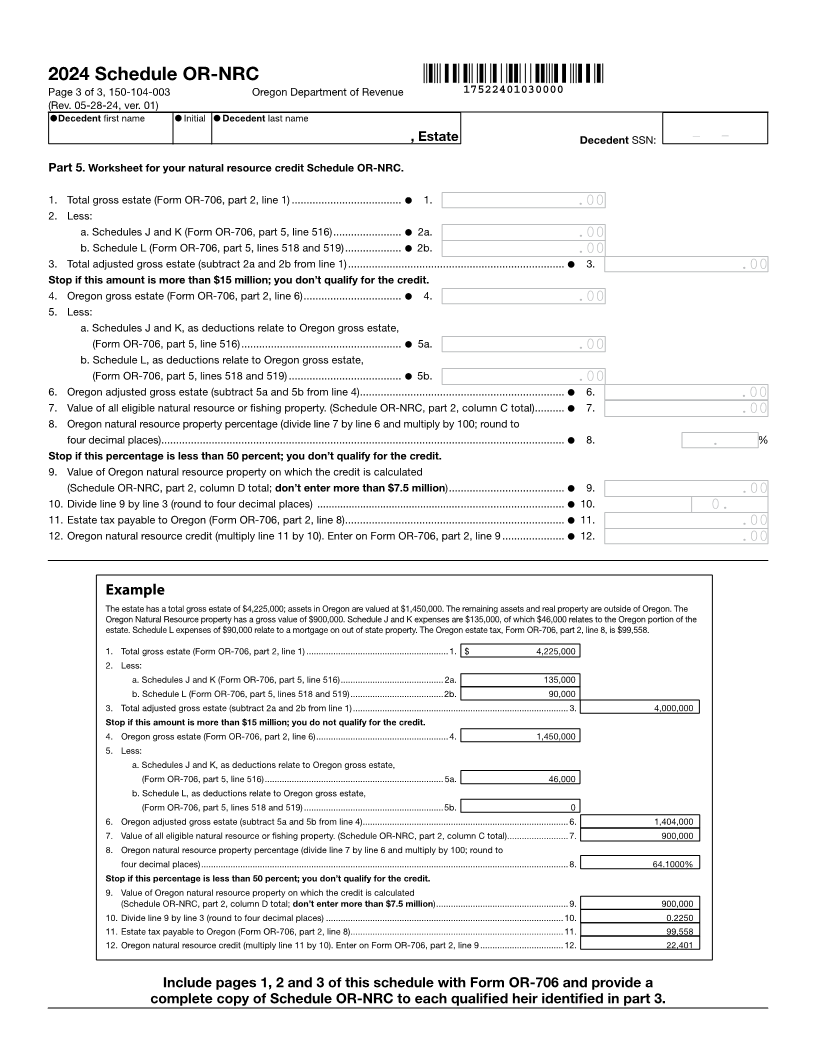

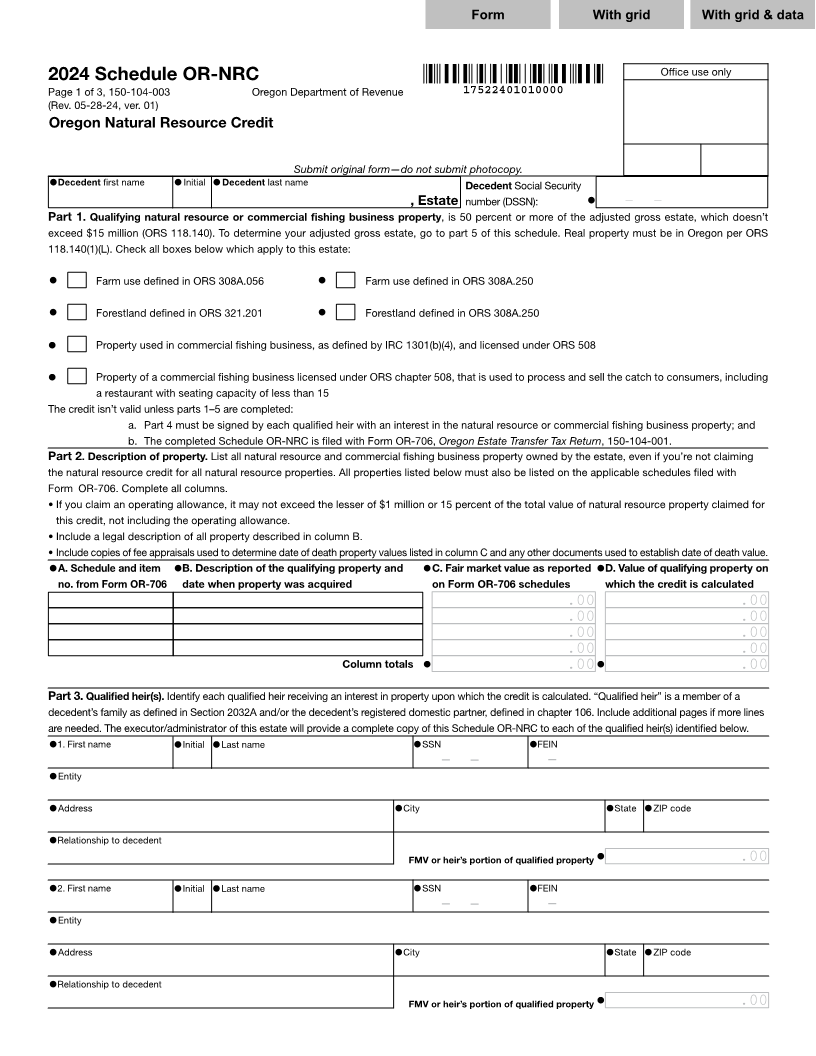

1 1 1 2 2 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 Form With grid With grid & data2 84 85 3 4 82 83 3 3 4 4 5 Office use only 5 2024 Schedule OR-NRC 6 Page 1 of 3, 150-104-003 Oregon Department of Revenue 17522401010000 6 7 (Rev. 05-28-24, ver. 01) 7 8 Oregon Natural Resource Credit 8 9 9 10 10 11 Submit original form—do not submit photocopy. 11 12 •Decedent first name •Initial •Decedent last name Decedent Social Security 12 13 XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXX, Estate number (DSSN): •999-99-9999– – 13 14 Part 1. Qualifying natural resource or commercial fishing business property, is 50 percent or more of the adjusted gross estate, which doesn’t 14 15 exceed $15 million (ORS 118.140). To determine your adjusted gross estate, go to part 5 of this schedule. Real property must be in Oregon per ORS 15 16 118.140(1)(L). Check all boxes below which apply to this estate: 16 17 17 18 • X Farm use defined in ORS 308A.056 • X Farm use defined in ORS 308A.250 18 19 19 20 • X Forestland defined in ORS 321.201 • X Forestland defined in ORS 308A.250 20 21 21 22 • X Property used in commercial fishing business, as defined by IRC 1301(b)(4), and licensed under ORS 508 22 23 23 24 • X Property of a commercial fishing business licensed under ORS chapter 508, that is used to process and sell the catch to consumers, including 24 25 a restaurant with seating capacity of less than 15 25 26 The credit isn’t valid unless parts 1–5 are completed: 26 27 a. Part 4 must be signed by each qualified heir with an interest in the natural resource or commercial fishing business property; and 27 28 b. The completed Schedule OR-NRC is filed with Form OR-706, Oregon Estate Transfer Tax Return, 150-104-001. 28 29 Part 2. Description of property. List all natural resource and commercial fishing business property owned by the estate, even if you’re not claiming 29 30 the natural resource credit for all natural resource properties. All properties listed below must also be listed on the applicable schedules filed with 30 31 Form OR-706. Complete all columns. 31 32 • If you claim an operating allowance, it may not exceed the lesser of $1 million or 15 percent of the total value of natural resource property claimed for 32 33 this credit, not including the operating allowance. 33 34 • Include a legal description of all property described in column B. 34 35 • Include copies of fee appraisals used to determine date of death property values listed in column C and any other documents used to establish date of death value. 35 36 •A. Schedule and item •B. Description of the qualifying property and •C. Fair market value as reported •D. Value of qualifying property on 36 37 no. from Form OR-706 date when property was acquired on Form OR-706 schedules which the credit is calculated 37 38 38 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99,999,999,999.00.00 99,999,999,999.00.00 39 39 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99,999,999,999.00.00 99,999,999,999.00.00 40 40 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99,999,999,999.00.00 99,999,999,999.00.00 41 41 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 99,999,999,999.00.00 99,999,999,999.00.00 42 Column totals • • 42 99,999,999,999.00.00 99,999,999,999.00.00 43 43 44 Part 3. Qualified heir(s). Identify each qualified heir receiving an interest in property upon which the credit is calculated. “Qualified heir” is a member of a 44 45 decedent’s family as defined in Section 2032A and/or the decedent’s registered domestic partner, defined in chapter 106. Include additional pages if more lines 45 46 are needed. The executor/administrator of this estate will provide a complete copy of this Schedule OR-NRC to each of the qualified heir(s) identified below. 46 47 •1. First name •Initial •Last name •SSN •FEIN 47 48 XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXX999-99-9999– – 99-9999999– 48 49 •Entity 49 50 50 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 51 •Address •City •State •ZIP code 51 52 52 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXX XX XXXXX-XXXX 53 •Relationship to decedent 53 54 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX FMV or heir’s portion of qualified property •99,999,999,999.00.00 54 55 55 56 •2. First name •Initial •Last name •SSN •FEIN 56 57 XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXX999-99-9999– – 99-9999999– 57 58 •Entity 58 59 59 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX 60 •Address •City •State •ZIP code 60 61 61 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXXXXX XX XXXXX-XXXX 62 •Relationship to decedent 62 63 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX FMV or heir’s portion of qualified property •99,999,999,999.00.00 63 64 64 1 2 65 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 65 84 85 3 4 82 83 66 66