- 9 -

Enlarge image

|

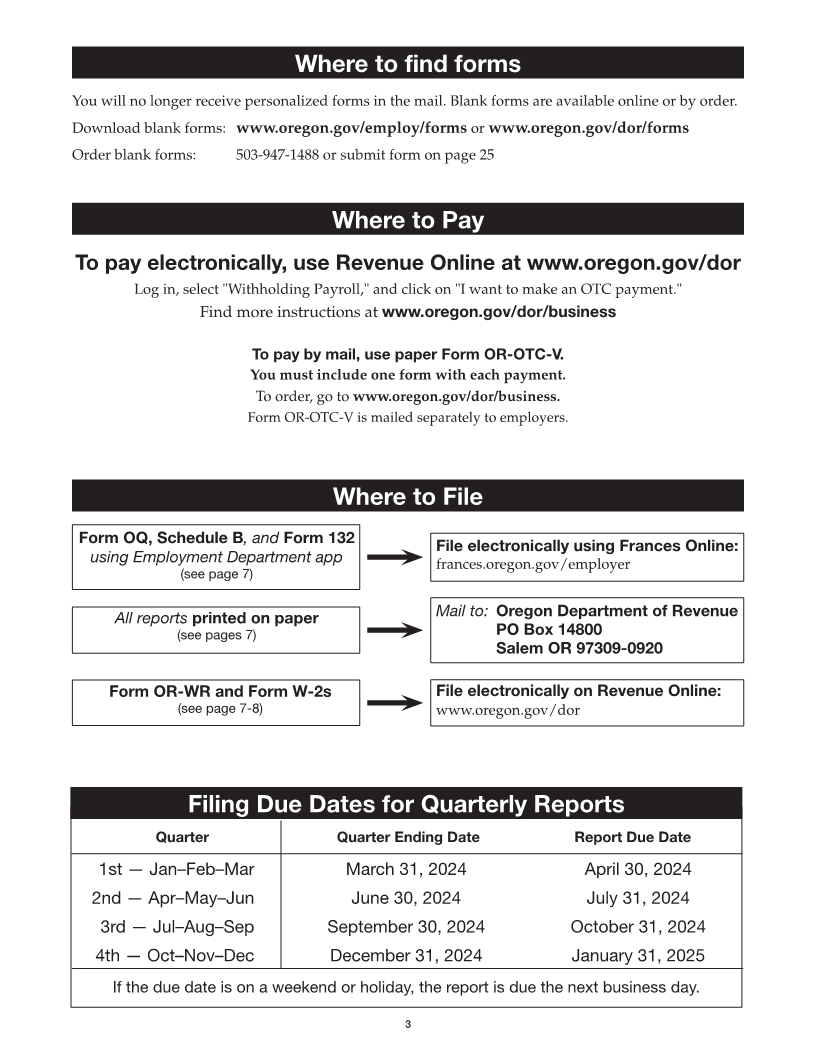

Required Forms

We process paper forms electronically. It’s critical

Note:

for successful reporting to use the correct format

OED processes Form OQ, Schedule B, and Form 132.

and color of ink.

DOR processes payments and Form OR-STT-A. You

To avoid problems when filling out reports:

can mail in Form OR-OTC-V with your check or, you

• Use only blue or black ink.

can pay on Revenue Online. Include any payments

• Only file with official forms.

you made to DOR on Form OQ.

• Only use CAPITAL LETTERS ONLY.

If you use a tax preparer, check that they have this DOR: You may make changes as far back as nec-

booklet and the correct forms. essary to make corrections and report the proper

Forms needed for reporting amount of withholding and transit taxes. However,

if that correction results in a refund, you have three

Form OQ—File this form each quarter to docu- years from the due date of the return, or two years

ment how you calculate the amounts of with-

from the date the tax was paid, whichever is later,

holding tax, UI tax, TriMet Transit District tax,

to request that refund.

Lane Transit District tax, STT, Paid Leave contri-

butions, and WBF assessment you owe. OED: You may make changes to the UI tax or the

Paid Leave contribution portions of the reports for

Also use it to report withholding on pension/annu-

any quarter between the first quarter three years

ity payments.

back up through the current quarter.

Schedule B—For withholding tax only. Use this

form only if you must make semi-weekly or daily DCBS: You may make changes to the WBF

state income tax withholding deposits. File Sched- assessment portion of the reports for any quarter

ule B with Form OQ to document withholding tax between the first quarter three years back and the

deposit amounts by payroll date. current quarter.

Form 132—Use to report UI subject wages and Other forms

hours, state income tax withholding, STT, or Paid

Leave subject wages. Form 132 is filed with Form Since we process reports and payments elec-

OQ on a quarterly basis. tronically, our systems won’t pick up special

instructions or notations you write on Form OQ

For each employee, you must include the following

or Form OR-OTC-V. Use the following forms,

detailed information:

located in the back of this booklet, to make updates:

1. Social Security number

2. First initial Business Change in Status Form—Use this form to

3. Last name update your business information, such as: chang-

4. Whole hours worked ing a business name, correcting an FEIN, selling or

5. State income tax withholding closing a business, no longer working in a transit

6. STT subject wages district, and starting a business in a transit district.

7. STT withholding

8. UI subject wages If the structure of your business changes, you may

9. Paid Leave subject wages need to complete a Combined Employers Registration

found on DOR's website (see page 1).

Form OR‑OTC‑V— File with each payroll tax

payment to show how the amount paid is to be Business Contact Change Form—Use this form

distributed among withholding tax, STT, TM, LTD, to update your contact information, such as:

UI, Paid Leave, and WBF assessment. physical, mailing, or email address; phone or fax

number; and off site payroll service, accountant,

Amended forms

or bookkeeper.

Use fillable amended report forms available at Form OR‑WR— If you're an employer, you are

OED's website (see page 1):

required to file this form annually even if you are

• Form OQ/OA–AMENDED reporting 0. If you're an employer, you are required

• Schedule B–AMENDED to file electronically through Revenue Online by

• Form 132–AMENDED January 31 of the following year.

7

|