Enlarge image

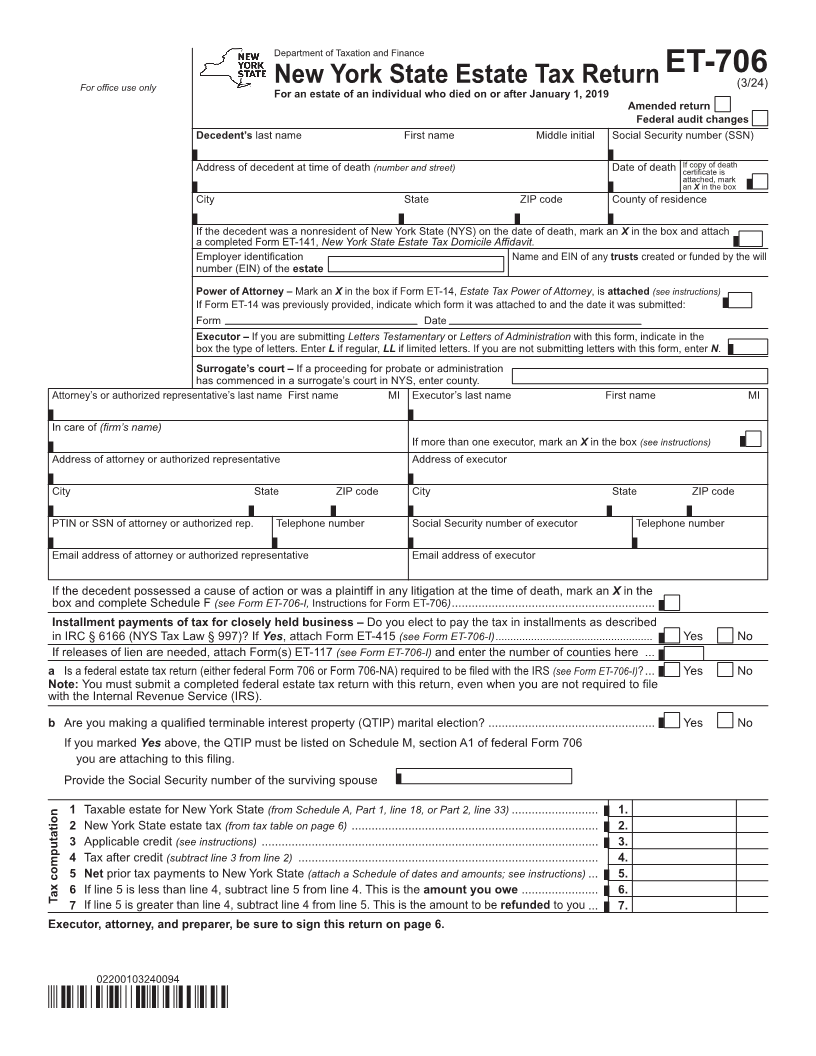

Department of Taxation and Finance

ET-706

For office use only New York State Estate Tax Return (3/24)

For an estate of an individual who died on or after January 1, 2019

Amended return

Federal audit changes

Decedent’s last name First name Middle initial Social Security number (SSN)

Address of decedent at time of death (number and street) Date of death If copy of death

certificate is

attached, mark

an Xin the box

City State ZIP code County of residence

If the decedent was a nonresident of New York State (NYS) on the date of death, mark an Xin the box and attach

a completed Form ET-141, New York State Estate Tax Domicile Affidavit.

Employer identification Name and EIN of any trusts created or funded by the will

number (EIN) of the estate

Power of Attorney – Mark an Xin the box if Form ET-14,Estate Tax Power of Attorney , isattached (see instructions)

If Form ET-14 was previously provided, indicate which form it was attached to and the date it was submitted:

Form Date

Executor – If you are submitting Letters Testamentary or Letters of Administration with this form, indicate in the

box the type of letters. Enter Lif regular,LL if limited letters. If you are not submitting letters with this form, enter N .

Surrogate’s court – If a proceeding for probate or administration

has commenced in a surrogate’s court in NYS, enter county.

Attorney’s or authorized representative’s last name First name MI Executor’s last name First name MI

In care of (firm’s name)

If more than one executor, mark an Xin the box (see instructions)

Address of attorney or authorized representative Address of executor

City State ZIP code City State ZIP code

PTIN or SSN of attorney or authorized rep. Telephone number Social Security number of executor Telephone number

Email address of attorney or authorized representative Email address of executor

If the decedent possessed a cause of action or was a plaintiff in any litigation at the time of death, mark an X in the

box and complete Schedule F (see Form ET-706-I, Instructions for Form ET-706) .............................................................

Installment payments of tax for closely held business – Do you elect to pay the tax in installments as described

in IRC § 6166 (NYS Tax Law § 997)? If Yes, attach Form ET-415 (see Form ET-706-I) ..................................................... Yes No

If releases of lien are needed, attach Form(s) ET-117 (see Form ET-706-I) and enter the number of counties here ...

a Is a federal estate tax return (either federal Form 706 or Form 706-NA) required to be filed with the IRS (see Form ET-706-I)? ... Yes No

Note: You must submit a completed federal estate tax return with this return, even when you are not required to file

with the Internal Revenue Service (IRS).

b Are you making a qualified terminable interest property (QTIP) marital election? .................................................. Yes No

If you marked Yes above, the QTIP must be listed on Schedule M, section A1 of federal Form 706

you are attaching to this filing.

Provide the Social Security number of the surviving spouse

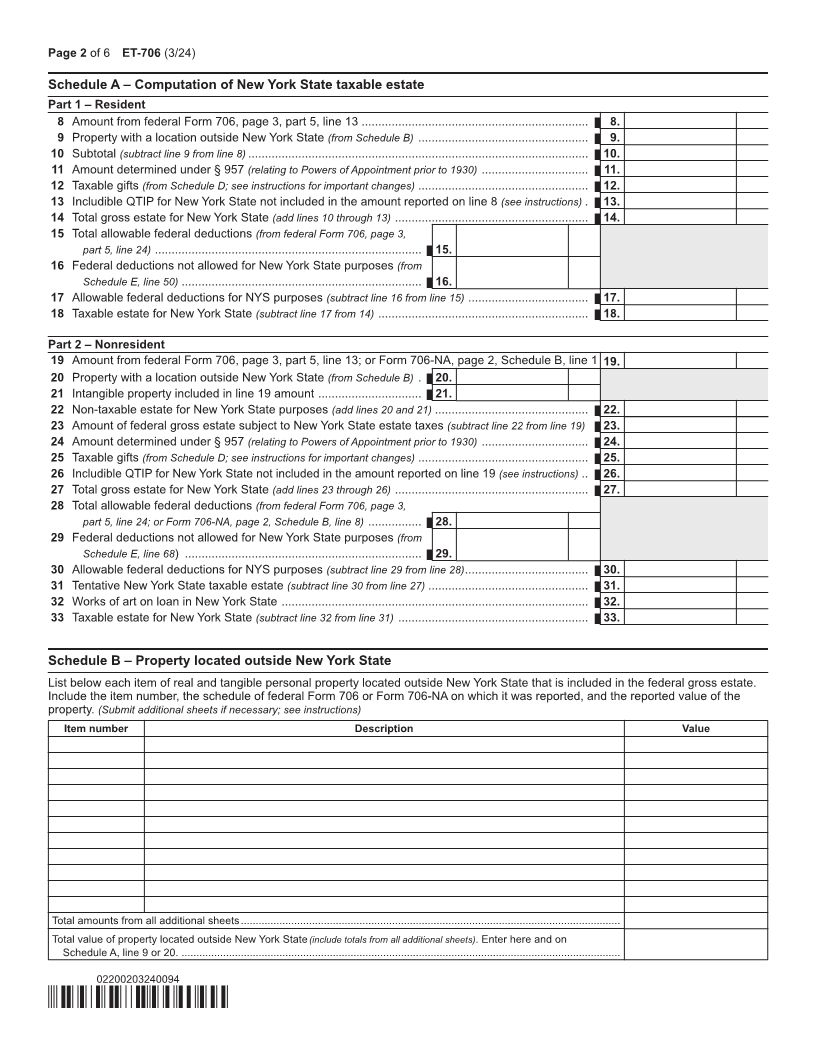

1 Taxable estate for New York State (from Schedule A, Part 1, line 18, or Part 2, line 33) .......................... 1.

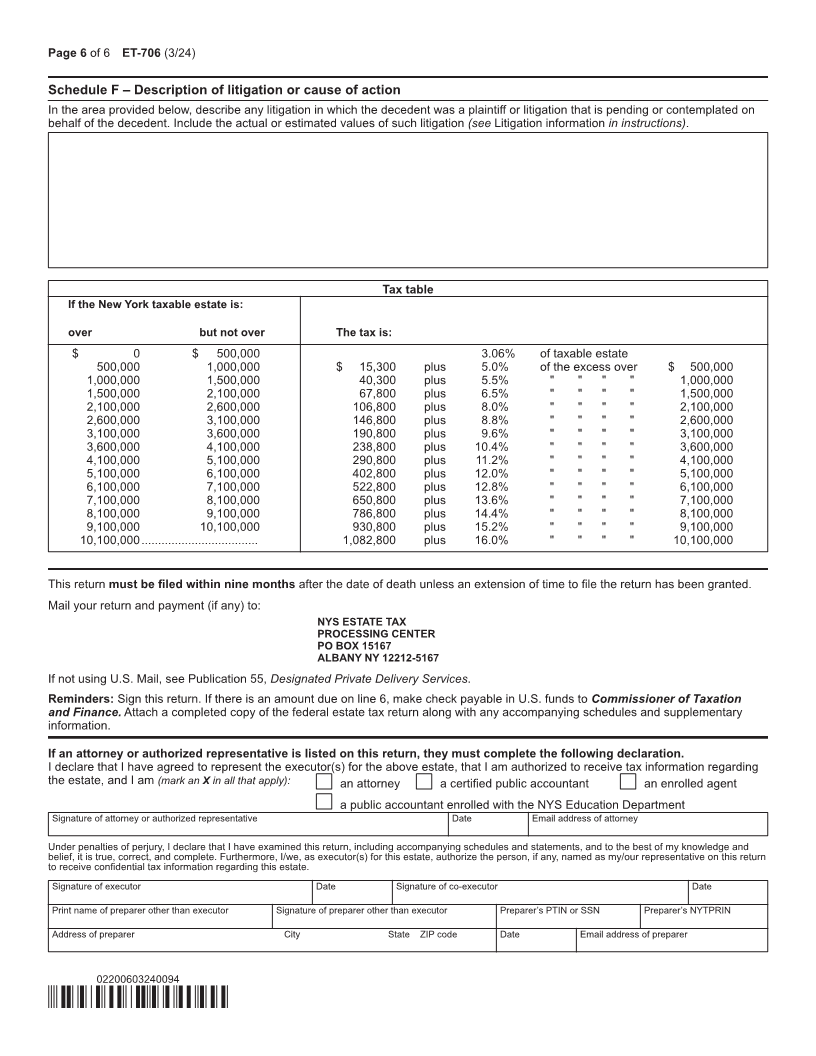

2 New York State estate tax (from tax table on page 6) .......................................................................... 2.

3 Applicable credit (see instructions) ..................................................................................................... 3.

4 Tax after credit (subtract line 3 from line 2) .......................................................................................... 4.

5 Net prior tax payments to New York State (attach a Schedule of dates and amounts; see instructions) ... 5.

Tax computation 6 If line 5 is less than line 4, subtract line 5 from line 4. This is the amount you owe ....................... 6.

7 If line 5 is greater than line 4, subtract line 4 from line 5. This is the amount to be refunded to you ... 7.

Executor, attorney, and preparer, be sure to sign this return on page 6.

02200103240094