Enlarge image

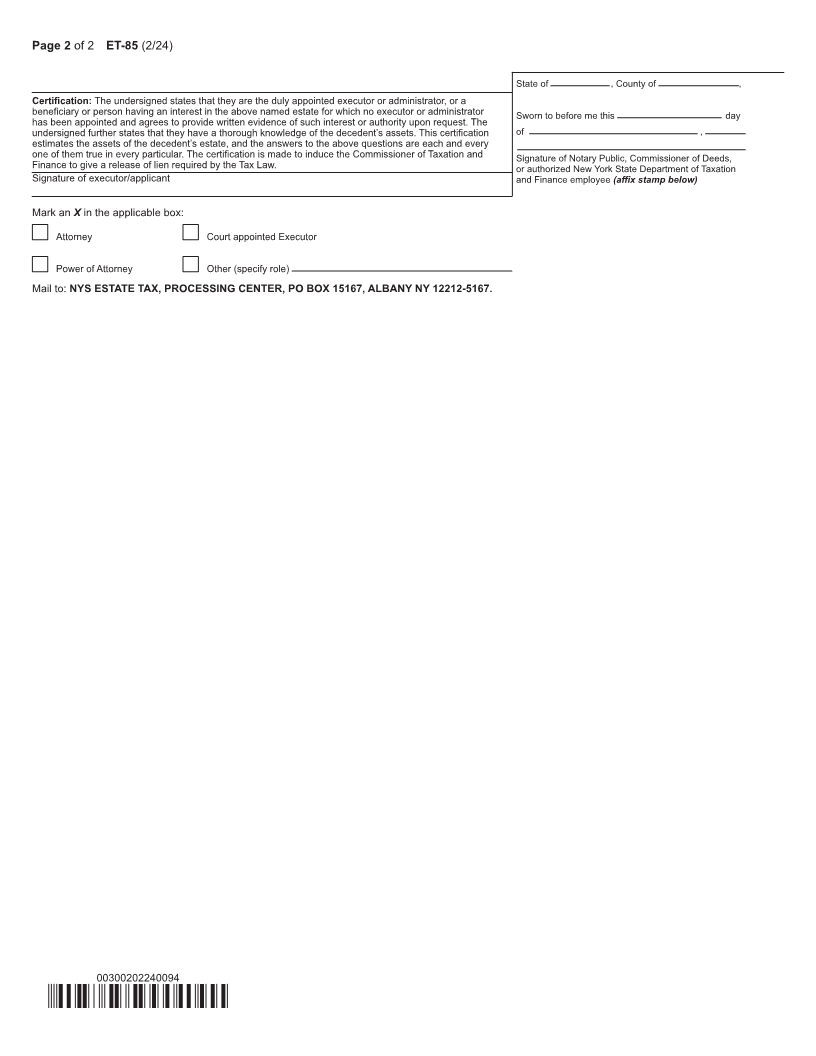

Department of Taxation and Finance

For office use only New York State Estate Tax Certification ET-85(2/24)

For an estate of an individual whose date of death is on or after January 1, 2019

Decedent’s last name First name Middle initial Social Security number (SSN)

Address of decedent at time of death (number and street) Date of death Mark an Xif

copy of death

certificate is

attached (see instr.)

City State ZIP code County of residence

If the decedent was a nonresident of New York State on the date of death, mark an Xin this box and attach a completed

Form ET-141, New York State Estate Tax Domicile Affidavit ..................................................................................................

Power of Attorney – Mark an Xin the box if Form ET-14,Estate Tax Power of Attorney , isattached (see instructions)

If Form ET-14 was previously provided, indicate which form it was attached to and the date it was submitted:

Form Date

Executor – If you are submitting Letters Testamentary or Letters of Administration with this form, indicate in this box

the type of letters. Enter Lif regular, LL if limited letters. If you are not submitting letters with this form, enter N. .............

Attorney’s or authorized representative’s last name First name MI Executor’s (for definition, see instr.) last name First name MI

In care of (firm’s name) If more than one executor,

mark an Xin the box (see instr.)

Address of attorney or authorized representative Address of executor

City State ZIP code City State ZIP code

SSN or PTIN of attorney or authorized rep. Telephone number Social Security number of executor Telephone number

Email address of attorney or authorized representative Email address of executor

Estimated net estate (including jointly held assets) Were releases of lien previously issued? ............... Yes No

1Real property .................................... 1

2 Bank deposits, mortgages, notes and cash 2 If Yes, give date of issuance (mm-dd-yyyy).

3 Stocks and bonds ............................. 3

Was the decedent a member of a partnership? ...... Yes No

4 Life insurance ................................... 4

5 Annuities ........................................... 5 Did the decedent have a surviving spouse?............ Yes No

6 Retirement benefits .......................... 6

If the decedent was a nonresident of New York

7 Miscellaneous assets

State, does the estate include real property or

(such as cars, boats, and coin collections) 7

tangible personal property having an actual

8 Taxable gifts (see instructions) ............ 8

situs in New York State?.......................................... Yes No

9 Includible QTIP Property (see instr.) .. 9

10 Estimated litigation awards (see instr.) 10

11 Add lines 1 through 10........................ 11

12 Estimated deductions ......................... 12

13 Estimated net estate (subtract line 12 from line 11) 13

Mark an inXthe box below if a release of lien is requested.

Releases of lien are requested – Submit a separate Form ET-117, Release of Lien of Estate Tax, for each county, cooperative housing corporation, and

purchaser (see instructions). A release of lien is not required if the property was held jointly by the decedent and the surviving spouse as the only joint

tenants. There is no fee for a release of lien.

If releases of lien are required, enter the total number of counties here ....................

Executor or applicant, be sure to sign this return on page 2.

If an attorney or authorized representative is listed on this return, they must complete the following declaration.

I declare that I have agreed to represent the executor(s) for the above estate, that I am authorized to receive tax information regarding the estate, and I am

(mark an inXall boxes that apply): an attorney a certified public accountant an enrolled agent

a public accountant enrolled with the New York State Education Department

Signature of attorney or authorized representative Date

00300102240094