Enlarge image

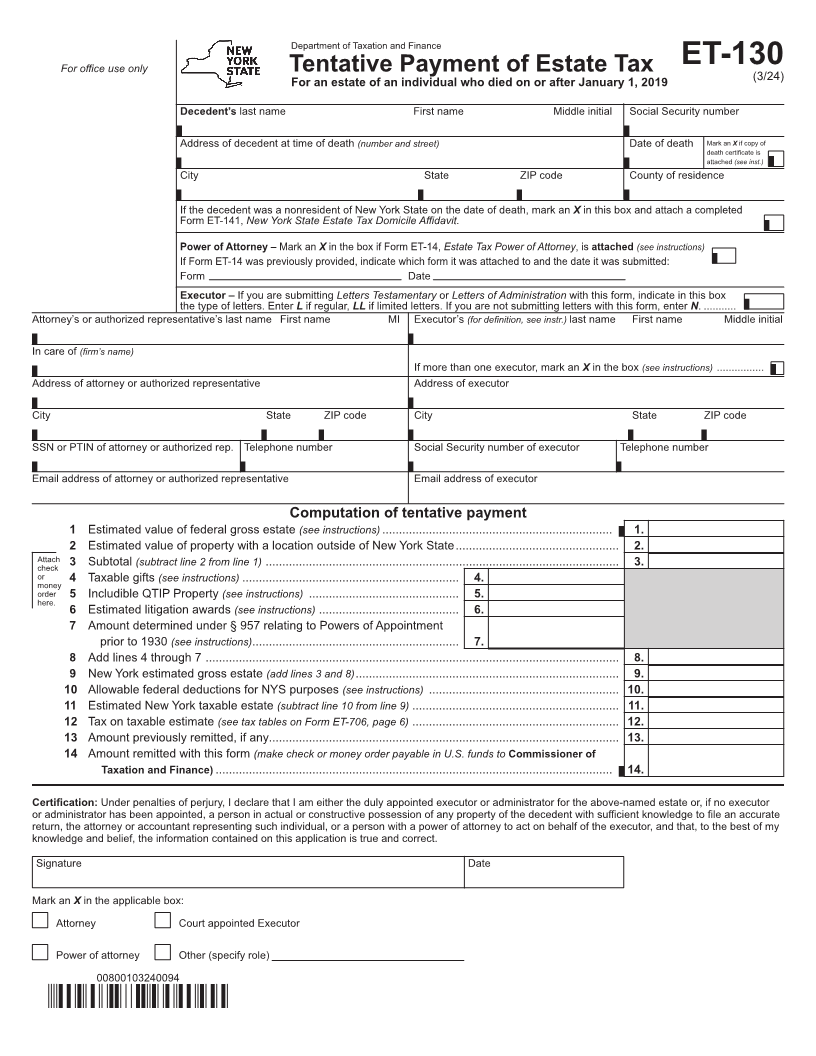

Department of Taxation and Finance

For office use only Tentative Payment of Estate Tax ET-130

(3/24)

For an estate of an individual who died on or after January 1, 2019

Decedent’s last name First name Middle initial Social Security number

Address of decedent at time of death (number and street) Date of death Mark an Xif copy of

death certificate is

attached (see inst.)

City State ZIP code County of residence

If the decedent was a nonresident of New York State on the date of death, mark an Xin this box and attach a completed

Form ET-141, New York State Estate Tax Domicile Affidavit.

Power of Attorney – Mark an Xin the box if Form ET-14,Estate Tax Power of Attorney , isattached (see instructions)

If Form ET-14 was previously provided, indicate which form it was attached to and the date it was submitted:

Form Date

Executor – If you are submitting Letters Testamentary or Letters of Administration with this form, indicate in this box

the type of letters. Enter Lif regular, LL if limited letters. If you are not submitting letters with this form, enter N. ...........

Attorney’s or authorized representative’s last name First name MI Executor’s (for definition, see instr.) last name First name Middle initial

In care of (firm’s name)

If more than one executor, mark an Xin the box (see instructions) ................

Address of attorney or authorized representative Address of executor

City State ZIP code City State ZIP code

SSN or PTIN of attorney or authorized rep. Telephone number Social Security number of executor Telephone number

Email address of attorney or authorized representative Email address of executor

Computation of tentative payment

1 Estimated value of federal gross estate (see instructions) ..................................................................... 1.

2 Estimated value of property with a location outside of New York State ................................................. 2.

Attach 3 Subtotal (subtract line 2 from line 1) .......................................................................................................... 3.

check

or 4 Taxable gifts (see instructions) ................................................................. 4.

money

order 5 Includible QTIP Property (see instructions) ............................................. 5.

here.

6 Estimated litigation awards (see instructions) .......................................... 6.

7 Amount determined under § 957 relating to Powers of Appointment

prior to 1930 (see instructions) .............................................................. 7.

8 Add lines 4 through 7 ............................................................................................................................ 8.

9 New York estimated gross estate (add lines 3 and 8) ............................................................................... 9.

10 Allowable federal deductions for NYS purposes (see instructions) ......................................................... 10.

11 Estimated New York taxable estate (subtract line 10 from line 9) .............................................................. 11.

12 Tax on taxable estimate (see tax tables on Form ET-706, page 6) .............................................................. 12.

13 Amount previously remitted, if any......................................................................................................... 13.

14 Amount remitted with this form (make check or money order payable in U.S. funds to Commissioner of

Taxation and Finance) ....................................................................................................................... 14.

Certification: Under penalties of perjury, I declare that I am either the duly appointed executor or administrator for the above-named estate or, if no executor

or administrator has been appointed, a person in actual or constructive possession of any property of the decedent with sufficient knowledge to file an accurate

return, the attorney or accountant representing such individual, or a person with a power of attorney to act on behalf of the executor, and that, to the best of my

knowledge and belief, the information contained on this application is true and correct.

Signature Date

Mark an Xin the applicable box:

Attorney Court appointed Executor

Power of attorney Other (specify role)

00800103240094