Enlarge image

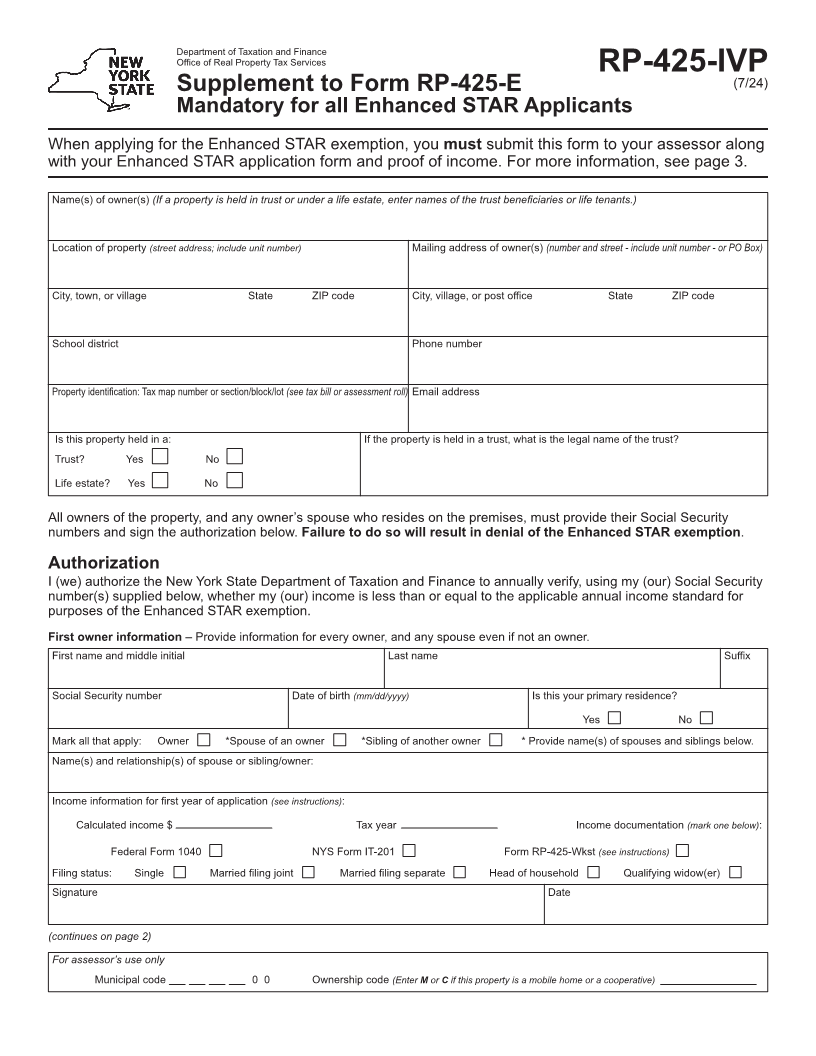

Department of Taxation and Finance

Office of Real Property Tax Services

RP-425-IVP

(7/24)

Supplement to Form RP-425-E

Mandatory for all Enhanced STAR Applicants

When applying for the Enhanced STAR exemption, you must submit this form to your assessor along

with your Enhanced STAR application form and proof of income. For more information, see page 3.

Name(s) of owner(s) (If a property is held in trust or under a life estate, enter names of the trust beneficiaries or life tenants.)

Location of property (street address; include unit number) Mailing address of owner(s) (number and street - include unit number - or PO Box)

City, town, or village State ZIP code City, village, or post office State ZIP code

School district Phone number

Property identification: Tax map number or section/block/lot (see tax bill or assessment roll) Email address

Is this property held in a: If the property is held in a trust, what is the legal name of the trust?

Trust? Yes No

Life estate? Yes No

All owners of the property, and any owner’s spouse who resides on the premises, must provide their Social Security

numbers and sign the authorization below. Failure to do so will result in denial of the Enhanced STAR exemption.

Authorization

I (we) authorize the New York State Department of Taxation and Finance to annually verify, using my (our) Social Security

number(s) supplied below, whether my (our) income is less than or equal to the applicable annual income standard for

purposes of the Enhanced STAR exemption.

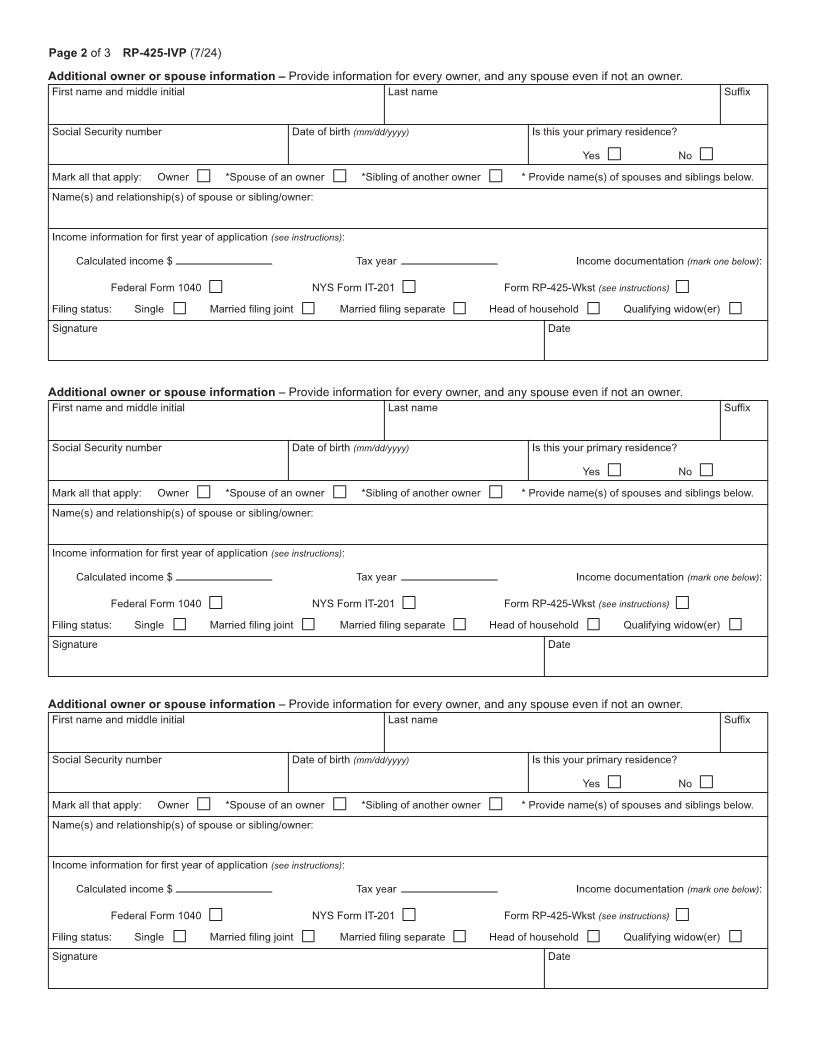

First owner information – Provide information for every owner, and any spouse even if not an owner.

First name and middle initial Last name Suffix

Social Security number Date of birth (mm/dd/yyyy) Is this your primary residence?

Yes No

Mark all that apply: Owner *Spouse of an owner *Sibling of another owner * Provide name(s) of spouses and siblings below.

Name(s) and relationship(s) of spouse or sibling/owner:

Income information for first year of application (see instructions):

Calculated income $ Tax year Income documentation (mark one below):

Federal Form 1040 NYS Form IT-201 Form RP-425-Wkst (see instructions)

Filing status: Single Married filing joint Married filing separate Head of household Qualifying widow(er)

Signature Date

(continues on page 2)

For assessor’s use only

Municipal code 0 0 Ownership code (Enter Mor Cif this property is a mobile home or a cooperative)