Enlarge image

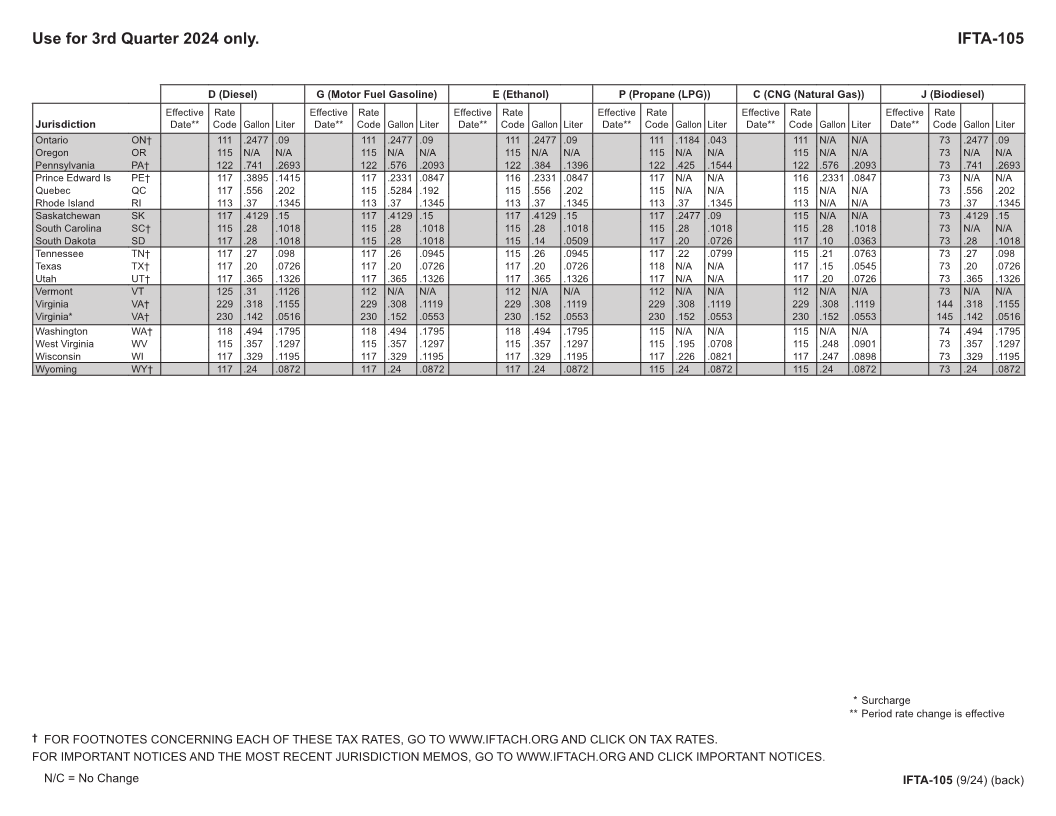

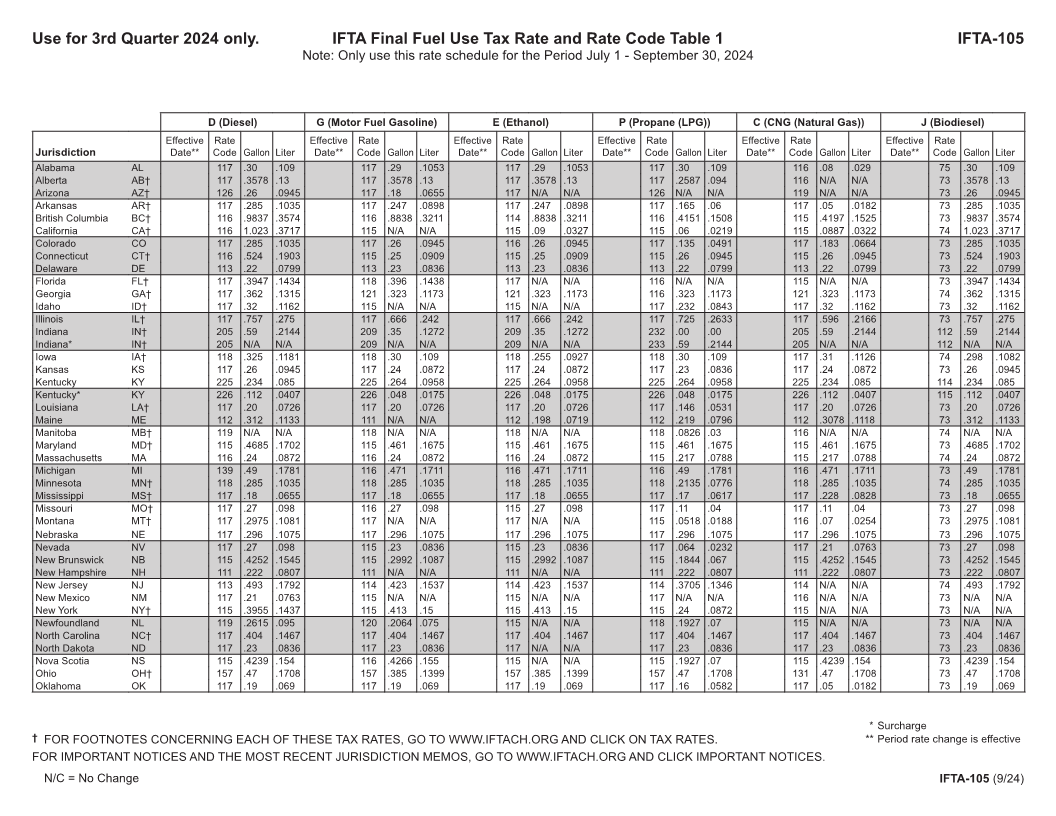

Use for 3rd Quarter 2024 only. IFTA Final Fuel Use Tax Rate and Rate Code Table 1 IFTA-105 Note: Only use this rate schedule for the Period July 1 - September 30, 2024 D (Diesel) G (Motor Fuel Gasoline) E (Ethanol) P (Propane (LPG)) C (CNG (Natural Gas)) J (Biodiesel) Effective Rate Effective Rate Effective Rate Effective Rate Effective Rate Effective Rate Jurisdiction Date** Code Gallon Liter Date** Code Gallon Liter Date** Code Gallon Liter Date** Code Gallon Liter Date** Code Gallon Liter Date** Code Gallon Liter Alabama AL 117 .30 .109 117 .29 .1053 117 .29 .1053 117 .30 .109 116 .08 .029 75 .30 .109 Alberta AB† 117 .3578 .13 117 .3578 .13 117 .3578 .13 117 .2587 .094 116 N/A N/A 73 .3578 .13 Arizona AZ† 126 .26 .0945 117 .18 .0655 117 N/A N/A 126 N/A N/A 119 N/A N/A 73 .26 .0945 Arkansas AR† 117 .285 .1035 117 .247 .0898 117 .247 .0898 117 .165 .06 117 .05 .0182 73 .285 .1035 British Columbia BC† 116 .9837 .3574 116 .8838 .3211 114 .8838 .3211 116 .4151 .1508 115 .4197 .1525 73 .9837 .3574 California CA† 116 1.023 .3717 115 N/A N/A 115 .09 .0327 115 .06 .0219 115 .0887 .0322 74 1.023 .3717 Colorado CO 117 .285 .1035 117 .26 .0945 116 .26 .0945 117 .135 .0491 117 .183 .0664 73 .285 .1035 Connecticut CT† 116 .524 .1903 115 .25 .0909 115 .25 .0909 115 .26 .0945 115 .26 .0945 73 .524 .1903 Delaware DE 113 .22 .0799 113 .23 .0836 113 .23 .0836 113 .22 .0799 113 .22 .0799 73 .22 .0799 Florida FL† 117 .3947 .1434 118 .396 .1438 117 N/A N/A 116 N/A N/A 115 N/A N/A 73 .3947 .1434 Georgia GA† 117 .362 .1315 121 .323 .1173 121 .323 .1173 116 .323 .1173 121 .323 .1173 74 .362 .1315 Idaho ID† 117 .32 .1162 115 N/A N/A 115 N/A N/A 117 .232 .0843 117 .32 .1162 73 .32 .1162 Illinois IL† 117 .757 .275 117 .666 .242 117 .666 .242 117 .725 .2633 117 .596 .2166 73 .757 .275 Indiana IN† 205 .59 .2144 209 .35 .1272 209 .35 .1272 232 .00 .00 205 .59 .2144 112 .59 .2144 Indiana* IN† 205 N/A N/A 209 N/A N/A 209 N/A N/A 233 .59 .2144 205 N/A N/A 112 N/A N/A Iowa IA† 118 .325 .1181 118 .30 .109 118 .255 .0927 118 .30 .109 117 .31 .1126 74 .298 .1082 Kansas KS 117 .26 .0945 117 .24 .0872 117 .24 .0872 117 .23 .0836 117 .24 .0872 73 .26 .0945 Kentucky KY 225 .234 .085 225 .264 .0958 225 .264 .0958 225 .264 .0958 225 .234 .085 114 .234 .085 Kentucky* KY 226 .112 .0407 226 .048 .0175 226 .048 .0175 226 .048 .0175 226 .112 .0407 115 .112 .0407 Louisiana LA† 117 .20 .0726 117 .20 .0726 117 .20 .0726 117 .146 .0531 117 .20 .0726 73 .20 .0726 Maine ME 112 .312 .1133 111 N/A N/A 112 .198 .0719 112 .219 .0796 112 .3078 .1118 73 .312 .1133 Manitoba MB† 119 N/A N/A 118 N/A N/A 118 N/A N/A 118 .0826 .03 116 N/A N/A 74 N/A N/A Maryland MD† 115 .4685 .1702 115 .461 .1675 115 .461 .1675 115 .461 .1675 115 .461 .1675 73 .4685 .1702 Massachusetts MA 116 .24 .0872 116 .24 .0872 116 .24 .0872 115 .217 .0788 115 .217 .0788 74 .24 .0872 Michigan MI 139 .49 .1781 116 .471 .1711 116 .471 .1711 116 .49 .1781 116 .471 .1711 73 .49 .1781 Minnesota MN† 118 .285 .1035 118 .285 .1035 118 .285 .1035 118 .2135 .0776 118 .285 .1035 74 .285 .1035 Mississippi MS† 117 .18 .0655 117 .18 .0655 117 .18 .0655 117 .17 .0617 117 .228 .0828 73 .18 .0655 Missouri MO† 117 .27 .098 116 .27 .098 115 .27 .098 117 .11 .04 117 .11 .04 73 .27 .098 Montana MT† 117 .2975 .1081 117 N/A N/A 117 N/A N/A 115 .0518 .0188 116 .07 .0254 73 .2975 .1081 Nebraska NE 117 .296 .1075 117 .296 .1075 117 .296 .1075 117 .296 .1075 117 .296 .1075 73 .296 .1075 Nevada NV 117 .27 .098 115 .23 .0836 115 .23 .0836 117 .064 .0232 117 .21 .0763 73 .27 .098 New Brunswick NB 115 .4252 .1545 115 .2992 .1087 115 .2992 .1087 115 .1844 .067 115 .4252 .1545 73 .4252 .1545 New Hampshire NH 111 .222 .0807 111 N/A N/A 111 N/A N/A 111 .222 .0807 111 .222 .0807 73 .222 .0807 New Jersey NJ 113 .493 .1792 114 .423 .1537 114 .423 .1537 114 .3705 .1346 114 N/A N/A 74 .493 .1792 New Mexico NM 117 .21 .0763 115 N/A N/A 115 N/A N/A 117 N/A N/A 116 N/A N/A 73 N/A N/A New York NY† 115 .3955 .1437 115 .413 .15 115 .413 .15 115 .24 .0872 115 N/A N/A 73 N/A N/A Newfoundland NL 119 .2615 .095 120 .2064 .075 115 N/A N/A 118 .1927 .07 115 N/A N/A 73 N/A N/A North Carolina NC† 117 .404 .1467 117 .404 .1467 117 .404 .1467 117 .404 .1467 117 .404 .1467 73 .404 .1467 North Dakota ND 117 .23 .0836 117 .23 .0836 117 N/A N/A 117 .23 .0836 117 .23 .0836 73 .23 .0836 Nova Scotia NS 115 .4239 .154 116 .4266 .155 115 N/A N/A 115 .1927 .07 115 .4239 .154 73 .4239 .154 Ohio OH† 157 .47 .1708 157 .385 .1399 157 .385 .1399 157 .47 .1708 131 .47 .1708 73 .47 .1708 Oklahoma OK 117 .19 .069 117 .19 .069 117 .19 .069 117 .16 .0582 117 .05 .0182 73 .19 .069 * Surcharge † FOR FOOTNOTES CONCERNING EACH OF THESE TAX RATES, GO TO WWW.IFTACH.ORG AND CLICK ON TAX RATES. ** Period rate change is effective FOR IMPORTANT NOTICES AND THE MOST RECENT JURISDICTION MEMOS, GO TO WWW.IFTACH.ORG AND CLICK IMPORTANT NOTICES. N/C = No Change IFTA-105 (9/24)