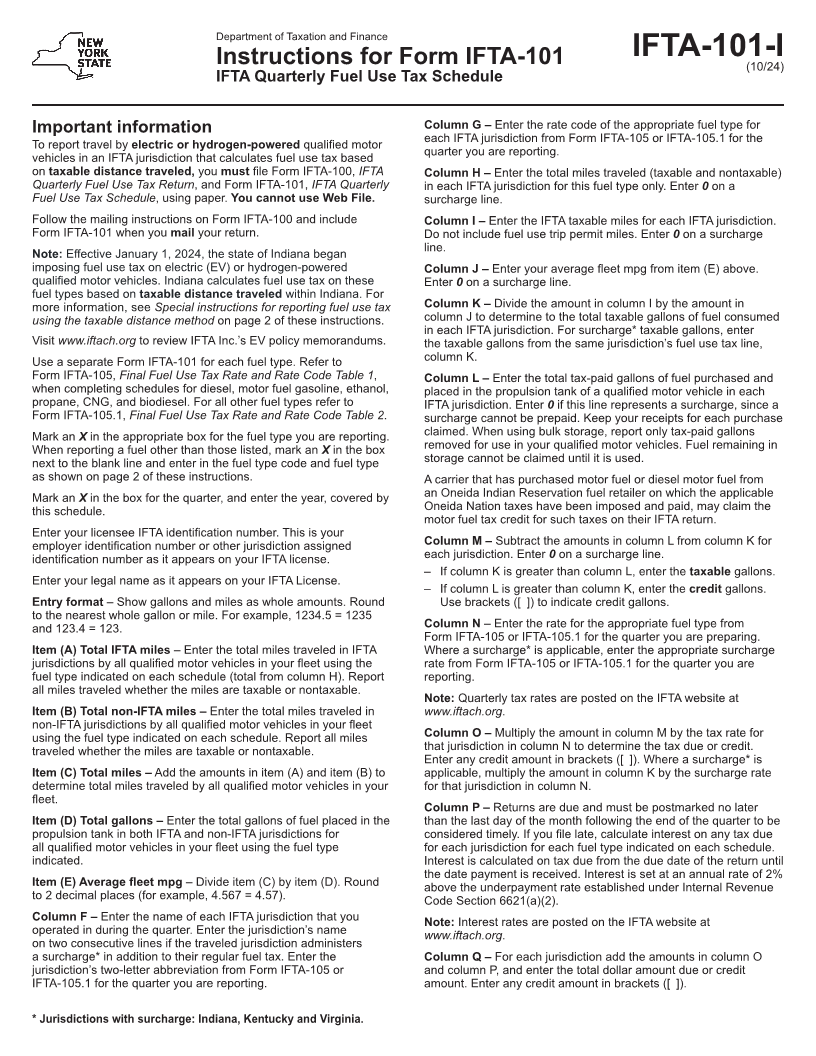

Enlarge image

Department of Taxation and Finance

Instructions for Form IFTA-101 IFTA-101-I(10/24)

IFTA Quarterly Fuel Use Tax Schedule

Important information Column G – Enter the rate code of the appropriate fuel type for

To report travel by electric or hydrogen-powered qualified motor each IFTA jurisdiction from Form IFTA-105 or IFTA-105.1 for the

vehicles in an IFTA jurisdiction that calculates fuel use tax based quarter you are reporting.

on taxable distance traveled, you must file Form IFTA-100, IFTA Column H – Enter the total miles traveled (taxable and nontaxable)

Quarterly Fuel Use Tax Return, and Form IFTA-101, IFTA Quarterly in each IFTA jurisdiction for this fuel type only. Enter 0 on a

Fuel Use Tax Schedule, using paper. You cannot use Web File. surcharge line.

Follow the mailing instructions on Form IFTA-100 and include Column I – Enter the IFTA taxable miles for each IFTA jurisdiction.

Form IFTA-101 when you mail your return. Do not include fuel use trip permit miles. Enter on a surcharge0

Note: Effective January 1, 2024, the state of Indiana began line.

imposing fuel use tax on electric (EV) or hydrogen-powered Column J – Enter your average fleet mpg from item (E) above.

qualified motor vehicles. Indiana calculates fuel use tax on these Enter 0 on a surcharge line.

fuel types based on taxable distance traveled within Indiana. For

more information, see Special instructions for reporting fuel use tax Column K – Divide the amount in column I by the amount in

using the taxable distance method on page 2 of these instructions. column J to determine to the total taxable gallons of fuel consumed

in each IFTA jurisdiction. For surcharge* taxable gallons, enter

Visit www.iftach.org to review IFTA Inc.’s EV policy memorandums. the taxable gallons from the same jurisdiction’s fuel use tax line,

Use a separate Form IFTA-101 for each fuel type. Refer to column K.

Form IFTA-105, Final Fuel Use Tax Rate and Rate Code Table 1, Column L – Enter the total tax-paid gallons of fuel purchased and

when completing schedules for diesel, motor fuel gasoline, ethanol, placed in the propulsion tank of a qualified motor vehicle in each

propane, CNG, and biodiesel. For all other fuel types refer to IFTA jurisdiction. Enter if this0line represents a surcharge, since a

Form IFTA-105.1, Final Fuel Use Tax Rate and Rate Code Table 2. surcharge cannot be prepaid. Keep your receipts for each purchase

Mark an X in the appropriate box for the fuel type you are reporting. claimed. When using bulk storage, report only tax-paid gallons

When reporting a fuel other than those listed, mark an X in the box removed for use in your qualified motor vehicles. Fuel remaining in

next to the blank line and enter in the fuel type code and fuel type storage cannot be claimed until it is used.

as shown on page 2 of these instructions. A carrier that has purchased motor fuel or diesel motor fuel from

Mark an X in the box for the quarter, and enter the year, covered by an Oneida Indian Reservation fuel retailer on which the applicable

this schedule. Oneida Nation taxes have been imposed and paid, may claim the

motor fuel tax credit for such taxes on their IFTA return.

Enter your licensee IFTA identification number. This is your

employer identification number or other jurisdiction assigned Column M – Subtract the amounts in column L from column K for

identification number as it appears on your IFTA license. each jurisdiction. Enter on0a surcharge line.

– If column K is greater than column L, enter the taxable gallons.

Enter your legal name as it appears on your IFTA License.

– If column L is greater than column K, enter the credit gallons.

Entry format – Show gallons and miles as whole amounts. Round Use brackets ([ ]) to indicate credit gallons.

to the nearest whole gallon or mile. For example, 1234.5 = 1235

and 123.4 = 123. Column N – Enter the rate for the appropriate fuel type from

Form IFTA-105 or IFTA-105.1 for the quarter you are preparing.

Item (A) Total IFTA miles – Enter the total miles traveled in IFTA Where a surcharge* is applicable, enter the appropriate surcharge

jurisdictions by all qualified motor vehicles in your fleet using the rate from Form IFTA-105 or IFTA-105.1 for the quarter you are

fuel type indicated on each schedule (total from column H). Report reporting.

all miles traveled whether the miles are taxable or nontaxable.

Note: Quarterly tax rates are posted on the IFTA website at

Item (B) Total non-IFTA miles – Enter the total miles traveled in www.iftach.org.

non-IFTA jurisdictions by all qualified motor vehicles in your fleet

using the fuel type indicated on each schedule. Report all miles Column O – Multiply the amount in column M by the tax rate for

traveled whether the miles are taxable or nontaxable. that jurisdiction in column N to determine the tax due or credit.

Enter any credit amount in brackets ([ ]). Where a surcharge* is

Item (C) Total miles – Add the amounts in item (A) and item (B) to applicable, multiply the amount in column K by the surcharge rate

determine total miles traveled by all qualified motor vehicles in your for that jurisdiction in column N.

fleet.

Column P – Returns are due and must be postmarked no later

Item (D) Total gallons – Enter the total gallons of fuel placed in the than the last day of the month following the end of the quarter to be

propulsion tank in both IFTA and non-IFTA jurisdictions for considered timely. If you file late, calculate interest on any tax due

all qualified motor vehicles in your fleet using the fuel type for each jurisdiction for each fuel type indicated on each schedule.

indicated. Interest is calculated on tax due from the due date of the return until

the date payment is received. Interest is set at an annual rate of 2%

Item (E) Average fleet mpg – Divide item (C) by item (D). Round above the underpayment rate established under Internal Revenue

to 2 decimal places (for example, 4.567 = 4.57). Code Section 6621(a)(2).

Column F – Enter the name of each IFTA jurisdiction that you Note: Interest rates are posted on the IFTA website at

operated in during the quarter. Enter the jurisdiction’s name www.iftach.org.

on two consecutive lines if the traveled jurisdiction administers

a surcharge* in addition to their regular fuel tax. Enter the Column Q – For each jurisdiction add the amounts in column O

jurisdiction’s two-letter abbreviation from Form IFTA-105 or and column P, and enter the total dollar amount due or credit

IFTA-105.1 for the quarter you are reporting. amount. Enter any credit amount in brackets ([ ]).

* Jurisdictions with surcharge: Indiana, Kentucky and Virginia.