Enlarge image

Department of Taxation and Finance

Instructions for Form DTF-17 DTF-17-I(6/24)

Application to Register for a Sales Tax Certificate of Authority

General information When to file and pay

Complete this application to obtain your sales tax Certificate of In general, new vendors must file quarterly returns. As part of your

Authority, which allows you to collect tax, make taxable sales in New application for a Certificate of Authority, you must indicate the date

York State (NYS), and issue or accept most sales tax exemption you plan on beginning business. You must file your first sales tax

certificates. return for the sales tax quarter that includes this date.

You must collect sales tax from your customers and remit it to the You must file this return even if you do not start your business as

Tax Department with your sales tax return; otherwise, you may be originally planned. You will automatically receive a bill if you miss the

responsible for paying these taxes yourself. required due date of your first return. The minimum penalty is $50.

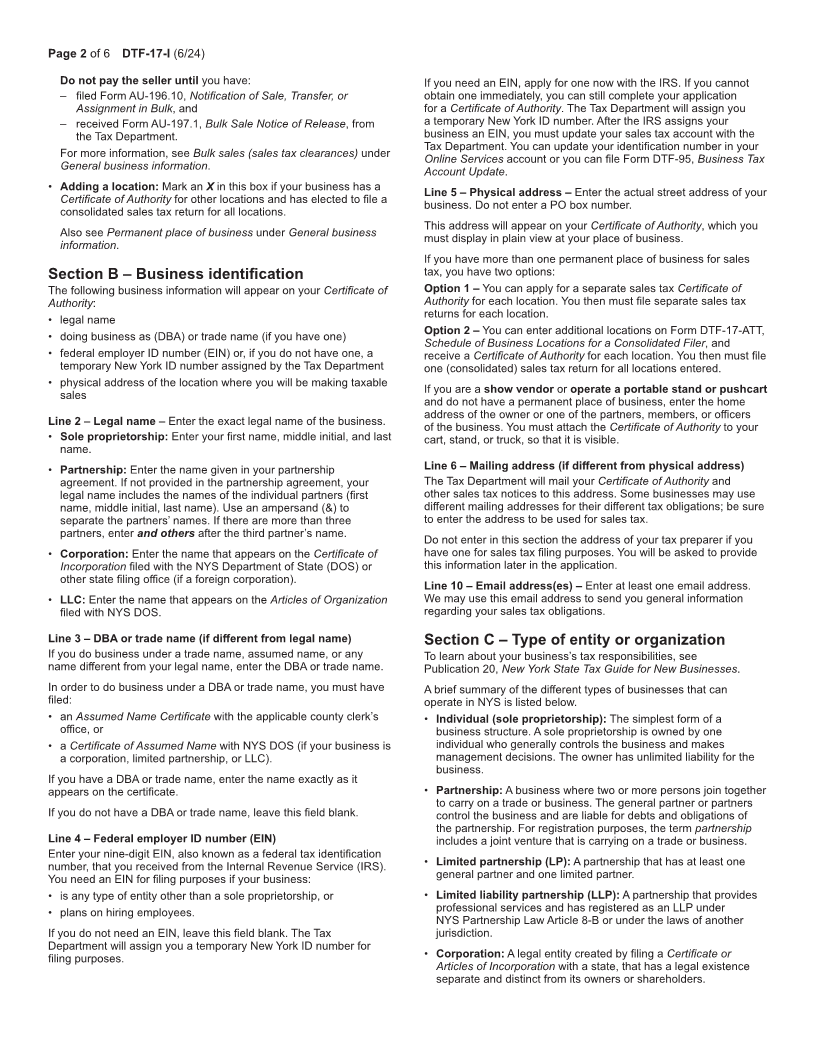

The Tax Department will process your application, and, if it is Sales tax quarter Due date

approved, mail your Certificate of Authority to you. Do not make any March 1 – May 31 June 20

taxable sales until you have received your Certificate of Authority. June 1 – August 31 September 20

September 1 – November 30 December 20

Do not complete this application if you are changing or updating December 1 – February 28/29 March 20

information such as the name, identification (ID) number, physical

address, responsible person information, or business activity. See If the due date falls on a Saturday, Sunday, or legal holiday, you

Tax Bulletin TB-ST-25, Amending or Surrendering a Certificate of must file your return by the first business day after the due date.

Authority. For example, if you indicate on your application that you plan

to begin business on July 15, you must file your first sales tax

Who must register return for the sales tax quarter of June 1 through August 31, by

You must register with the Tax Department and get a Certificate of September 20.

Authority if you plan to make any taxable sale in NYS, including:

You should file your sales tax returns online using the Tax

• the sale of tangible personal property or certain services Department’s Sales Tax Web File. Create an Online Services

• the sale of food or drink by a restaurant or caterer account for your business so you can:

• the charge for admission to a place of amusement • Web File sales tax returns

• the rental of a hotel room • make payments

If you are unsure whether you need to register, see Tax Bulletin • receive email alerts (such as filing reminders)

TB-ST-175, Do I Need to Register for Sales Tax? • view and pay tax bills

See Tax Bulletin TB-ST-275, Filing Requirements for Sales and Use

When to register Tax Returns.

You must apply for a Certificate of Authority at least 20 days before

you make any taxable sale or provide any taxable service in NYS, or Establish a segregated bank account for sales taxes

issue or accept exemption certificates.

As a registered sales tax vendor, NYS and your customers are

entrusting you to collect the right amount of tax and remit it timely

Once you are registered to NYS. You must not use sales tax money to pay for business

Display your Certificate of Authority or personal expenses under any circumstance. To avoid this, you

We will mail you a Certificate of Authority if we approve your should maintain a separate bank account for your sales tax money.

application. This will ensure that you are able to remit the sales tax when due.

• You must display your certificate in plain view at your place of To learn more about your sales tax responsibilities, see

business. Publication 750, A Guide to Sales Tax in New York State.

• If you have more than one location, display a certificate at each

location with the appropriate address corresponding to that

location. Line instructions

• If you don’t have a regular place of business, attach the certificate Section A – Starting your business or updating

to your cart, stand, or truck, so that it is visible. its status

• Starting a new business: Mark an Xin this box if your business

Keep required records will engage in activity in NYS that requires a Certificate of

As a registered sales tax vendor, you must keep accurate and Authority and has never previously obtained one.

complete records of your sales and purchases. You will need to

provide these records to the Tax Department if your sales tax returns • Change in organization: Mark an Xin this box if your business

are selected for audit. If your records are considered inadequate, is changing its organization type in NYS, such as changing from

you will be subject to: a sole proprietorship to a corporation, and has a Certificate of

Authority. You must enter the effective date of the change in

• an estimated audit methodology to determine any additional taxes organization structure in the field provided.

due;

• interest and penalties on additional tax due; and • Restarting prior business: Mark an Xin this box if your business

was previously registered to collect sales tax but its Certificate of

• possible criminal penalties for willfully failing to maintain proper Authority expired or was surrendered, revoked, or suspended.

records.

•

To learn more about your recordkeeping responsibilities, see Tax Purchasing existing business: Mark an Xin this box if your

business plans on acquiring a business, or any of its assets, that

Bulletin TB-ST-770, Recordkeeping Requirements for Sales Tax is required to be registered to collect sales tax.

Vendors. Also see Tax Bulletin TB-ST-805, Sales and Use Tax

Penalties.