Enlarge image

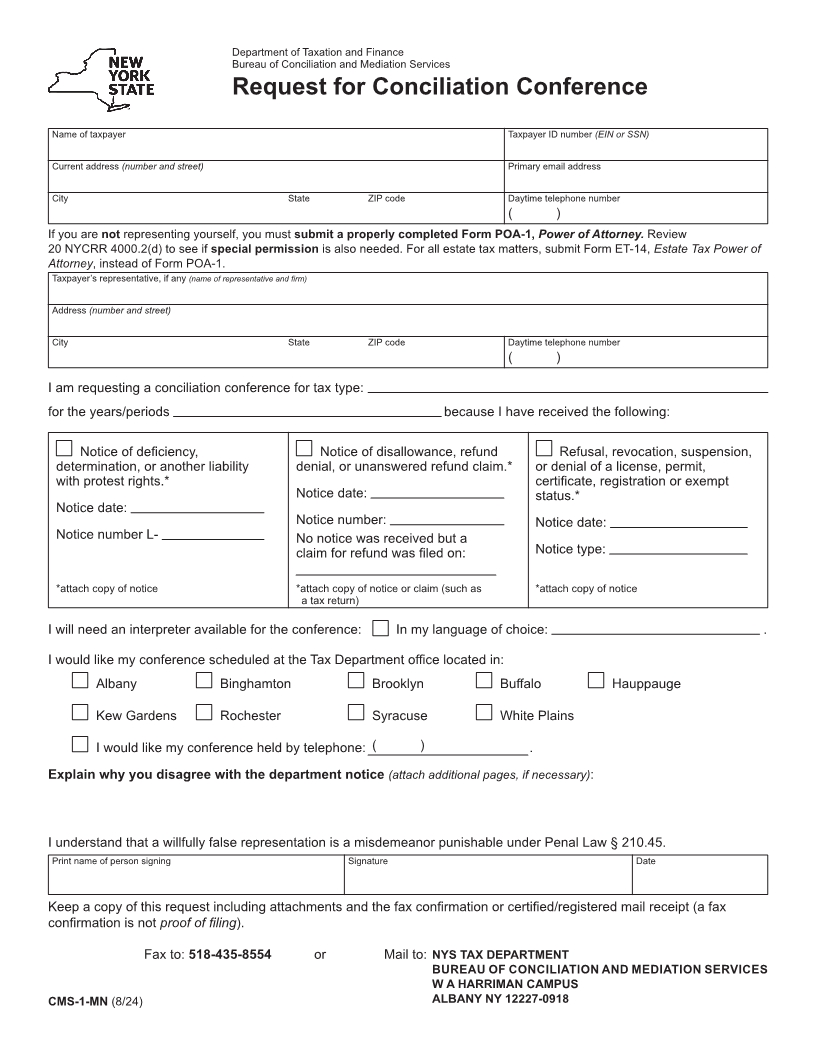

Department of Taxation and Finance

Bureau of Conciliation and Mediation Services

Request for Conciliation Conference

Name of taxpayer Taxpayer ID number (EIN or SSN)

Current address (number and street) Primary email address

City State ZIP code Daytime telephone number

( )

If you are not representing yourself, you must submit a properly completed Form POA-1, Power of Attorney. Review

20 NYCRR 4000.2(d) to see if special permission is also needed. For all estate tax matters, submit Form ET-14, Estate Tax Power of

Attorney, instead of Form POA-1.

Taxpayer’s representative, if any (name of representative and firm)

Address (number and street)

City State ZIP code Daytime telephone number

( )

I am requesting a conciliation conference for tax type:

for the years/periods because I have received the following:

Notice of deficiency, Notice of disallowance, refund Refusal, revocation, suspension,

determination, or another liability denial, or unanswered refund claim.* or denial of a license, permit,

with protest rights.* certificate, registration or exempt

Notice date: status.*

Notice date:

Notice number: Notice date:

Notice number L- No notice was received but a

claim for refund was filed on: Notice type:

*attach copy of notice *attach copy of notice or claim (such as *attach copy of notice

a tax return)

I will need an interpreter available for the conference: In my language of choice: .

I would like my conference scheduled at the Tax Department office located in:

Albany Binghamton Brooklyn Buffalo Hauppauge

Kew Gardens Rochester Syracuse White Plains

I would like my conference held by telephone: ( ) .

Explain why you disagree with the department notice (attach additional pages, if necessary):

I understand that a willfully false representation is a misdemeanor punishable under Penal Law § 210.45.

Print name of person signing Signature Date

Keep a copy of this request including attachments and the fax confirmation or certified/registered mail receipt (a fax

confirmation is not proof of filing).

Fax to: 518-435-8554 or Mail to: NYS TAX DEPARTMENT

BUREAU OF CONCILIATION AND MEDIATION SERVICES

W A HARRIMAN CAMPUS

CMS-1-MN (8/24) ALBANY NY 12227-0918