Enlarge image

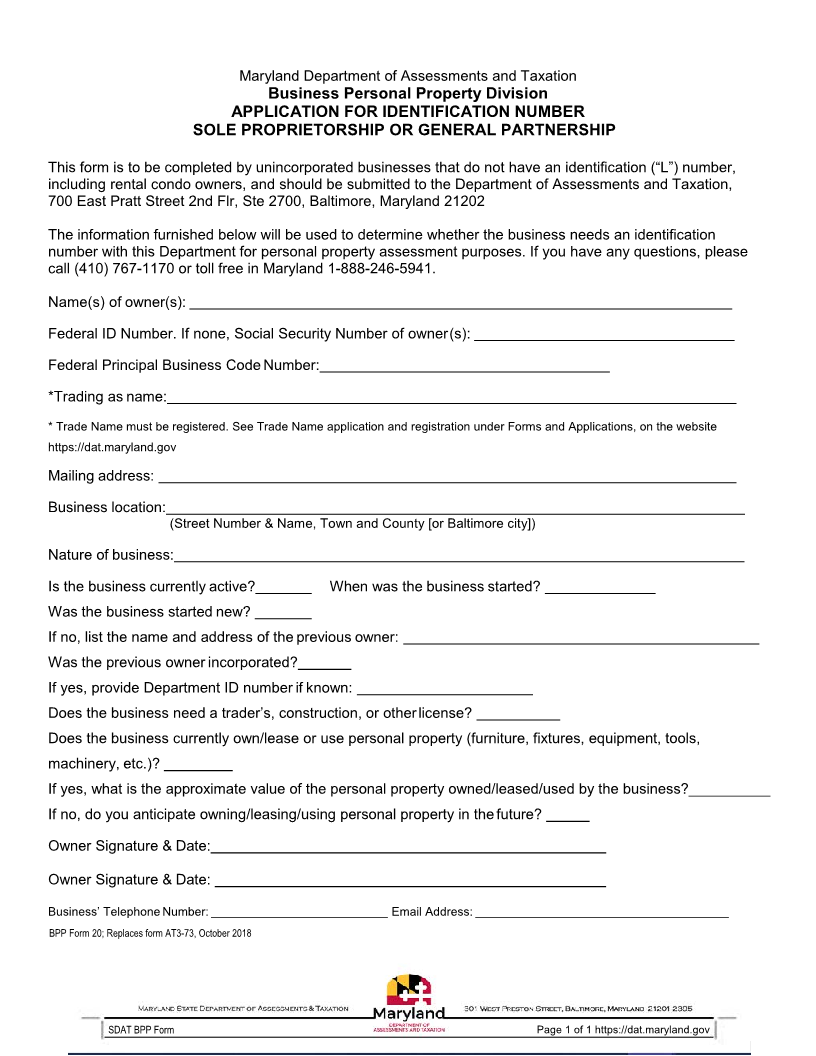

Maryland Department of Assessments and Taxation

Business Personal Property Division

APPLICATION FOR IDENTIFICATION NUMBER

SOLE PROPRIETORSHIP OR GENERAL PARTNERSHIP

This form is to be completed by unincorporated businesses that do not have an identification (“L”) number,

including rental condo owners, and should be submitted to the Department of Assessments and Taxation,

700 East Pratt Street 2nd Flr, Ste 2700, Baltimore, Maryland 21202

The information furnished below will be used to determine whether the business needs an identification

number with this Department for personal property assessment purposes. If you have any questions, please

call (410) 767-1170 or toll free in Maryland 1-888-246-5941.

Name(s) of owner(s):

Federal ID Number. If none, Social Security Number of owner(s):

Federal Principal Business Code Number:

*Trading as name:

* Trade Name must be registered. See Trade Name application and registration under Forms and Applications, on the website

https://dat.maryland.gov

Mailing address:

Business location:

(Street Number & Name, Town and County [or Baltimore city])

Nature of business:

Is the business currently active? When was the business started?

Was the business started new?

If no, list the name and address of the previous owner:

Was the previous owner incorporated?

If yes, provide Department ID number if known:

Does the business need a trader’s, construction, or other license?

Does the business currently own/lease or use personal property (furniture, fixtures, equipment, tools,

machinery, etc.)?

If yes, what is the approximate value of the personal property owned/leased/used by the business?__________

If no, do you anticipate owning/leasing/using personal property in the future?

Owner Signature & Date:

Owner Signature & Date:

Business’ Telephone Number: Email Address:

BPP Form 20; Replaces form AT3-73, October 2018

SDAT BPP Form Page 1 of 1 https://dat.maryland.gov