Enlarge image

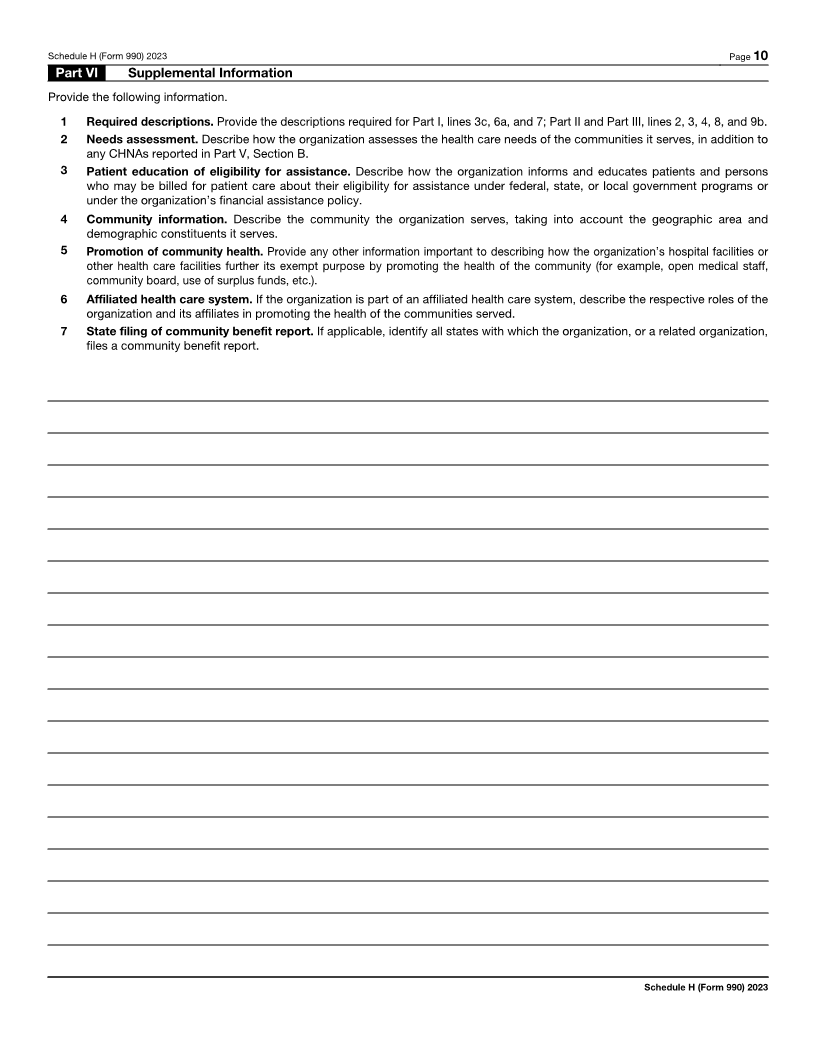

SCHEDULE H OMB No. 1545-0047

(Form 990) Hospitals

Complete if the organization answered “Yes” on Form 990, Part IV, question 20a. 23

20

Attach to Form 990. Open to Public

Internal Revenue Service

Department of the Treasury Go to www.irs.gov/Form990 for instructions and the latest information. Inspection

Name of the organization Employer identification number

Part I Financial Assistance and Certain Other Community Benefits at Cost

Yes No

1a Did the organization have a financial assistance policy during the tax year? If “No,” skip to question 6a . . 1a

b If “Yes,” was it a written policy? . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b

2 If the organization had multiple hospital facilities, indicate which of the following best describes application of

the financial assistance policy to its various hospital facilities during the tax year:

Applied uniformly to all hospital facilities Applied uniformly to most hospital facilities

Generally tailored to individual hospital facilities

3 Answer the following based on the financial assistance eligibility criteria that applied to the largest number of

the organization’s patients during the tax year.

a Did the organization use Federal Poverty Guidelines (FPG) as a factor in determining eligibility for providing

free care? If “Yes,” indicate which of the following was the FPG family income limit for eligibility for free care: 3a

100% 150% 200% Other %

b Did the organization use FPG as a factor in determining eligibility for providing discounted care? If “Yes,”

indicate which of the following was the family income limit for eligibility for discounted care: . . . . . 3b

200% 250% 300% 350% 400% Other %

c If the organization used factors other than FPG in determining eligibility, describe in Part VI the criteria used

for determining eligibility for free or discounted care. Include in the description whether the organization used

an asset test or other threshold, regardless of income, as a factor in determining eligibility for free or

discounted care.

4 Did the organization’s financial assistance policy that applied to the largest number of its patients during the

tax year provide for free or discounted care to the “medically indigent”? . . . . . . . . . . . . 4

5a Did the organization budget amounts for free or discounted care provided under its financial assistance policy during the tax year? 5a

b If “Yes,” did the organization’s financial assistance expenses exceed the budgeted amount? . . . . . 5b

c If “Yes” to line 5b, as a result of budget considerations, was the organization unable to provide free or

discounted care to a patient who was eligible for free or discounted care? . . . . . . . . . . . 5c

6a Did the organization prepare a community benefit report during the tax year? . . . . . . . . . . 6a

b If “Yes,” did the organization make it available to the public? . . . . . . . . . . . . . . . . 6b

Complete the following table using the worksheets provided in the Schedule H instructions. Do not submit

these worksheets with the Schedule H.

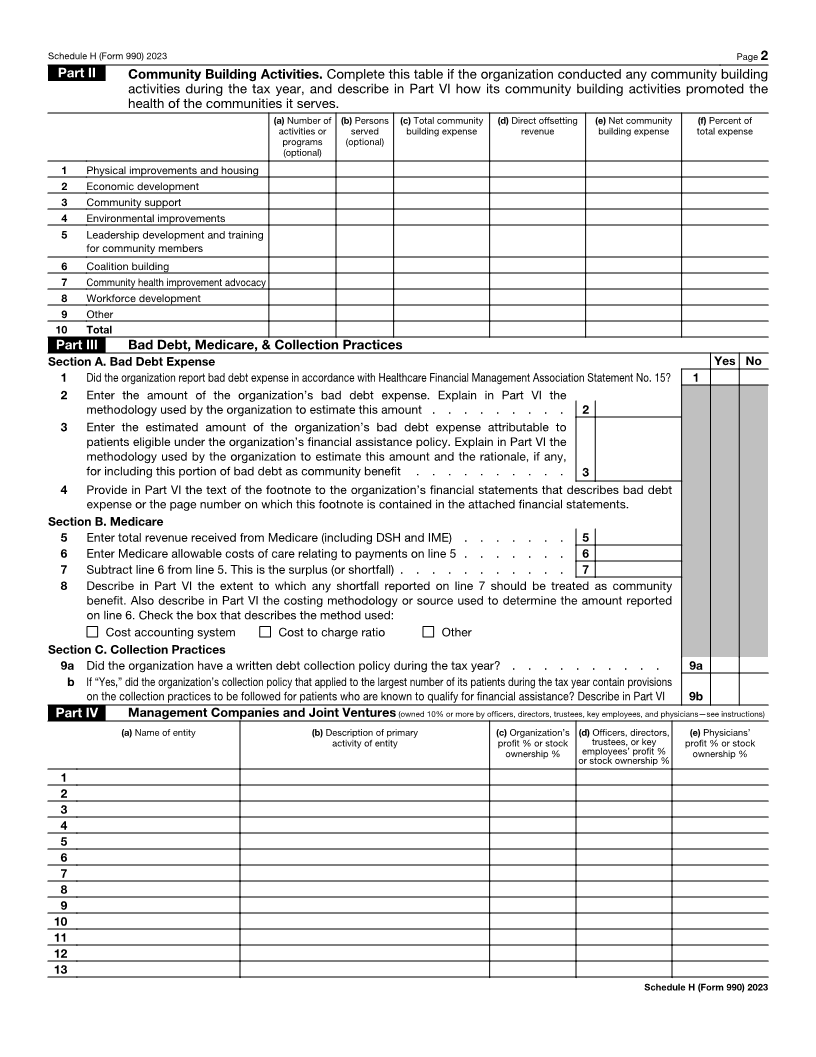

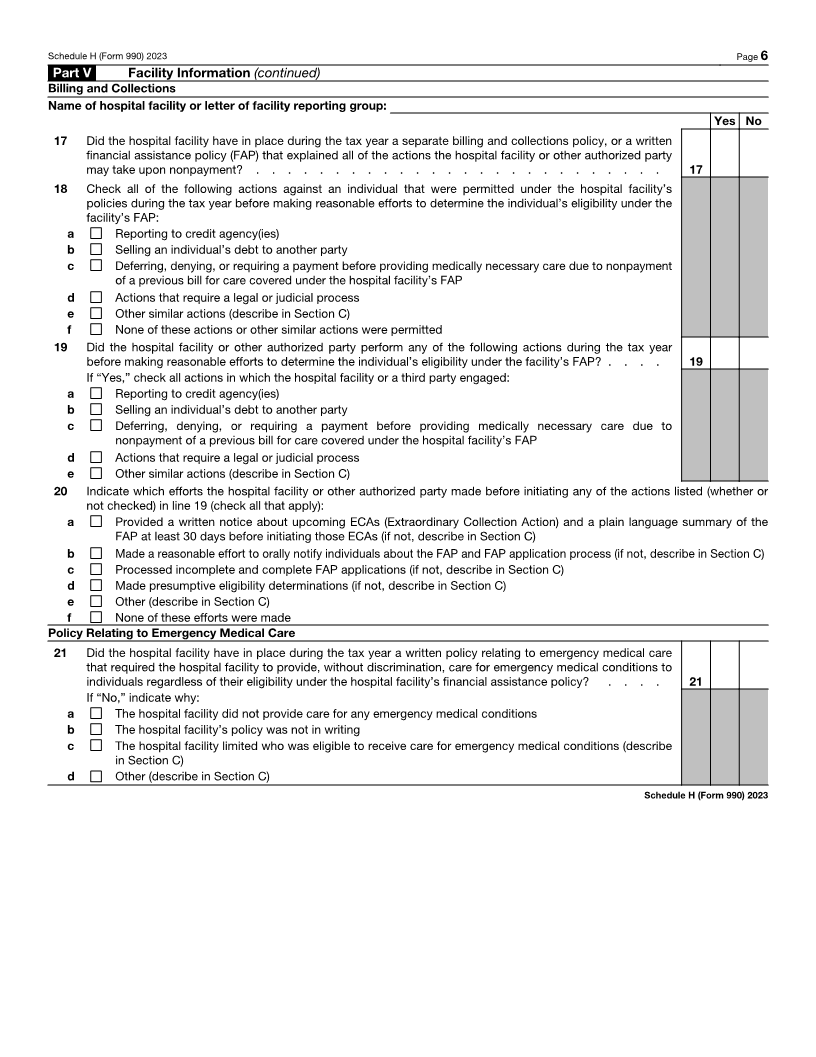

7 Financial Assistance and Certain Other Community Benefits at Cost

Financial Assistance and (a) Number of (b) Persons (c) Total community (d) Direct offsetting (e) Net community (f) Percent

activities or served benefit expense revenue benefit expense of total

Means-Tested Government Programsprograms (optional) (optional) expense

a Financial Assistance at cost (from

Worksheet 1) . . . . . .

b Medicaid (from Worksheet 3, column a)

c Costs of other means-tested

government programs (from

Worksheet 3, column b) . . .

d Total. Financial Assistance and

Means-Tested Government Programs

Other Benefits

e Community health improvement

services and community benefit

operations (from Worksheet 4) . .

f Health professions education

(from Worksheet 5) . . . .

g Subsidized health services (from

Worksheet 6) . . . . . .

h Research (from Worksheet 7) .

i Cash and in-kind contributions

for community benefit (from

Worksheet 8) . . . . . .

j Total. Other Benefits . . . .

k Total. Add lines 7d and 7j . .

For Paperwork Reduction Act Notice, see the Instructions for Form 990. Cat. No. 50192T Schedule H (Form 990) 2023