Enlarge image

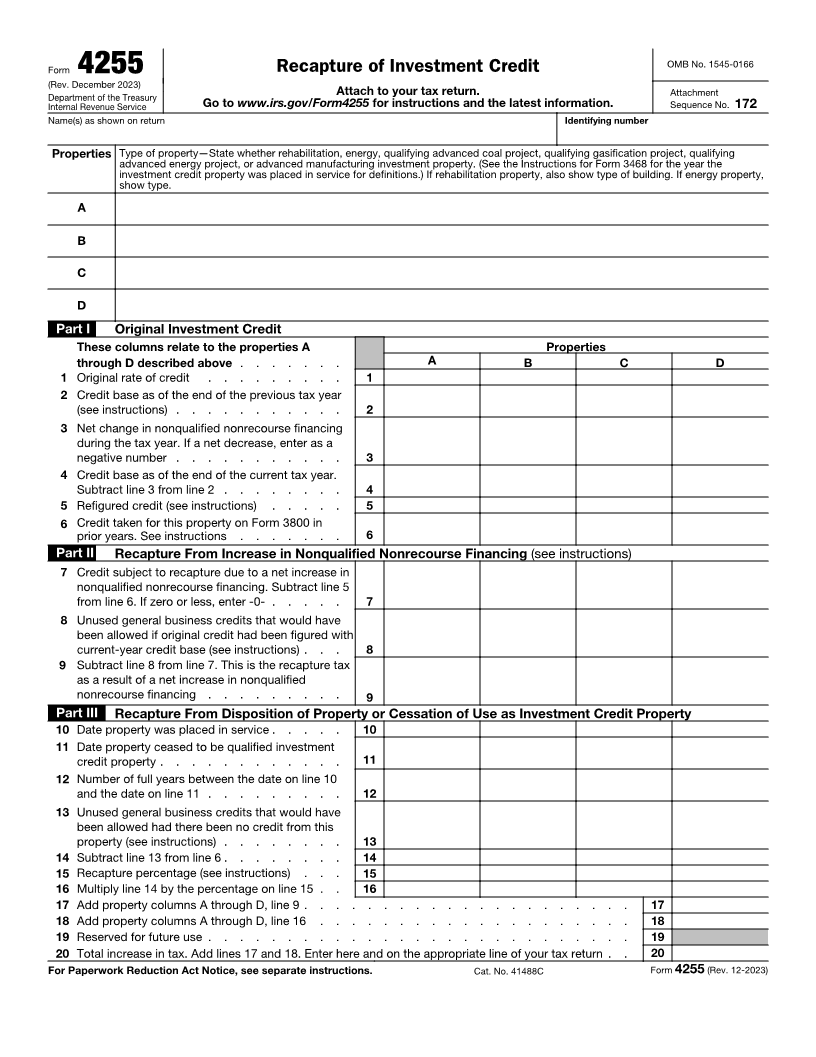

OMB No. 1545-0166

Form 4255 Recapture of Investment Credit

(Rev. December 2023)

Department of the Treasury Attach to your tax return. Attachment

Internal Revenue Service Go to www.irs.gov/Form4255 for instructions and the latest information. Sequence No. 172

Name(s) as shown on return Identifying number

Properties Type of property—State whether rehabilitation, energy, qualifying advanced coal project, qualifying gasification project, qualifying

advanced energy project, or advanced manufacturing investment property. (See the Instructions for Form 3468 for the year the

investment credit property was placed in service for definitions.) If rehabilitation property, also show type of building. If energy property,

show type.

A

B

C

D

Part I Original Investment Credit

These columns relate to the properties A Properties

through D described above . . . . . . . A B C D

1 Original rate of credit . . . . . . . . . 1

2 Credit base as of the end of the previous tax year

(see instructions) . . . . . . . . . . . 2

3 Net change in nonqualified nonrecourse financing

during the tax year. If a net decrease, enter as a

negative number . . . . . . . . . . . 3

4 Credit base as of the end of the current tax year.

Subtract line 3 from line 2 . . . . . . . . 4

5 Refigured credit (see instructions) . . . . . 5

6 Credit taken for this property on Form 3800 in

prior years. See instructions . . . . . . . 6

Part II Recapture From Increase in Nonqualified Nonrecourse Financing (see instructions)

7 Credit subject to recapture due to a net increase in

nonqualified nonrecourse financing. Subtract line 5

from line 6. If zero or less, enter -0- . . . . . 7

8 Unused general business credits that would have

been allowed if original credit had been figured with

current-year credit base (see instructions) . . . 8

9 Subtract line 8 from line 7. This is the recapture tax

as a result of a net increase in nonqualified

nonrecourse financing . . . . . . . . . 9

Part IIIRecapture From Disposition of Property or Cessation of Use as Investment Credit Property

10 Date property was placed in service . . . . . 10

11 Date property ceased to be qualified investment

credit property . . . . . . . . . . . . 11

12 Number of full years between the date on line 10

and the date on line 11 . . . . . . . . . 12

13 Unused general business credits that would have

been allowed had there been no credit from this

property (see instructions) . . . . . . . . 13

14 Subtract line 13 from line 6 . . . . . . . . 14

15 Recapture percentage (see instructions) . . . 15

16 Multiply line 14 by the percentage on line 15 . . 16

17 Add property columns A through D, line 9 . . . . . . . . . . . . . . . . . . . . . 17

18 Add property columns A through D, line 16 . . . . . . . . . . . . . . . . . . . . 18

19 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Total increase in tax. Add lines 17 and 18. Enter here and on the appropriate line of your tax return . . 20

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 41488C Form 4255 (Rev. 12-2023)