Enlarge image

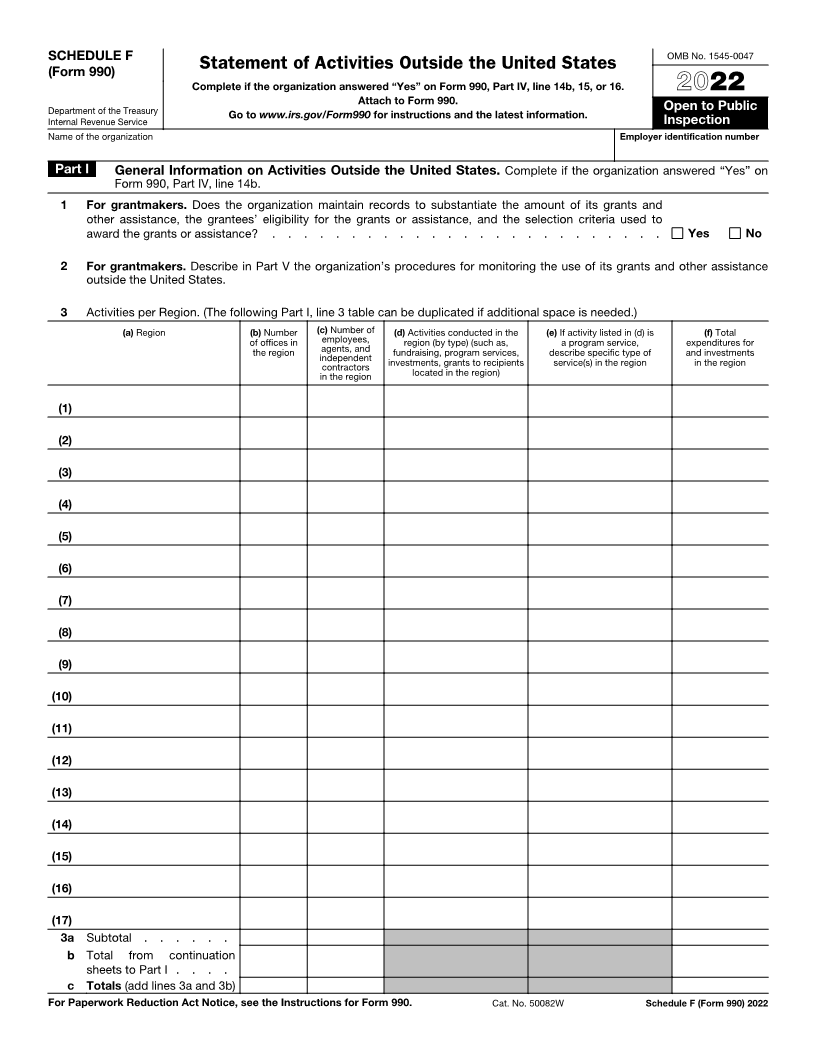

SCHEDULE F OMB No. 1545-0047

(Form 990) Statement of Activities Outside the United States

Complete if the organization answered “Yes” on Form 990, Part IV, line 14b, 15, or 16. 2022

Attach to Form 990. Open to Public

Department of the Treasury Go to www.irs.gov/Form990 for instructions and the latest information. Inspection

Internal Revenue Service

Name of the organization Employer identification number

Part I General Information on Activities Outside the United States. Complete if the organization answered “Yes” on

Form 990, Part IV, line 14b.

1 For grantmakers. Does the organization maintain records to substantiate the amount of its grants and

other assistance, the grantees’ eligibility for the grants or assistance, and the selection criteria used to

award the grants or assistance? . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

2 For grantmakers. Describe in Part V the organization’s procedures for monitoring the use of its grants and other assistance

outside the United States.

3 Activities per Region. (The following Part I, line 3 table can be duplicated if additional space is needed.)

(a) Region (b) Number (c) Number of (d) Activities conducted in the (e) If activity listed in (d) is (f) Total

of offices in employees, region (by type) (such as, a program service, expenditures for

the region agents, and fundraising, program services, describe specific type of and investments

independent investments, grants to recipients service(s) in the region in the region

contractors located in the region)

in the region

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

(12)

(13)

(14)

(15)

(16)

(17)

3 a Subtotal . . . . . .

b Total from continuation

sheets to Part I . . . .

c Totals (add lines 3a and 3b)

For Paperwork Reduction Act Notice, see the Instructions for Form 990. Cat. No. 50082W Schedule F (Form 990) 2022