- 3 -

Enlarge image

|

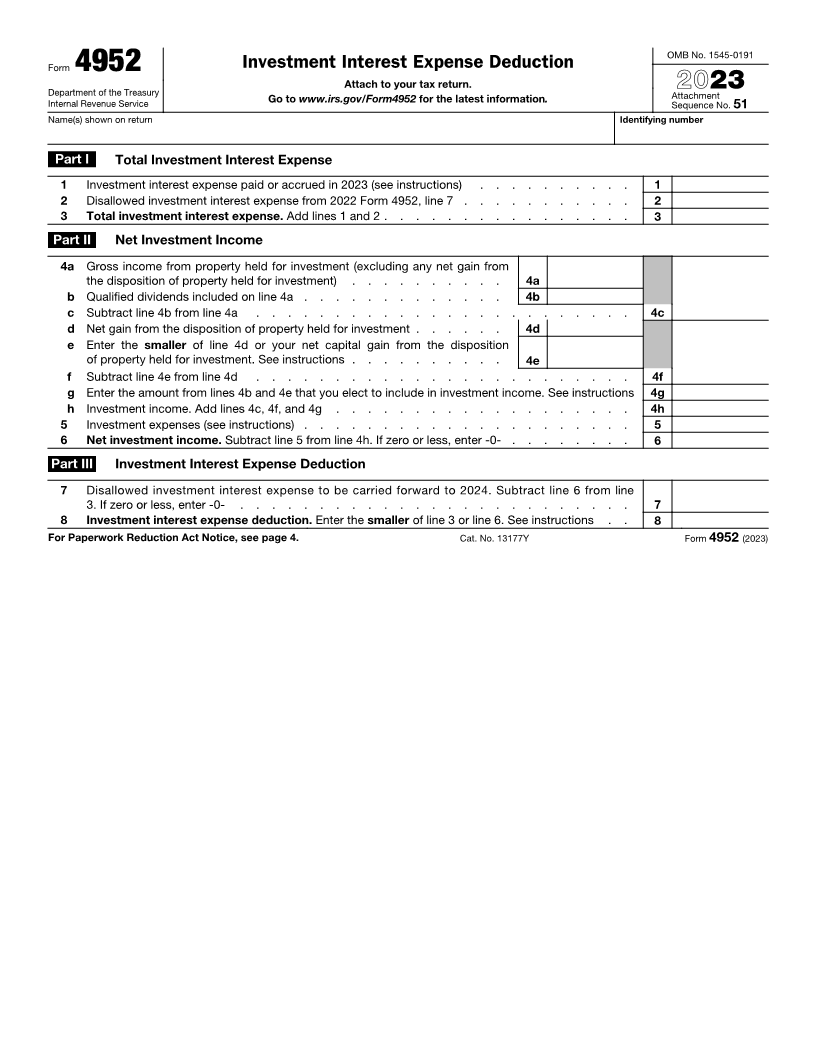

Form 4952 (2023) Page 3

Section references are to the Internal Revenue Code unless otherwise Exception. A working interest in an oil or gas property that you held

noted. directly or through an entity that didn’t limit your liability is property held

for investment, but only if you didn’t materially participate in the activity.

Future Developments

For the latest information about developments related to Form 4952 and Part II—Net Investment Income

its instructions, such as legislation enacted after they were published, Line 4a

go to www.irs.gov/Form4952. Gross income from property held for investment includes income,

unless derived in the ordinary course of a trade or business, from

General Instructions interest, ordinary dividends (except Alaska Permanent Fund dividends),

Purpose of Form annuities, and royalties. Include investment income reported to you on

Use Form 4952 to figure the amount of investment interest expense you Schedule K-1 from a partnership or an S corporation. Also include net

can deduct for 2023 and the amount you can carry forward to future investment income from an estate or a trust.

years. Your investment interest expense deduction is limited to your net Also include on line 4a (or 4d, if applicable) net passive income from a

investment income. passive activity of a publicly traded partnership (as defined in section

For more information, see Pub. 550, Investment Income and 469(k)(2)). See Regulations sections 1.469-10 and 1.7704-1 (including

Expenses. the transition rule of section 1.7704-1(l)) for details.

Net income from certain passive activities, such as rental of

Who Must File substantially nondepreciable property, may have to be recharacterized

If you are an individual, estate, or a trust, you must file Form 4952 to and included on line 4a. For details, see Pub. 925, Passive Activity and

claim a deduction for your investment interest expense. At-Risk Rules, or Regulations section 1.469-2(f)(10).

Exception. You don’t have to file Form 4952 if all of the following apply. If you are filing Form 8814, Parents’ Election To Report Child’s

• Your investment income from interest and ordinary dividends minus Interest and Dividends, part or all of your child’s income may be

any qualified dividends is more than your investment interest expense. included on line 4a. See the instructions for Form 8814 and Pub. 550 for

• You don’t have any other deductible investment expenses. details.

• You don’t have any carryover of disallowed investment interest Don’t include on line 4a any net gain from the disposition of

expense from 2022. property held for investment. Instead, enter it on line 4d.

Allocation of Interest Expense ▲!

CAUTION

If you paid or accrued interest on a loan and used the loan proceeds for

more than one purpose, you may have to allocate the interest. This is Line 4b

necessary because different rules apply to investment interest, personal Enter the portion of ordinary dividends included on line 4a that are

interest, trade or business interest, home mortgage interest, and passive qualified dividends. For the definition of qualified dividends, see the

activity interest. See Temporary Regulations section 1.163-8T, instructions for Form 1040, line 3a (or Form 1041, line 2b).

Regulations section 1.163-15, and Notice 89-35, 1989-1 C.B. 675. Line 4d

Net gain from the disposition of property held for investment is the

Specific Instructions excess, if any, of your total gains over your total losses from the

Part I—Total Investment Interest Expense disposition of property held for investment. When figuring this amount,

include capital gain distributions from mutual funds and capital loss

Line 1 carryovers.

Enter the investment interest expense paid or accrued during the tax

year, regardless of when you incurred the indebtedness. Investment Line 4e

interest expense is interest paid or accrued on a loan or part of a loan Net capital gain from the disposition of property held for investment is

that is allocable to property held for investment (as defined later). the excess, if any, of your net long-term capital gain over your net short-

Include investment interest expense reported to you on Schedule K-1 term capital loss from the disposition of property held for investment.

from a partnership or an S corporation. Include amortization of bond Capital gain distributions from mutual funds are treated as long-term

premium on taxable bonds purchased after October 22, 1986, but capital gains.

before January 1, 1988, unless you elected to offset amortizable bond Note: If line 4e is more than zero and you enter an amount on line 4g,

premium against the interest payments on the bond. A taxable bond is a see the Note in the line 4g instructions, later.

bond on which the interest is includible in gross income. Line 4g

Investment interest expense doesn’t include any of the following. In general, qualified dividends and net capital gain from the disposition

• Personal interest under section 163(h), including qualified residence of property held for investment are excluded from investment income.

interest. But you can elect to include part or all of these amounts in investment

• Interest expense that is properly allocable to a passive activity. income.

Generally, a passive activity is any trade or business activity in which The qualified dividends and net capital gain that you elect to

you don’t materially participate and any rental activity. See the include in investment income on line 4g aren’t eligible to be

Instructions for Form 8582, Passive Activity Loss Limitations, for details. taxed at the qualified dividends or capital gains tax rates.

• Any interest expense that is capitalized, such as construction interest ▲!

CAUTION You should consider the tax effect of using the qualified

subject to section 263A. dividends and capital gains tax rates before making this

• Interest expense related to tax-exempt interest income under election. Once made, the election can be revoked only with IRS consent.

section 265. To make the election, enter on line 4g the amount you elect to include

• Interest expense, disallowed under section 264, on indebtedness with in investment income (don’t enter more than the sum of lines 4b and 4e).

respect to life insurance, endowment, or annuity contracts issued after Also enter this amount on whichever of the following applies.

June 8, 1997, even if the proceeds were used to purchase any property • The Schedule D Tax Worksheet, line 3.

held for investment. • Schedule D (Form 1041), line 25.

Property held for investment.Property held for investment includes • The Qualified Dividends Tax Worksheet, line 3, in the Instructions for

property that produces income, not derived in the ordinary course of a Form 1041.

trade or business, from interest, dividends, annuities, or royalties. It also If you file Form 1040 or 1040-SR and enter an amount on

includes property that produces gain or loss, not derived in the ordinary line 4g, use the Schedule D Tax Worksheet in the

course of a trade or business, from the disposition of property that TIP Instructions for Schedule D (Form 1040) to figure the amount

produces these types of income or is held for investment. However, it to enter on Form 1040 or 1040-SR, line 16. If you file Form

doesn’t include an interest in a passive activity. 1041 and enter amounts on lines 4e and 4g, use the Schedule D Tax

Worksheet in the Instructions for Schedule D (Form 1041) to figure the

amount to enter on Form 1041, Schedule G, line 1a.

|