Enlarge image

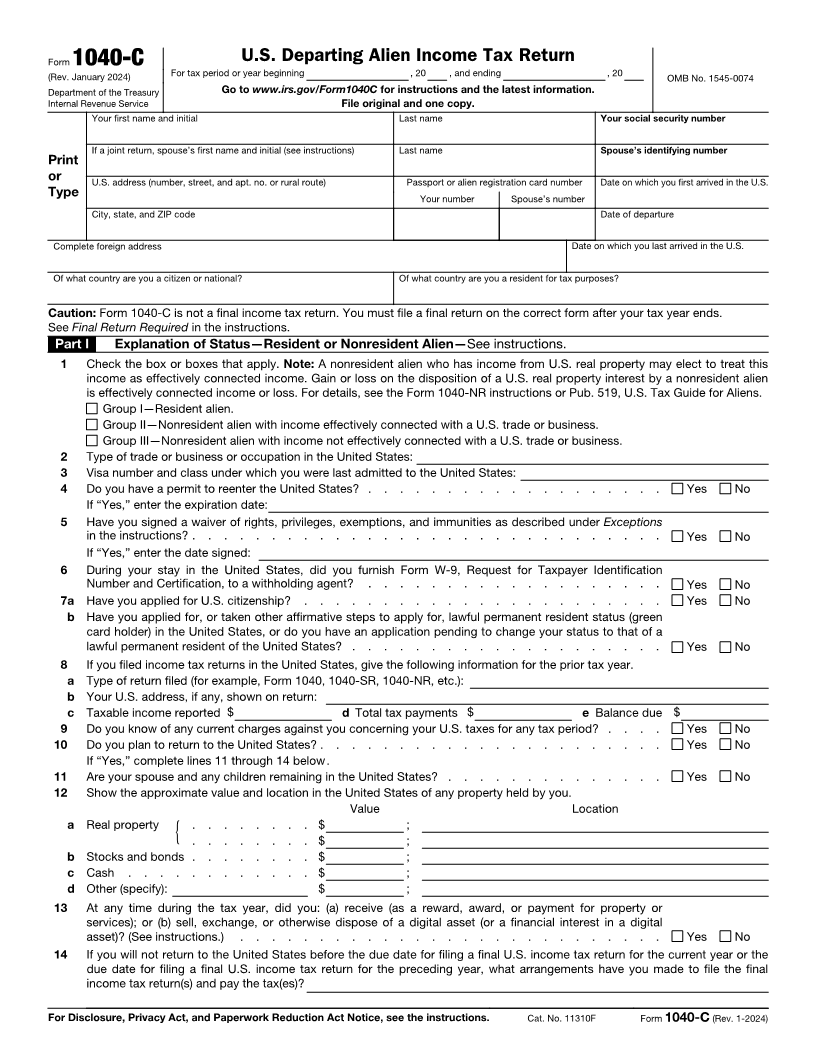

Form 1040-C U.S. Departing Alien Income Tax Return

(Rev. January 2024) For tax period or year beginning , 20 , and ending , 20 OMB No. 1545-0074

Department of the Treasury Go to www.irs.gov/Form1040C for instructions and the latest information.

Internal Revenue Service File original and one copy.

Your first name and initial Last name Your social security number

If a joint return, spouse’s first name and initial (see instructions) Last name Spouse’s identifying number

Print

or U.S. address (number, street, and apt. no. or rural route) Passport or alien registration card number Date on which you first arrived in the U.S.

Type Your number Spouse’s number

City, state, and ZIP code Date of departure

Complete foreign address Date on which you last arrived in the U.S.

Of what country are you a citizen or national? Of what country are you a resident for tax purposes?

Caution: Form 1040-C is not a final income tax return. You must file a final return on the correct form after your tax year ends.

See Final Return Required in the instructions.

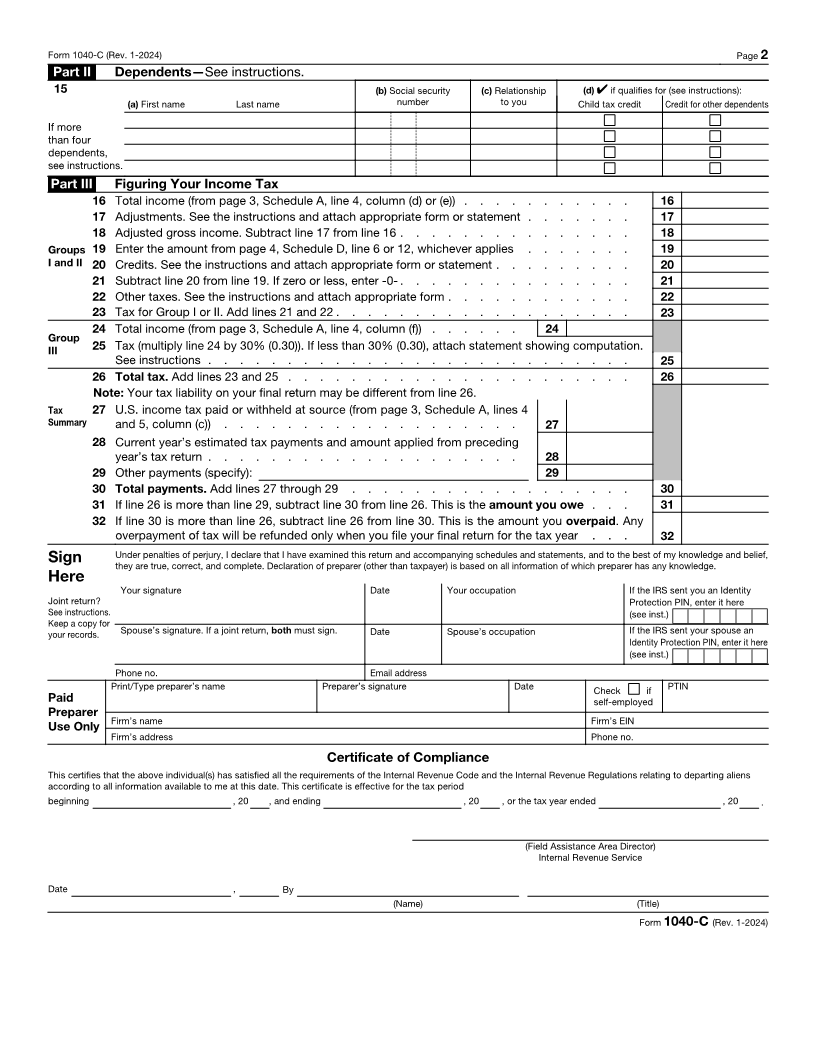

Part I Explanation of Status—Resident or Nonresident Alien—See instructions.

1 Check the box or boxes that apply. Note: A nonresident alien who has income from U.S. real property may elect to treat this

income as effectively connected income. Gain or loss on the disposition of a U.S. real property interest by a nonresident alien

is effectively connected income or loss. For details, see the Form 1040-NR instructions or Pub. 519, U.S. Tax Guide for Aliens.

Group I—Resident alien.

Group II—Nonresident alien with income effectively connected with a U.S. trade or business.

Group III—Nonresident alien with income not effectively connected with a U.S. trade or business.

2 Type of trade or business or occupation in the United States:

3 Visa number and class under which you were last admitted to the United States:

4 Do you have a permit to reenter the United States? . . . . . . . . . . . . . . . . . . . Yes No

If “Yes,” enter the expiration date:

5 Have you signed a waiver of rights, privileges, exemptions, and immunities as described under Exceptions

in the instructions? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

If “Yes,” enter the date signed:

6 During your stay in the United States, did you furnish Form W-9, Request for Taxpayer Identification

Number and Certification, to a withholding agent? . . . . . . . . . . . . . . . . . . . Yes No

7 a Have you applied for U.S. citizenship? . . . . . . . . . . . . . . . . . . . . . . . Yes No

b Have you applied for, or taken other affirmative steps to apply for, lawful permanent resident status (green

card holder) in the United States, or do you have an application pending to change your status to that of a

lawful permanent resident of the United States? . . . . . . . . . . . . . . . . . . . . Yes No

8 If you filed income tax returns in the United States, give the following information for the prior tax year.

a Type of return filed (for example, Form 1040, 1040-SR, 1040-NR, etc.):

b Your U.S. address, if any, shown on return:

c Taxable income reported $ d Total tax payments $ e Balance due $

9 Do you know of any current charges against you concerning your U.S. taxes for any tax period? . . . . Yes No

10 Do you plan to return to the United States? . . . . . . . . . . . . . . . . . . . . . . Yes No

If “Yes,” complete lines 11 through 14 below .

11 Are your spouse and any children remaining in the United States? . . . . . . . . . . . . . . Yes No

12 Show the approximate value and location in the United States of any property held by you.

Value Location

a Real property . . . . . . . . $ ;

{ . . . . . . . . $ ;

b Stocks and bonds . . . . . . . . $ ;

c Cash . . . . . . . . . . . . $ ;

d Other (specify): $ ;

13 At any time during the tax year, did you: (a) receive (as a reward, award, or payment for property or

services); or (b) sell, exchange, or otherwise dispose of a digital asset (or a financial interest in a digital

asset)? (See instructions.) . . . . . . . . . . . . . . . . . . . . . . . . . . . Yes No

14 If you will not return to the United States before the due date for filing a final U.S. income tax return for the current year or the

due date for filing a final U.S. income tax return for the preceding year, what arrangements have you made to file the final

income tax return(s) and pay the tax(es)?

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see the instructions. Cat. No. 11310F Form 1040-C (Rev. 1-2024)