Enlarge image

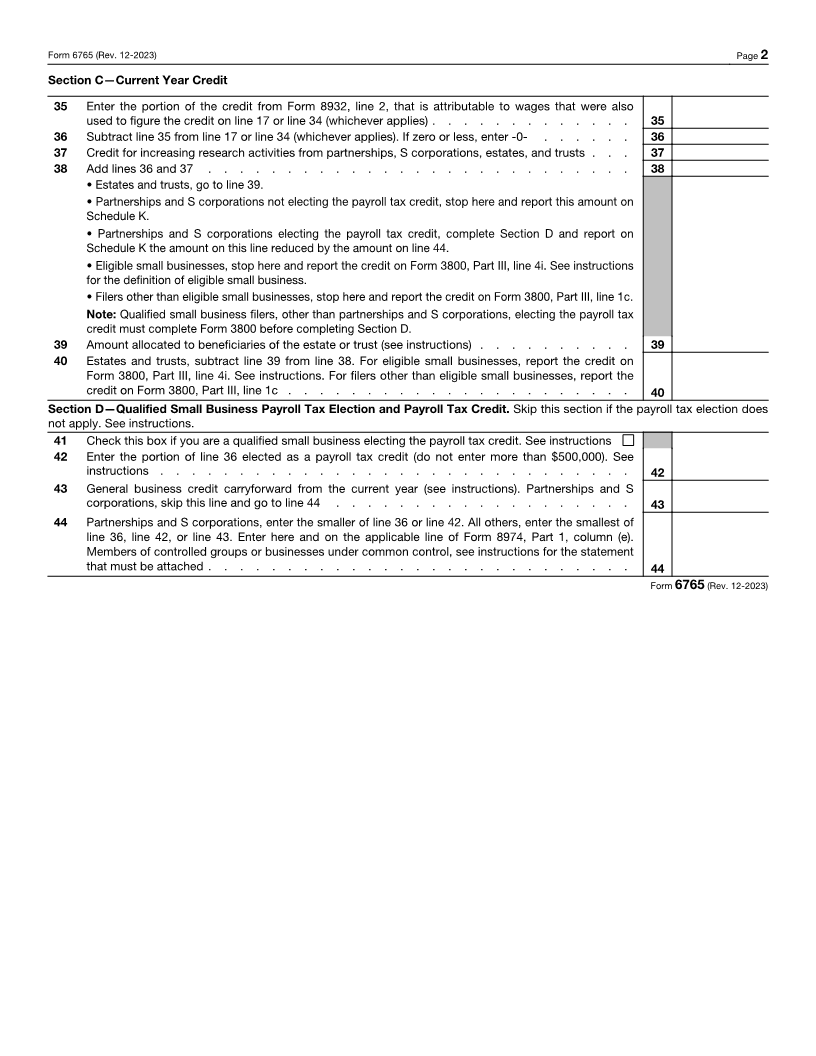

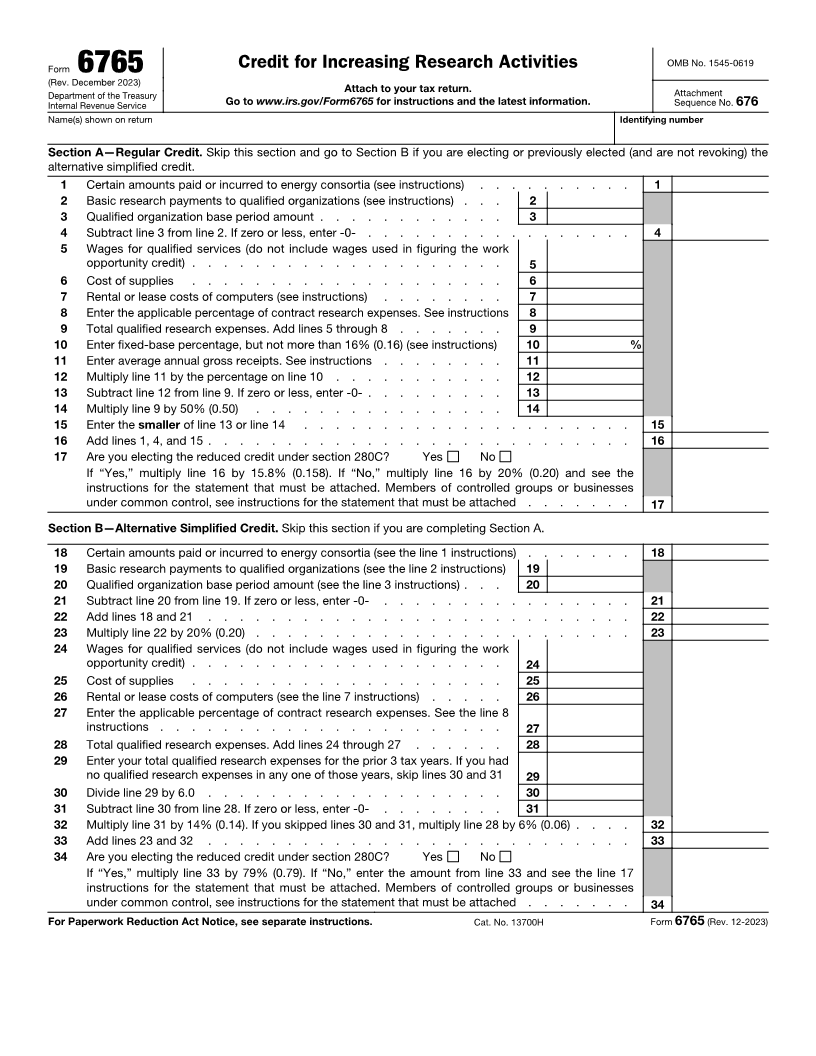

Credit for Increasing Research Activities OMB No. 1545-0619

Form 6765

(Rev. December 2023)

Department of the Treasury Attach to your tax return. Attachment

Internal Revenue Service Go to www.irs.gov/Form6765 for instructions and the latest information. Sequence No. 676

Name(s) shown on return Identifying number

Section A—Regular Credit. Skip this section and go to Section B if you are electing or previously elected (and are not revoking) the

alternative simplified credit.

1 Certain amounts paid or incurred to energy consortia (see instructions) . . . . . . . . . . 1

2 Basic research payments to qualified organizations (see instructions) . . . 2

3 Qualified organization base period amount . . . . . . . . . . . . 3

4 Subtract line 3 from line 2. If zero or less, enter -0- . . . . . . . . . . . . . . . . . 4

5 Wages for qualified services (do not include wages used in figuring the work

opportunity credit) . . . . . . . . . . . . . . . . . . . . 5

6 Cost of supplies . . . . . . . . . . . . . . . . . . . . 6

7 Rental or lease costs of computers (see instructions) . . . . . . . . 7

8 Enter the applicable percentage of contract research expenses. See instructions 8

9 Total qualified research expenses. Add lines 5 through 8 . . . . . . . 9

10 Enter fixed-base percentage, but not more than 16% (0.16) (see instructions) 10 %

11 Enter average annual gross receipts. See instructions . . . . . . . . 11

12 Multiply line 11 by the percentage on line 10 . . . . . . . . . . . 12

13 Subtract line 12 from line 9. If zero or less, enter -0- . . . . . . . . . 13

14 Multiply line 9 by 50% (0.50) . . . . . . . . . . . . . . . . 14

15 Enter the smaller of line 13 or line 14 . . . . . . . . . . . . . . . . . . . . . 15

16 Add lines 1, 4, and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Are you electing the reduced credit under section 280C? Yes No

If “Yes,” multiply line 16 by 15.8% (0.158). If “No,” multiply line 16 by 20% (0.20) and see the

instructions for the statement that must be attached. Members of controlled groups or businesses

under common control, see instructions for the statement that must be attached . . . . . . . 17

Section B—Alternative Simplified Credit. Skip this section if you are completing Section A.

18 Certain amounts paid or incurred to energy consortia (see the line 1 instructions) . . . . . . . 18

19 Basic research payments to qualified organizations (see the line 2 instructions) 19

20 Qualified organization base period amount (see the line 3 instructions) . . . 20

21 Subtract line 20 from line 19. If zero or less, enter -0- . . . . . . . . . . . . . . . . 21

22 Add lines 18 and 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

23 Multiply line 22 by 20% (0.20) . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Wages for qualified services (do not include wages used in figuring the work

opportunity credit) . . . . . . . . . . . . . . . . . . . . 24

25 Cost of supplies . . . . . . . . . . . . . . . . . . . . 25

26 Rental or lease costs of computers (see the line 7 instructions) . . . . . 26

27 Enter the applicable percentage of contract research expenses. See the line 8

instructions . . . . . . . . . . . . . . . . . . . . . . 27

28 Total qualified research expenses. Add lines 24 through 27 . . . . . . 28

29 Enter your total qualified research expenses for the prior 3 tax years. If you had

no qualified research expenses in any one of those years, skip lines 30 and 31 29

30 Divide line 29 by 6.0 . . . . . . . . . . . . . . . . . . . 30

31 Subtract line 30 from line 28. If zero or less, enter -0- . . . . . . . . 31

32 Multiply line 31 by 14% (0.14). If you skipped lines 30 and 31, multiply line 28 by 6% (0.06) . . . . 32

33 Add lines 23 and 32 . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

34 Are you electing the reduced credit under section 280C? Yes No

If “Yes,” multiply line 33 by 79% (0.79). If “No,” enter the amount from line 33 and see the line 17

instructions for the statement that must be attached. Members of controlled groups or businesses

under common control, see instructions for the statement that must be attached . . . . . . . 34

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 13700H Form 6765 (Rev. 12-2023)