Enlarge image

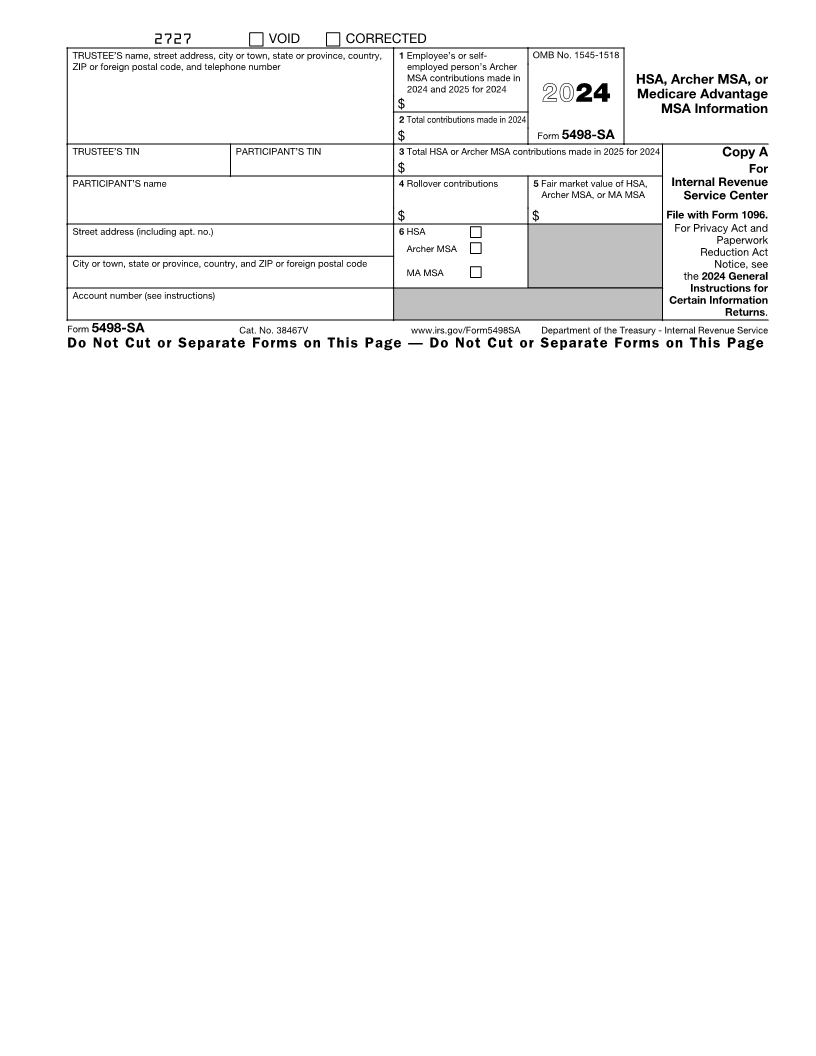

2727 VOID CORRECTED

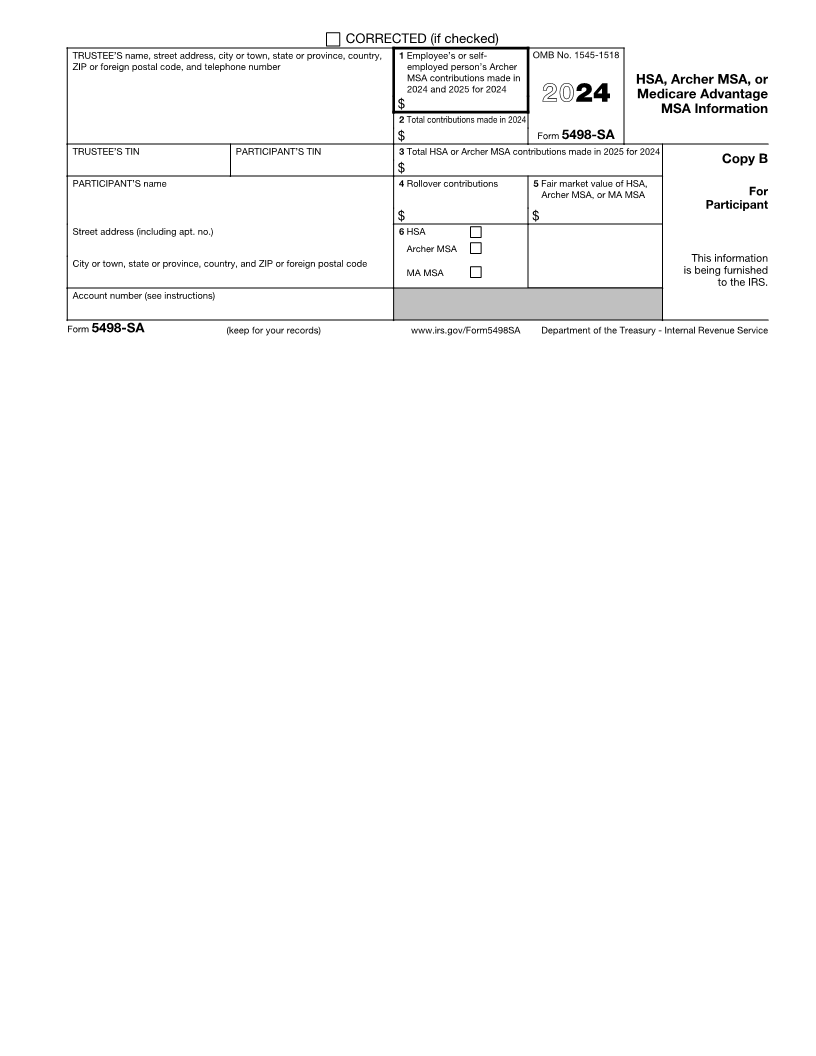

TRUSTEE’S name, street address, city or town, state or province, country, 1 Employee’s or self- OMB No. 1545-1518

ZIP or foreign postal code, and telephone number employed person’s Archer

MSA contributions made in HSA, Archer MSA, or

2024 and 2025 for 2024

Medicare Advantage

$ 2024 MSA Information

2 Total contributions made in 2024

$ Form 5498-SA

TRUSTEE’S TIN PARTICIPANT’S TIN 3 Total HSA or Archer MSA contributions made in 2025 for 2024 Copy A

$ For

PARTICIPANT’S name 4 Rollover contributions 5 Fair market value of HSA, Internal Revenue

Archer MSA, or MA MSA Service Center

$ $ File with Form 1096.

Street address (including apt. no.) 6 HSA For Privacy Act and

Paperwork

Archer MSA Reduction Act

City or town, state or province, country, and ZIP or foreign postal code Notice, see

MA MSA the 2024 General

Instructions for

Account number (see instructions) Certain Information

Returns.

Form 5498-SA Cat. No. 38467V www.irs.gov/Form5498SA Department of the Treasury - Internal Revenue Service

Do Not Cut or Separate Forms on This Page — Do Not Cut or Separate Forms on This Page