- 3 -

Enlarge image

|

Form 1095-A (2023) Page 2

If advance credit payments are made, the only individuals listed on

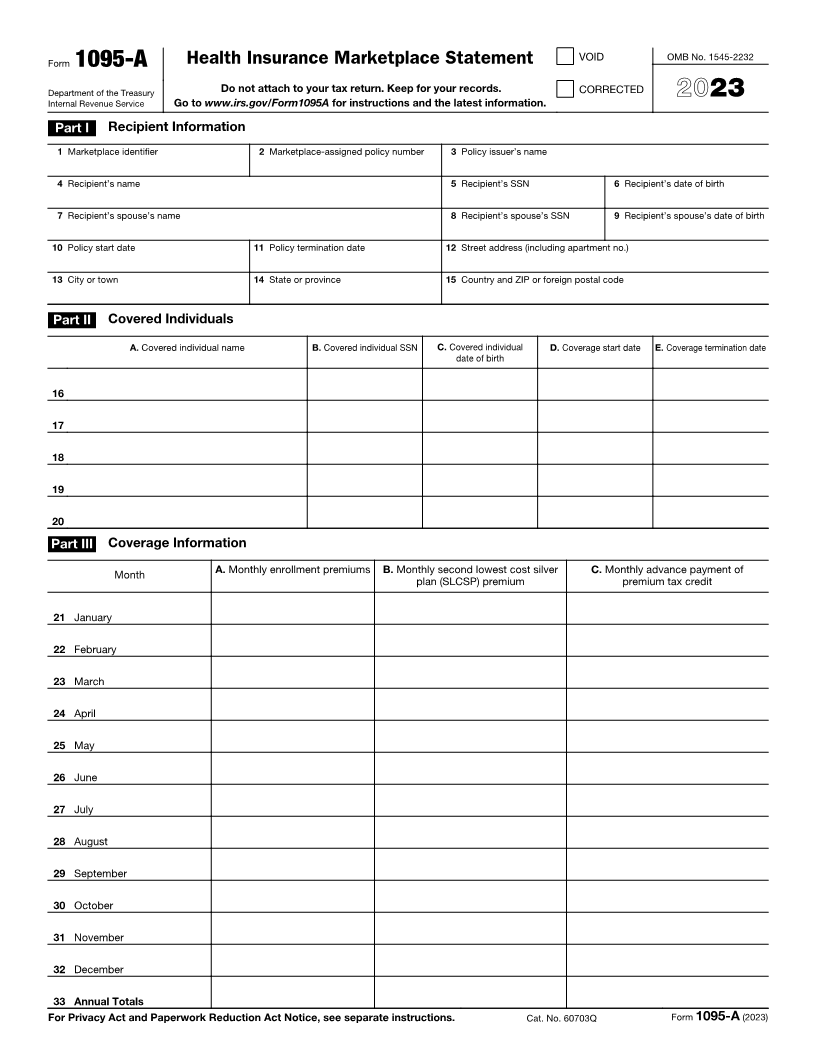

Instructions for Recipient Form 1095-A will be those whom you certified to the Marketplace would

You received this Form 1095-A because you or a family member be in your tax family for the year of coverage (yourself, spouse, and

enrolled in health insurance coverage through the Health Insurance dependents). If you certified to the Marketplace at enrollment that one or

Marketplace. This Form 1095-A provides information you need to more of the individuals who enrolled in the plan aren’t individuals who

complete Form 8962, Premium Tax Credit (PTC). You must complete would be in your tax family for the year of coverage, those individuals

Form 8962 and file it with your tax return (Form 1040, Form won’t be listed on your Form 1095-A. For example, if you indicated to

1040-SR, or Form 1040-NR) if any amount other than zero is shown the Marketplace at enrollment that an individual enrolling in the policy is

in Part III, column C, of this Form 1095-A (meaning that you your adult child who will not be your dependent for the year of coverage,

received premium assistance through advance payments of the that child will receive a separate Form 1095-A and won’t be listed in

premium tax credit (also called advance credit payments)) or if you Part II on your Form 1095-A.

want to take the premium tax credit. The filing requirement applies If advance credit payments are made and you certify that one or more

whether or not you’re otherwise required to file a tax return. If you are enrolled individuals aren’t individuals who would be in your tax family for

filing Form 8962, you cannot file Form 1040-NR-EZ, Form the year of coverage, your Form 1095-A will include coverage

1040-SS, or Form 1040-PR. The Marketplace has also reported the information in Part III that is applicable solely to the individuals listed on

information on this form to the IRS. If you or your family members your Form 1095-A, and separately issued Forms 1095-A will include

enrolled at the Marketplace in more than one qualified health plan coverage information, including dollar amounts, applicable to those

policy, you will receive a Form 1095-A for each policy. Check the individuals not in your tax family.

information on this form carefully. Please contact your Marketplace if

you have questions concerning its accuracy. If you or your family If advance credit payments weren’t made and you didn’t identify at

members were enrolled in a Marketplace catastrophic health plan or enrollment the individuals who would be in your tax family for the year of

separate dental policy, you aren’t entitled to take a premium tax credit coverage, Form 1095-A will list all enrolled individuals in Part II on your

for this coverage when you file your return, even if you received a Form Form 1095-A.

1095-A for this coverage. For additional information related to Form If there are more than five individuals covered by a policy, you will

1095-A, go to www.irs.gov/Affordable-Care-Act/Individuals-and- receive one or more additional Forms 1095-A that continue Part II.

Families/Health-Insurance-Marketplace-Statements. Part III. Coverage Information, lines 21–33. Part III reports information

Additional information. For additional information about the tax about your insurance coverage that you will need to complete Form

provisions of the Affordable Care Act (ACA), including the premium tax 8962 to reconcile advance credit payments or to take the premium tax

credit, see www.irs.gov/Affordable-Care-Act/Individuals-and-Families or credit when you file your return.

call the IRS Healthcare Hotline for ACA questions (800-919-0452). Column A. This column is the monthly premiums for the plan in which

VOID box. If the “VOID” box is checked at the top of the form, you you or family members were enrolled, including premiums that you paid

previously received a Form 1095-A for the policy described in Part I. and premiums that were paid through advance payments of the

That Form 1095-A was sent in error. You shouldn’t have received a premium tax credit. If you or a family member enrolled in a separate

Form 1095-A for this policy. Don’t use the information on this or the dental plan with pediatric benefits, this column includes the portion of

previously received Form 1095-A to figure your premium tax credit on the dental plan premiums for the pediatric benefits. If your plan covered

Form 8962. benefits that aren’t essential health benefits, such as adult dental or

CORRECTED box. If the “CORRECTED” box is checked at the top of vision benefits, the amount in this column will be reduced by the

the form, use the information on this Form 1095-A to figure the premium premiums for the nonessential benefits. If the policy was terminated by

tax credit and reconcile any advance credit payments on Form 8962. your insurance company due to nonpayment of premiums for 1 or more

Don’t use the information on the original Form 1095-A you received for months, then a -0- will appear in this column for these months

this policy. regardless of whether advance credit payments were made for these

months. See the instructions for Form 8962, Part II, on how to complete

Part I. Recipient Information, lines 1–15. Part I reports information Form 8962 if -0- is reported for 1 or more months.

about you, the insurance company that issued your policy, and the

Marketplace where you enrolled in the coverage. Column B. This column is the monthly premium for the second lowest

cost silver plan (SLCSP) that the Marketplace has determined applies to

Line 1. This line identifies the state where you enrolled in coverage members of your family enrolled in the coverage. The applicable SLCSP

through the Marketplace. premium is used to compute your monthly advance credit payments

Line 2. This line is the policy number assigned by the Marketplace to and the premium tax credit you take on your return. See the instructions

identify the policy in which you enrolled. If you are completing Part IV of for Form 8962, Part II, on how to use the information in this column or

Form 8962, enter this number on line 30, 31, 32, or 33, box a. how to complete Form 8962 if there is no information entered, the

Line 3. This is the name of the insurance company that issued your information is incorrect, or the information is reported as -0-. If the

policy. policy was terminated by your insurance company due to nonpayment

of premiums for 1 or more months, then a -0- will appear in this column

Line 4. You are the recipient because you are the person the for the months, regardless of whether advance credit payments were

Marketplace identified at enrollment who is expected to file a tax return made for these months.

and who, if qualified, would take the premium tax credit for the year of

coverage. Column C. This column is the monthly amount of advance credit

payments that were made to your insurance company on your behalf to

Line 5. This is your social security number (SSN). For your protection, pay for all or part of the premiums for your coverage. If this is the only

this form may show only the last four digits. However, the Marketplace column in Part III that is filled in with an amount other than zero for a

has reported your complete SSN to the IRS. month, it means your policy was terminated by your insurance company

Line 6. A date of birth will be entered if there is no SSN on line 5. due to nonpayment of premiums, and you aren’t entitled to take the

Lines 7, 8, and 9. Information about your spouse will be entered only if premium tax credit for that month when you file your tax return. You

advance credit payments were made for your coverage. The date of must still reconcile the entire advance payment that was paid on your

birth will be entered on line 9 only if line 8 is blank. behalf for that month using Form 8962. No information will be entered in

this column if no advance credit payments were made.

Lines 10 and 11. These are the starting and ending dates of the policy.

Lines 21–33. The Marketplace will report the amounts in columns A, B,

Lines 12 through 15. Your address is entered on these lines. and C on lines 21–32 for each month and enter the totals on line 33. Use

Part II. Covered Individuals, lines 16–20. Part II reports information this information to complete Form 8962, line 11 or lines 12–23.

about each individual who is covered under your policy. This information

includes the name, SSN, date of birth, and the starting and ending dates

of coverage for each covered individual. For each line, a date of birth is

reported in column C only if an SSN isn’t entered in column B.

|