- 2 -

Enlarge image

|

Form 1363 (Rev. 8-2021) Page 2

If a statement that the documents are available is used, the

General Instructions statement must:

Section references are to the Internal Revenue Code. • Certify that the property covered by Form 1363 was exported;

What’s New • Identify the available evidence;

The address for mailing in a request for blanket exemption is • Specify the foreign destination or U.S. possession to which the

changed. See Blanket Exemption below. property was shipped; and,

• Give the address where the evidence is available for inspection.

Purpose of Form

The description of property to be exported should be brief. In the

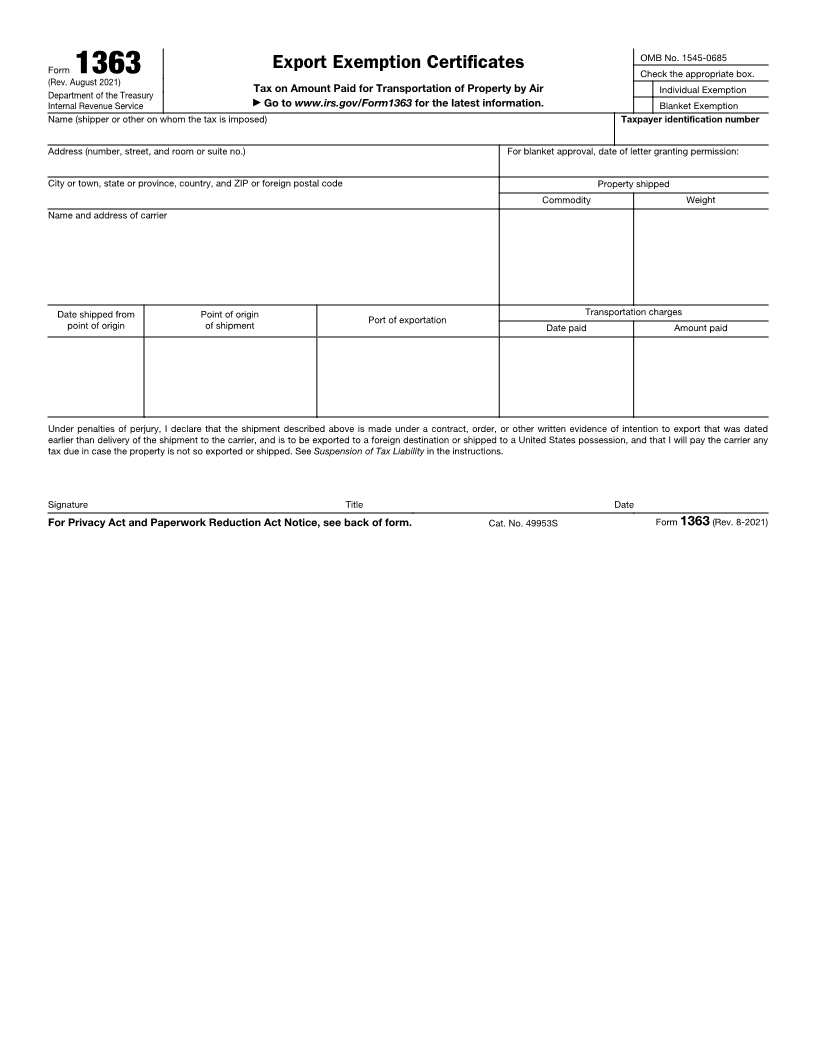

File Form 1363 with the carrier to suspend the liability for the case of a blanket exemption, a general description is sufficient. If

section 4271 6.25% tax on transportation of property by air. The tax you have been granted a blanket exemption, it applies to all

is imposed on the amount paid for the transportation of property by products exported even though different products may be exported

air if the transportation begins and ends in the United States. later. File only one Form 1363 with the carrier.

However, if you export property (including shipment to a U.S.

possession) by continuous movement, the amount you pay for Check the appropriate box on the form to show if this is a blanket

transportation of property by air is exempt from this tax. exemption or individual shipment exemption.

You may use a separate Form 1363 in connection with each

payment otherwise subject to tax or, with the permission of the IRS, Privacy Act and Paperwork Reduction Act Notice

you may use one Form 1363 as a blanket exemption certificate. We ask for the information on this form to carry out the Internal

Revenue laws of the United States. We need this information to

Blanket Exemption ensure that you are complying with the revenue laws and to allow

You may use a blanket exemption on Form 1363 if you expect to us to figure and collect the right amount of tax. Section 4271

make payments for numerous export shipments over an indefinite authorizes us to request this information. Section 6109 requires

period of time. You must demonstrate that it isn’t practical to filers to provide their social security number or other identifying

complete a separate Form 1363 for each payment. numbers. The information will be used to suspend your liability for

Permission to use the blanket exemption should be requested by the tax on transportation of property by air.

submitting a letter to: Generally, tax returns and return information are confidential, as

Department of the Treasury stated in section 6103. However, section 6103 allows or requires

Internal Revenue Service the IRS to disclose such information to the Department of Justice

Mail Stop 5701G for civil and criminal litigation, and to cities, states, the District of

Cincinnati, OH 45999 Columbia, and U.S. commonwealths and possessions for use in

administering their tax laws. We may also disclose this information

If permission is granted, you should complete a separate blanket to other countries under a tax treaty, to federal and state agencies

certificate, for each air carrier accepting export shipments. to enforce federal nontax criminal laws, or to federal law

Permission to use the blanket exemption, if granted, will remain in enforcement and intelligence agencies to combat terrorism. Failing

effect until withdrawn. to provide all of the requested information may forfeit any

Recordkeeping.—You should keep a copy with all shipping papers exemption; providing false or fraudulent information may subject

and file the original with the air carrier on or before payment of the you to penalties.

first transportation charge to be covered by the blanket certificate. You do not have to provide information requested on a form that

The air carrier should keep the original blanket certificate with all is subject to the Paperwork Reduction Act unless the form displays

records showing payment of the transportation charges. a valid OMB control number. Books or records relating to a form or

its instructions must be retained as long as their contents may

Each person must keep the blanket certificate for at least 3 years become material in the administration of any Internal Revenue law.

after the last day of the month the final shipment covered by the

certificate was made from the point of origin. Shipping and payment The time needed to provide this information will vary depending

records for individual exemption items should be kept at least 3 on individual circumstances. The estimated average time is:

years after the last day of the month the shipment was made from Recordkeeping . . . . . . . . . . . . 3 hr., 59 min.

the point of origin. Learning about the law or the form . . . . . . . 30 min.

Suspension of Tax Liability Preparing, copying, assembling, and

sending the form to the IRS . . . . . . . . . . 37 min.

Form 1363 as an individual or blanket exemption suspends the

liability for payment of the tax for a period of 6 months starting from If you have comments concerning the accuracy of this time

the date the property is shipped from point of origin. If you or the estimate or suggestions for reducing this burden, we would be

person liable for the tax doesn’t provide evidence of exportation happy to hear from you. You can write to:

(see below) to the carrier within this 6-month period, the temporary Internal Revenue Service

suspension of the liability for the payment of tax ends. The carrier Tax Products Coordinating Committee

should then collect the tax from you or the person who paid the 1111 Constitution Ave. NW, IR-6526

transportation charge. If, after collection of the tax, proof of Washington, DC 20224

exportation is later received by the carrier, credit or refund of the tax Don’t file this form with this office. Instead, give the original to the

may be obtained under section 6415(a). carrier and keep a copy for your records.

You don’t have to consecutively number your exemption

certificate(s). However, you must provide proof of exportation to the

carrier along with Form 1363.

Evidence of exportation.—A completed and signed Form 1363

and proof of exportation, or a statement that the documents are

available, must be furnished to the carrier by the person liable for

the tax. Proof of exportation may consist of:

• A copy of export bill of lading,

• A memorandum from the captain of the vessel, customs official, or

a foreign consignee, and/or

• A shipper’s export declaration.

|