Enlarge image

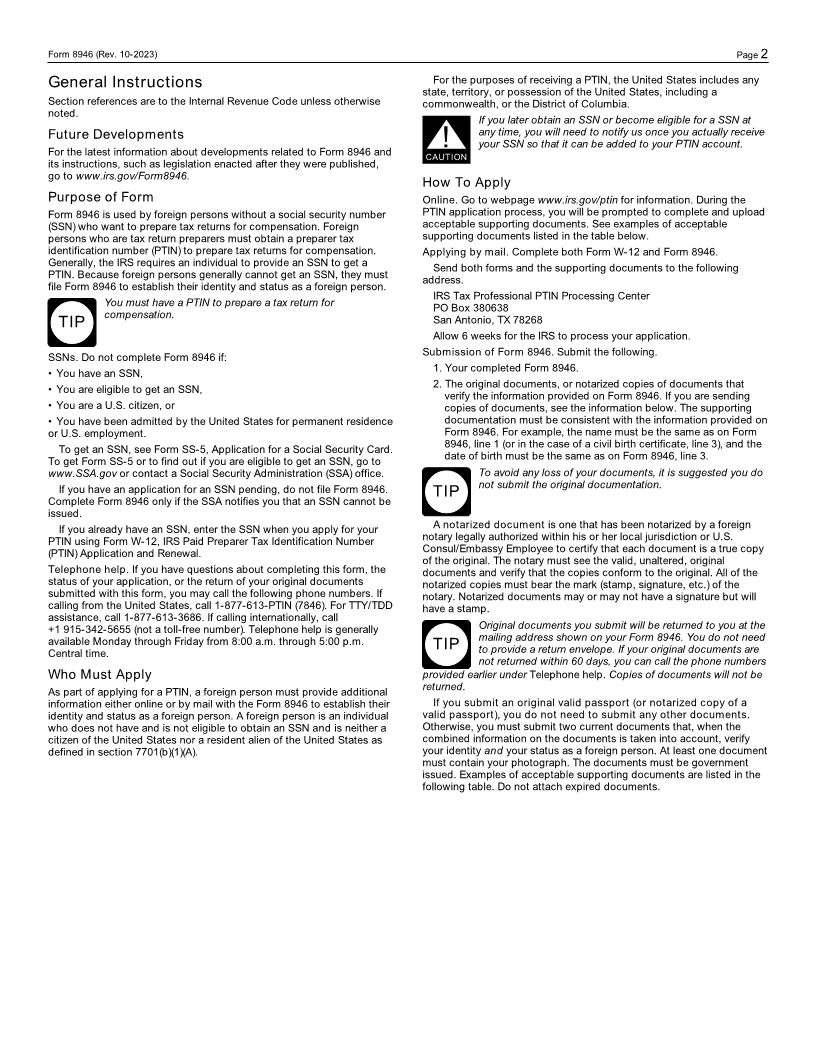

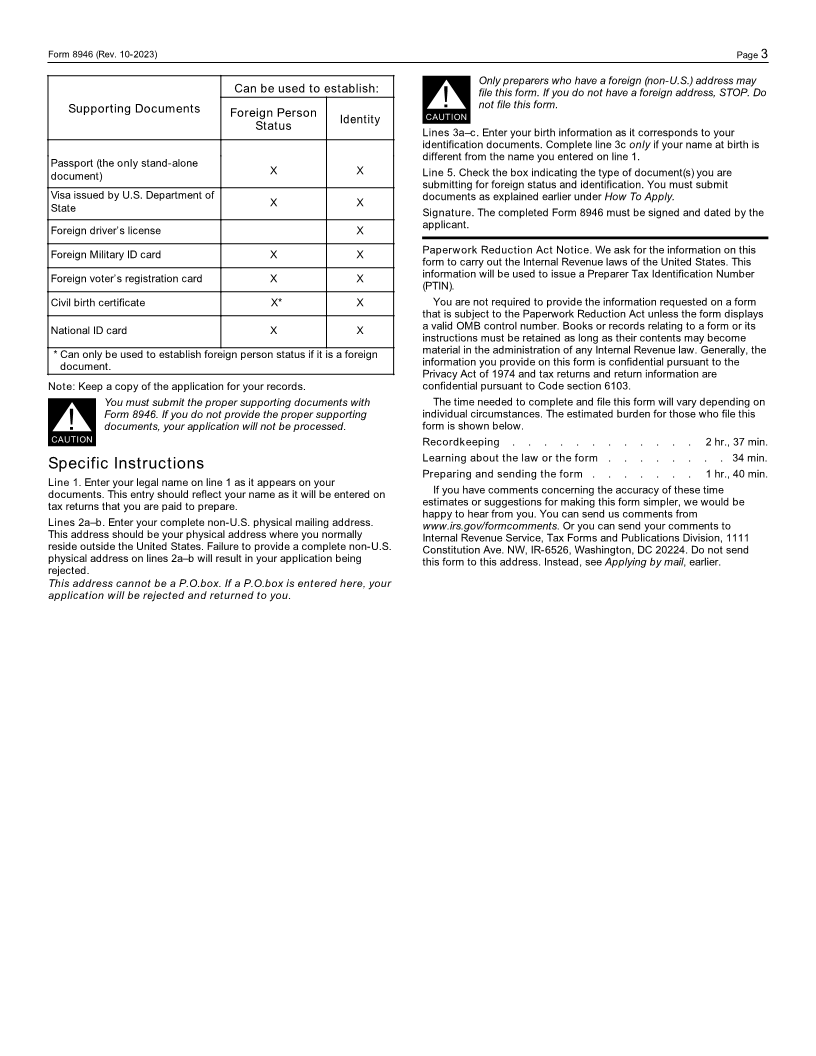

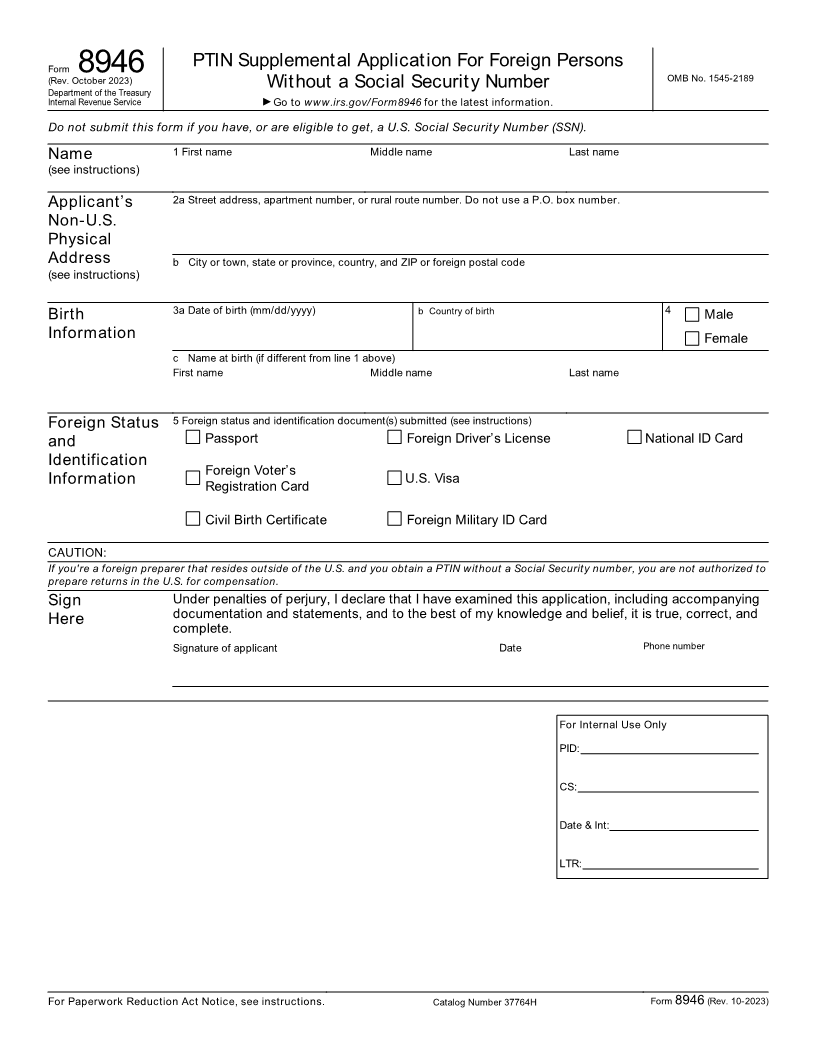

PTIN Supplemental Application For Foreign Persons

OMB No. 1545-2189

Form (Rev. October 2023)8946 Without a Social Security Number

Department of the Treasury

Internal Revenue Service ▶ Go to www.irs.gov/Form8946 for the latest information.

Do not submit this form if you have, or are eligible to get, a U.S. Social Security Number (SSN).

Name 1 First name Middle name Last name

(see instructions)

Applicant’s 2a Street address, apartment number, or rural route number. Do not use a P.O. box number.

Non-U.S.

Physical

Address b City or town, state or province, country, and ZIP or foreign postal code

(see instructions)

Birth 3a Date of birth (mm/dd/yyyy) b Country of birth 4 Male

Information Female

c Name at birth (if different from line 1 above)

First name Middle name Last name

Foreign Status 5 Foreign status and identification document(s) submitted (see instructions)

and Passport Foreign Driver’s License National ID Card

Identification

Foreign Voter’s

U.S. Visa

Information Registration Card

Civil Birth Certificate Foreign Military ID Card

CAUTION:

If you're a foreign preparer that resides outside of the U.S. and you obtain a PTIN without a Social Security number, you are not authorized to

prepare returns in the U.S. for compensation.

Sign Under penalties of perjury, I declare that I have examined this application, including accompanying

Here documentation and statements, and to the best of my knowledge and belief, it is true, correct, and

complete.

Signature of applicant Date Phone number

For Internal Use Only

PID:

CS:

Date & Int:

LTR:

For Paperwork Reduction Act Notice, see instructions. Catalog Number 37764H Form 8946 (Rev. 10-2023)