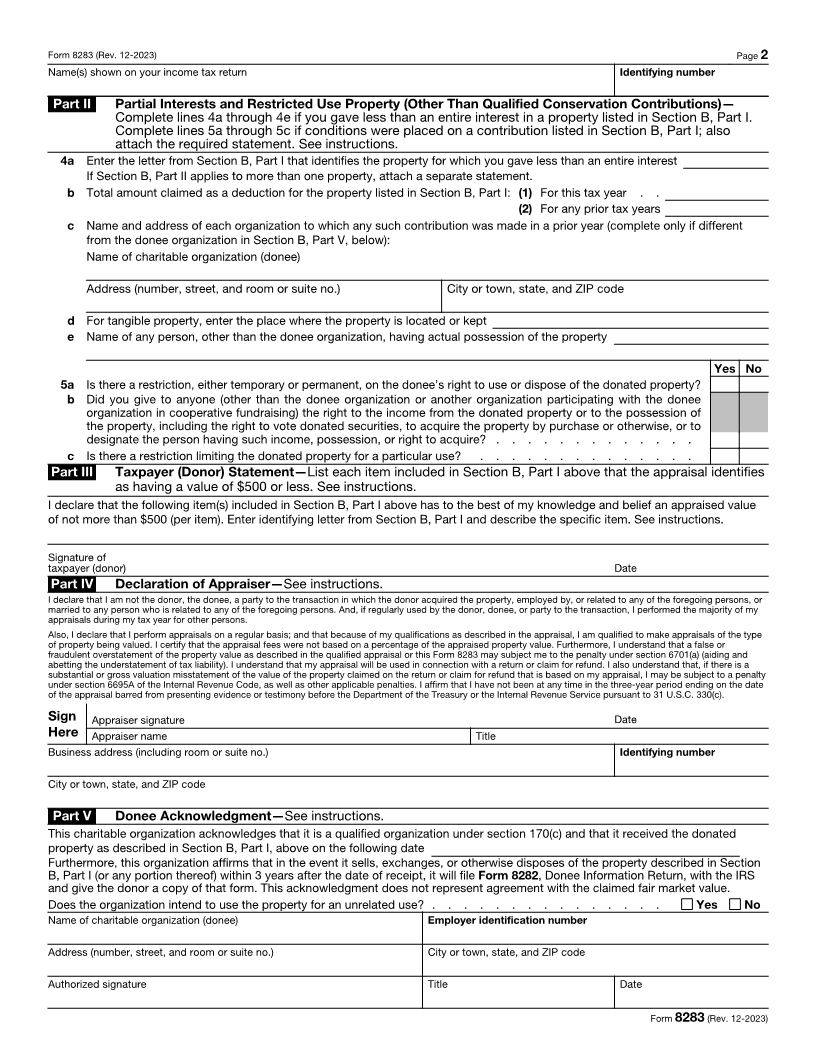

Enlarge image

Noncash Charitable Contributions OMB No. 1545-0074

Form 8283 Attach one or more Forms 8283 to your tax return if you claimed a total deduction

(Rev. December 2023) of over $500 for all contributed property. Attachment

Department of the Treasury Sequence No. 155

Internal Revenue Service Go to www.irs.gov/Form8283 for instructions and the latest information.

Name(s) shown on your income tax return Identifying number

Enter the entity name and identifying number from the tax return where the noncash charitable contribution was originally reported, if

different from above.

Name: Identifying number:

Check this box if a family pass-through entity made the noncash charitable contribution. See instructions . . . . . . . .

Note: Figure the amount of your contribution deduction before completing this form. See your tax return instructions.

Section A. Donated Property of $5,000 or Less and Publicly Traded Securities—List in this section only an item

(or a group of similar items) for which you claimed a deduction of $5,000 or less. Also list publicly traded

securities and certain other property even if the deduction is more than $5,000. If you need more space,

attach a statement. See instructions.

1 (a) Name and address of the (b) If donated property is a vehicle (see instructions), (c) Description and condition of donated property

donee organization check the box. Also enter the vehicle identification (For a vehicle, enter the year, make, model, and

number (unless Form 1098-C is attached). mileage. For securities and other property,

see instructions.)

A

B

C

D

Note: If the amount you claimed as a deduction for an item is $500 or less, you do not have to complete columns (e), (f), and (g).

(d) Date of the (e) Date acquired (f) How acquired (g) Donor’s cost (h) Fair market value (i) Method used to determine

contribution by donor (mo., yr.) by donor or adjusted basis (see instructions) the fair market value

A

B

C

D

Section B. Donated Property Over $5,000 (Except Publicly Traded Securities, Vehicles, Intellectual Property or

Inventory Reportable in Section A)—Complete this section for one item (or a group of similar items) for which

you claimed a deduction of more than $5,000 per item or group (except contributions reportable in Section A).

Provide a separate form for each item donated unless it is part of a group of similar items. A qualified appraisal

is required for items reportable in Section B and in certain cases must be attached. See instructions.

Part I Information on Donated Property

2 Check the box that describes the type of property donated. See instructions for definitions.

a Art (contribution of $20,000 or more) d Other real estate i Vehicles

b Qualified conservation contribution e Equipment j Clothing and household items

b(1) Certified historic structure f Securities k Digital assets

NPS # g Collectibles l Other

c Art (contribution of less than $20,000) h Intellectual property

3 (a) Description of donated property (if you need (b) If any tangible personal property or real property was donated, give a brief (c) Appraised fair

more space, attach a separate statement) summary of the overall physical condition of the property at the time of the gift. market value

A

B

C

(d) Date acquired (e) How acquired by donor (f) Donor’s cost or (g) For bargain sales, (h) Qualified (i) Amount claimed

by donor adjusted basis enter amount conservation as a deduction

(mo., yr.) received contribution (see instructions)

relevant basis

(see instructions)

A

B

C

For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 62299J Form 8283 (Rev. 12-2023)