- 7 -

Enlarge image

|

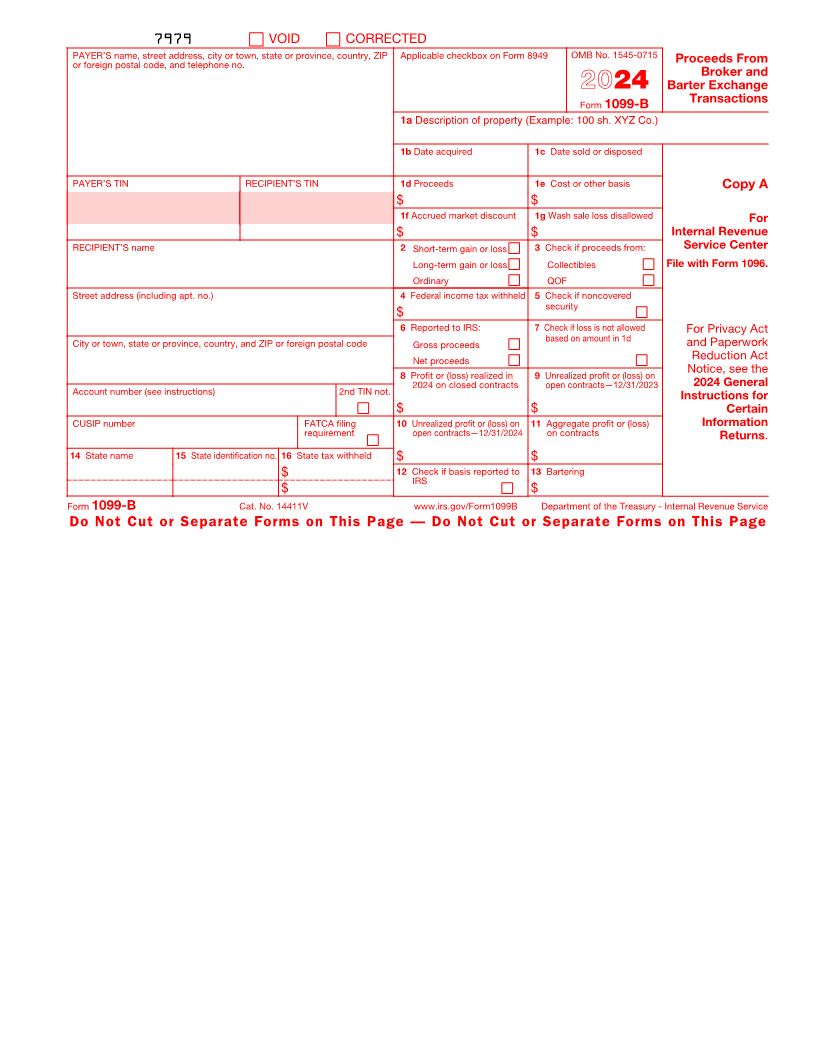

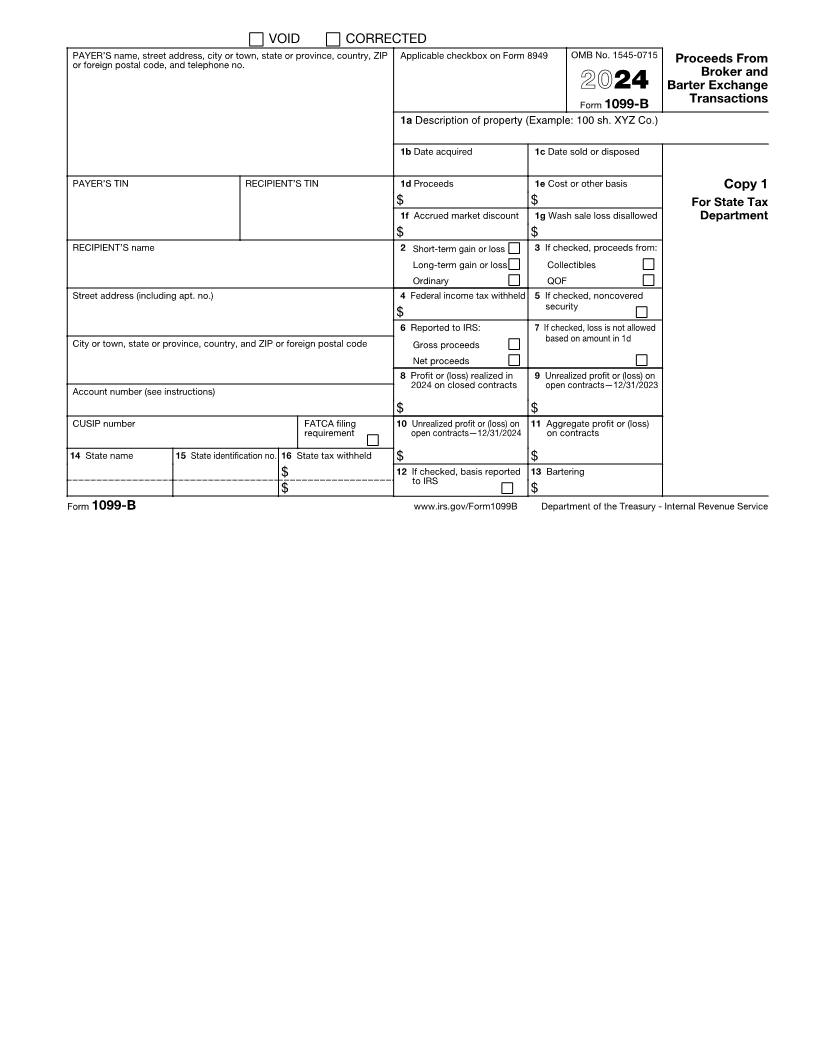

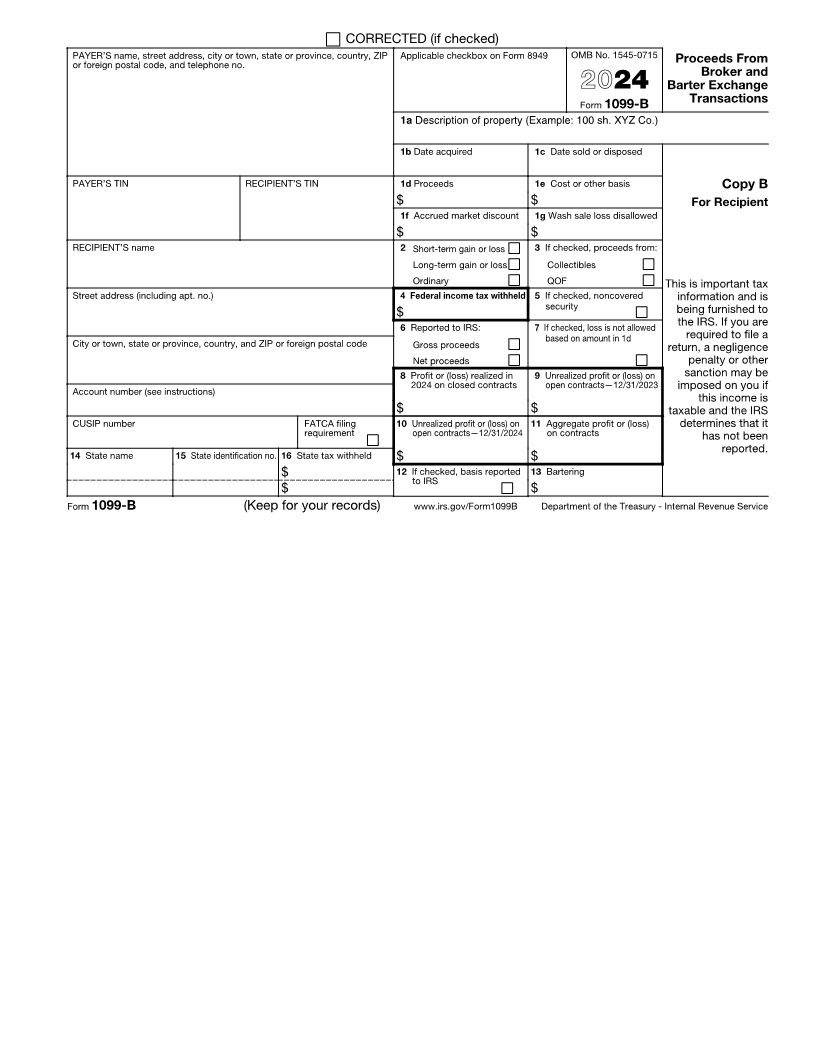

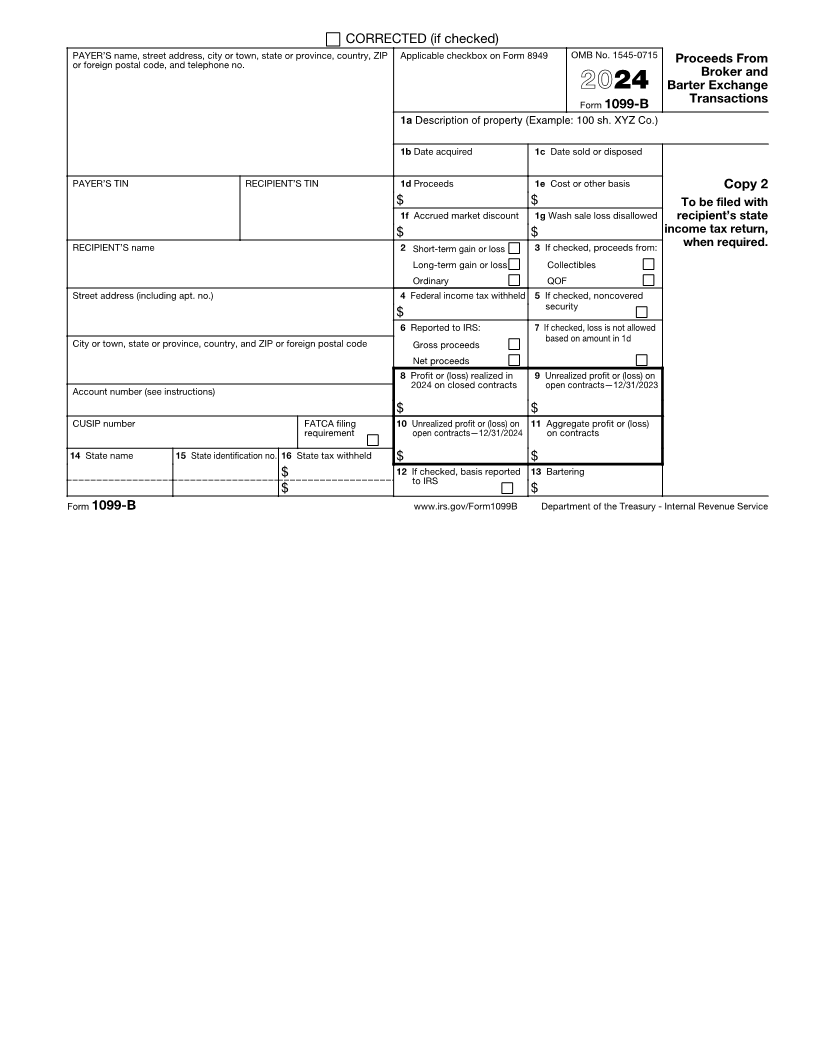

Instructions for Recipient (continued) structure reported in box 1d. See the Form 8949 and Schedule D

(Form 1040) instructions. The broker should advise you of any losses

Box 1f. Shows the amount of accrued market discount. For details on

on a separate statement.

market discount, see the Schedule D (Form 1040) instructions, the

Instructions for Form 8949, and Pub. 550. If box 5 is checked, box 1f Regulated Futures Contracts, Foreign Currency Contracts, and

may be blank. Section 1256 Option Contracts (Boxes 8 Through 11)

Box 1g. Shows the amount of nondeductible loss in a wash sale Box 8. Shows the profit or (loss) realized on regulated futures, foreign

transaction. For details on wash sales, see the Schedule D (Form currency, or Section 1256 option contracts closed during 2024.

1040) instructions, the Instructions for Form 8949, and Pub. 550. If

box 5 is checked, box 1g may be blank. Box 9. Shows any year-end adjustment to the profit or (loss) shown in

box 8 due to open contracts on December 31, 2023.

Box 2. The short-term and long-term boxes pertain to short-term gain

or loss and long-term gain or loss. If the “Ordinary” box is checked, Box 10. Shows the unrealized profit or (loss) on open contracts held in

your security may be subject to special rules. For example, gain on a your account on December 31, 2024. These are considered closed

contingent payment debt instrument subject to the noncontingent out as of that date. This will become an adjustment reported as

bond method is generally treated as ordinary interest income rather unrealized profit or (loss) on open contracts—12/31/2024 in 2025.

than as capital gain. See the Instructions for Form 8949, Pub. 550, or Box 11. Boxes 8, 9, and 10 are all used to figure the aggregate profit

Pub. 1212 for more details on whether there are any special rules or or (loss) on regulated futures, foreign currency, or Section 1256 option

adjustments that might apply to your security. If box 5 is checked, box contracts for the year. Include this amount on your 2024 Form 6781.

2 may be blank.

Box 12. If checked, the basis in box 1e has been reported to the IRS

Box 3. If checked, proceeds are from a transaction involving and either the short-term or the long-term gain or loss box in box 2

collectibles or from a Qualified Opportunity Fund (QOF). will be checked. If box 12 is checked on Form(s) 1099-B and NO

Box 4. Shows backup withholding. Generally, a payer must backup adjustment is required, see the instructions for your Schedule D (Form

withhold if you did not furnish your TIN to the payer. See Form W-9 for 1040) as you may be able to report your transaction directly on

information on backup withholding. Include this amount on your Schedule D (Form 1040). If the “Ordinary” box in box 2 is checked, an

income tax return as tax withheld. adjustment may be required.

Box 5. If checked, the securities sold were noncovered securities and Box 13. Shows the cash you received, the FMV of any property or

boxes 1b, 1e, 1f, 1g, and 2 may be blank. Generally, a noncovered services you received, and the FMV of any trade credits or scrip

security means (a) stock purchased before 2011, (b) stock in most credited to your account by a barter exchange. See Pub. 525.

mutual funds purchased before 2012, (c) stock purchased in or Boxes 14–16. Show state(s)/local income tax information.

transferred to a dividend reinvestment plan before 2012, (d) debt

acquired before 2014, (e) options granted or acquired before 2014, Future developments. For the latest information about any

and (f) securities futures contracts executed before 2014. developments related to Form 1099-B and its instructions, such as

legislation enacted after they were published, go to

Box 6. If the exercise of a noncompensatory option resulted in a sale www.irs.gov/Form1099B.

of a security, a checked “Net proceeds” box indicates whether the

amount in box 1d was adjusted for option premium. Free File Program. Go to www.irs.gov/FreeFile to see if you qualify

for no-cost online federal tax preparation, e-filing, and direct deposit

Box 7. If checked, you cannot take a loss on your tax return based on or payment options.

gross proceeds from a reportable change in control or capital

|