Enlarge image

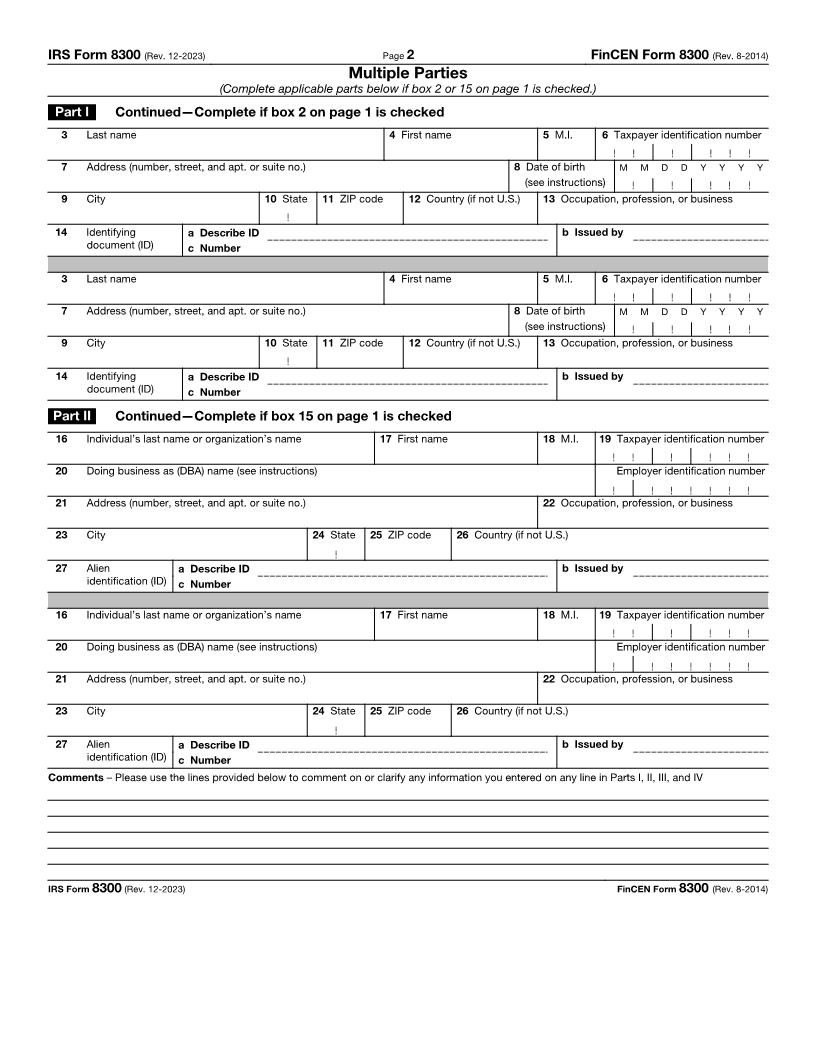

IRS Report of Cash Payments Over $10,000 FinCEN

Form

Form 8300 Received in a Trade or Business 8300

(Rev. December 2023) (Rev. August 2014)

See instructions for definition of cash. OMB No. 1506-0018

Department of the Treasury Use this form for transactions occurring after December 31, 2023. Do not use prior versions after this date. Department of the Treasury

Financial Crimes

Internal Revenue Service For Privacy Act and Paperwork Reduction Act Notice, see the instructions. Enforcement Network

1 Check appropriate box(es) if: a Amends prior report; b Suspicious transaction.

Part I Identity of Individual From Whom the Cash Was Received

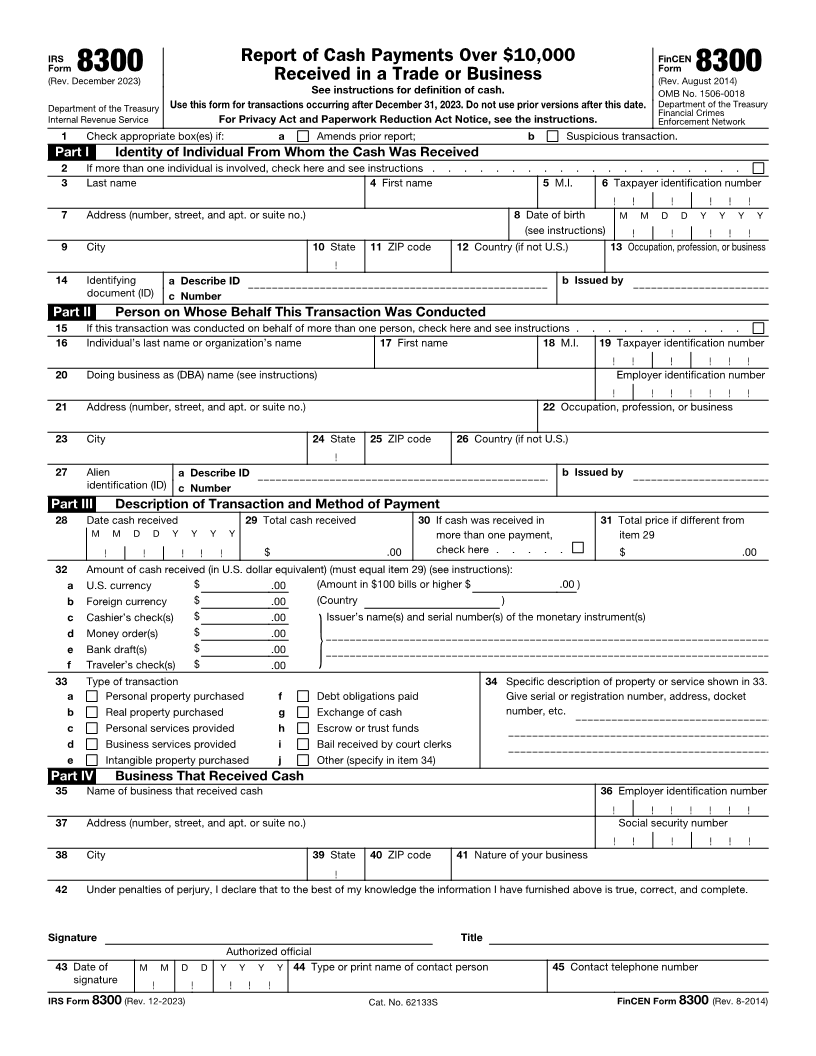

2 If more than one individual is involved, check here and see instructions . . . . . . . . . . . . . . . . . . . .

3 Last name 4 First name 5 M.I. 6 Taxpayer identification number

7 Address (number, street, and apt. or suite no.) 8 Date of birth M M D D Y Y Y Y

(see instructions)

9 City 10 State 11 ZIP code 12 Country (if not U.S.) 13 Occupation, profession, or business

14 Identifying a Describe ID b Issued by

document (ID) c Number

Part II Person on Whose Behalf This Transaction Was Conducted

15 If this transaction was conducted on behalf of more than one person, check here and see instructions . . . . . . . . . . .

16 Individual’s last name or organization’s name 17 First name 18 M.I. 19 Taxpayer identification number

20 Doing business as (DBA) name (see instructions) Employer identification number

21 Address (number, street, and apt. or suite no.) 22 Occupation, profession, or business

23 City 24 State 25 ZIP code 26 Country (if not U.S.)

27 Alien a Describe ID b Issued by

identification (ID) c Number

Part III Description of Transaction and Method of Payment

28 Date cash received 29 Total cash received 30 If cash was received in 31 Total price if different from

M M D D Y Y Y Y more than one payment, item 29

$ .00 check here . . . . . $ .00

32 Amount of cash received (in U.S. dollar equivalent) (must equal item 29) (see instructions):

a U.S. currency $ .00 (Amount in $100 bills or higher $ .00 )

b Foreign currency $ .00 (Country )

c Cashier’s check(s) $ .00 Issuer’s name(s) and serial number(s) of the monetary instrument(s)

d Money order(s) $ .00

e Bank draft(s) $ .00

f Traveler’s check(s) $ .00 }

33 Type of transaction 34 Specific description of property or service shown in 33.

a Personal property purchased f Debt obligations paid Give serial or registration number, address, docket

b Real property purchased g Exchange of cash number, etc.

c Personal services provided h Escrow or trust funds

d Business services provided i Bail received by court clerks

e Intangible property purchased j Other (specify in item 34)

Part IV Business That Received Cash

35 Name of business that received cash 36 Employer identification number

37 Address (number, street, and apt. or suite no.) Social security number

38 City 39 State 40 ZIP code 41 Nature of your business

42 Under penalties of perjury, I declare that to the best of my knowledge the information I have furnished above is true, correct, and complete.

Signature Title

Authorized official

43 Date of M M D D Y Y Y Y 44 Type or print name of contact person 45 Contact telephone number

signature

IRS Form 8300 (Rev. 12-2023) Cat. No. 62133S FinCEN Form 8300 (Rev. 8-2014)