Enlarge image

Annual Withholding Tax Return for U.S. Source OMB No. 1545-0096

Form 1042 Income of Foreign Persons

Department of the Treasury

Internal Revenue Service Go to www.irs.gov/Form1042 for instructions and the latest information. 2022

If this is an amended return, check here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Name of withholding agent Employer identification number

For IRS Use Only

Ch. 3 Status Code Ch. 4 Status Code CC FD

Number, street, and room or suite no. (If a P.O. box, see instructions.) RD FF

CAF FP

City or town, state or province, country, and ZIP or foreign postal code CR I

EDC SIC

If you do not expect to file this return in the future, check here Enter date final income paid

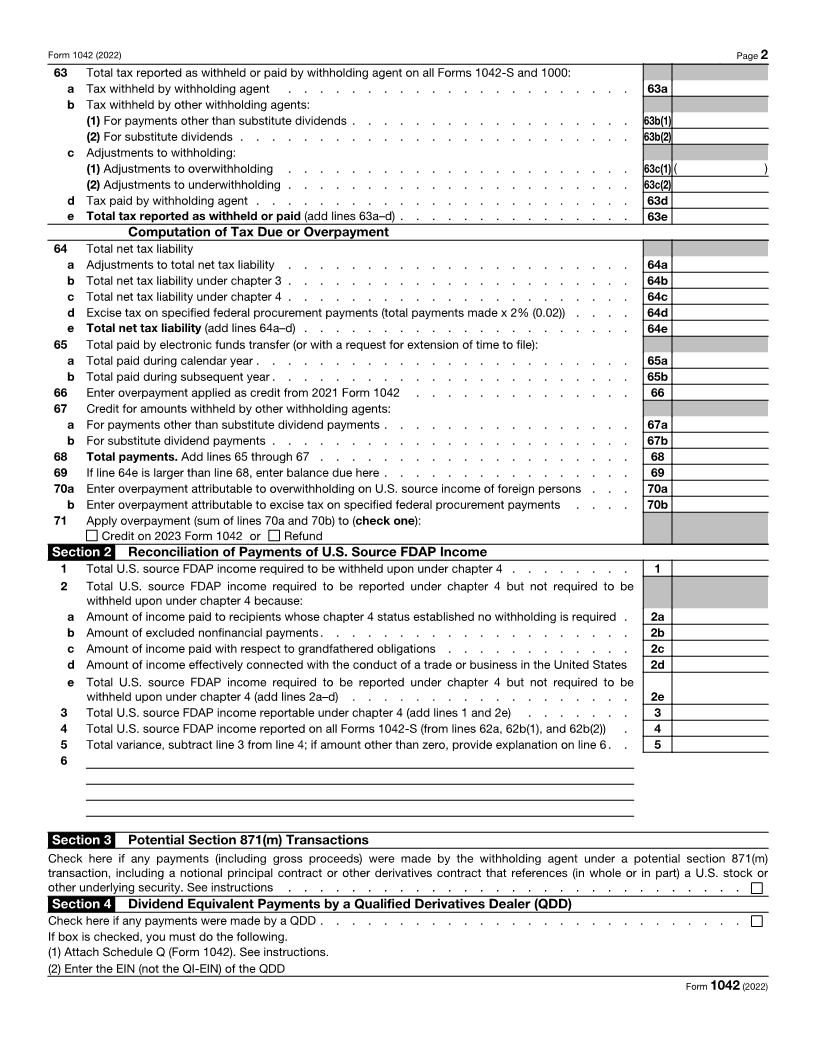

Section 1 Record of Federal Tax Liability (do not show federal tax deposits here)

Tax liability for period Tax liability for period Tax liability for period

Line Period (including any taxes assumed Line Period (including any taxes assumed Line Period (including any taxes assumed

No. ending on Form(s) 1000) No. ending on Form(s) 1000) No. ending on Form(s) 1000)

1 7 21 7 41 7

2 15 22 15 42 15

Jan. 22 23 May 22 43 Sept. 22

3

4 31 24 31 44 30

5 Jan. total 25 May total 45 Sept. total

6 7 26 7 46 7

7 15 27 15 47 15

Feb. 22 28 June 22 48 Oct. 22

8

9 28 29 30 49 31

10 Feb. total 30 June total 50 Oct. total

11 7 31 7 51 7

12 15 32 15 52 15

Mar. 22 33 July 22 53 Nov. 22

13

14 31 34 31 54 30

15 Mar. total 35 July total 55 Nov. total

16 7 36 7 56 7

17 15 37 15 57 15

Apr. 22 38 Aug. 22 58 Dec. 22

18

19 30 39 31 59 31

20 Apr. total 40 Aug. total 60 Dec. total

Note: The totals from the above table are to be entered on lines 64b through 64d (as indicated in the instructions for those lines).

61 No. of Forms 1042-S filed: a On paper b Electronically

62 Total gross amounts reported on all Forms 1042-S and 1000:

a Total U.S. source FDAP income (other than U.S. source substitute payments) reported . . . . . 62a

b Total U.S. source substitute payments reported:

(1) Total U.S. source substitute dividend payments reported . . . . . . . . . . . . . . 62b(1)

(2) Total U.S. source substitute payments reported other than substitute dividend payments . . . 62b(2)

c Total gross amounts reported (add lines 62a–b) . . . . . . . . . . . . . . . . . 62c

d Enter gross amounts actually paid if different from gross amounts reported . . . . . . . . . 62d

Do you want to allow another person to discuss this return with the IRS? See instructions.Yes. Complete the following. No

Third Party

Designee Designee’s Phone Personal identification

name no. number (PIN)

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than withholding agent) is based on all information of which preparer

Sign has any knowledge.

Date

Here Your Capacity in which acting

signature Daytime phone number

Print/Type preparer’s name Preparer’s signature Date Check if PTIN

Paid self-employed

Preparer

Firm’s name Firm’s EIN

Use Only

Firm’s address Phone no.

For Privacy Act and Paperwork Reduction Act Notice, see instructions. Cat. No. 11384V Form 1042 (2022)