- 5 -

Enlarge image

|

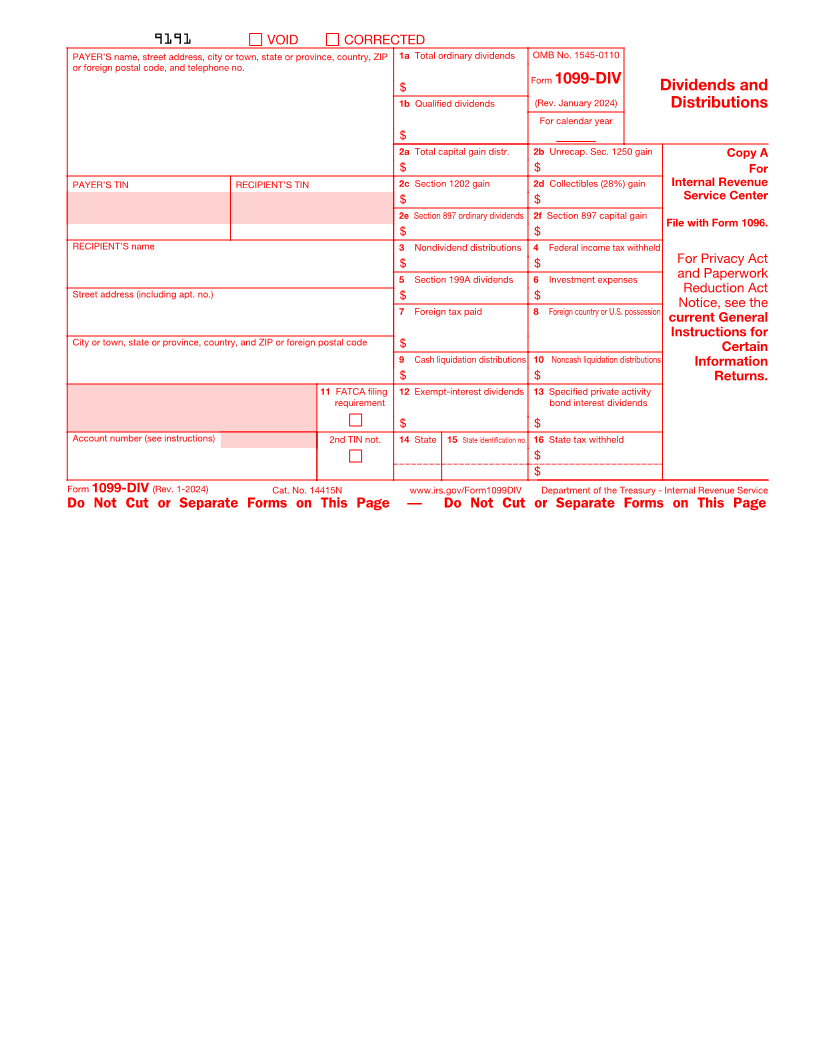

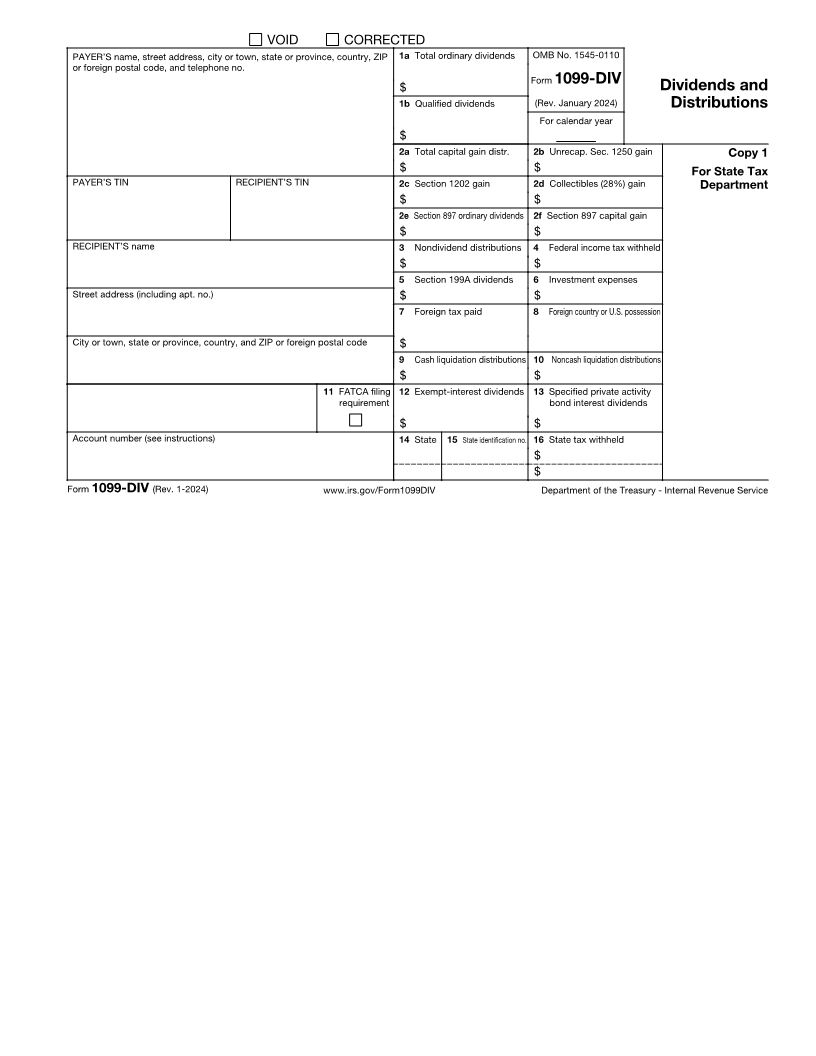

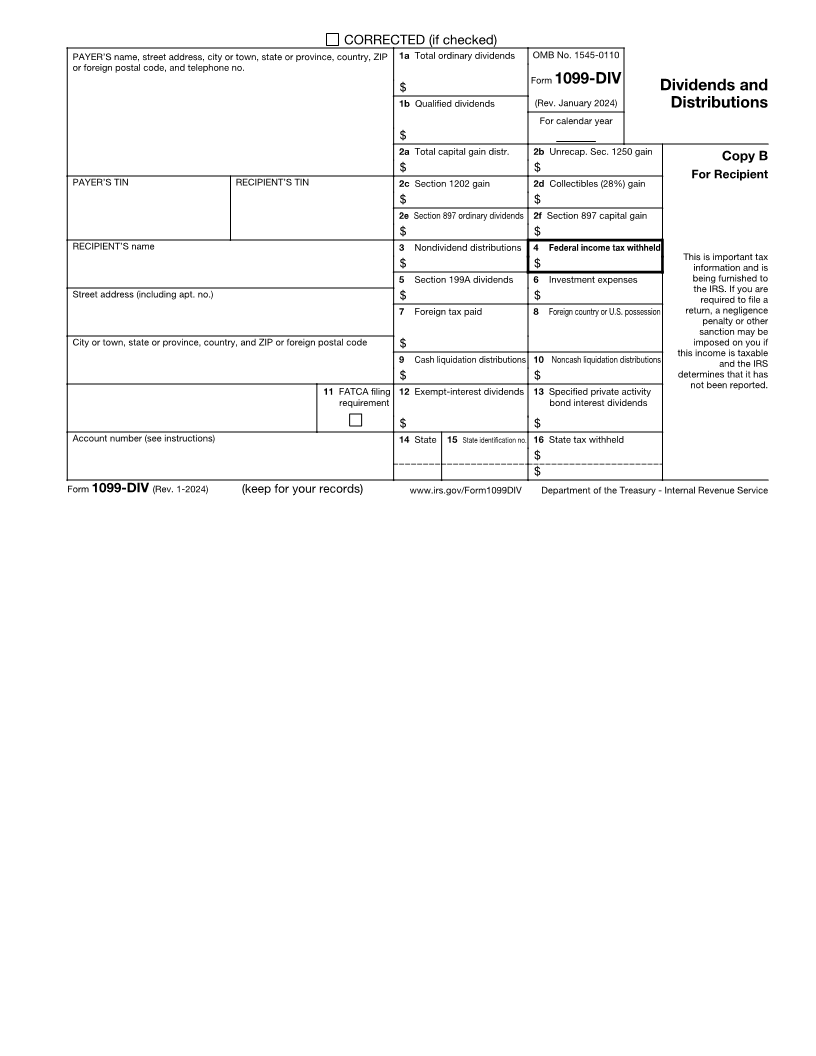

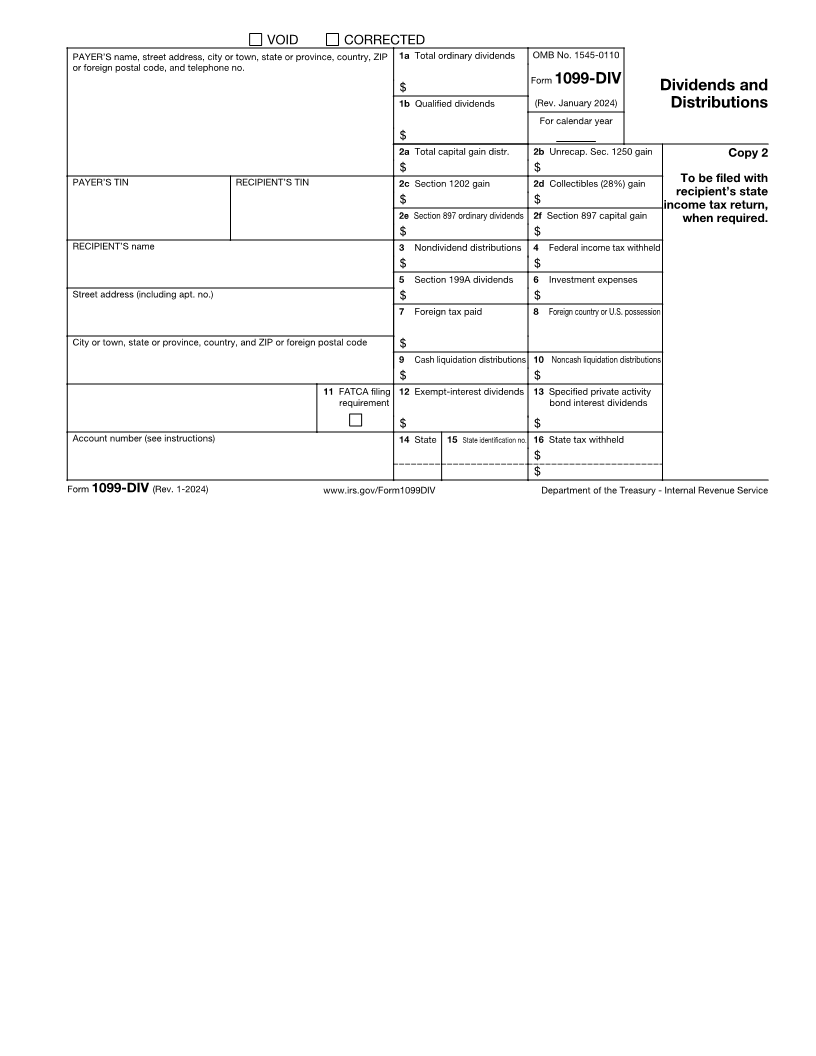

Instructions for Recipient indirect foreign owners or beneficiaries. It is generally treated as effectively

Recipient’s taxpayer identification number (TIN). For your protection, this connected to a trade or business within the United States. See the instructions

form may show only the last four digits of your TIN (SSN, ITIN, ATIN, or EIN). for your tax return.

However, the issuer has reported your complete TIN to the IRS. Box 3. Shows a return of capital. To the extent of your cost (or other basis) in

Account number. May show an account or other unique number the payer the stock, the distribution reduces your basis and is not taxable. Any amount

assigned to distinguish your account. received in excess of your basis is taxable to you as capital gain. See Pub. 550.

Box 1a. Shows total ordinary dividends that are taxable. Include this amount on Box 4. Shows backup withholding. A payer must backup withhold on certain

the “Ordinary dividends” line of Form 1040 or 1040-SR. Also report it on payments if you did not give your TIN to the payer. See Form W-9 for

Schedule B (Form 1040), if required. information on backup withholding. Include this amount on your income tax

return as tax withheld.

Box 1b. Shows the portion of the amount in box 1a that may be eligible for Box 5. Shows the portion of the amount in box 1a that may be eligible for the

reduced capital gains rates. See the Instructions for Form 1040 for how to 20% qualified business income deduction under section 199A. See the

determine this amount and where to report. instructions for Form 8995 and Form 8995-A.

The amount shown may be dividends a corporation paid directly to you as a Box 6. Shows your share of expenses of a nonpublicly offered RIC, generally a

participant (or beneficiary of a participant) in an employee stock ownership plan nonpublicly offered mutual fund. This amount is included in box 1a.

(ESOP). Report it as a dividend on your Form 1040 or 1040-SR but treat it as a

plan distribution, not as investment income, for any other purpose. Box 7. Shows the foreign tax that you may be able to claim as a deduction or a

Box 2a. Shows total capital gain distributions from a regulated investment credit on Form 1040 or 1040-SR. See the Instructions for Form 1040.

company (RIC) or real estate investment trust (REIT). See How To Report in the Box 8. This box should be left blank if a RIC reported the foreign tax shown in

Instructions for Schedule D (Form 1040). But, if no amount is shown in boxes box 7.

2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain Boxes 9 and 10. Show cash and noncash liquidation distributions.

distributions, you may be able to report the amounts shown in box 2a on your Box 11. If the FATCA filing requirement box is checked, the payer is reporting

Form 1040 or 1040-SR rather than Schedule D. See the Instructions for Form on this Form 1099 to satisfy its account reporting requirement under chapter 4

1040. of the Internal Revenue Code. You may also have a filing requirement. See the

Box 2b. Shows the portion of the amount in box 2a that is unrecaptured section Instructions for Form 8938.

1250 gain from certain depreciable real property. See the Unrecaptured Section Box 12. Shows exempt-interest dividends from a mutual fund or other RIC paid

1250 Gain Worksheet in the Instructions for Schedule D (Form 1040). to you during the calendar year. See the Instructions for Form 1040 for where to

Box 2c. Shows the portion of the amount in box 2a that is section 1202 gain report. This amount may be subject to backup withholding. See Box 4 above.

from certain small business stock that may be subject to an exclusion. See the Box 13. Shows exempt-interest dividends subject to the alternative minimum

Schedule D (Form 1040) instructions. tax. This amount is included in box 12. See the Instructions for Form 6251.

Box 2d. Shows the portion of the amount in box 2a that is 28% rate gain from Boxes 14–16. State income tax withheld reporting boxes.

sales or exchanges of collectibles. If required, use this amount when completing Nominees. If this form includes amounts belonging to another person, you are

the 28% Rate Gain Worksheet in the Instructions for Schedule D (Form 1040). considered a nominee recipient. You must file Form 1099-DIV (with a Form

Box 2e. Shows the portion of the amount in box 1a that is section 897 gain 1096) with the IRS for each of the other owners to show their share of the

attributable to disposition of U.S. real property interests (USRPI). income, and you must furnish a Form 1099-DIV to each. A spouse is not

Box 2f. Shows the portion of the amount in box 2a that is section 897 gain required to file a nominee return to show amounts owned by the other spouse.

attributable to disposition of USRPI. See the current General Instructions for Certain Information Returns.

Note: Boxes 2e and 2f apply only to foreign persons and entities whose income

maintains its character when passed through or distributed to its direct or

|