Enlarge image

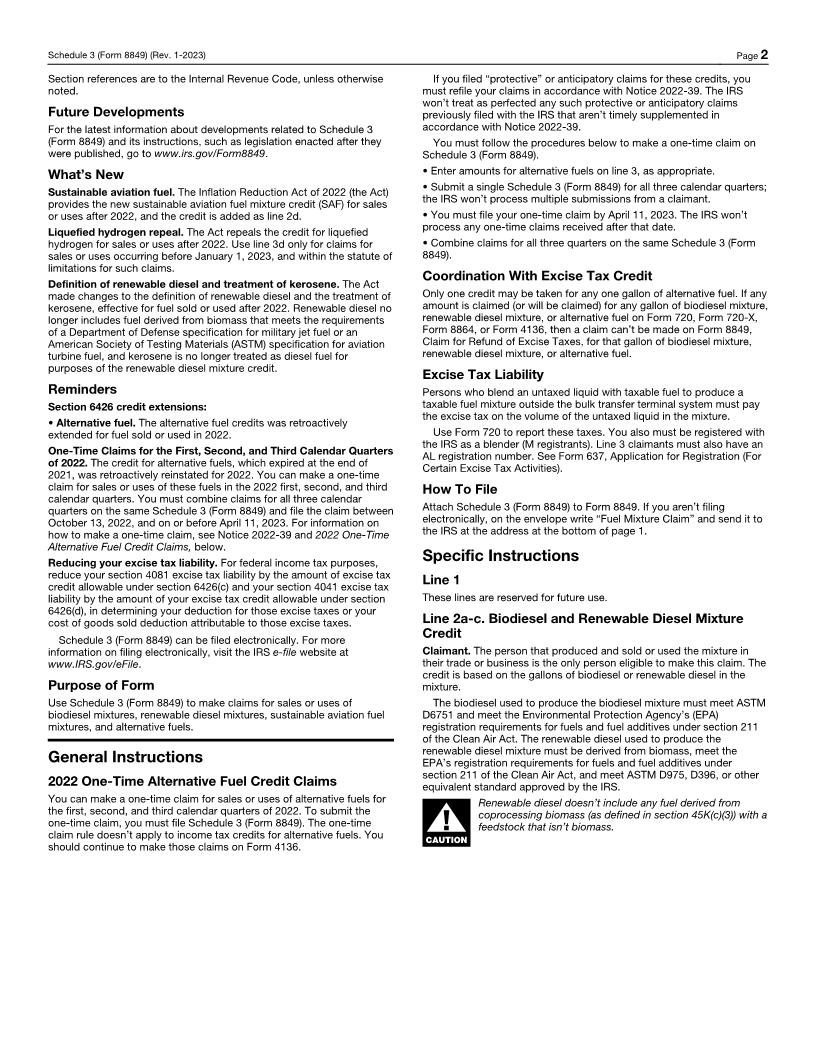

Schedule 3 Certain Fuel Mixtures

(Form 8849)

(Rev. January 2023) and the Alternative Fuel Credit OMB No. 1545-1420

Department of the Treasury Attach to Form 8849. Don’t file with any other schedule.

Internal Revenue Service Go to www.irs.gov/Form8849 for instructions and the latest information.

Name as shown on Form 8849 EIN or SSN Total refund (see instructions)

$

Caution: For instructions on how to make a one-time claim for the alternative fuel credit for the first, second, and third calendar quarters of 2022,

see the instructions and Notice 2022-39. For the fourth calendar quarter of 2022 and later, the alternative fuel credits must first be taken on Form

720, Quarterly Federal Excise Return, as a credit against your alternative fuel or compressed natural gas (CNG) tax liability. If you have this tax

liability and you didn’t make the claim on Form 720, Schedule C, as a credit against that liability, you must first file Form 720-X, Amended

Quarterly Federal Excise Tax Return, before Schedule 3 (Form 8849) can be used for the refund. You can’t claim any amounts on Form 8849 that

you claimed (or will claim) on Form 720, Schedule C; Form 720-X; or Form 4136, Credit for Federal Tax Paid on Fuels or Form 8864, Biodiesel,

Renewable Diesel, or Sustainable Aviation Fuels Credit.

Claimant’s registration no.

Enter your registration number, including the prefix. Line 3 claimants must enter their AL or AM registration number.

Period of claim: Enter month, day, and year in

MMDDYYYY format. From To

1 Reserved for future use

Reserved for future use

(a) (b) (c) Amount of claim (d)

Rate Gallons of alcohol Multiply col. (a) by col. (b). CRN

a Reserved for future use

b Reserved for future use

2 Biodiesel, Renewable Diesel, or Sustainable Aviation Fuel (SAF) Mixture Credit

Biodiesel or renewable diesel mixtures. Claimant produced a mixture by mixing biodiesel with diesel fuel, or produced a mixture by mixing

renewable diesel with liquid fuel (other than renewable diesel). The biodiesel used to produce the biodiesel mixture met ASTM D6751 and met

EPA’s registration requirements for fuels and fuel additives. The renewable diesel used to produce the renewable diesel mixture was derived

from biomass, met EPA’s registration requirements for fuels and fuel additives, and met ASTM D975, D396, or other equivalent standard

approved by the IRS. The biodiesel or renewable mixture was sold by the claimant to any person for use as a fuel or was used as a fuel by the

claimant. Sustainable aviation fuel (SAF) mixtures. Claimant produced a qualified mixture by mixing SAF with kerosene. The qualified

mixture was produced by the claimant in the United States, such mixture was used by the claimant (or sold by the claimant for use) in an

aircraft, such sale or use was in the ordinary course of a trade or business of the claimant, and the transfer of such mixture to the fuel tank of

such aircraft occurred in the United States. The SAF used to produce the qualified mixture is the portion of liquid fuel that isn't kerosene that (i)

either (A) meets the specifications of one of the ASTM D7566 Annexes, or (B) meets the specifications of ASTM D1655 Annex A1, (ii) isn’t

derived from coprocessing an applicable material (or materials derived from an applicable material) with a feedstock that isn't biomass, (iii) isn’t

derived from palm fatty acid distillates or petroleum, and (iv) has been certified in accordance with section 40B(e) as having a lifecycle

greenhouse gas emissions reduction percentage of at least 50 percent. For all claims. Claimant has attached the appropriate certificates and,

if applicable, appropriate reseller statements. Claimant has no reason to believe that the information in the certificate or statement is false. See

the instructions for additional information and requirements.

(a) (b) (c) Amount of claim (d)

Rate Number of gallons Multiply col. (a) by col. (b) CRN

sold or used

a Biodiesel (other than agri-biodiesel) mixtures $1.00 $ 388

b Agri-biodiesel mixtures 1.00 390

c Renewable diesel mixtures 1.00 307

d Sustainable aviation fuel mixtures (see instructions) 440

3 Alternative Fuel Credit

(a) (b) (c) Amount of claim (d)

Rate Gallons, or Multiply col. (a) by col. (b) CRN

gasoline or diesel

gallon equivalent

a Liquefied petroleum gas (LPG) (see instructions) $.50 $ 426

b “P” Series fuels .50 427

c Compressed natural gas (CNG) (see instructions) .50 428

d Liquefied hydrogen sold or used before 2023 .50 429

e Fischer-Tropsch process liquid fuel from coal (including peat) .50 430

f Liquid fuel derived from biomass .50 431

g Liquefied natural gas (LNG) (see instructions) .50 432

h Liquefied gas derived from biomass .50 436

i Compressed gas derived from biomass .50 437

Send this schedule with completed Form 8849 to: Internal Revenue Service, P.O. Box 312, Covington, KY 41012-0312; on the envelope write “Fuel Mixture Claim.”

For Privacy Act and Paperwork Reduction Act Notice, see Form 8849 instructions. Cat. No. 27451F Schedule 3 (Form 8849) (Rev. 1-2023)