Enlarge image

Print Reset

TENNESSEE DEPARTMENT OF REVENUE

Installment Payment Agreement Program

TENNESSEE DEPARTMENT

OF REVENUE

INSTALLMENT PAYMENT AGREEMENT

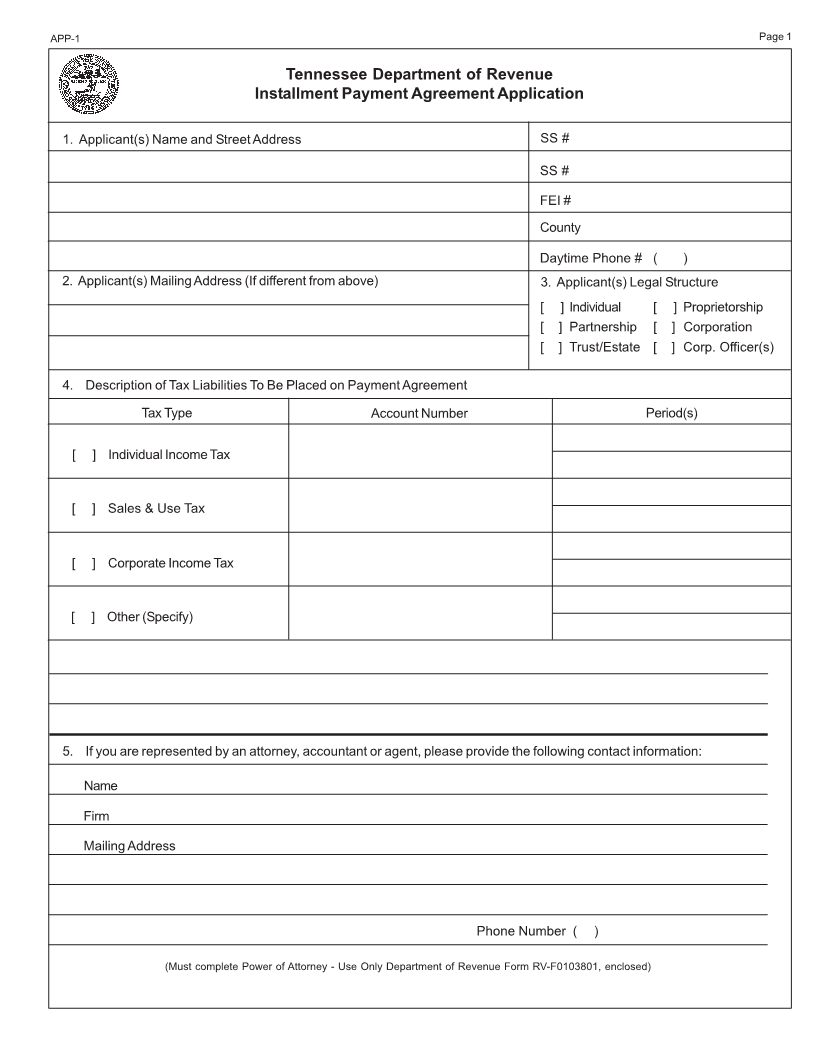

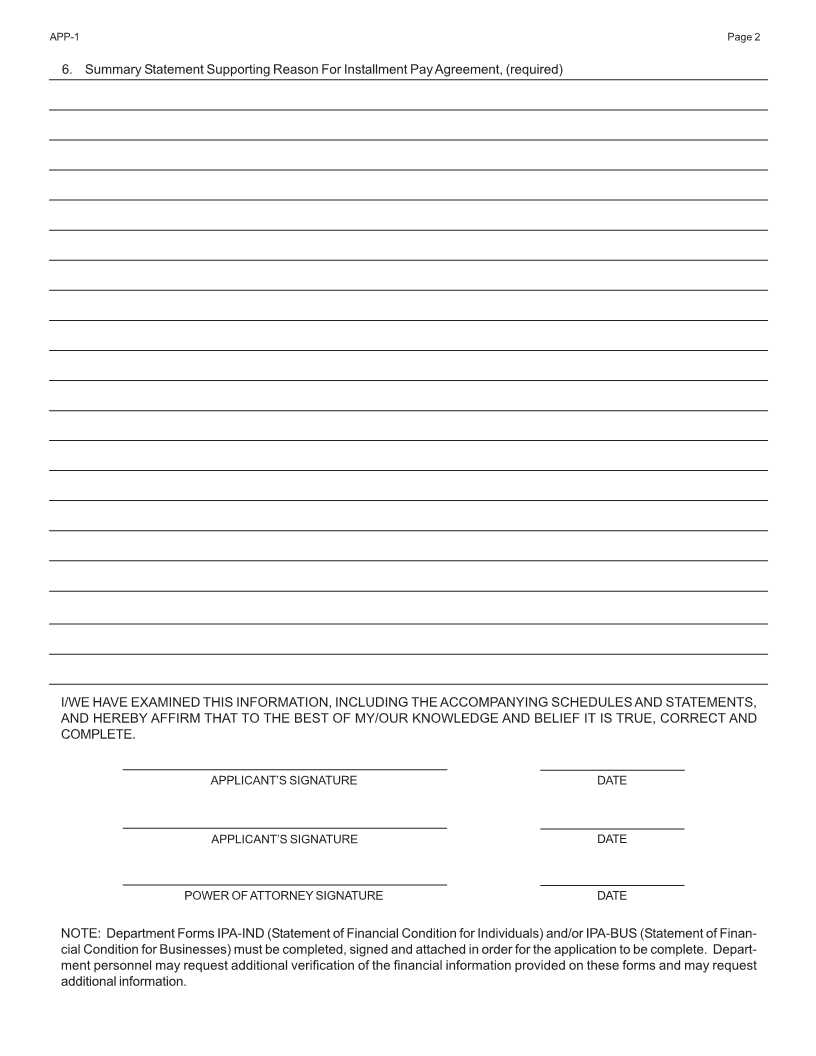

APPLICATION

The Following Pages Contain:

Basic Information

Terms and Conditions

Installment Payment Application

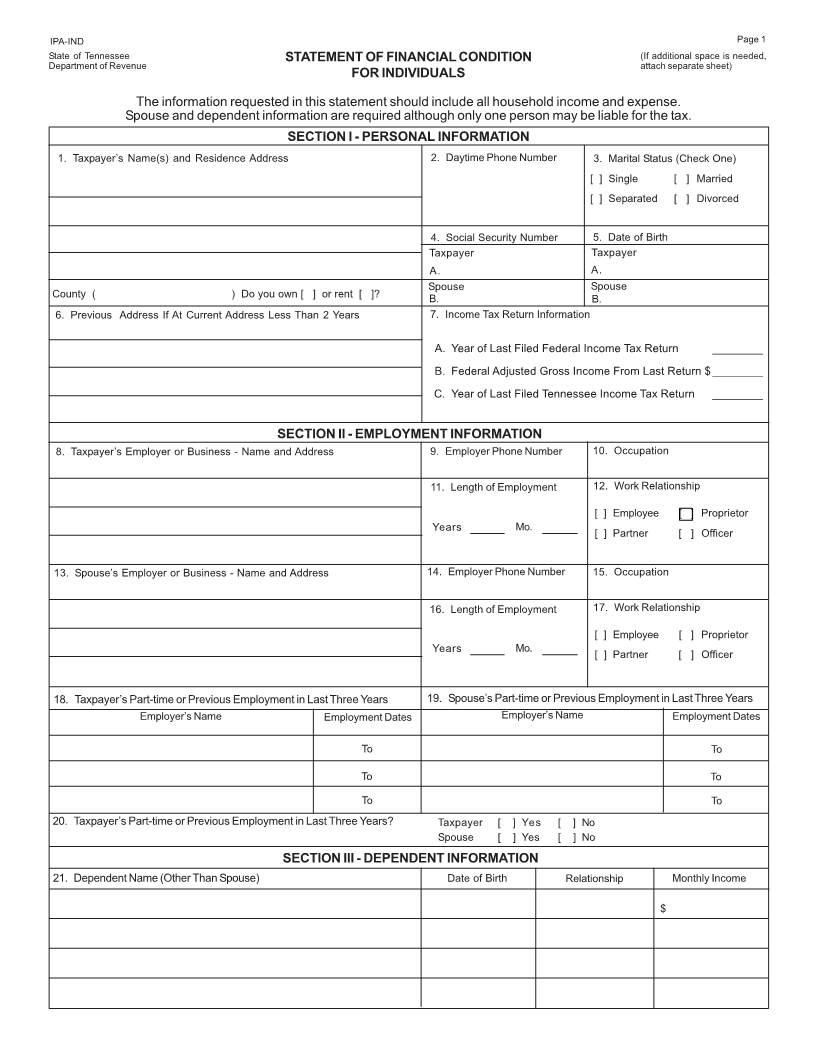

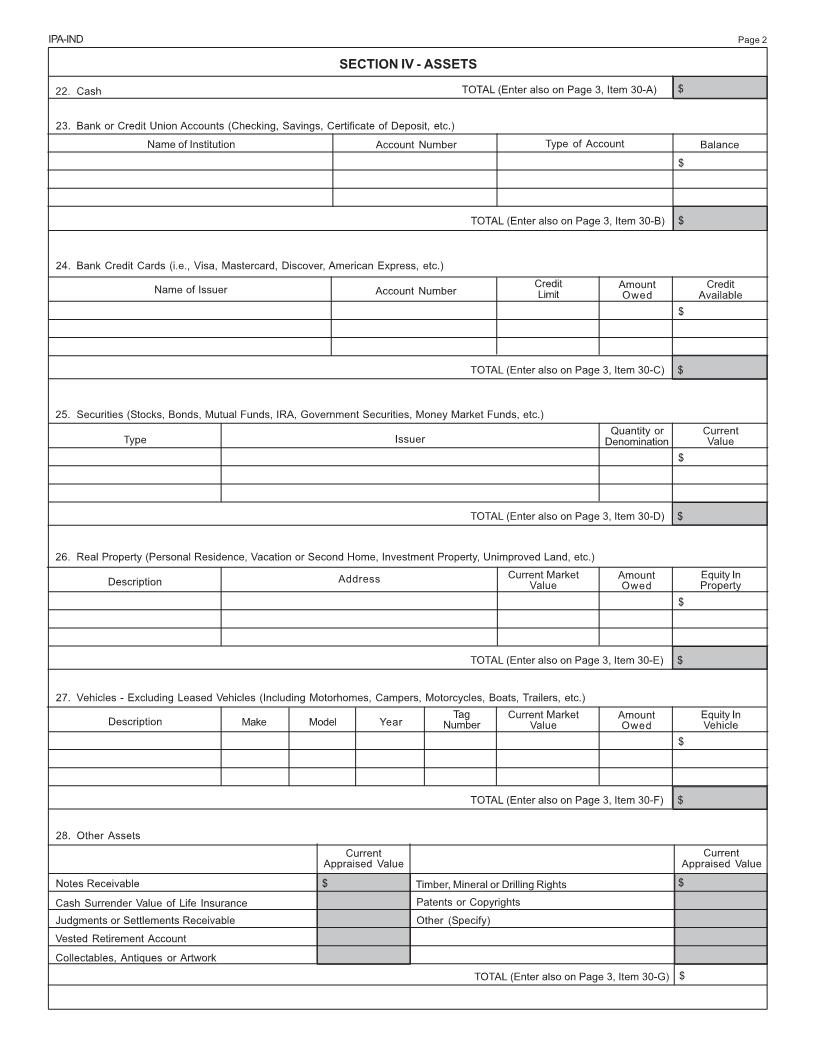

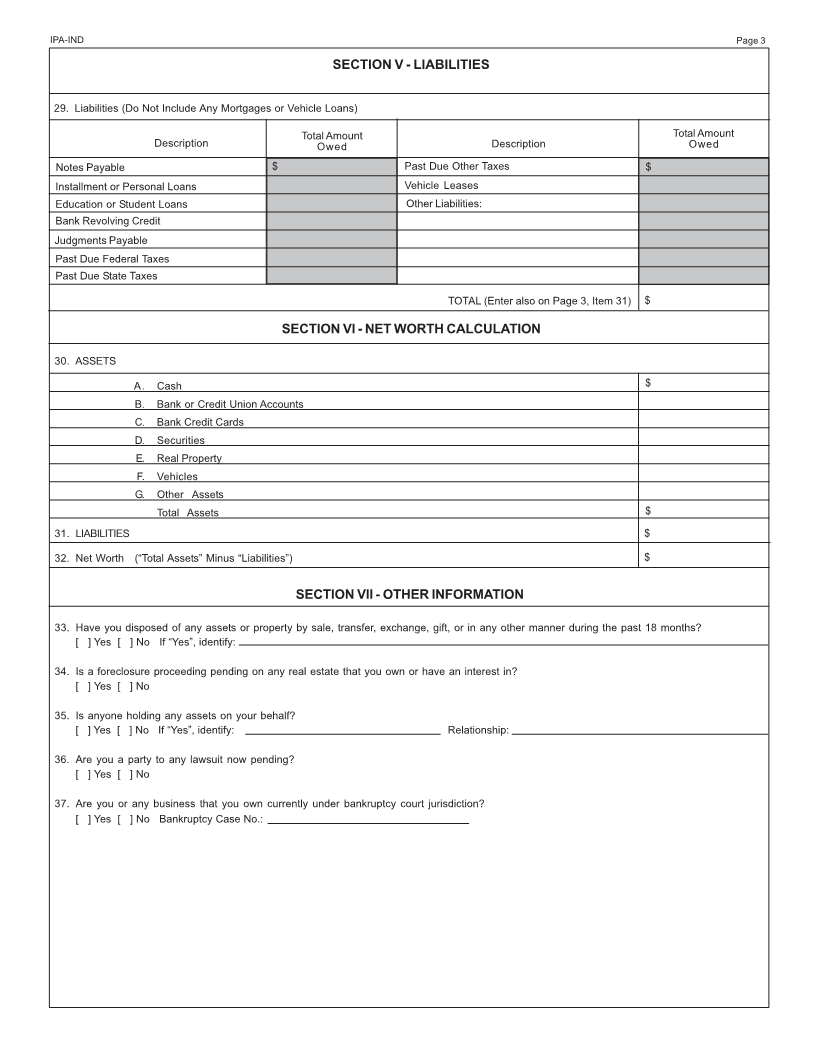

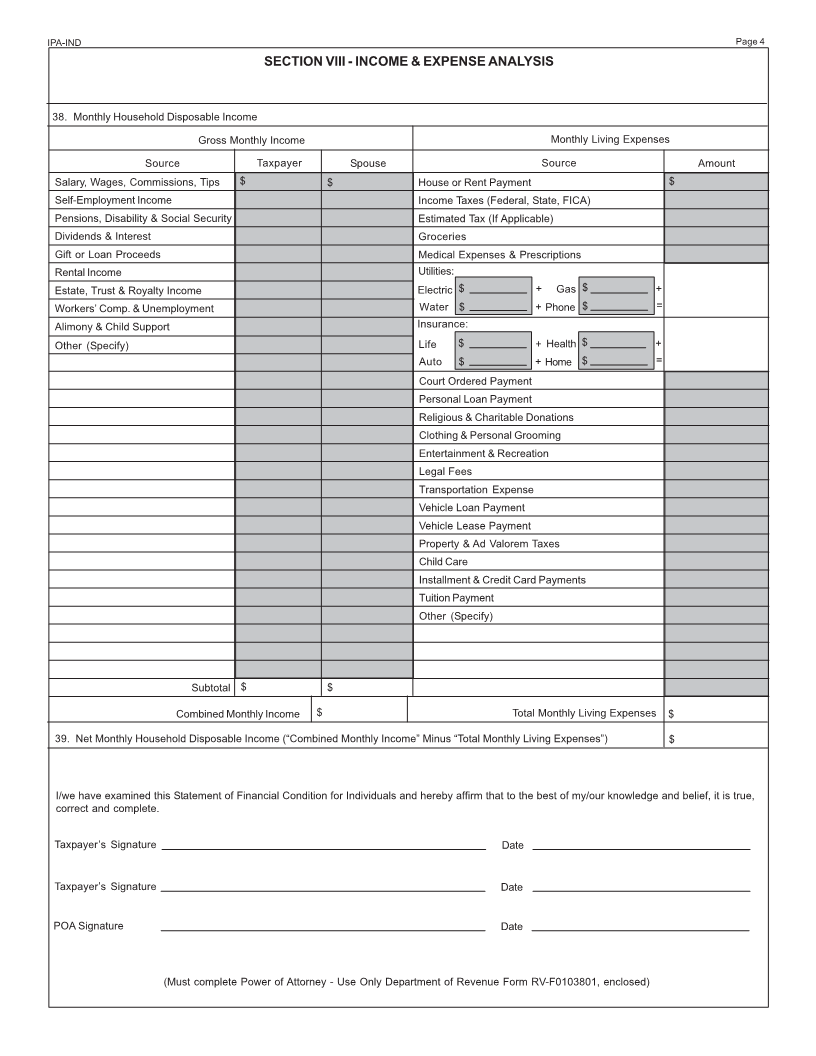

Statement of Financial Condition for Individuals

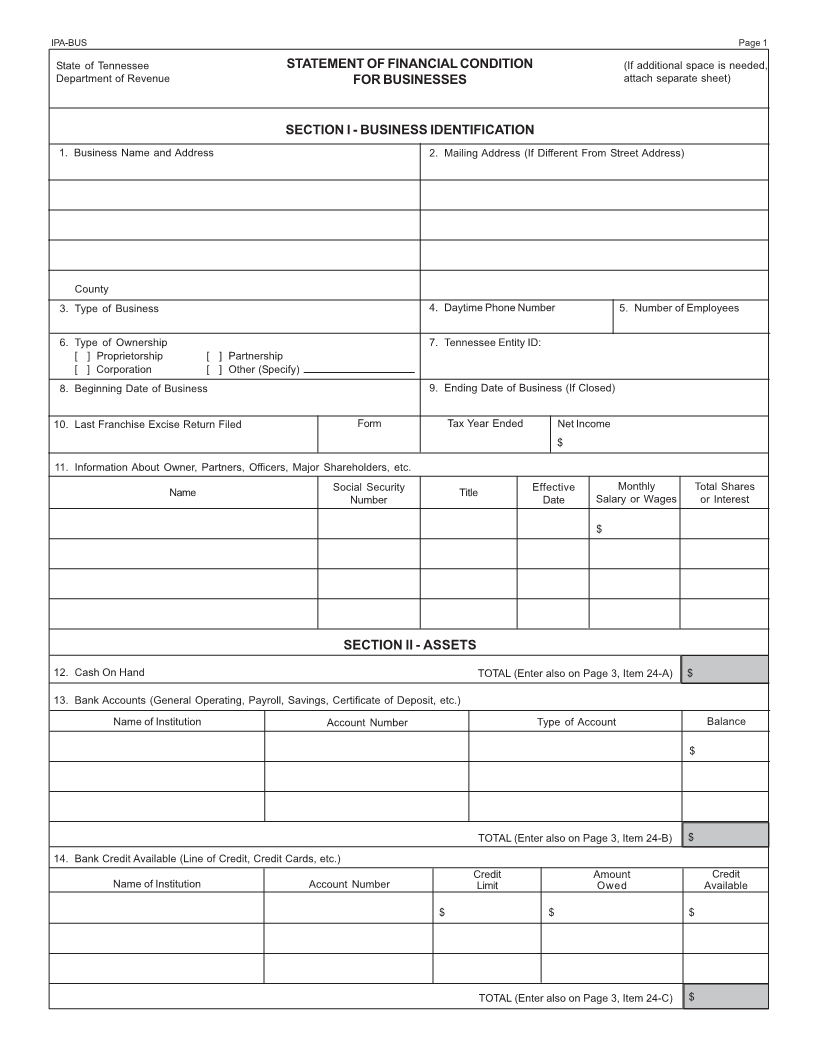

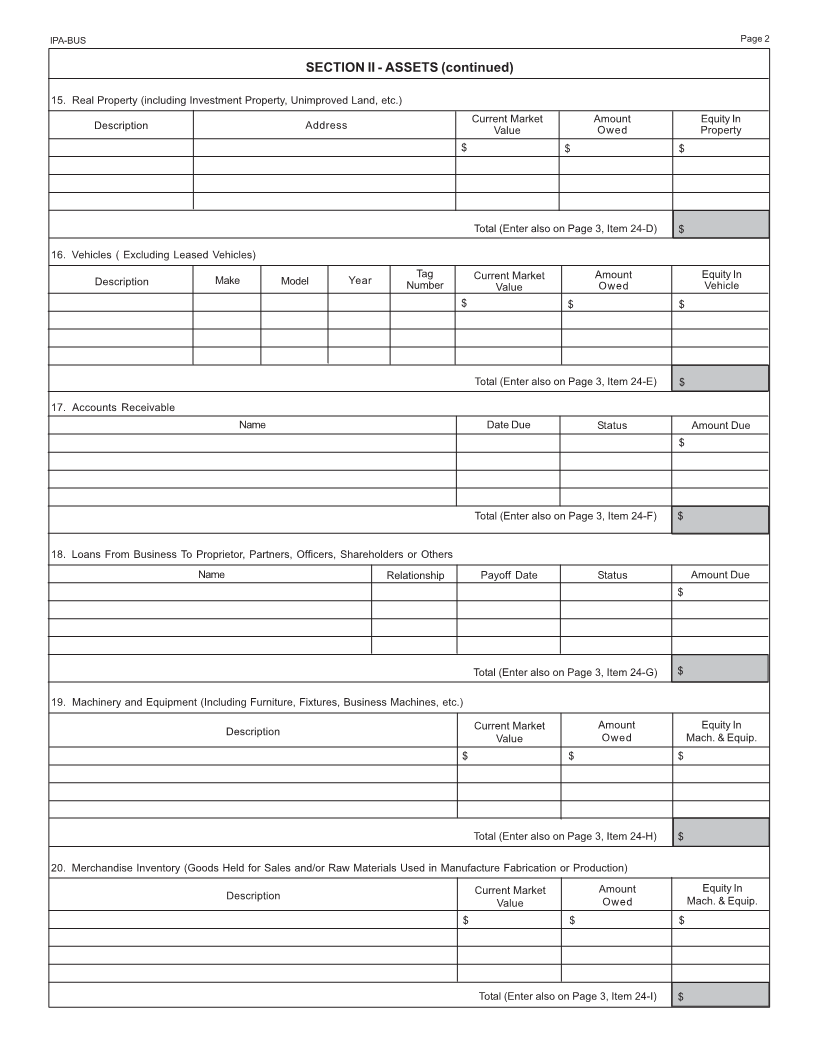

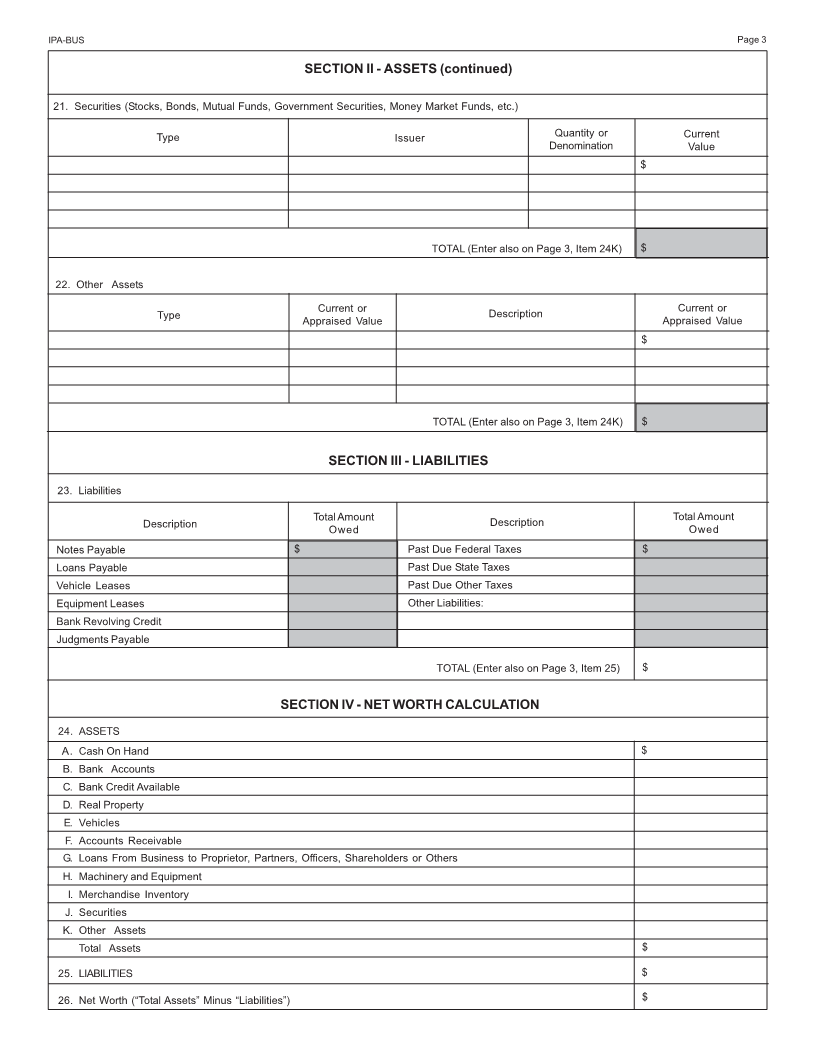

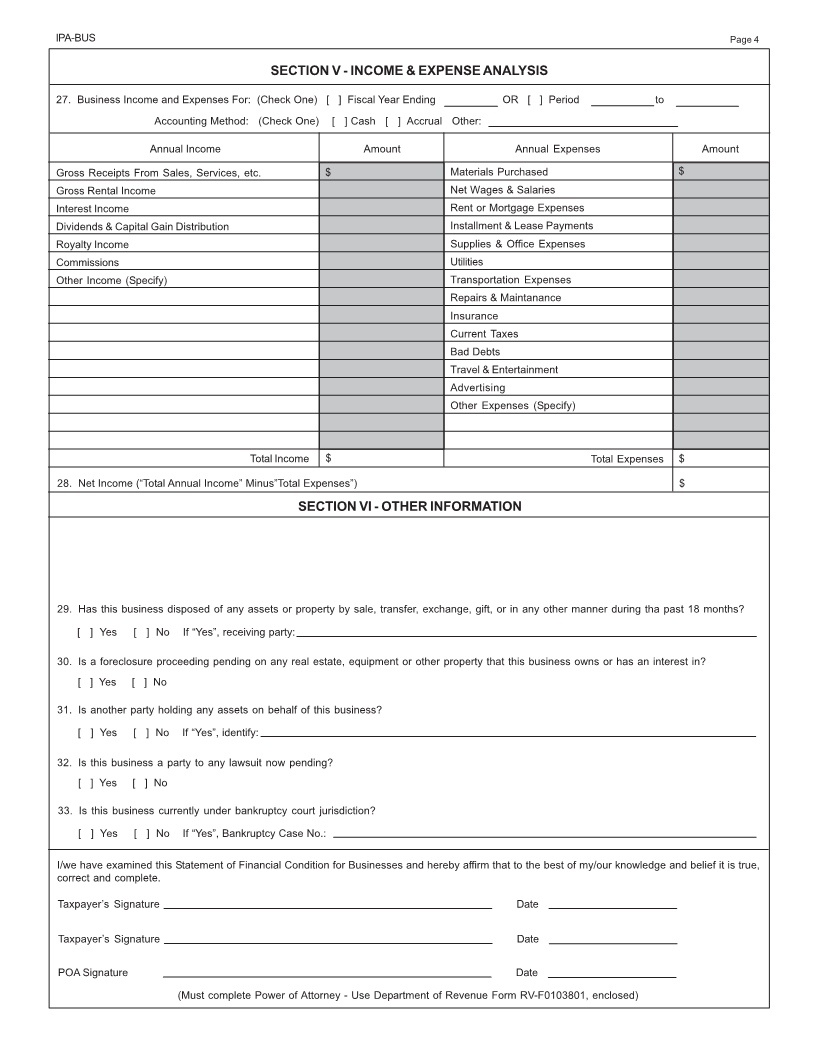

Statement of Financial Condition for Businesses

Supporting Document Checklist

Financial Release Statement

Power of Attorney

RV-F0200201 (Rev. 7-16)