Enlarge image

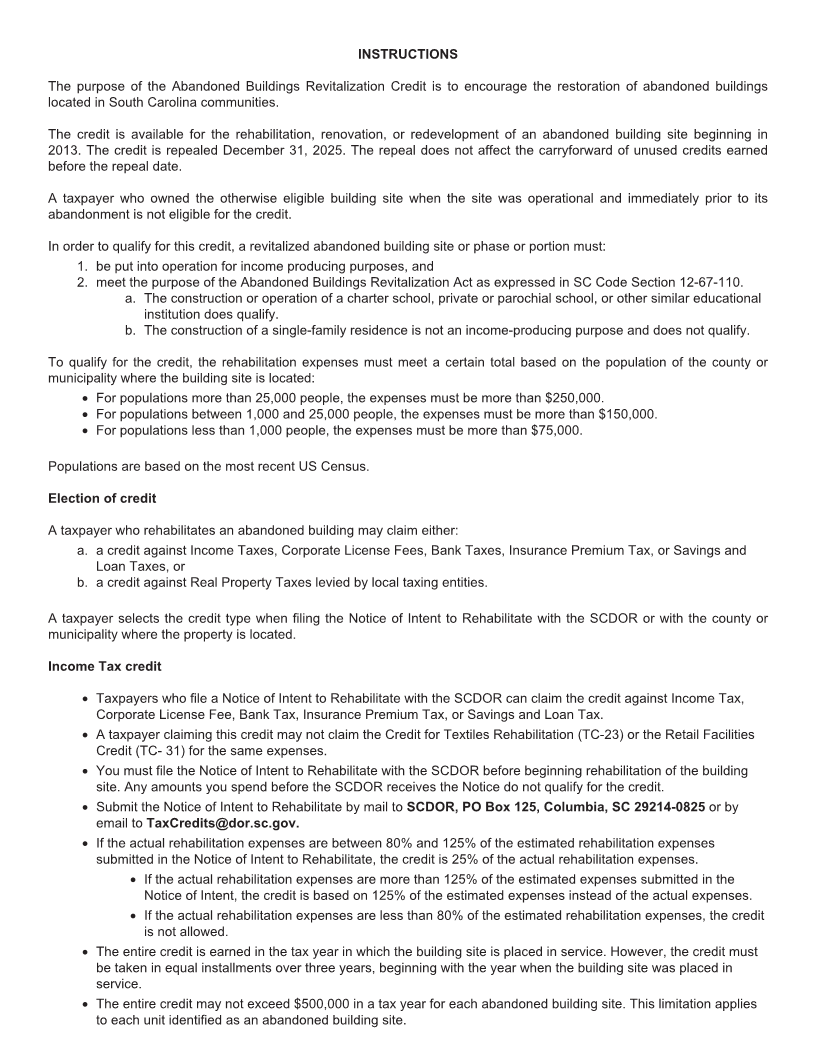

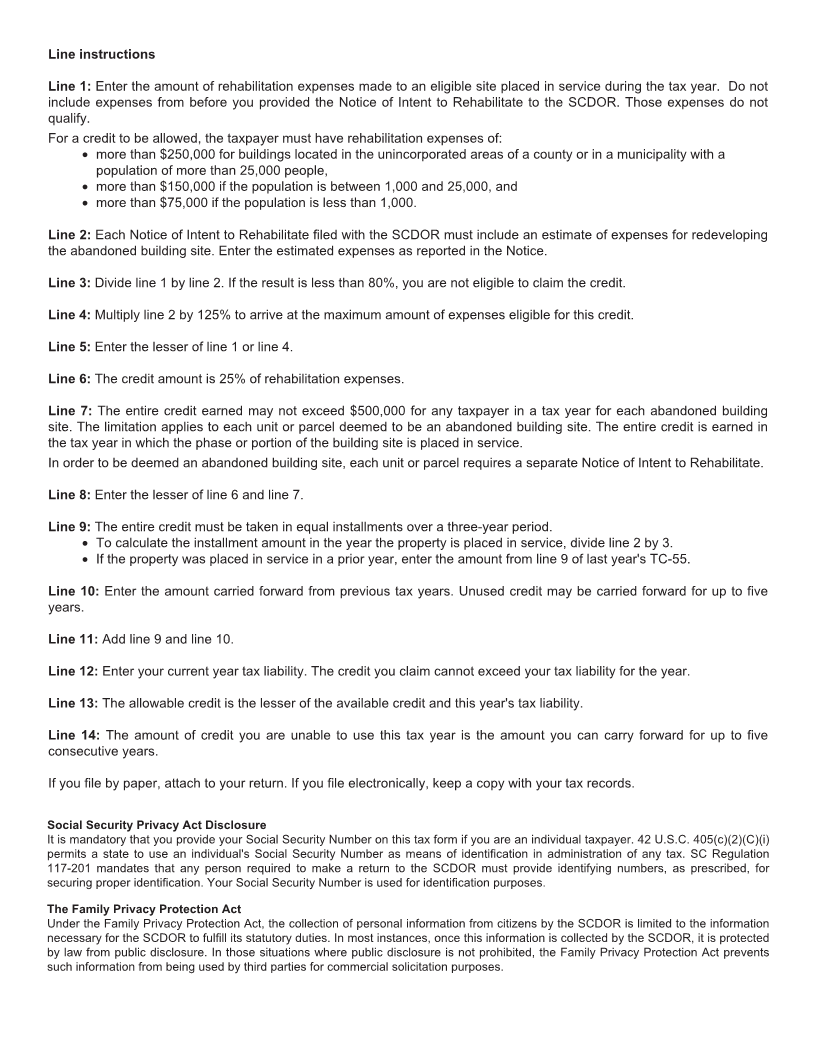

1350 STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE SC SCH.TC-55

ABANDONED BUILDINGS (Rev. 5/26/21)

REVITALIZATION CREDIT 3653

dor.sc.gov 20

Name SSN or FEIN

Name as shown on Notice of Intent to Rehabilitate (if different from name on tax return)

If credit was received from a pass-through entity, name and FEIN of entity

Location of the abandoned building site: Street address

County City State ZIP

Use this form to calculate your Income Tax credit. File a separate SC SCH. TC-55 for each abandoned building site.

1. Rehabilitation expenses made to an eligible site placed in service during the tax year.

Do not include expenses from before you provided the Notice of Intent to Rehabilitate to the

SCDOR. ............................................................................................................................ 1.

2. Estimated expenses as reported in the Notice of Intent to Rehabilitate ................................... 2.

3. Divide line 1 by line 2. If less than 80%, STOP! You do not qualify......................................... 3.

4. Maximum amount eligible for this credit (multiply line 2 by 125%) .......................................... 4.

5. Lesser of line 1 or line 4 ......................................................................................................5.

6. Credit amount earned (multiply line 5 by 25%)...................................................................... 6.

7. Maximum credit earned in a tax year for each abandoned building site .................................. 7. $500,000

8. Lesser of line 6 or line 7 ...................................................................................................... 8.

9. Annual installment amount (divide line 8 by 3 for property placed in service this year, or enter

the previous year's installment amount)................................................................................9.

10. Amount carried forward from prior tax years. .......................................................................10.

11. Add line 9 and line 10 ........................................................................................................11.

12. Current year tax liability......................................................................................................12.

13. Current year credit (lesser of line 11 and line 12) .................................................................13.

14. Credit carryforward (subtract line13 from line 11) .................................................................14.

Unused credits can be carried forward for five years

36531010