- 3 -

Enlarge image

|

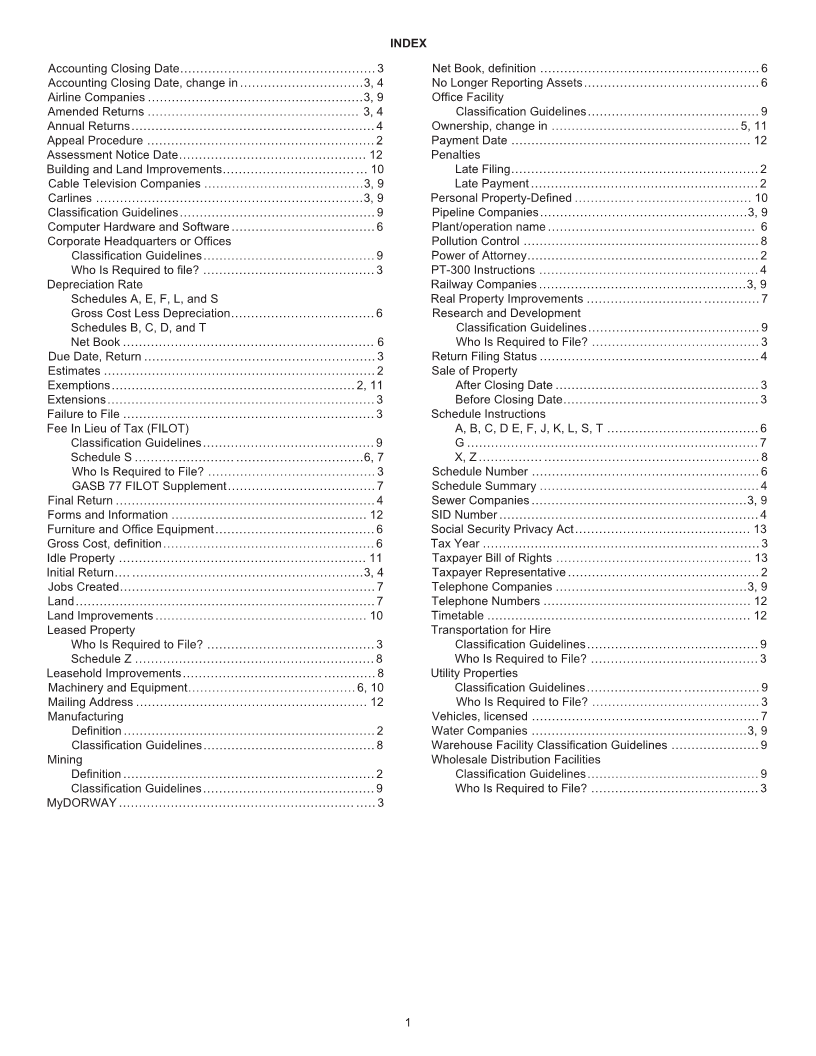

GENERAL INFORMATION

Manufacturing and Mining Defined

A manufacturer is every person engaged in making, fabricating, or changing things into new forms or in refining, rectifying, or

combining different materials.

Manufacturing and mining is further defined by the classifications set out in Sectors 21, 31, 32, and 33 of the most recent North

American Industrial Classification System (NAICS) manual, with the exception of publishers of newspapers, books, and periodicals,

which do not print their publications. (SC Code Section 12-43-335.)

Exemptions/Estimates

See application for exemption and the following SC Code Sections for more information: 12-37-220(A)(7), (A)(8), (B)(32), (B)(34), (B)

(52), and 12-37-220(C).

Appeal Procedures

If you dispute a new or amended value, assessment, or fee, you may appeal by filing a written protest within 90 days of the date of

the Property Assessment Notice. If your appeal is accepted, the SCDOR will adjust the valuation to 80% of the original amount. Any

valuation greater than 80% which you agree to in writing may be accepted pending resolution of the appeal. You will be charged

interest for the unpaid amount. A written protest must be filed within 90 days and contain the following:

· Property owner's name, address, and phone number

· SID number as shown on the Property Assessment Notice

· Date of the Property Assessment Notice you are appealing

· Tax year

· Plant operation schedule identification number (SCHD A00001)

· Any combination of the following as the matter(s) under appeal for each schedule:

· Real Property value, assessment, or fee

· Personal Property value, assessment, or fee

· Exemption assessment

· Penalty assessment fee

· Your reasons or grounds for disagreeing with the valuation, assessment, or fee

· What you believe is the fair market value and assessment of the property

· Contact name and phone number

· Agreed-upon percentage valuation, assessment, or fee in excess of 80%. See information above.

You must complete and file an SC2848, Power of Attorney and Declaration of Representative, for all taxpayer representatives.

Taxpayer Representative

In order to authorize and individual as your representative, you must file an SC2848, signed by you and the representative. You can

only be represented by an attorney, CPA, or enrolled agent. You must indicate on the SC2848 that the representative has the authority

to represent you in Property Tax matters as well as Income Tax matters as they relate to Property Tax.

This is important, since many Property Tax issues reference information filed on your Income Tax return. If this power is not granted,

we will not be able to discuss these issues with the representative. Authorization may be extended to registered, licensed, or certified

real estate appraisers in questions of real property value only. See SC Code Section 12-60-90 for more information.

Failure to File and Late Penalties

If returns are not filed on time, you may lose exemptions and be charged late filing penalties. See SC Code Section 12-37-800 for more

information.

You may appeal late filing penalties in writing in accordance with South Carolina Revenue Procedure #98-3, available at dor.sc.gov/

policy.

Local county auditors assess late payment penalties. You should appeal to the County Auditor. Telephone numbers and mailing

addresses for all county officials are on the Association of Counties website at sccounties.org.

Millage Rates or tax levies are applied by the local county auditors. Contact information for all county auditors is available on the

Association of Counties website at sccounties.org.

2

|