Enlarge image

1350

STATE OF SOUTH CAROLINA SC SCH.TC-4SA

DEPARTMENT OF REVENUE (Rev. 7/31/24)

ACCELERATED SMALL 3449

dor.sc.gov BUSINESS JOBS CREDIT 20

Name SSN or FEIN

If credit was received from a pass-through entity, name and FEIN of entity

Street address of facility creating new jobs

County City State ZIP

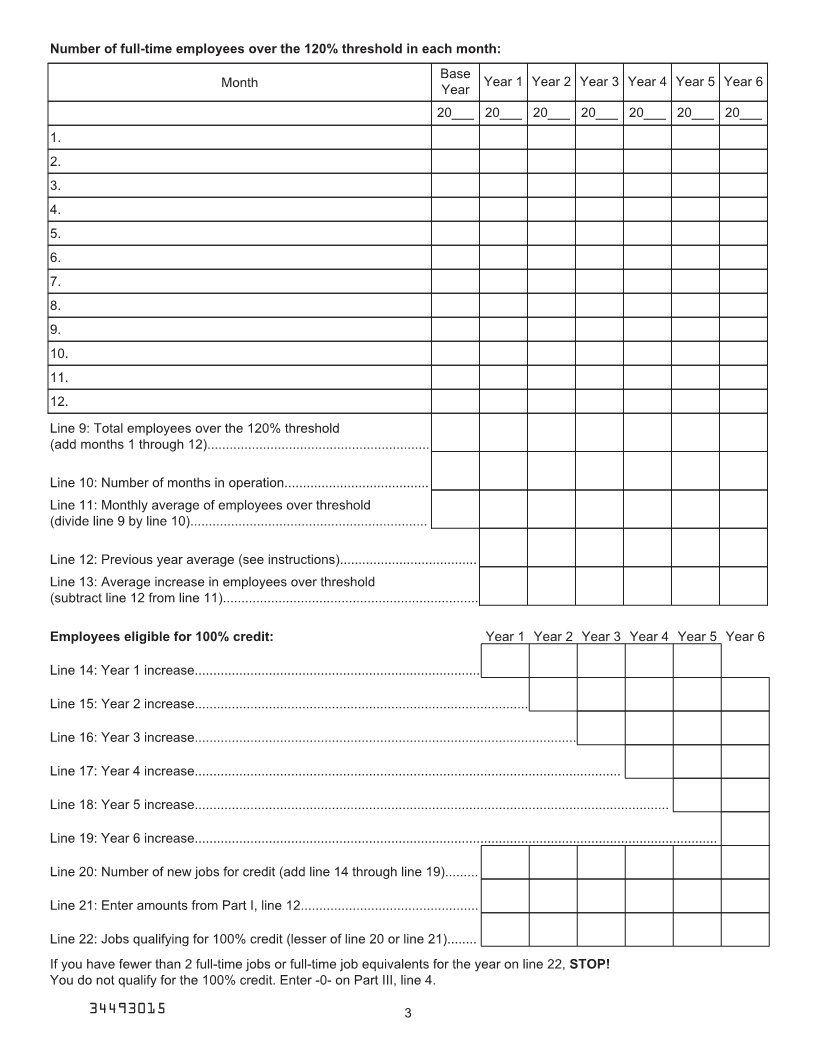

Part I: Computing the number of qualifying jobs

In the tax year when you first claimed the credit, did you have a total of 99 or fewer full-time jobs everywhere, at either the

beginning or ending of the tax year? Yes No If No, STOP - you do not qualify for this credit

Number of full-time employees subject to withholding during each month:

Base

Month Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Year

20___ 20___ 20___ 20___ 20___ 20___ 20___

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

Line 1: Total employees (add months 1 through 12)....................

Line 2: Number of months in operation.........................................

Line 3: Monthly average of full-time employees

(divide line 1 by line 2)..................................................................

Line 4: Previous year average (see instructions).......................................

Line 5: Average increase in full-time employees

(subtract line 4 from line 3)........................................................................

34491019 1